Good morning.

$1 trillion has been wiped out from tech stocks, amounting to their worst week in months. And it seems like it was largely still because of Anthropic, the AI company wrestling with Google, OpenAI, and xAI for chatbot supremacy.

The AI lab dropped Opus 4.6 on Thursday, calling it "the most capable model for all enterprise and knowledge work." Days earlier, they'd unveiled Claude Cowork plugins designed to handle legal briefs, sales workflows, and marketing campaigns. The message to Wall Street is clear: AI agents are coming for your SaaS subscription.

Salesforce, SAP, Intuit, and Thomson Reuters have all cratered 25% to 32% since New Year's. Palantir and Oracle are down 12% in three days alone. But Wall Street analyst Dan Ives sees two diamond stocks in the software rough right now.

Today:

Amazon announced unprecedented CapEx for 2026: $200 billion

$1 trillion in value is gone, just like that

Bitcoin crashed to $60,000 (its lowest since September 2024)

January layoff announcements hit their highest level since 2009

Let's get into it.

This is not financial advice. Always do your own research. Past performance doesn’t guarantee future results.

In partnership with GuyStocks

2026 Is Taking Shape - Stay Ahead of the Market

The market doesn’t

wait—and some of the strongest opportunities of 2026 are already starting to form.

GuyStocks delivers fast, free alerts to help you spot momentum early and stay aligned with market strength.

What you get:

• Real-time momentum tracking

• Clear, actionable market insights

• 100% free—always

Finish strong. Start 2026 informed, confident, and ahead of the crowd.

👉 Join GuyStocks Free and confirm your subscription.

(By joining, you agree to receive emails from GuyStocks.com. You can unsubscribe anytime.)

📰 Market Headlines

Stocks took a beating Thursday as a full-blown tech wipeout continued, with investors fleeing software names amid growing fears that AI tools will cannibalize established players.

The Nasdaq shed 1.5%, the S&P 500 dropped 1.2%, and the Dow lost over 500 points.

Palantir and Oracle led the carnage among enterprise software stocks, both down ~12% over the past three sessions. Salesforce, SAP, ServiceNow, Snowflake, and Microsoft all plummeted alongside them.

Anthropic dropped Opus 4.6, calling it the company's "most capable model for all enterprise and knowledge work." The release came days after Anthropic unveiled Claude Cowork plugins for legal, sales, and marketing tasks, stoking investor panic that AI agents could replace SaaS offerings entirely.

Salesforce's stock is now down 25% since January 1. SAP has lost 18%. Intuit and Thomson Reuters have cratered 32% and 30%, respectively.

Big Tech CEOs tried to calm the storm. NVIDIA's Jensen Huang called fears that AI will replace software tools "the most illogical thing in the world." Alphabet's Sundar Pichai said his SaaS customers are "incorporating Gemini deeply in critical workflows." Arm's CEO Rene Haas dismissed the sell-off as a "micro-hysteria."

Is this a software dip to buy? Wall Street technology analyst Dan Ives thinks so, and he’s highlighted two software stocks that he thinks are a buy right now: Palantir (PLTR) and Snowflake (SNOW). Read the quick thesis here.

Amazon reported Q4 earnings after the close, beat on the top and bottom lines, but projected a whopping $200 billion in capital spending for 2026. That's well above the $147 billion consensus and sent shares sinking 4% after hours.

Bitcoin almost fell below $60,000, its lowest level since September 2024, erasing all gains made during President Trump's second term. The token is now down nearly 50% from its all-time high.

Strategy (formerly MicroStrategy) tumbled 13% and reported a $12.4 billion quarterly loss. The company holds 713,502 BTC at an average price of $76,052, meaning it's sitting on roughly $6.5 billion in unrealized losses.

Silver fell 20%, wiping out its two-day recovery as Chinese buyers dumped holdings. Gold slipped to $4,721/oz before recovering to $4,900. Analysts warn silver's short-term rebound remains volatile.

Labor market cracks deepened. Weekly jobless claims rose to 231,000, topping forecasts. Job openings sank to their lowest level since 2020. January marked the worst month for layoff announcements since 2009, per Challenger data.

Oil slid ahead of US-Iran talks in Oman on Friday. Brent dropped to $67.05/barrel, WTI to $62.77, both on track for their first weekly decline in more than a month.

Hims & Hers soared 9% after announcing it will sell compounded copies of Novo Nordisk's Wegovy pill at about $100 less. Eli Lilly and Novo Nordisk both tumbled 7% on the news.

Starbucks won dismissal of Missouri's lawsuit accusing the company of using DEI policies to discriminate. The judge said the state failed to prove Starbucks discriminated against "even a single Missouri resident."

🤖 AI/Future/Tech News

OpenAI fired back on Anthropic with GPT-5.3 Codex, an agentic coding model 25% faster than the predecessor that debugged itself during development.

Fundamental emerged from stealth with $255 million at a $1.2 billion valuation to build large tabular models for structured data analysis.

Reddit's AI search users jumped from 1 million to 15 million in 2025, with CEO Steve Huffman eyeing monetization of the "enormous market opportunity."

🪙 Crypto

BlackRock's IBIT smashed volume records with $10 billion traded as BTC dropped 15% intraday, its second-worst day since launch.

Treasury Secretary Bessent blasted crypto "nihilists" blocking the Digital Asset Market Clarity Act, telling holdouts to "move to El Salvador."

Senate crypto talks resumed immediately after last week's party-line vote, with stablecoin yield rewards the main sticking point between banks and crypto firms.

The crypto market cap collapsed by $2 trillion since October, with XRP down 25% Thursday, and Stifel warning BTC could hit $38,000.

🚨 Trending on Reddit

Amazon (AMZN) chatter rose 200%, as discussions centered on recent layoffs tied to AI and automation rather than recession fears. Investors debated near-term earnings risk, potential dip-buying opportunities, and whether Amazon can avoid missteps seen at other big tech peers.

Figma (FIG) chatter surged 240%, following continued debate over the stock’s ~80% drop since IPO. Sentiment is split between regret from early buyers and long-term optimism from investors viewing the selloff as a second-chance entry.

🚚 Market Movers

Job openings sank to 6.54 million in December, down 900,000 from October and the lowest since September 2020.

Amazon is shuttering all 60 Amazon Fresh stores, cutting 3,900 jobs in California alone, with 90 days of pay plus one weekof severance per six months worked.

Wells Fargo announced 49 more layoffs at its Jordan Creek campus, bringing total cuts there to 224 since September, part of 65,000 jobs trimmed since 2019.

❓ Market Trivia Corner

Is Bitcoin becoming more or less interesting as an investment to you?

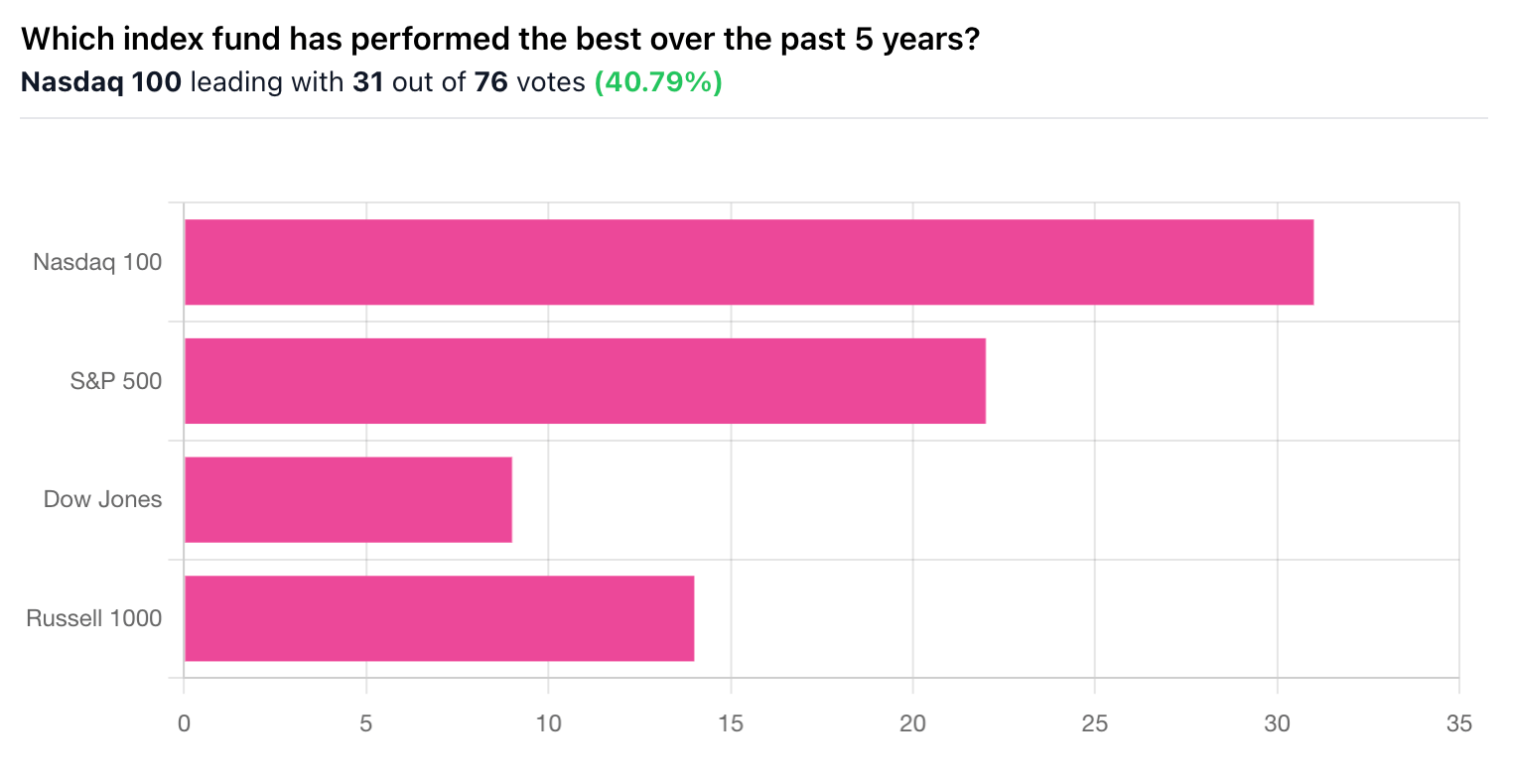

🎤️ What you said last time

🧠 The Missing (Market) Links

Executive coach Liz Tran says AQ, agility quotient, now separates successful people from the rest. Which of the four archetypes are you?

The US fertility rate hit a record low of 1.6, with annual births down 16% since 2007, sparking debates over economics, feminism, and pronatalist policies.

President Trump's baby bonus bill offers $1,000 per birth, but researchers say it won't address why Americans are having fewer kids.

Solar generation surged 32% in 2025, offsetting a 3% drop in natural gas-fired power.

📜 Quote of the Day

Wide diversification is only required when investors do not understand what they are doing

📢 We want to hear from you.

Your feedback matters to us! Let us know what you liked or didn’t like about today’s edition.

⭐️ What did you think of today's edition?

That’s all for today. Did we miss anything? Smash the reply button to let me know.

Cheers,

Brandon & Blake of Invested Inc

The information provided in Stocks & Income is for informational and educational purposes only and should not be construed as financial advice, investment advice, or a recommendation to buy or sell any securities. Stocks & Income is not a registered investment advisor, broker-dealer, or licensed financial planner. Always do your own research and consult with a licensed financial advisor before making any investment decisions. We may hold positions in or receive compensation from the companies or products mentioned. Disclosures will be made where applicable. Past performance doesn’t guarantee future results.

Stocks & Income, AltIndex by Invested Inc. (AltIndex LLC), Finance Wrapped, The Chain, Future Funders, and Dinner Table Discussions are all owned by Invested Inc.