Ozempic Made Peptides Famous. This Company Is Making Them Accessible

On behalf of Pangea Natural Foods Inc.

Good morning.

Ozempic made peptides a household name. Rebel Wilson credits them for weight loss. Jennifer Aniston uses them for skincare.1 Jrue Holiday swears by them for recovery. But here's the problem: most peptide therapies require needles, clinic visits, and hundreds of dollars per treatment.

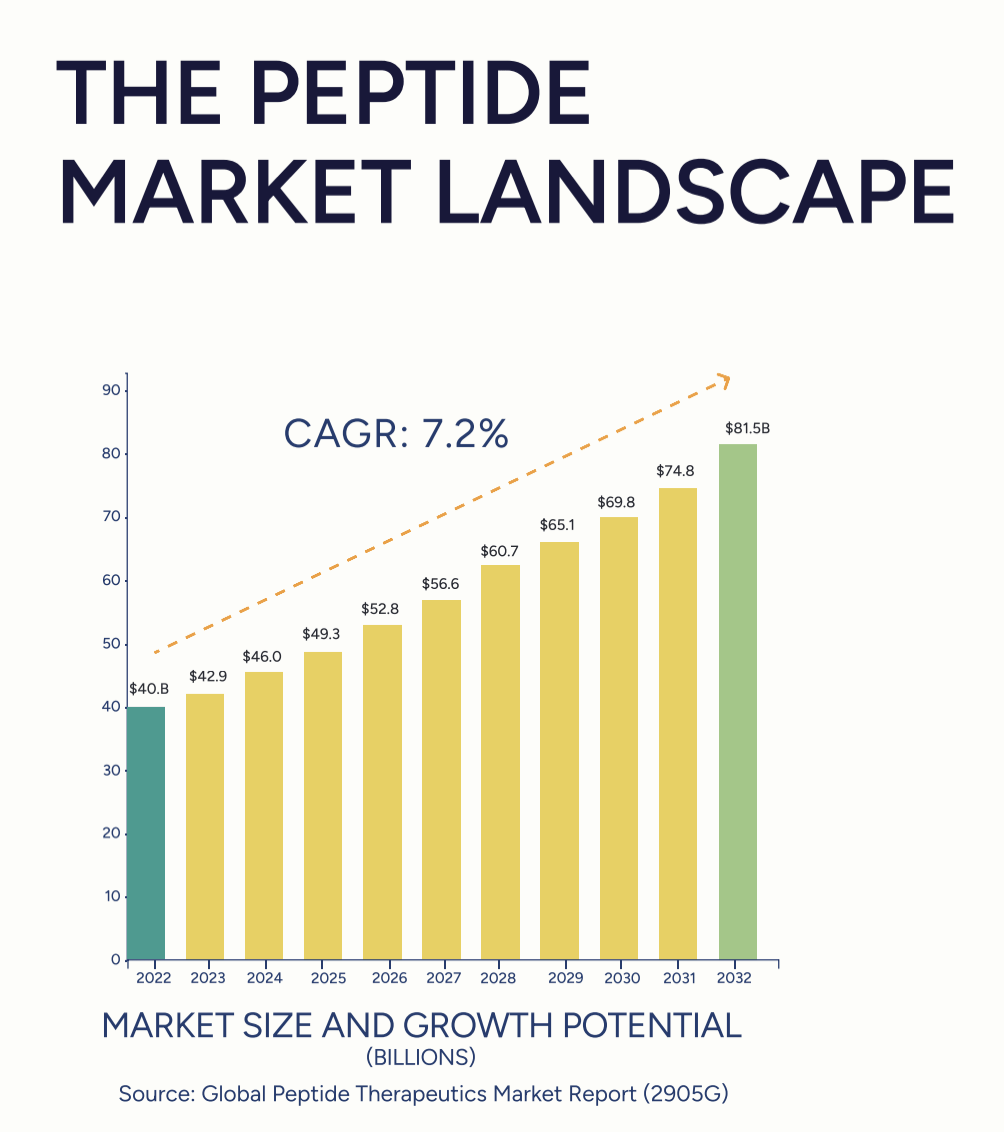

That's the $81.5 billion peptide therapeutics market in a nutshell. It’s massive, it’s growing at CAGR of 5.35% annually,2 and it’s completely inaccessible to most people who want the benefits without the complexity.

Pangea Natural Foods (CSE: PNGA | OTC: PNGAF) just entered this space with a different approach: no injections required. The company acquired Amino Innovations in 2025, a wellness firm developing needle-free peptide delivery systems (oral supplements, transdermal patches, and sublingual films) designed for recovery, longevity, immune health, and skin repair.

The thesis is simple. If you can deliver peptide benefits without needles at a fraction of the cost, you open a massive addressable market of people who want the results but won't commit to injections.

Below, we'll break down the potential opportunity, Amino's unit economics, and whether the company's positioning makes sense as an investment. And as always, this is not financial advice, just the data so you can decide for yourself.

1 https://www.glamour.com/story/peptide-injections-therapy

2 https://www.towardshealthcare.com/insights/peptide-therapeutics-market-sizing

The Peptide Market Opportunity

The global peptide therapeutics market is projected to hit $260.25 billion by 2030, growing at 10.77% annually. North America leads with over 60% market share, driven by high R&D investment and consumer adoption of advanced treatments. The OTC peptide supplement market alone is expected to grow from $3.72 billion in 2024 to over $10 billion by 2034 at a 10.5% CAGR.

Pharmaceutical peptides like Ozempic and Wegovy have validated consumer demand. The problem is that they require prescriptions, medical oversight, and major pharmaceutical companies control access. That means that generally speaking there’s an opportunity to make the benefits of peptides more accessible.

Peptides are natural compounds that signal cellular functions throughout the body that support skin health, muscle recovery, immune response, and longevity. Think of them as wellness messengers that keep your body functioning optimally. The issue has always been delivery: injections work but create friction. A lot of consumers won't commit to needles, mixing protocols, and clinic visits.

Amino Innovations' approach: eliminate the barriers entirely. The company launched its eCommerce platform in June 2025 with a suite of oral peptide supplements targeting recovery (BPC), immune function (KPV), cognitive performance (BLUE methylene blue nootropic), hair growth, skin health, sleep, and stress management. All products are manufactured in cGMP-certified US facilities with third-party testing for purity and potency.

It’s Amino’s next-generation delivery systems could change the game. Amino is developing transdermal patches and sublingual films (film that dissolves under your tongue) designed to deliver peptides efficiently without injections. A working patch prototype was completed in August 2025, with third-party bioavailability and efficacy testing expected to begin in Q4 2025. If successful, these formats will offer higher patient compliance and greater convenience, which could position PNGA as a serious contender in the biotech/wellness space.

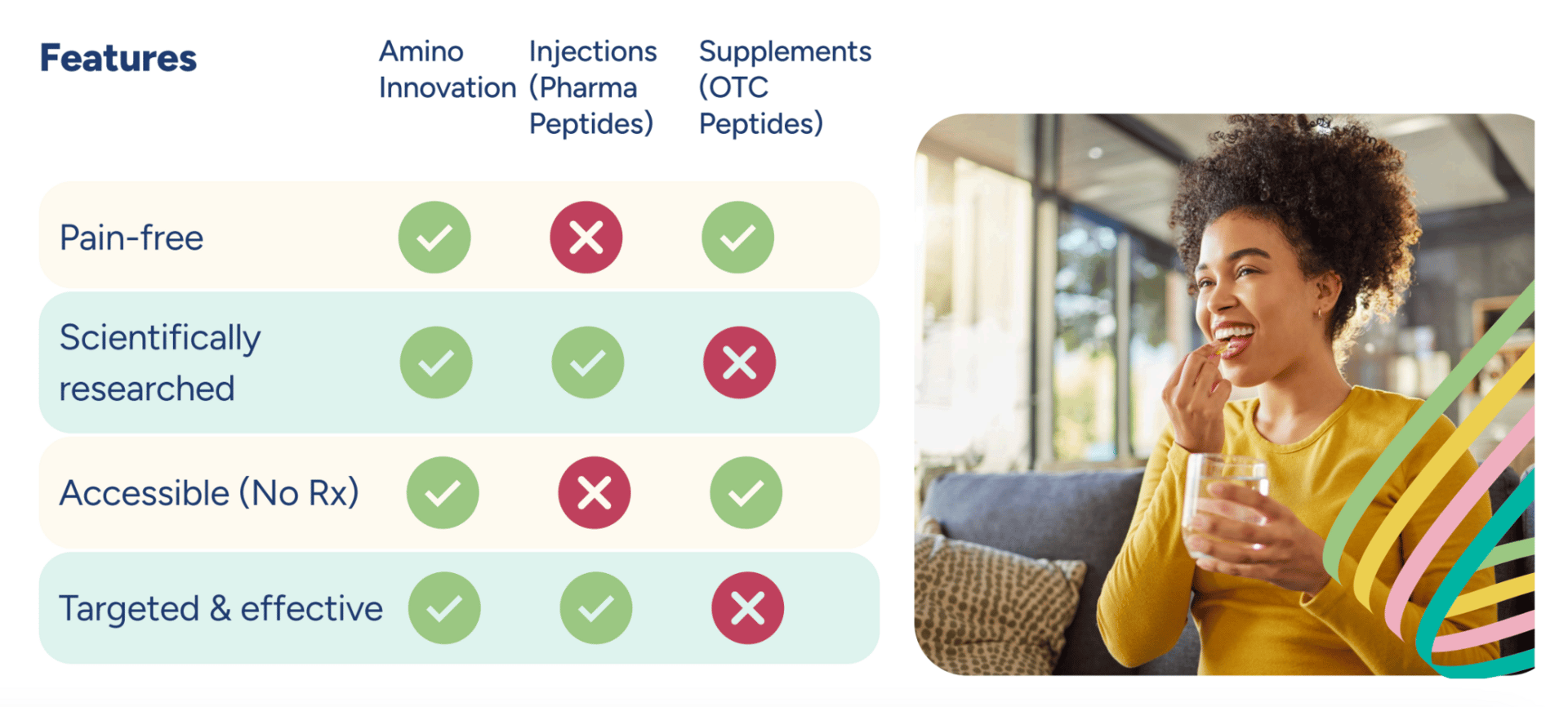

Competitive Positioning

Amino Innovations offers something competitors don't: scientifically researched peptides that are pain-free, accessible without prescriptions, and both targeted and effective. Traditional injectable pharmaceutical peptides require prescriptions and medical oversight. OTC peptide supplements avoid those barriers but often lack scientific backing and efficacy.

Amino appears to occupy a spot right in between both extremes, with pain-free and accessible OTC supplements that are scientifically researched and targeted like pharmaceutical peptides.

The company isn't trying to replace pharmaceutical-grade treatments. It's targeting the massive consumer segment that wants peptide benefits but won't commit to injections. These are people focused on preventative wellness, recovery, longevity, and performance optimization who prefer at-home solutions.

Pangea's manufacturing advantage is that it operates a state-of-the-art facility in Vancouver, BC under CFIA and FDA approval standards. The infrastructure supports both Amino's direct products and potential B2B opportunities as the peptide market expands.

PNGA also has 15+ years of established relationships with major North American retailers. That means trusted access to premium retail channels. While Amino currently focuses on DTC, this existing infrastructure creates optionality for scaled distribution if market demand materializes.

Catalysts to Watch

Q4 2025 patch testing results: Third-party lab testing for bioavailability and efficacy of the transdermal patch will validate whether the technology delivers on its promise. Positive results could significantly expand the addressable market.

Regulatory momentum: Favorable shifts in OTC peptide regulations could accelerate adoption and scaling. The company notes this as a potential tailwind, though specifics remain unclear.

RFK Jr.'s advocacy for peptides and at-home health solutions aligns with broader consumer trends toward preventative wellness and away from pharmaceutical dependency. Whether this translates to market growth remains to be seen, but the cultural momentum is building.

Celebrity and athlete endorsements have legitimized peptide use across entertainment, sports, and wellness. From weight management to recovery protocols, high-profile figures are openly using peptides, creating mainstream awareness that benefits accessible delivery formats.

The Bottom Line

In summary, Pangea Natural Foods acquired Amino Innovations to enter the rapidly growing OTC peptide market with needle-free delivery systems. The company is targeting a projected $10 billion OTC market by 2034, positioned within a broader $260 billion global peptide therapeutics landscape. And if it pulls it off, that could be a pretty big deal business-wise for PNGA.

And the transdermal patch technology, if validated in Q4 2025 testing, could be a huge differentiator for the business as well. Until then, Amino is executing on DTC oral supplements in a growing market with favorable tailwinds.

At current valuation, Pangea represents a bet on consumer preference shifting toward accessible, at-home peptide solutions. The data supports the opportunity. Whether execution matches the vision is what investors will need to watch.

This is not financial advice. Always do your own research.

Sources:

1 https://www.glamour.com/story/peptide-injections-therapy

2 https://www.towardshealthcare.com/insights/peptide-therapeutics-market-sizing

⭐️ What did you think of today's edition?

Disclosures

Examples that we provide of share price increases pertaining to a particular Issuer from one referenced date to another represent an arbitrarily chosen time period and are no indication whatsoever of future stock prices for that Issuer and are of no predictive value. Our stock profiles are intended to highlight certain companies for YOUR further investigation; they are NOT stock recommendations or constitute an offer or sale of the referenced securities.

Stocks & Income, AltIndex, Finance Wrapped, The Chain, and Future Funders are all owned by Invested, Inc.

The information provided in Stocks & Income is for informational and educational purposes only and should not be construed as financial advice, investment advice, or a recommendation to buy or sell any securities. Stocks & Income is not a registered investment advisor, broker-dealer, or licensed financial planner. Always do your own research and consult with a licensed financial advisor before making any investment decisions. We may hold positions in or receive compensation from the companies or products mentioned. Disclosures will be made where applicable.