Good morning.

Amazon is cutting 14,000 jobs to fund AI investments. Gold is close to all-time highs, but Bank of America is predicting gold to hit $6,000/oz next year. And Cathie Wood, one of the biggest tech bulls out there, is calling for an AI “reality check” correction.

This is the kind of environment where knowing when to take profits matters more than picking winners. Because even the winners can reverse violently when narratives shift. If you're sitting on gains in AI stocks, rare earth miners, or semiconductors, do you know your exit strategy? We've put together a guide on profit-taking timing for you below.

First, a word from our partners at Worthy Wealth:

In partnership with Worthy Wealth

High-yield investments for community growth

Worthy Wealth is building a new model for community-first investing

Regular investors can earn strong returns while backing real-world projects across America. No hedge fund games, no Wall Street complexity. Just tangible investments, transparent terms, and yields up to 15%.

Here’s what you can invest in:

Upgrade America’s aging infrastructure and earn a share of the upside

15% targeted net annualized return

Quarterly dividends plus 60% of Worthy's profits upon sale

$100 minimum, up to 5-year hold, preferred equity share class

Predictable fixed returns, backed by real estate

9% APY in years 1–3, 10% APY in years 4–5

Bonds priced at $10 each, redeemable after 3 years

Low volatility, quarterly interest, no fees

Become an early owner in Worthy itself

Invest in the growth of the company behind the platform

$10/share with $500 minimum

Private equity exposure with long-term exit upside

Whether you’re looking for passive income, equity participation, or mission-aligned returns.

Disclosure: Investments involve risk, including loss of principal. Past performance is not indicative of future results. Not available in all jurisdictions. Read all offering materials before investing.

💹 Portfolio Practicals: Should You Take Profit?

This is the question that separates average traders from great ones. Take profits too early, and you miss life-changing gains. Hold too long, and you watch them evaporate!

And the market is forcing the profit question on everyone this week:

AI stocks have run hard.

Gold just crashed from $4,100 to under $4,000 in days, but BoA thinks it could rise 50% by mid-2026.

Amazon is up huge this year but just announced its largest layoffs ever.

The Fed’s rate decision is tomorrow.

Most of the Magnificent 7 report earnings this week.

It’s a ton of news and information.

So, we've created a compact guide on profit-taking strategies for when to scale out, when to hold, and how to use technical and fundamental signals to make the decision:

📰 Market Headlines

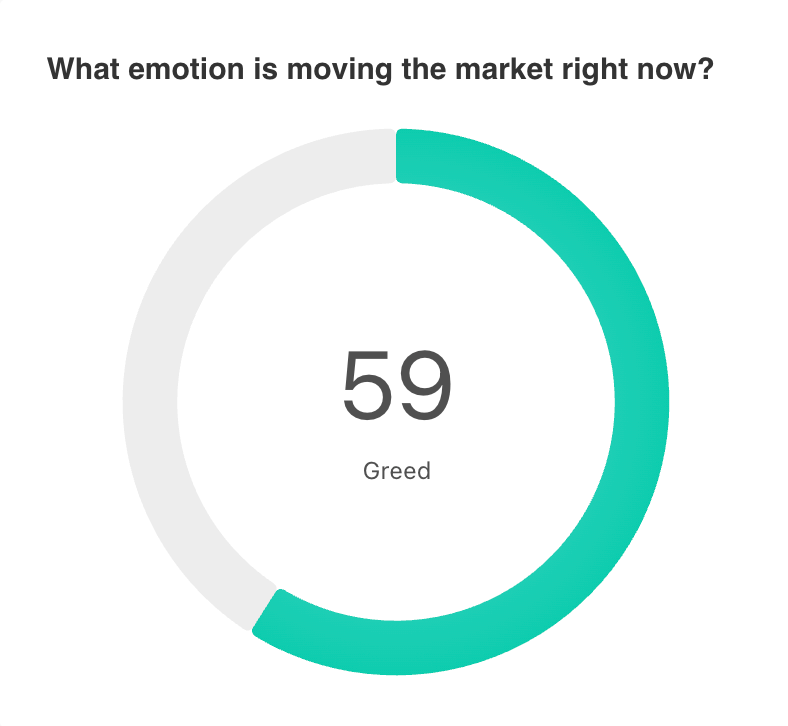

Markets sprinted to fresh records Monday after hopes for a US–China trade deal lifted sentiment.

The Dow rose 0.7%, the S&P 500 surged 1.2%, and the Nasdaq advanced 1.9%, with the S&P crossing 6,800 for the first time.

Both indexes extended last week’s gains as investors cheered progress in weekend negotiations between Washington and Beijing.

The Fed is widely expected to cut rates by 0.25 percentage points on Wednesday, with markets betting on additional cuts in December and January. Unemployment claims continue climbing while inflation cooled to 3%, though the central bank faces internal divisions and political pressure for aggressive easing.

Gold dropped below $4,000 as investors dumped safe-haven assets on trade deal optimism, snapping a nine-week winning streak. Despite the pullback from record highs, Wall Street remains bullish with Bank of America targeting $6,000 and Goldman Sachs forecasting $4,900 by the end of 2026.

OpenAI warned the US risks falling behind China in the AI race without massive power grid investments, calling for 100 gigawatts of new energy capacity annually. The company highlighted an "electron gap" as China added 429 gigawatts last year versus just 51 in the US, declaring "electrons are oil" in an 11-page White House submission. Is this legitimate, or is CEO Sam Altman getting desperate for funding?

Amazon is laying off 14,000 corporate employees in what's expected to become the largest corporate job cuts in the company's history. The company said it's cutting roles to make the organization leaner and less bureaucratic while investing more heavily in generative AI. The layoffs underscore a brutal trend: AI is simultaneously driving investment and eliminating jobs.

Cathie Wood warned of an AI "reality check" while rejecting fears of a full bubble. Speaking at Saudi Arabia's Future Investment Initiative, the Ark Invest CEO said that as interest rates begin to rise, "there will be a shudder" in markets. She also state that “We think there will be a reality check.” Despite the near-term warning, she remains long-term bullish on AI, particularly humanoid robots.

Qualcomm soared 11% after announcing its entry into the AI data center chip market with new AI200 and AI250 processors. The stock spiked over 20% intraday before settling, as the company targets AI inference workloads starting in 2026 and promises lower power consumption. The meaning: Qualcomm is stepping up to give Nvidia and AMD a run for their money in the chip space.

PayPal surged 14% in premarket trading after signing a deal with OpenAI to become the first payments wallet integrated into ChatGPT. Starting next year, PayPal users can purchase items through the AI platform, and merchants can sell directly through ChatGPT with inventory listed there. The agreement gives PayPal a massive new distribution channel and validates the conversational commerce thesis.

Rare earth miners fell sharply after reports that a potential US-China deal could ease export controls, removing a key bullish catalyst. MP Materials, USA Rare Earth, and Lithium Americas all declined as traders priced in reduced supply chain tension.

Short sellers are having their worst year since 2020, and they’re blaming retail investors (that’s you and us!). Retail investor activity surged to 22% of all stock market trades, the highest level since the February 2021 meme stock peak.

A new bill from Rep. Ro Khanna aims to ban stock and crypto trading by elected officials, following scrutiny of a timely AMD purchase by Rep. Dan Newhouse (who serves on the House Appropriations Subcommittee on Energy) just ahead of the DOE's $1 billion AMD partnership announcement.

🤖 AI/Future/Tech News

The US Department of Energy and AMD launched a $1 billion supercomputer partnership for fusion research and cancer treatment.

LSEG and Anthropic launched financial‑data access for Claude, letting users summarize earnings and trigger agentic workflows; LSEG shares rose 1.7%.

California passed a first‑of‑its‑kind law requiring police to label AI‑generated reports and keep full audit trails.

🏦 Alternative Investment: Private Equity Secondaries

The private equity secondaries boom hit $200 billion this year, tripling since 2020 as investors sought liquidity from aging funds. Firms such as Evercore helped limited partners offload stakes stuck in illiquid portfolios, turning secondaries into a key source of cash flow.

The surge came as traditional exits froze, pushing funds to recycle capital through continuation vehicles and secondary sales. Evercore’s private capital advisory team led a wave of deals that reshaped how private equity investors manage liquidity in a slow market.

🎙 What Do You Think?

Should politicians be banned from trading stocks & crypto like Khanna's bill says?

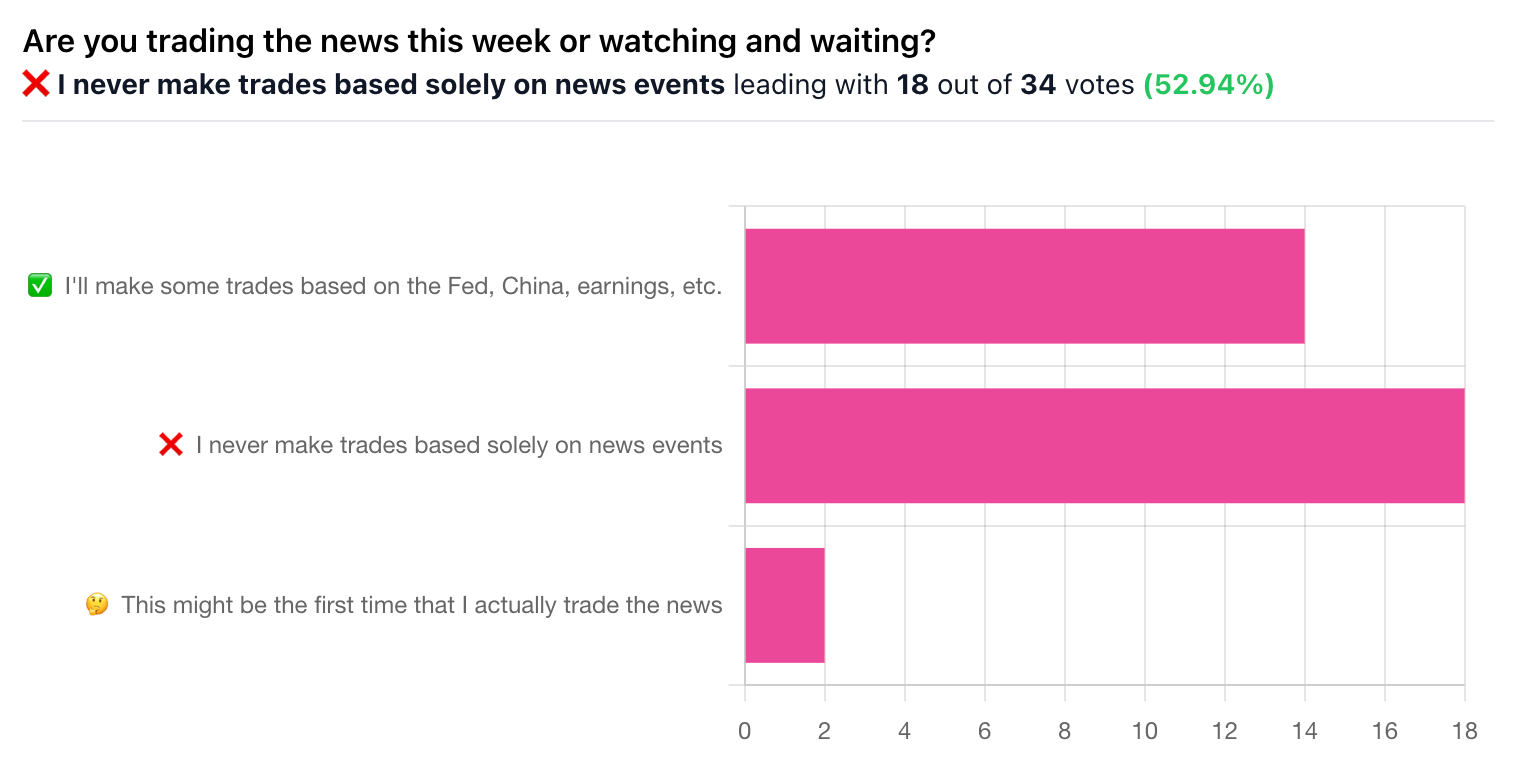

🎤️ What you said last time

🧠 The Missing (Market) Links

A quick investor personality quiz to learn more about yourself based on your investing goals and decisions.

Here are 10 US cities where millennials make way more money than everybody else.

Soybeans jumped 2.8% to a three‑month high after Bessent said China will resume purchases.

Here’s 8 traits introverts have that experts are apparently calling “superpowers.” Do you agree or disagree?

Meet the man who went from cab driver to bringing in $2 million a year.

📜 Quote of the Day

Bull markets are born on pessimism, grow on skepticism, mature on optimism, and die on euphoria.”

📢 We want to hear from you.

We love hearing from you, and we deeply appreciate your feedback.

⭐️ What did you think of today's edition?

That’s all for today. Did we miss anything? Smash the reply button to let me know.

Cheers,

Brandon & Blake of Invested Inc

The information provided in Stocks & Income is for informational and educational purposes only and should not be construed as financial advice, investment advice, or a recommendation to buy or sell any securities. Stocks & Income is not a registered investment advisor, broker-dealer, or licensed financial planner. Always do your own research and consult with a licensed financial advisor before making any investment decisions. We may hold positions in or receive compensation from the companies or products mentioned. Disclosures will be made where applicable.

Stocks & Income, AltIndex, Finance Wrapped, The Chain, and Future Funders are all owned by Invested, Inc.