Good morning.

We’ve got a huge week ahead in the wake of Jerome Powell’s Jackson Hole speech last Friday, which signaled rate cuts in September.

Nvidia reports earnings on Wednesday, a key test for the AI trade and the market at large. The $4 trillion chipmaker is up 30% this year and 1,400% since late 2022.

Canada dropped tariffs on some US goods to restart trade talks, but auto, steel, and aluminum levies remain.

And is $ROOT r/WallStreetBets’ next $OPEN?

In partnership with Pacaso

Big investors are buying this “unlisted” stock

When the founder who sold his last company to Zillow for $120M starts a new venture, people notice. That’s why the same VCs behind Uber and eBay also backed Pacaso. They made $110M+ in gross profit to date. They even reserved the Nasdaq ticker PCSO. Now, you can join, too.

Paid advertisement for Pacaso’s Regulation A offering. Read the offering circular at invest.pacaso.com. Reserving a ticker symbol is not a guarantee that the company will go public. Listing on the NASDAQ is subject to approvals.

Please support our partners!

📰 Market Headlines

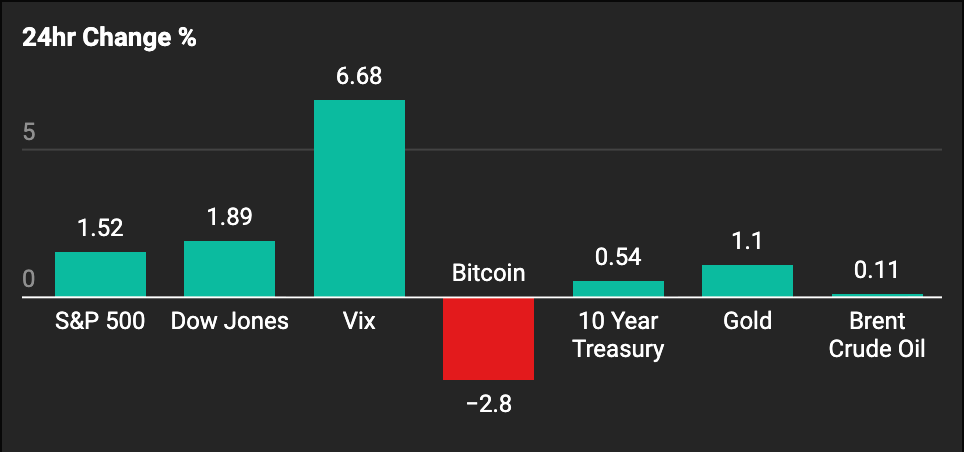

US markets rocketed on Friday after Fed Chair Powell's Jackson Hole speech signaled September rate cuts.

Dow and S&P 500 futures hovered near flat while Nasdaq 100 futures slipped 0.1%.

Nvidia's results on Wednesday will zero in on the AI trade's health after tech stocks wobbled last week. The chip giant, which topped $4 trillion in market value last month, has seen its stock climb over 30% this year and 1,400% since October 2022.

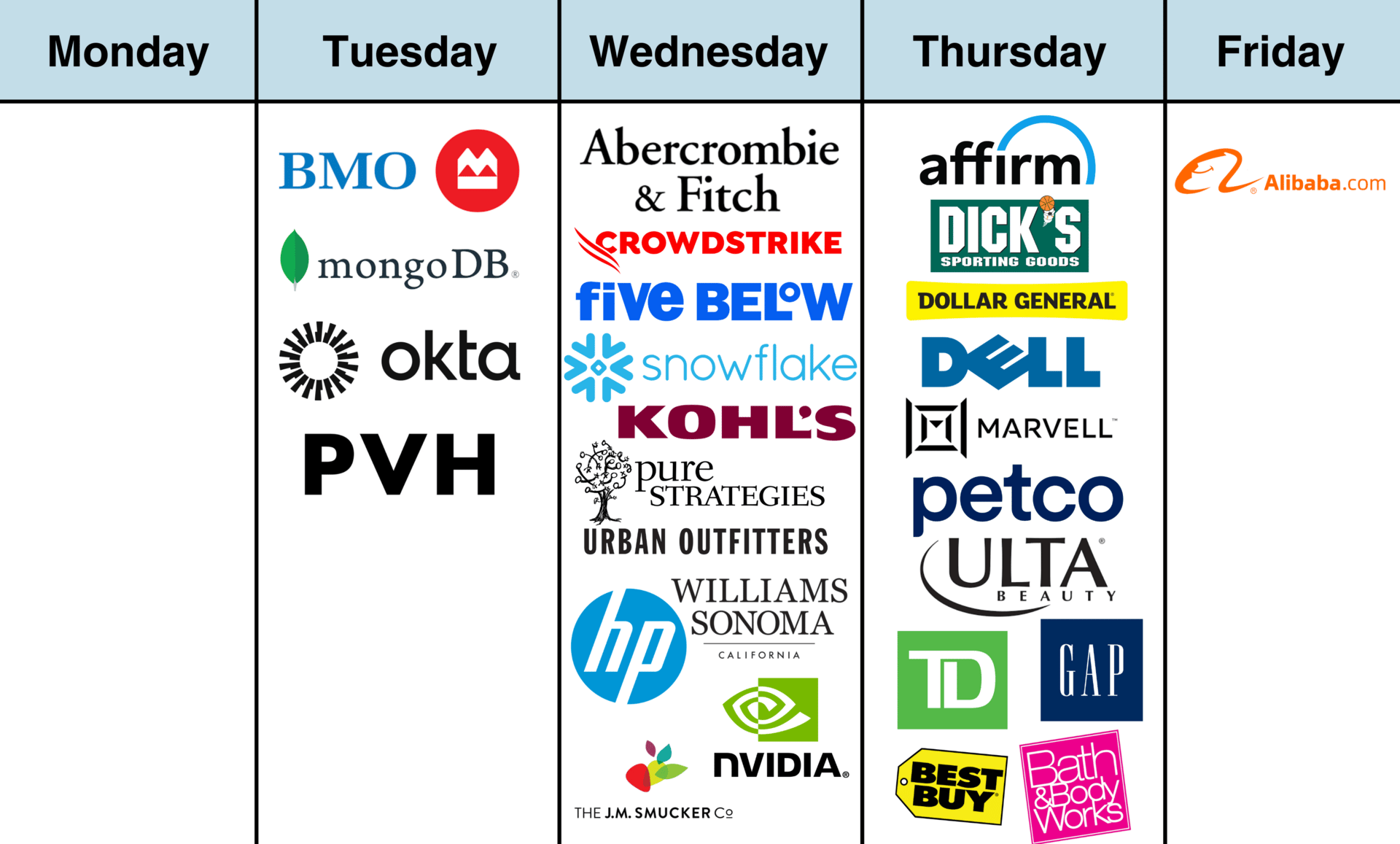

Other earnings reports to look out for this week:

MongoDB (Tuesday)

Okta (Tuesday)

Nvidia (Wednesday)

Crowdstrike (Wednesday)

Alibaba (Friday)

Canada removed retaliatory tariffs on many US goods on Friday as a goodwill gesture to restart trade talks. Prime Minister Mark Carney spoke with President Trump on Thursday but left auto, steel, and aluminum levies intact.

$ROOT is the talk of the town on Reddit—but it’s not all good press. AltIndex sent a signal for Reddit sentiment on Root Insurance, summarizing people’s thoughts on the stock as a mix of pump-and-dump accusations and positive outlooks on fundamentals and future growth. Also, users are predicting potential future partnerships between Root and companies like Amazon or Hertz.

Coca-Cola is exploring options to sell Costa Coffee, according to sources familiar with the matter. The beverage behemoth is working with Lazard to review potential deals, with indicative offers expected by early autumn. Coca-Cola acquired the British coffee chain in 2018 for over $5 billion, but CEO James Quincey recently admitted the investment "is not where we wanted it to be."

Eli Lilly's obesity pill remains viable despite underwhelming trial data that sent its stock tumbling 13%. Their daily pill orforglipron caused 12.4% weight loss on average, below Novo Nordisk's oral semaglutide at 16.6%, but offers advantages like no dietary restrictions and potentially easier manufacturing.

$GOOG rose 3% to a new ATH last Friday after Apple announced plans to incorporate Google’s Gemini AI in a new version of Siri. This partnership is taking place while the two tech behemoths are locked in a legal battle against the U.S. government over search engine monopoly.

😱 Fear and Greed Index

🪙 Crypto

Ethereum shattered its previous all-time high, reaching $4,945 before ETH snapped back to $4,543.

Standard Chartered analysts upped their year-end ETH price target to $7,500 from $4,000, with a $25,000 prediction by 2028.

Wall Street and crypto lobbyists clashed in Washington as banks pushed to amend the recently passed GENIUS Act for stablecoins, fearing deposit flight.

🤖 AI/Future/Tech News

Meta partnered with Midjourney to license its AI image and video tech, positioning itself against OpenAI’s Sora and Google’s Veo.

OpenText joined HPE’s Unleash AI program to drive adoption in healthcare, finance, and retail, with eyes on a $3.68 trillion market by 2034.

AltIndex’s AI model has highlighted Sea Limited, the Singapore-based consumer internet company, as a buy. Here’s what’s going on with the stock:

Fundamentals: YoY revenue growth of 38.51% and 397.18% YoY net income growth.

Technicals: RSI is at 20.8, indicating the stock may be undersold. It has a short- and long-term bullish price trend as well.

Alternative data: A congressman just bought Sea Limited. Employee sentiment is overwhelmingly positive at 96%. And website traffic is up 55%, which could translate to more sales.

The stock currently sits at $190.42, and AltIndex predicts an increase to $222.36.

Always do your own research.

🚨 Trending on Reddit

People are talking about BTC’s recent sharp drop. Some think it’s because of whale activity. There’s also a level of panic among new investors who bought Bitcoin at its recent peak and are now facing losses. At the same time, there are speculations about potential market manipulation and anticipations about future price movements.

People are actively discussing the potential of Ethereum's market cap surpassing that of Bitcoin, a scenario which was nearly realized in 2017. Reddit users are also talking about the crypto’s current performance, with some users noting its all-time high amidst claims of a crypto crash. Lastly, there is discussion about funds flowing from Bitcoin into Ethereum and other altcoins as Bitcoin's dominance decreases.

🤫 Insider Trading

Stock | Who bought/sold? | Trade details | Total amount |

|---|---|---|---|

Republic Services $RSG | 10% owner via Cascade Investment | Bought 4,258 shares | $1 million total |

Kymera Therapeutics $KYMR | Director | Bought 655,500 shares @ $44 | $28.84 million total |

📊 IPOs and Earnings

🎙 What Do You Think?

Where will Nvidia earnings land?

🎤️ What you said last time

“I am just feeling a little love from the big guy next month, after all, Oktoberfest starts September 20, and he may as well make it a 2fer. ”

Image: Olympian Motors

Y-Combinator-raised Olympian Motors is an electric vehicle company that aims to compete with the likes of Tesla and Rivian. The company is VC-backed, already has a $57 million pipeline, and has strategic partners at Foxconn, NVIDIA, Google/Android, Qualcomm, Bosch, and BYD & Columbia University.

🧠 The Missing (Market) Links

See mortgage rate predictions for the next 5 years.

The US dollar has lost 40% of its value in the past 25 years.

OpenAI CEO Sam Altman thinks that the age of AI is the most exciting time to start your career.

Senator Rick Scott disclosed trades of $26 million—one year late.

Warren Buffett cut 41% of Berkshire’s Bank of America stake and piled into a stock that’s returned nearly 47,000% since its IPO.

Buffett’s new favorite? A pool supply company that’s up 47,000% since 1995 and still quietly compounding.

See how much you need to retire with this handy calculator.

📜 Quote of the Day

“Yesterday ended last night. Today is a brand-new day.”

📢 We want to hear from you

We love hearing from you, and we deeply appreciate your feedback.

⭐️ What did you think of today's edition?

That’s all for today. Did we miss anything? Smash the reply button to let me know.

Cheers,

Brandon & Blake of Invested Inc

Thumbnail image: Federalreserve, Flickr

The information provided in Stocks & Income is for informational and educational purposes only and should not be construed as financial advice, investment advice, or a recommendation to buy or sell any securities. Stocks & Income is not a registered investment advisor, broker-dealer, or licensed financial planner. Always do your own research and consult with a licensed financial advisor before making any investment decisions. We may hold positions in or receive compensation from the companies or products mentioned. Disclosures will be made where applicable.