In partnership with Worthy Wealth

Good Morning.

Last year, I explored a surprisingly underdiscussed demographic trend – the gradual aging of the world economy.

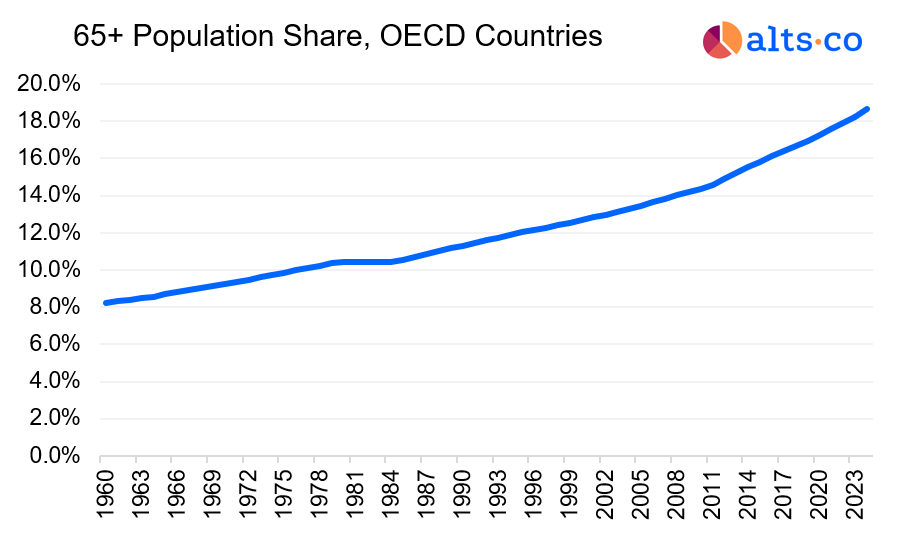

Globally, the share of the population aged 65+ has doubled since 1960. That trend shows no signs of stopping, and it’s already having a major impact in at least one area: housing.

Due to mobility and healthcare issues, many aging adults reside in dedicated senior living communities.

As the population has aged, demand for these communities has soared. But in the US, supply hasn’t been able to keep up.

Long development timelines and a lack of financing have led to limited new construction over the years. That’s created the perfect storm for a supply-constrained environment.

Senior living setups can range from ‘independent living’ arrangements to more intensive ‘memory care’ facilities. But all help provide additional support for the needs of seniors. Image: Vitaly Gariev

Today, we’re looking at a company focused on boosting the supply of high-quality senior living facilities in the US: Worthy Wealth.

Worthy Wealth specializes in fractionalizing private credit. Now, they’re taking that experience to the senior living market, partnering with expert institutional operators on an acquire-and-improve strategy.

What’s more, they’re inviting investors to participate in that journey, targeting net annualized returns of 15%.

In this issue, I’ll take a look at the supply-demand gap plaguing the senior living market and explore how Worthy Wealth plans to address it. Along the way, you’ll see:

Why America’s senior living supply gap is only expected to get worse,

Why today’s seniors are increasingly demanding senior living with access to modern amenities and personal programs,

How Worthy Wealth is seeking to make key improvements at underperforming senior sites,

And how investors can participate in applying a private equity playbook to this niche real estate sector.

This could be a unique opportunity for the right investor, offering the potential to earn competitive returns while also addressing an important social challenge.

Let’s go 👇

America’s Senior Surge: The “Silver Tsunami”

The numbers don’t lie – America is getting older.

In 1960, the share of the US population aged over 65 was just under 9%. By 2024, that had increased to almost 18%, driven by falling birth rates and rising life expectancy.

And this isn’t a trend unique to the US. In the developed world, countries are aging quickly, a pattern that shows no signs of slowing down.

Across the OECD, a group of mostly middle- and high-income countries, the average senior share of the population has risen markedly over the past few decades. Data: St. Louis Federal Reserve

Other data points underscore the scale of this trend:

In the US, an estimated 10,000 people turn 65 every single day.

In nearly half of all US counties, there are now more adults aged 65+ than children.

At the far end of the age curve, the figures are even more robust. America’s 80+ population is expected to double in the next ten years alone.

Since seniors don’t spend their money the same way younger people do, this is a shift with major economic impacts.

One of the biggest new expenses older adults might have? Senior living.

Senior living: When traditional housing no longer works

The concept of ‘senior living’ encompasses a variety of different structures: independent living, assisted living, skilled nursing facilities, etc.

Each of these arrangements comes with varying levels of assistance and support. But the logic behind all of them is the same – for some aging adults, traditional housing options are no longer well-suited to their needs.

There are a few reasons that can be the case:

Many seniors have limited mobility, meaning stairs and long walks may be out of the question.

Ongoing medical needs, especially for seniors with memory challenges, might require support from on-site nurses and aides.

Finally, your older years can be isolating. Many senior living arrangements offer a valuable sense of structured community.

Although the vast majority of older US adults live on their own or with family, the likelihood of needing additional support rises dramatically as you age. About 7 in 10 people are expected to need assisted living care at some point in their lives.

When combined with America’s aging population, these needs have translated into a huge rise in demand for senior living facilities.

But here’s the thing – the US hasn’t created nearly enough supply to match that demand.

The US Doesn’t Have Enough Senior Living

Right now, there are approximately 45,000 senior living facilities in the US, depending on how you count.

At current levels, the data indicates that this inventory isn’t sufficient for the country’s needs:

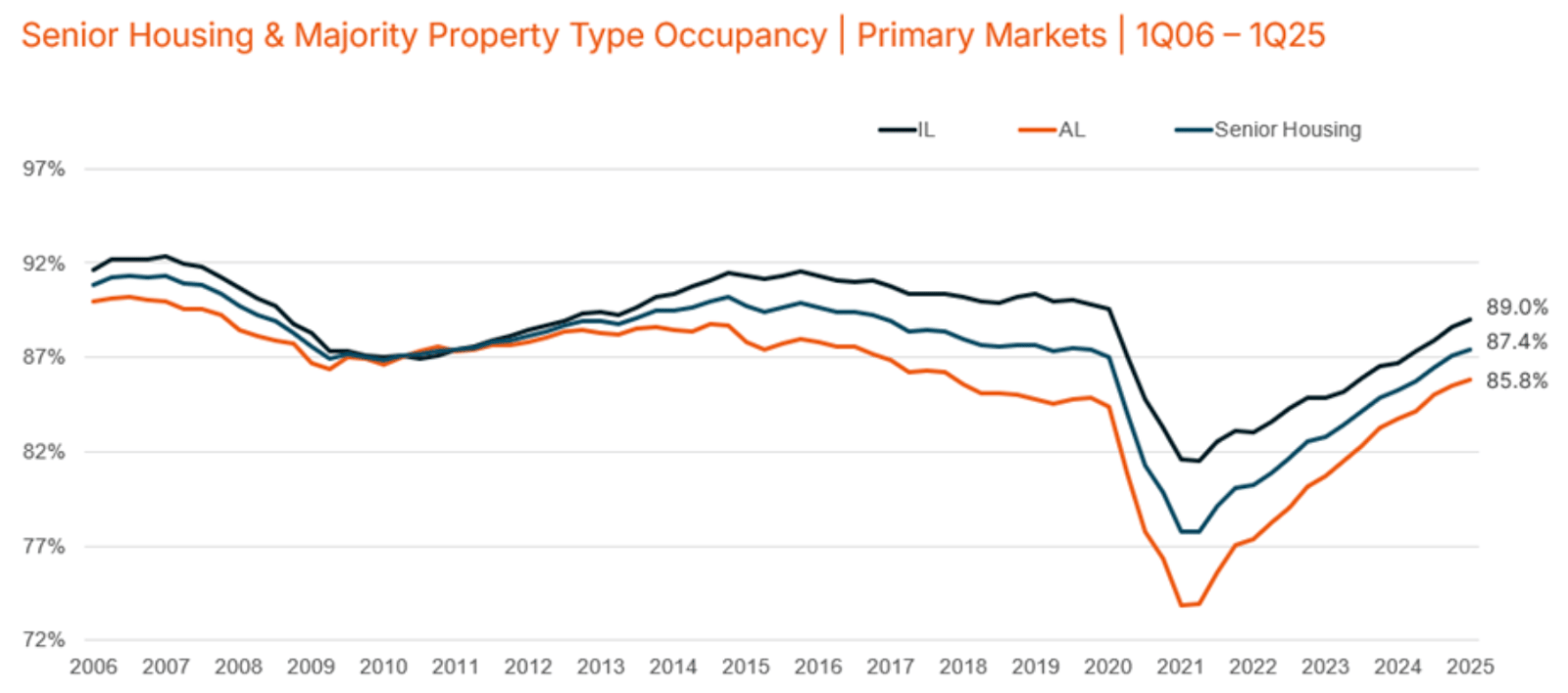

In the first quarter of 2025, the occupancy rate for senior living jumped to 87.4%, demonstrating tight supply.

The average waitlist to move into senior living varies by facility, but it can take months or even years for spots to open up.

High absorption continues to drive rising occupancy rates – units are being snatched up faster than newly constructed supply can come online.

While there’s some variation between specific categories, this supply-demand imbalance is being seen across all types of senior living.

To put it delicately, the COVID pandemic led to an increase in available senior living units. But that temporary supply glut has basically evaporated, leading to a tight market once again. Chart: NIC. IL: Independent Living AL: Assisted Living

The result? Senior living costs are on the rise.

In 2021, the median assisted living facility cost about $4,600 a month. By 2025, that had jumped to nearly $5,600, increasing at a pace of almost 5% per year.

In theory, new supply should be able to offset this price surge and accommodate America’s aging population. But in practice, this simply isn’t happening, meaning that supply constraints are only expected to get worse.

As of late 2024, fewer than 22,000 new senior living units were under construction nationwide. That’s the lowest level of construction activity since 2014, indicating a dangerous slowdown.

Unfortunately, traditional sources of capital remain wary of financing senior living projects. Due to a lengthy permitting and zoning process, it can take years for these sites to start generating profits.

And here’s the thing – senior living supply challenges aren’t just about quantity. They’re also about quality.

Modern senior living: Not your grandma’s retirement

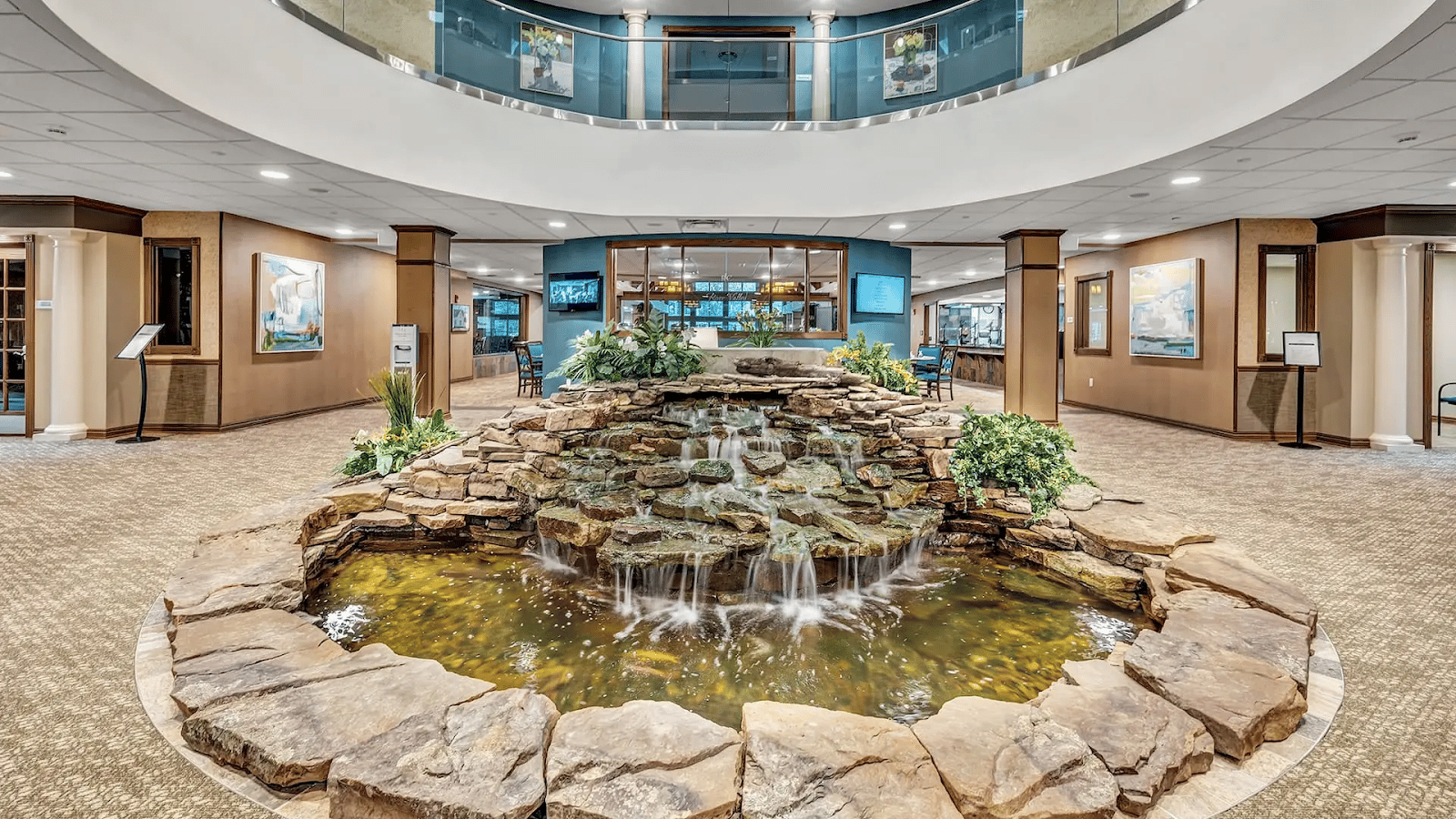

Traditionally, senior living facilities aren’t the most inspiring environments. Picture muted colors, drab meals, and the most thrilling activity being Wednesday bingo.

But today’s seniors have much higher expectations for what their living environment should look like.

Many modern senior living facilities look closer to luxury hotels. They come with resort-style amenities, chef-designed menus, and a range of tailored outings and activities.

Modern senior living might look a lot nicer than you’d expect. Unfortunately, most facilities still haven’t caught up yet. Image: Resort Lifestyle Communities

Not only is America’s senior living inventory ill-prepared for higher demand, it’s also ill-prepared for these higher expectations.

About 44% of the country’s senior living facilities are more than 25 years old. When we discuss the industry’s supply needs, we’re not just talking about fresh construction – renovation of existing inventory is also needed.

All this data points to one thing: there’s a massive opportunity waiting for investors who can bring modern senior living facilities to market.

This real estate niche could offer the chance to earn high, stable rents with strong occupancy rates. What’s more, investors can help supply the type of modern facilities that today’s seniors deserve, providing a valuable social boost on top of attractive economics.

This is exactly the opportunity that Worthy Wealth is focused on, helping narrow the market’s senior living gap and targeting attractive returns in the process.

What is Worthy Wealth?

Worthy Wealth is a financial firm focused on bringing wealth-building opportunities to everyday investors, bypassing Wall Street and traditional banks.

As the name suggests, these opportunities focus on socially valuable projects that are ‘worthy’ of investor backing. Previous deals have included financing Main Street businesses and residential real estate construction.

Worthy’s newest opportunity is centered on senior living developments in the United States.

The company is currently raising money to execute a strategy focused on acquiring and improving existing senior living facilities. Following a multi-year holding period, Worthy’s operating partners will then aim to sell those upgraded assets for a higher price.

In the process, Worthy is seeking to address the market’s drastic shortage of modern, high-quality senior living assets – while also generating competitive returns for investors.

Worthy’s plan: Acquire, improve, exit

Worthy’s strategy essentially follows the private equity playbook in a niche real estate sector. That playbook involves acquiring an asset and making significant operational improvements before selling it at a premium.

The company will consider acquisition sites across the senior living spectrum, including independent living, assisted living, and memory care facilities. Within this mandate, Worthy is targeting:

Sites in Sunbelt states, which are a frequent choice for retirees looking for a warmer climate.

Close proximity to metro areas and city hubs, which should help ensure robust occupancy.

And ample referral opportunities through nearby hospitals and medical facilities.

To improve acquired sites, Worthy will seek to make upgrades like hiring experienced managers, adding new amenities, and boosting marketing to drive occupancy rates.

To execute that strategy, Worthy has selected an institutional real estate partner with significant expertise in these types of transactions. The partner’s previous ‘acquire-and-improve’ deals have successfully generated ROIs around 100% over a 3 to 4 year period, helping support competitive projected returns.

Who’s behind Worthy Wealth?

Worthy Wealth is led by founder and CEO Sally Outlaw. Sally is a lifelong entrepreneur with over 30 years of experience in the real estate and financial industries.

Previously, Sally led a firm called Peerbackers, where entrepreneurs could raise crowdfunding for innovative business ideas. She also holds a license as a real estate broker and was formerly a Registered Investment Advisor. She is currently the Chief Executive Officer for both Worthy Financial and Worthy Wealth.

After helping thousands of entrepreneurs access funding, Sally realized the power of giving everyday individuals the opportunity to participate directly in these deals. Thus, the idea for Worthy Wealth was born, focused on raising funding for a wider range of asset classes.

Today, you can invest with Worthy Wealth through the firm’s newest Senior Living offering – below, we explore the details in depth.

Investing with Worthy: Senior Living Shares

Worthy Wealth is issuing Senior Living Shares to fund the company’s latest strategy, targeting a raise of $75 million.

About 5% of this raise will go toward working capital and general corporate purposes. The remaining 95% will be invested in senior living real estate investments.

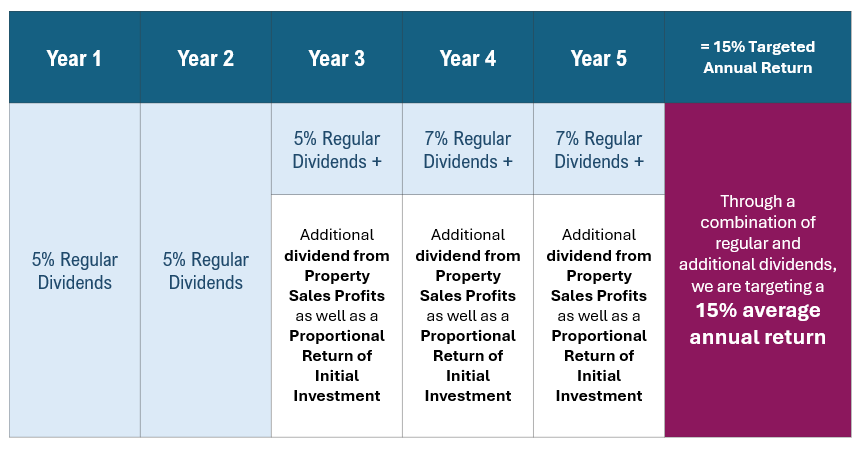

The company is targeting an annualized return of 15% with a three to five-year holding period. That return will be realized through a mix of ongoing dividends and acquisition proceeds.

For the first three years, investors will earn dividends of 5%. Thereafter, dividends increase to 7%.

Upon the sale of any underlying facility, investors will recoup their initial investment tied to that property (Worthy will redeem an equivalent number of outstanding shares pro rata).

Investors will also be entitled to 60% of Worthy’s acquisition profits from the sale, which accounts for the rest of the projected returns.

Worthy Wealth Senior Living projected return structure. Source: Worthy Wealth

Here are the final details:

Target return: 15% net annualized

Target holding period: Up to 5 years

Target raise: $75 million

Minimum investment: $100 (10 shares)

Maximum investment: $50,000 (5,000 shares)

Investment type: Preferred shares

Dividend schedule: Quarterly starting May 2026 (estimated)

Maturity: None; redemption dependent upon sale of underlying acquisitions.

Accreditation restrictions: None (Reg A offering). Non-accredited individuals may face investment limits.

In addition to this offering focused on senior living, Worthy Wealth also has two other current opportunities for investors to consider.

These include a real estate investment in Worthy’s housing bonds as well as an equity investment in Worthy’s corporate shares.

Worthy Senior Living: Risks & Rewards

Worthy Wealth’s projected annualized returns of 15% are highly competitive. Like all potentially lucrative opportunities, however, it’s important to understand the risks that go along with this deal.

The first batch of risks has to do with Worthy Wealth’s strategy itself:

Young company with an unproven strategy: Although its operating partners have deep experience in the sector, Worthy Wealth only launched its senior living strategy in early 2025. The company has yet to execute its proposed plan in practice, meaning there’s a limited track record for investors to judge.

Portfolio risks tied to uncertain sites: Worthy Wealth’s partners have only identified its first few acquisition targets, so investors don’t have many details on what the ultimate portfolio will look like.

Exit risks tied to unknown future market: The bulk of Worthy Wealth’s projected returns are expected to come from future exits. Despite the senior living supply-demand imbalance, it’s hard to say exactly what the exit market will look like five years from now, which could impact realized returns.

The second area worth understanding is the track record of the leadership team.

There are two officers on Worthy Wealth’s team who are also involved in Worthy Financial – a legally distinct entity with a similar brand.

That company encountered liquidity challenges tied to small business loans made during the COVID pandemic. 92% of their investors were repaid on schedule, while 8% are still impacted by pandemic-related setbacks. That said, it's important to note that none of Worthy Financial's real estate loans were impacted by these challenges, and that Worthy Wealth is focused entirely on the real estate sector.

⭐️ What did you think of today's edition?

🫡 See You Next Week

That’s all for today’s special edition. Thanks to our partners Alts.co and Worthy Wealth for the content. We hope you got value from it. Reply and let us know if you did.

Until next week,

— Brandon & Blake

The information provided in Stocks & Income is for informational and educational purposes only and should not be construed as financial advice, investment advice, or a recommendation to buy or sell any securities. Stocks & Income is not a registered investment advisor, broker-dealer, or licensed financial planner. Always do your own research and consult with a licensed financial advisor before making any investment decisions. We may hold positions in or receive compensation from the companies or products mentioned. Disclosures will be made where applicable.

Stocks & Income, AltIndex, Finance Wrapped, The Chain, and Future Funders are all owned by Invested, Inc.