Good morning.

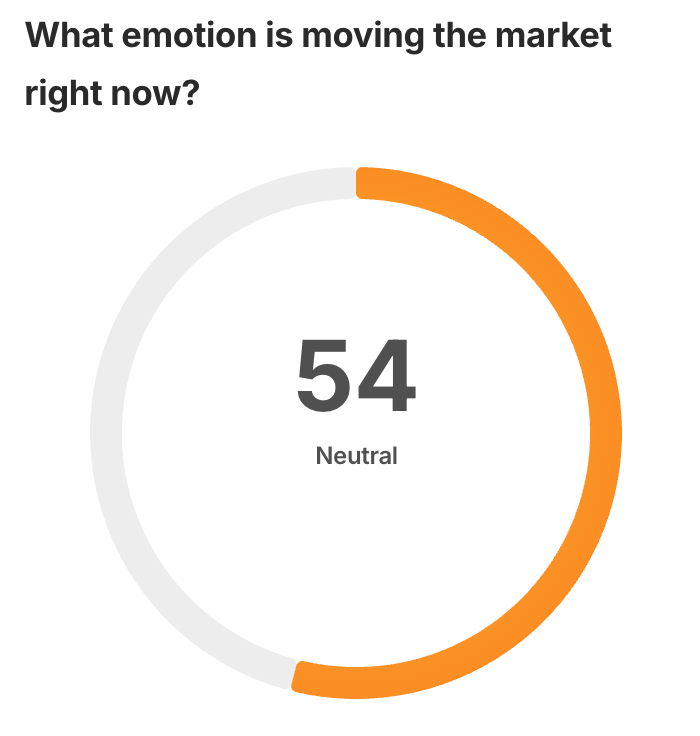

All of a sudden, it appears that markets are back in risk‑on mode.

AI chips are heating up, the Fed’s cut odds are soaring, and crypto just crossed a line nobody saw coming.

Eventbrite is up 78% premarket on news of an acquisition

Amazon unveiled a new AI chip that’s more “cost effective” than Nvidia’s.

Anthropic plans to go public as soon as 2026 (one of the largest IPOs ever)

Bank of America endorsed up to 4% crypto allocation for its investors

Let’s get into it.

In partnership with Roku

Shoppers are adding to cart for the holidays

Over the next year, Roku predicts that 100% of the streaming audience will see ads. For growth marketers in 2026, CTV will remain an important “safe space” as AI creates widespread disruption in the search and social channels. Plus, easier access to self-serve CTV ad buying tools and targeting options will lead to a surge in locally-targeted streaming campaigns.

Read our guide to find out why growth marketers should make sure CTV is part of their 2026 media mix.

Please support our partners!

📰 Market Headlines

Markets climbed on Tuesday as investors regained confidence after a shaky start to December.

The Dow rose 0.4%, the S&P 500 gained 0.3%, and the Nasdaq advanced 0.6%.

The ADP’s private payrolls just unexpectedly fell by 32,000 jobs. Lower employment means higher likelihood that the Fed will cut rates this month. While that’s positive for stocks and crypto, keep in mind that a December rate cut may already be fully priced in. Which could mean that not much would happen if rates are cut on December 9 (and that prices could fall a lot if rates are paused).

Amazon launched its new Trainium3 AI chip, claiming it’s four times faster and more energy efficient than its predecessor. The chip is part of Amazon’s push to challenge Nvidia’s dominance in AI hardware. AWS said customers could save 30–40% on compute costs using its chips, which are already being deployed by Anthropic. Amazon also said it is developing Trainium4, designed for compatibility with Nvidia’s NVLink Fusion technology.

OpenAI CEO Sam Altman declared a “code red” inside the company**, ordering teams to focus on improving ChatGPT after Google’s Gemini 3 outperformed it on benchmarks. The move delayed OpenAI’s other projects, including AI agents. Altman warned staff that Gemini’s success could create “economic headwinds” for OpenAI, which has pledged $1.4 trillion in AI infrastructure spending over the next eight years.

Anthropic has apparently tapped IPO lawyers to prepare to go public as early as next year. It appears that the AI company is racing against OpenAI to see who can IPO first; maybe that’s another reason for Altman’s “code red” (see above).

Alphabet shares outperformed peers this quarter, with investors signaling the company has overtaken OpenAI and Nvidia in the AI race. Since Gemini 3’s release, Alphabet stock has surged 30%, while Nvidia and Microsoft have lagged. Wells Fargo analysts said “AI is no longer a tide that lifts all boats,” as the market starts picking winners and losers.

Bitcoin posted its best day since May (up 11%) right after its worst day since March. Here were the three main catalysts:

Vanguard lifted its ban on crypto ETFs, triggering a surge as BlackRock's IBIT saw $1 billion in volume within 30 minutes.

Bank of America (BOA) recommended that clients consider putting 1 to 4% of their portfolios in crypto.

SEC Chair Paul Atkins said the agency will release an "innovation exemption" for crypto firms in January.

Marvell Technology announced a $3.25 billion deal to acquire Celestial AI, expanding its networking portfolio amid fierce competition from Nvidia and Broadcom. Celestial will receive $1 billion in cash and 27.2 million Marvell shares. Marvell stock fell 6% after hours on the news.

Comcast is bidding to merge NBCUniversal and Warner Bros., creating a Hollywood giant spanning film, TV, and streaming. Shares of both companies jumped on the report, with Comcast up 2.6% and Warner Bros. up 3%. The deal would combine Peacock and HBO Max under one umbrella, though regulators are expected to scrutinize the merger closely.

Intel shares jumped 8.6% after reports that it will build Apple’s M-series chips starting in 2027. The move would mark Apple’s return to Intel’s foundry business after years of relying on TSMC. Intel’s 18A-P process will power the chips, signaling a major comeback for its manufacturing arm.

Eventbrite soared 78% pre-market after agreeing to a $500 million buyout by Italian tech conglomerate Bending Spoons. The $4.50-per-share deal represents an 82% premium and will take the company private in 2026. Bending Spoons has been on an acquisition spree, recently closing deals for Vimeo and AOL.

American Eagle stock surged 15% after raising its holiday forecast on strong third-quarter results. The retailer now expects comparable sales to grow 8–9% this quarter, far above expectations. Aerie brand drove most of the gains, with sales up 13%, while its celebrity campaigns with Sydney Sweeney and Travis Kelce helped boost brand awareness.

🤖 AI/Future/Tech News

Mark Zuckerberg has been cooking soup and hand-delivering it to OpenAI researchers as part of Meta’s (META) AI researcher headhunting process.

Uber (UBER) launched a partnership with Nebius’s (NBIS) Avride for self-driving uber rides and robot food deliveries in Austin, Texas.

Amazon (AMZN) launched Nova Forge, a $100K-a-year service letting companies inject data into AI models mid-training.

🪙 Crypto

The UK just passed a law that officially recognizes crypto as property.

Symbiote on Twitter thinks BTC’s weakness is a giveaway sign that we might be in for “altseason,” where altcoins take off after Bitcoin’s dominance falls.

🚨Trending on Reddit

🃏 Alternative Investment: Collectible Cards

The collectible card market hit $3.79 billion in 2024 and is projected to reach $7.17 billion by 2032, growing at an 8.3% annual clip as millennials returned to the hobby with higher disposable incomes and nostalgia-driven purchasing power. Investment-minded collectors treated rare cards as alternative assets, prompting authentication companies to expand operations for condition-verified premium pieces.

Women's sports viewership exploded 89% this past season, driving manufacturers to launch dedicated product lines like trading cards featuring female athletes, tapping into an underserved market segment with strong purchasing power.

📊 IPOs and Earnings

Crowdstrike (CRWD) barely beat Q3 estimates on top and bottom lines. However, despite only squeaking past estimates, CRWD posted a $265 million in net new annual recurring revenue, which is a new record, and ARR rose to $4.92 billion. Subscription revenue rose 21% to $1.17 billion.

Scotiabank (BNS) beat analyst estimates, with profit up 31% to C$2.21 billion and adjusted EPS of C$1.93 vs C$1.84 expected; however, shares were little changed as higher credit-loss provisions weighed on the outlook.

American Eagle Outfitters (AEO) beat Q3 2025 estimates with revenue up 5% to $1.6 billion and EPS of $0.54 vs $0.51 expected; shares rose ~15% after the company raised its holiday sales forecast.

🎙 What Do You Think?

How long with the Bitcoin bear market last?

🎤️ What you said last time

🧠 The Missing (Market) Links

President Trump is apparently serious about wanting to abolish the income tax.

Global government debt climbed to $111 trillion, with Japan taking the top spot with a 230% debt-to-GDP ratio.

Southwest Airlines revealed plans to permanently cut several daily and weekend routes starting in August 2026.

Credit card delinquency rates spiked in the Deep South, with Mississippi leading the nation at 37%. See the full map here.

📜 Quote of the Day

Volatiltiy is the price of admission. Uncertainty is the source of return.”

📢 We want to hear from you.

We love hearing from you, and we deeply appreciate your feedback.

⭐️ What did you think of today's edition?

That’s all for today. Did we miss anything? Smash the reply button to let me know.

Cheers,

Brandon & Blake of Invested Inc

The information provided in Stocks & Income is for informational and educational purposes only and should not be construed as financial advice, investment advice, or a recommendation to buy or sell any securities. Stocks & Income is not a registered investment advisor, broker-dealer, or licensed financial planner. Always do your own research and consult with a licensed financial advisor before making any investment decisions. We may hold positions in or receive compensation from the companies or products mentioned. Disclosures will be made where applicable.

Stocks & Income, AltIndex, Finance Wrapped, The Chain, and Future Funders are all owned by Invested, Inc.