I fly back to Spain today, so we’ll be back on track with normal delivery of these guys tomorrow, all going well.

Thanks for your patience.

This is fine.

The top 5 stocks for 2024 (from investing legend Louis Navellier)

In the ever-changing tides of the stock market, a guiding star emerges. Meet Louis Navellier, one of America's top Money Managers with a staggering $1 billion under management.

With InvestorPlace, you're not just investing; you're being led by a legend who's been uncovering America's biggest investment opportunities before anyone else.

Why trust Louis?

Proven Track Record: He found Apple at $1.49, Microsoft at 38 cents, and Amazon at just $46.

Consistent Excellence: For the last eleven years, his system identified the S&P's #1 stock.

The Earnings Whisperer: Dubbed by CNBC for his uncanny ability to spot winners like Netflix, Nvidia, and AMD.

Visionary Insight: Hailed by MarketWatch as "The Advisor Who Recommended Google Before Anyone Else."

Louis has just updated his most anticipated report of the year: The Top 5 Stocks for 2024.

This is your chance to gain insights from a legend, with critical details about 5 stocks set for explosive growth.

Ready to transform your portfolio with insights from a legend?

SPONSOR

📰 Market Headlines

*past 24-hour performance

Tech giants led the market downturn yesterday; all major indexes fell about 1%.

Apple's sales plunged in China by 24%.

Tesla's Berlin factory shut down after an attempted firebombing. Shares are at their lowest in nearly 2 years.

Facebook, Instagram, and Threads all went down for a while.

Bitcoin soared to a new all-time high of $68,869, then crashed hard down 11%. It’s around $66k at publishing.

Fed Chair Jerome Powell testifies to Congress today. Markets will be looking for any hint of change in the Fed's rate cut plans.

“The message very much is not going to be ‘mission accomplished,’ but ‘we’ve made a lot of progress, we anticipate rate cuts are coming,’” said Joseph LaVorgna, chief economist at SMBC Nikko Securities.

🕶️ Market Vibes

A big call by Apollo saying the Fed will cut rates zero times this year.

Here are my current open positions on Kalshi.

As you can see, I’ve been bearish on rate cuts for some time, and it’s paying off now. Also, it’s now been widely covered that the new Nintendo Switch won’t come out until 2025, but markets on Kalshi haven’t caught up yet

You can get $25 free to play this disconnect if you’d like.

🎰 Market Forecasts and Futures

Forecasts via Kalshi, the prediction market.

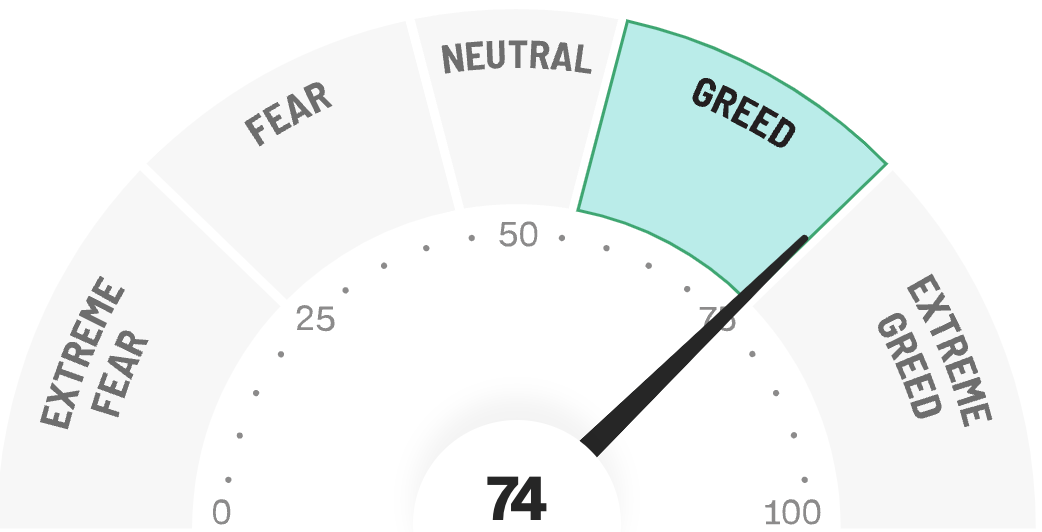

😱 Fear and Greed Index

🧠 What do you think?

Ross Stores issued a double beat yesterday (see below). I honestly didn’t know they were still around.

When is the last time you (or your spouse/partner) were in a Ross?

🎤 What you said last time

Properly combined through an excellent documentary and a plate of brisket.

Smoked meats

“Not everyone likes talking about war; almost everyone likes good smoked meat.”

It doesn’t get any better than this, boys.

Ross stores had a bit of a moment during the pandemic, but it looks like the chain of discount retailers is sliding into a slow demise. Could a recession save the company? |

📊 Stocks

Want to invest like Buffet? With Public.com, you can emulate Berkshire Hathaway’s portfolio with just a few clicks.

Winners and losers

Earnings, upgrades, and acquisitions

Target beat expected Q4 sales, gross profit margins, and EPS. It announced plans for growth in 2024, focusing on new stores, remodels, and a membership program. Stock popped over 10% on the news.

CrowdStrike issued strong guidance, beat earnings, and announced its acquisition of Flow Security. Shares up 23%.

Box exceeded Q4 earnings expectations but issued poor 2024 guidance; stock stable.

ChargePoint saw shares fall 7.5% after reporting a 24% year-over-year revenue decline.

NIO briefly reached a new 52-week low then stabilized after missing earnings estimates.

Ross Stores provided cautious guidance despite beating earnings and revenue estimates for the holiday quarter; shares 1.5%. [Ed: honestly didn’t know Ross was still a thing.]

Market movers

The Biden administration capped credit card late fees at $8; banks are predictably indignant.

Apple's shares tumbled below $170, entering a technical correction and erasing over $300 billion in market value.

Its sleepy response to the AI wave isn't helping.

Tesla's German Gigafactory halted operations due to a suspected arson attack, with losses expected in hundreds of millions of euros.

Palantir will likely win a $178M TITAN contract with the US Army.

Nordstrom's shares dropped 10% after it warned of declining 2024 sales.

China targets around 5% economic growth for the year, according to Premier Li Qiang.

Ideas, trends, and analysis

US applications for jobless benefits rose but remain historically low.

The Nikkei's rally may persist, fueled by AI and corporate governance reforms.

UK investors bought US stocks at the fastest rate in nine years.

🌍 Global Perspectives

🇷🇺🇨🇳 Russia and China are considering installing a nuclear power plant on the moon by 2035. [Ed: Wut]

🇨🇳 🇹🇼 China increased its defense budget by 7.2% and sharpened rhetoric against Taiwan.

🇱🇧🇮🇱 Hezbollah launched a rocket barrage at Kiryat Shmona, Israel, in response to an IDF airstrike.

🇻🇳 Vietnamese tycoon Truong My Lan faces the death penalty in a $12.5 billion fraud trial.

🇵🇭 Four Philippine sailors were injured after a Chinese attempt to block a resupply mission to Second Thomas Shoal.

📊 Income

Seven no-frills stocks stand out for their consistent and reliable dividends.

Now might be the best time to invest in REITs, with the potential for asset acquisition and rent growth.

These pharma dividends might cure your portfolio.

Five under-$25 stocks offer ultra-yield dividends for aggressive investors.

📊 Crypto

Spot Bitcoin ETFs shattered records with over $10 billion in trading volume amid BTC's price rollercoaster.

The SEC will probably decide on Ethereum spot ETF proposals in May.

Mining stocks have underperformed during this Bitcoin run.

Ether reversed gains, dropping 5% under pressure from Bitcoin's decline. It quickly bounced back and sits well above $3,800 atm.

🧠 Errata

A Frenchman found a near-complete fossilized Titanosaur. He surrendered immediately.

Cities across the US are offering up to $15,000 to entice new residents.

The mysterious 'Vulkan Group' declared "no Tesla is safe" after claiming responsibility for firebombing the Berlin Tesla factory.

Musk is having a bad day. OpenAI hit back with a bundle of email archives where he directly contradicts his lawsuit's claims.

A tragic plane crash on the side of an interstate in Tennessee killed five.

Congress wants to ban/sell TikTok again.

📺 What to Watch Today

That’s all for today. Did I miss anything? Smash the reply button to let me know.

Cheers,

Wyatt