In partnership with Trading Whisperer

Potential Tesla Battery Rival Just Posted 219% Revenue Growth

Tesla is obviously making home battery storage cool (and viable). But here’s a question: what if there was another battery storage company that could install batteries up to 8x faster than Tesla, and wasn’t affected by tariffs, would you be intrigued?

And what if this company’s market cap was only $178 million?

The home battery revolution may have started with Tesla, but there’s a small-cap company out there that’s looking to give Musk a run for his money. Today, we want to take a look at some of the more interesting points of analysis and news regarding NeoVolta, Inc. (NASDAQ:NEOV), which could be positioned to become a major contender in the battery storage industry (if things go according to the company’s plan).

NeoVolta’s story is simple: rapid growth, smart execution, and a potential acquisition that could change the game entirely. The company is in the process of acquiring an energy tech firm that could cut installation times to 30 minutes (versus Tesla’s 4 hours) on its new product, while shifting its supply chain outside the reach of tariffs.

Why Battery Storage Matters

Quickly, we’re going to set the stage for why battery storage companies even matter in the first place.

Investors are piling into battery storage because AI data centers and crypto mining are devouring electricity, gigawatt by gigawatt.

If that trend continues, power costs could keep climbing and outages could become more frequent.

In that kind of environment, households and businesses could face higher utility bills and less control over when power is available. Even if the government intervenes to stabilize prices, it can’t guarantee consistent supply during peak demand.

That’s where at-home battery storage comes in. These systems give homeowners access to electricity when they need it, in a cleaner and quieter way than a generator. Over time, they can also help lower costs by storing energy when it’s cheapest and using it when rates are high.

Ok, so that’s the general backdrop, and now we’ll show you some specifics that make NEOV stand out from its competition.

What Makes NEOV Interesting

We’re just going to get straight to what NEOV is doing well, and why it could be interesting as an investment opportunity.

NeoVolta, Inc. (NASDAQ:NEOV) just posted 219% year-over-year revenue growth, marking its third straight quarters of record growth.

That’s not incremental progress; that’s acceleration.

If the trajectory continues, profitability could soon be within reach, which is when small-cap growth stories often catch Wall Street’s attention.

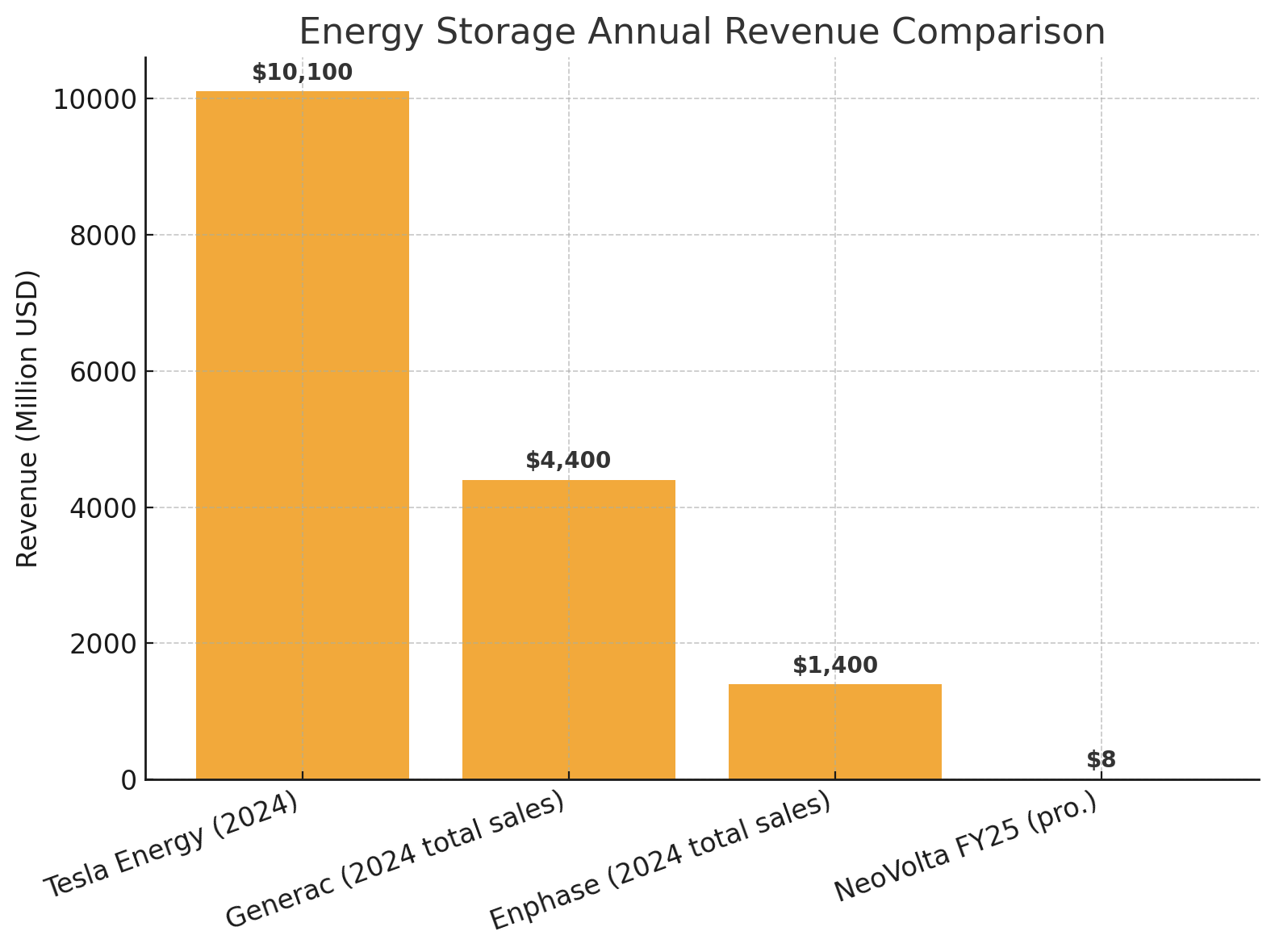

To put that growth into perspective: NeoVolta’s revenue may still be a fraction of industry giants like Tesla or Enphase, but the rate of acceleration tells a different story.

Tesla’s revenue may be 126,100% higher, but NEOV’s expansion speed is still remarkable.

This gap in scale and speed is exactly what makes early-stage growth stories compelling.

NeoVolta, Inc. (NASDAQ:NEOV) isn’t trying to be Tesla tomorrow. It’s carving out a fast-growing niche today, in one of the most capital-intensive and competitive industries in the world: energy storage and home power systems.

NeoVolta recently signed a letter of intent to acquire Neubau Energy, a company with technology that will enable 30 minute battery installs.

If the acquisition moves forward, NEOV could instantly gain two major competitive advantages:

Installation Efficiency: Neubau’s system would make NeoVolta’s installs up to 8x faster than Tesla’s, allowing more deployments per day and happier customers.

Supply Chain Strength: Neubau operates in the US and Austria, meaning NEOV could sidestep costly tariffs that hit imported batteries (up to 28% in some cases). US products face no tariffs, and Austrian goods only 15%, a strategic win in a tariff-heavy environment.

And NeoVolta isn’t stopping at homes. The company plans to move into commercial energy storage with systems designed for schools, factories, and utilities, a $5.19 billion US market.

This is a critical next step. The residential market is competitive, but commercial deployments could significantly expand NEOV’s total addressable market and revenue base.

Adding to its credibility, the company already has a deal with Puerto Rico (backed by the Department of Energy) to provide up to 1,000 home installations.

That partnership demonstrates institutional trust at multiple levels of government. While it doesn’t guarantee a higher share price, it’s hard to overlook the significance: the Department of Energy doesn’t back just any battery company.

The Competition

Let’s take a look at how NeoVolta, Inc. (NASDAQ:NEOV) compares to some competitors.

It’s worth noting also that although NEOV is set to compete against the likes of Tesla, Generac, and Enphase, none of those companies are pure battery plays like NEOV.

They’re all conglomerates, meaning that an investment in those companies is not a play purely on battery storage. If you want to make a bet solely on batteries, NEOV offers that.

Company | What They Do Best | Current Constraint | Recent Scale Signal |

Tesla (NASDAQ: TSLA) | Scale, strong brand, advanced fleet software | Install time and channel bottlenecks in several markets | 31.4 GWh storage deployed in 2024 |

Enphase Energy (NASDAQ: ENPH) | Large installer network, integrated microinverter ecosystem | Tariffs expected to reduce margins by 6-8 points | TTM revenue $1.48B, 150-170 MWh shipped |

Generac (NYSE: GNRC) | Trusted backup brand with a wide dealer network | Total installed cost often near $18,000 | Pricing guides confirm typical installs around $18,000 |

NeoVolta (NASDAQ: NEOV) | Fast installs, broad electrician access, VPP-ready | Small cap, early stage scale-up | 30-minute install via Neubau platform, active DOE-backed Puerto Rico rollout |

So, the field is full of companies that are bigger than NEOV and have been there longer. But we wouldn’t even be writing about NEOV if it didn’t have some meaningful competitive advantages over the competition.

If the Neubau acquisition goes through, NeoVolta will be set to beat competitors with far faster installation times and prices that aren’t nearly as impacted by tariffs as the rest.

Bottom Line

In summary, NeoVolta, Inc. (NASDAQ:NEOV) is an interesting company that’s posted record growth in the past three quarters and has one of its biggest potential upgrades ever coming up (in the form of the Neubau Energy acquisition). There’s no guarantee that NEOV will outperform in the stock market, but the data tells a potentially interesting story: at a current market cap of $177 million, if NeoVolta can continue its growth and become profitable, it could cement itself as a serious player in the battery storage industry.

⭐️ What did you think of today's edition?

Disclosures

Examples that we provide of share price increases pertaining to a particular Issuer from one referenced date to another represent an arbitrarily chosen time period and are no indication whatsoever of future stock prices for that Issuer and are of no predictive value. Our stock profiles are intended to highlight certain companies for YOUR further investigation; they are NOT stock recommendations or constitute an offer or sale of the referenced securities.

Stocks & Income, AltIndex, Finance Wrapped, The Chain, and Future Funders are all owned by Invested, Inc.

The information provided in Stocks & Income is for informational and educational purposes only and should not be construed as financial advice, investment advice, or a recommendation to buy or sell any securities. Stocks & Income is not a registered investment advisor, broker-dealer, or licensed financial planner. Always do your own research and consult with a licensed financial advisor before making any investment decisions. We may hold positions in or receive compensation from the companies or products mentioned. Disclosures will be made where applicable.