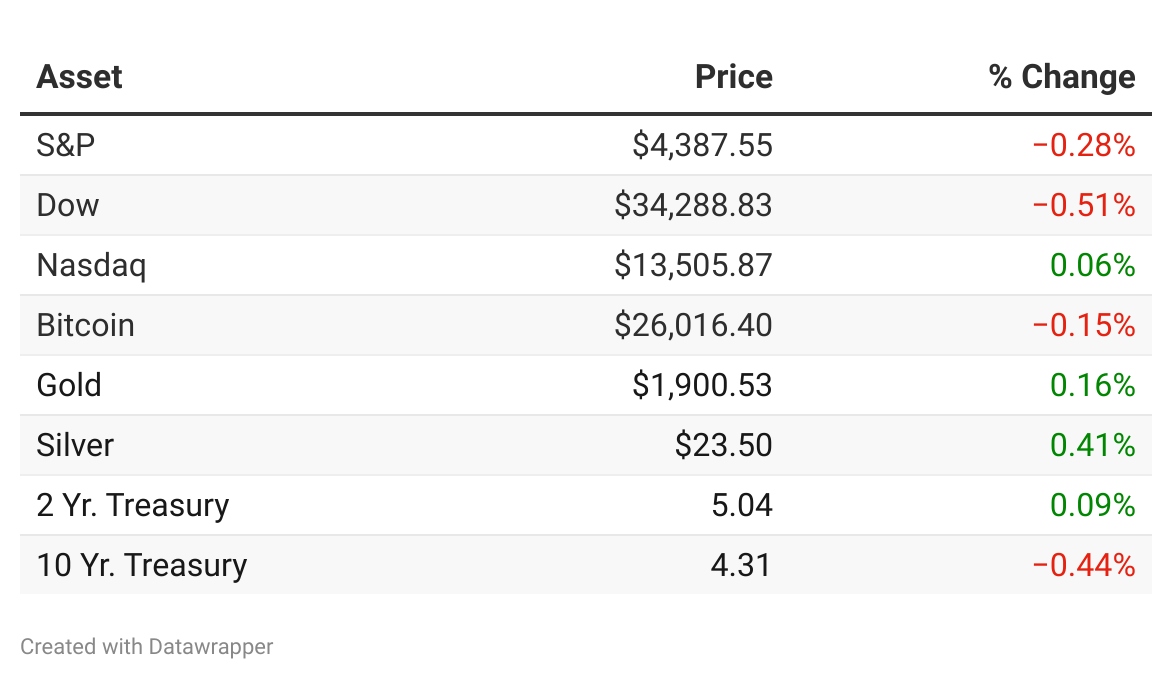

*past 24-hour performance

People aren't paying for stuff: Dick’s (DKS) and Macy’s (M) traded down -24.15% and -14.05% respectively after posting weak quarterly earnings as rising levels of theft, student-loan repayments and credit-card delinquencies cloud earnings picture for retailers (Axios)

Nike logs longest losing streak on record: Nike (NKE) posted a record streak of losses as concern over China’s sluggish consumer recovery builds and elevated merchandise stockpiles continue to weigh on profitability across the activewear industry (Fortune)

Artificial exuberance: Nvidia's (NVDA) stock reached an all-time high of $481.77 yesterday ahead of its earnings report today. The stock has surged over 320% since 2020, when its share price traded at $106 (The Street)

IBM selling The Weather Channel: IBM (IBM) will sell The Weather Company and its assets to Francisco Partners, a tech-focused private equity firm, for an undisclosed sum (CNBC)

Miner flags China uncertainty: BHP Group (BHP), the world’s largest miner, reported its lowest annual profit in 3 years, warning the outlook for China is uncertain as the nation grapples with a brewing crisis in the steel-intensive construction sector (BNN)

Traffic jam: More than 200 ships, carrying millions of dollars of goods, are stuck on both sides of the Panama Canal after authorities capped the number of crossings because of a serious drought. Delays set to wipe $200M off profits and cause spikes in US grocery prices (WSJ)

Bacon prices double: Bacon is about to get even more expensive as wholesale pork belly prices are up 100% this year on the back of an animal welfare law in California, as well as peak summer demand (CNBC)

How to apply for the new student loan repayment plan: The Biden administration’s new income-driven repayment plan, known as SAVE, opened for enrollment on Tuesday, providing millions of borrowers with a more affordable way to pay their monthly student loan bills, which will become due again in October after a three-year pause. Read more »

The stock market has a real problem—a real yield problem: The yield on 10-year U.S. Treasury inflation-protected securities was negative until May of last year. It touched 2% on Friday, its highest level since 2009. That’s an attractive-enough after-inflation yield for many investors, and it presents more competition for stocks, especially those with high valuations. Read more »

Housing affordability… for students?: In America’s most expensive college town, students must make $72,000 just to afford one year’s rent — with a lack of housing construction and an increase in students creating an affordability crisis. Read more »

Pentagon lowering recruitment standards again (American Military News)

The secret weapon hackers can use to dox nearly anyone in America for $15 (404 Media)

DeSantis suggests he would use drone strikes against drug cartels (The Hill)

Why startups are investing millions to make drugs and semiconductors in space (CNBC)

Ecuador votes to ban oil drilling in part of Amazon (Reuters)

Share Stocks & Income → Get Our Free Report

We just launched our brand new report: 5 Stocks Paying 10% Yields... You Probably Haven't Heard Of.

Want access? All you have to do is refer 1 friend to Stocks & Income with your personal referral link and we will send the report to you for free.

You can also copy/paste the link here: {{rp_refer_url}}

Thunderclap Research is a professional investment research firm focused on understanding and profiting from market anomalies.

We take both a quantitative and qualitative approach to research and focus extensively on strategies for established money managers and everyday retail investors.

We are a small, self-funded team of real humans going up against the hype-filled, sensational news outlets in the world. You can check out a selection of our other publications below.