Good morning.

The market does seem to be extremely reactive on the surface (and it is), but that doesn’t mean high-level traders can’t find good trade setups and investment opportunities.

Banking is doing great, gold keeps breaking records, and some more AI companies are creeping into the spotlight.

Today, in the middle of tariff chaos and the AI roller coaster that seems to be pulling us endlessly upward (before the drop?), we’re sharing some trade ideas and news you might not have seen yet. We hope it provides you with some value.

Let’s begin.

In partnership with Rippling

Don’t get SaaD. Get Rippling.

Remember when software made business simpler?

Today, the average company runs 100+ apps—each with its own logins, data, and headaches. HR can’t find employee info. IT fights security blind spots. Finance reconciles numbers instead of planning growth.

Our State of Software Sprawl report reveals the true cost of “Software as a Disservice” (SaaD)—and how much time, money, and sanity it’s draining from your teams.

The future of work is unified. Don’t get SaaD. Get Rippling.

Please support our partners!

Market Headlines

Stocks bounced back sharply on Monday after President Trump cooled his China rhetoric.

The Dow jumped 600 points, the S&P 500 climbed 1.6%, and the Nasdaq surged 2.2%.

Bank earnings week has kicked off strong with earnings beats from JPMorgan (JPM), Goldman Sachs (GS), and Wells Fargo (WFC). After a great summer for bank stocks (rising about 20% overall), Truist “lifted its 2025 and 2026 earnings forecasts for JPMorgan by 20 cents per share” and upped its JPM price target to $319 from $290 (still a “hold” rating), according to Investors Business Daily.

JPMorgan also unveiled a $1.5 trillion decade-long investment pledge, with $10 billion earmarked for US national security. CEO Jamie Dimon is targeting defense, energy infrastructure, semiconductors, and manufacturing. Here’s a list of stocks that could potentially benefit.

Is AMD becoming real competition for Nvidia? Wolfe Research predicts a $300 AMD (currently $216.42) based on its recent deal with OpenAI, allowing the ChatGPT creator to purchase up to 6 GW of computing power. Moreover, Oracle just announced a partnership with AMD, too: Oracle will be deploying 50,000 AMD chips starting next year.

Navitas Semiconductor Corp (NVTS) rocketed 23% after sharing that it will become part of Nvidia’s new AI factory ecosystem. Its role? Specifically to “develop high-voltage power solutions.” Add it to the list of AI picks and shovel stocks to keep an eye on!

Gold topped $4,100 per ounce for the first time ever, surging 2.1% on safe-haven buying as trade tensions resurfaced and Fed rate cut expectations grew. OF NOTE: Gold is also now at its highest RSI (relative strength index) of ALL TIME (91.8). This indicates that gold could be highly overbought. Investors, remain cautious; the precious metal’s future seems like a tug of war between crazy high valuations (bad) and continued inflation, devaluation of the dollar, and global uncertainty (good for gold’s price).

Snowflake (SNOW) could reach a buy range soon if it hits $249.99, according to IBD. SNOW did reach that price last week but sank below it during Friday’s market selloff. The cloud-based data-warehousing company has been steadily building higher and higher revenues over the past two years (growing by 32% in the second quarter of this year). Furthermore, IBD notes that SNOW’s “21-day exponential moving average climbed back above the longer-term 50-day line in September,” another sign of strength for the stock.

😱 Fear & Greed Index

🤖 AI/Future/Tech News

Apple launched pre-orders for its new iPhone Air in China after the government granted eSIM approvals, giving Beijing’s telecom regulators unprecedented control over which devices can connect to domestic networks.

Salesforce rolled out Agentforce 360 ahead of Dreamforce, a major AI push that critics say comes as the company cuts staff and struggles to prove real ROI on its billion-dollar AI bets.

In partnership with AltIndex

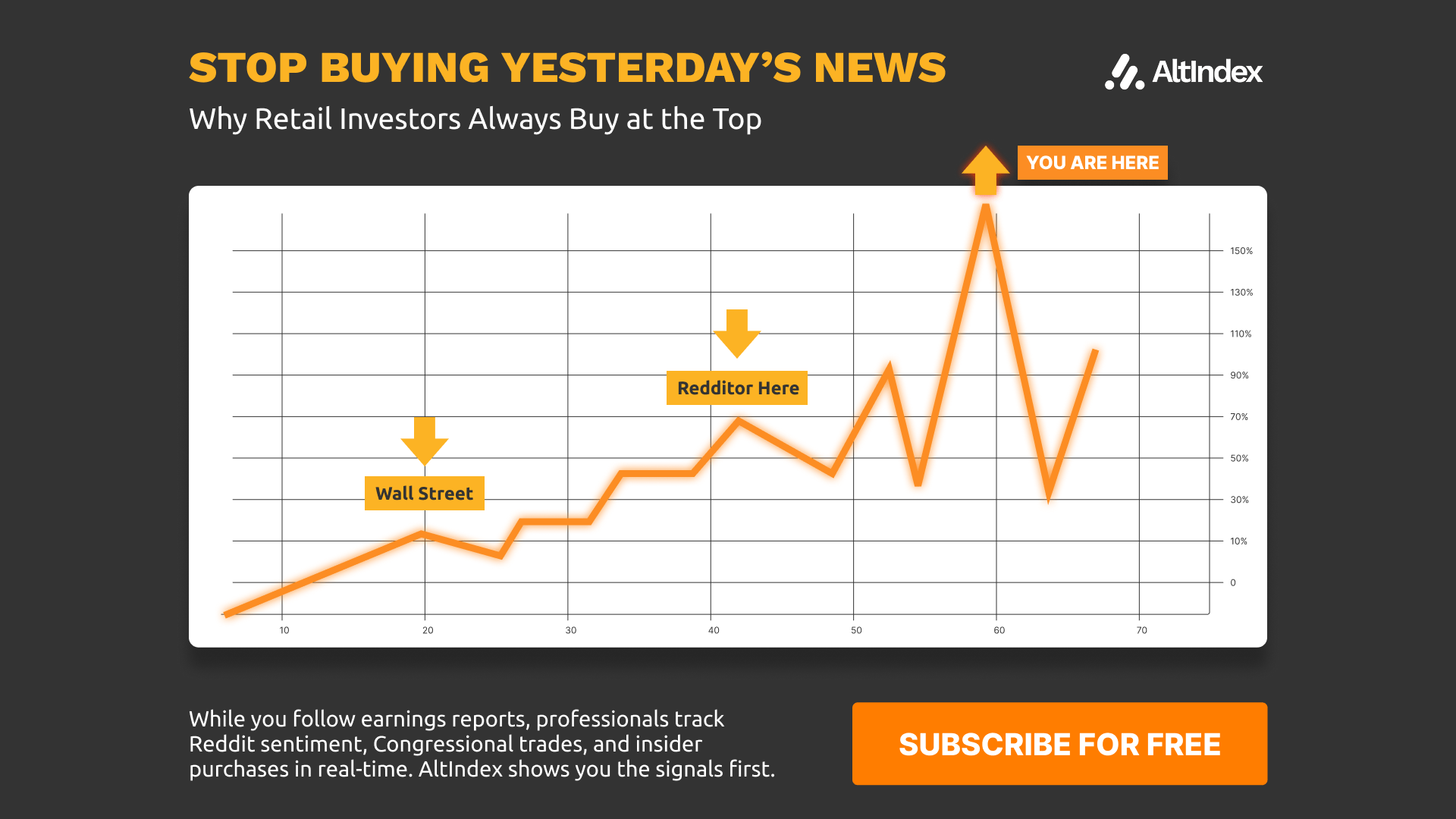

8 Out of 10 Analysts Missed This 469% Winner

Before OPEN rose 469%, three key stock signals appeared:

July 15: Reddit mentions of OPEN spike 12,400%

July 5-25: Opendoor’s job postings surge 816%

August 7: Congressman Cleo Fields buys shares

Meanwhile, only two out of 10 Wall Street analysts gave OPEN a buy rating.

If you followed the analysts, you missed a 469% gain. If you tracked the alternative signals, you were positioned before the surge.

Markets don't price fundamentals anymore. They price behavior.

Crowd psychology, social sentiment, and insider moves now matter more than P/E ratios. The institutions figured this out years ago. Retail traders are still using yesterday's playbook.

AltIndex tracks Reddit sentiment, Congress trades, hiring trends, and insider activity in real-time. Get alerts when signals spike—before the crowd catches on.

Stop analyzing companies. Start analyzing behavior.

Please support our partners!

🤫 Insider Trading

🥈Alternative Investments

Silver hit $51 an ounce, climbing 2.4% Monday as investors piled into safe-haven metals. The metal is now up 78% year-to-date, outpacing gold’s 50% gain as industrial demand surges and supply tightens.

Morgan Stanley predicted copper will face its biggest deficit in 22 years next year as supply shocks collide with surging AI and green energy demand.

🎙 What Do You Think?

What are your current plans in this market?

🎤️ What you said last time

🎪 Crowdfunding Showcase: LIGHT Helmets

Light Helmets designs and manufactures ultra-light, high-performance football helmets engineered to reduce head impact without compromising protection. Their helmets use advanced composite materials originally developed for the US military and aerospace industry, making them half a pound lighter than traditional models. Lighter gear means faster players and lower collision forces, an advantage that appeals to athletes, parents, and coaches alike.

🧠 The Missing (Market) Links

BlackRock's fund manager said investors miss out on global government bonds, which can boost yields while reducing volatility through currency hedging that captures rate differentials.

China dominated "open" AI development last year, with all the best freely available models coming from Chinese companies instead of US firms, according to a Washington Post analysis.

Coca-Cola rolled out 7.5-ounce mini cans as single-serve options in convenience stores starting January 2026, priced at $1.29 each to capture portion-conscious consumers.

📜 Quote of the Day

The stock market is a device for transferring money from the impatient to the patient

📢 We want to hear from you.

We love hearing from you, and we deeply appreciate your feedback.

⭐️ What did you think of today's edition?

That’s all for today. Did we miss anything? Smash the reply button to let me know.

Cheers,

Brandon & Blake of Invested Inc

Thumbnail image: OTA Photos, Flickr

The information provided in Stocks & Income is for informational and educational purposes only and should not be construed as financial advice, investment advice, or a recommendation to buy or sell any securities. Stocks & Income is not a registered investment advisor, broker-dealer, or licensed financial planner. Always do your own research and consult with a licensed financial advisor before making any investment decisions. We may hold positions in or receive compensation from the companies or products mentioned. Disclosures will be made where applicable.

Stocks & Income, AltIndex, Finance Wrapped, The Chain, and Future Funders are all owned by Invested, Inc.