Good morning.

No two ways about it. Yesterday was a bad day for stocks. The only Magnificent 7 member that didn’t end the day in the red was APPL, which rose by a massive… 0.37%. Impressive.

Meanwhile, crypto had it even worse: Ethereum sank 13% at one point, Bitcoin tumbled all the way to $99K before coming back to the $102K range, and most other tokens saw similar drops.

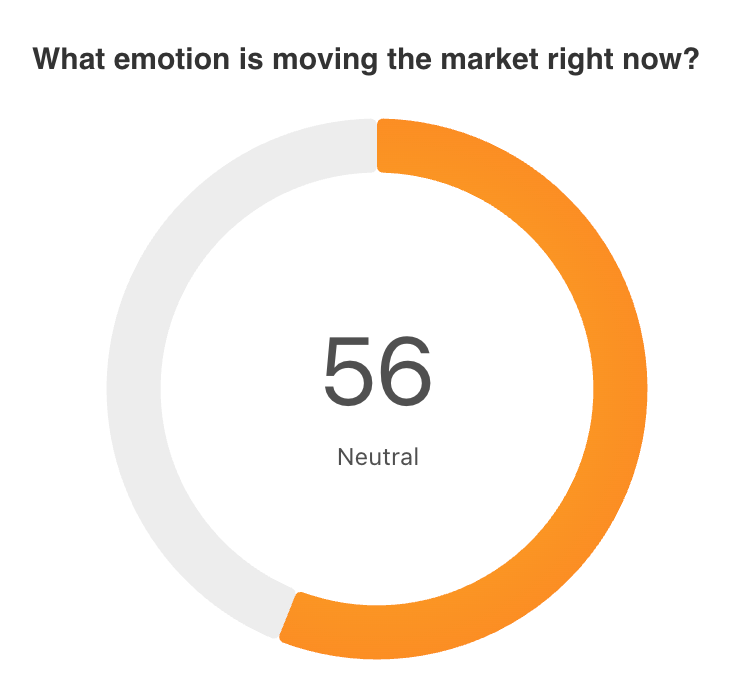

It’s safe to say that markets are straight up not having a good time right now.

Some people are calling this the beginning of the bear market, saying that the bubble is popping.

We don’t buy it though. Did you see those earnings reports from PLTR and AMD yesterday? Do you know how much money companies are putting into AI?

More importantly, markets have to correct slightly at some point in order to go higher anyway. Is everyone really so scared by just a 1% drop in the S&P 500?

Let’s talk about it.

In partnership with Roku

Find your customers on Roku this Black Friday

As with any digital ad campaign, the important thing is to reach streaming audiences who will convert. To that end, Roku’s self-service Ads Manager stands ready with powerful segmentation and targeting options. After all, you know your customers, and we know our streaming audience.

Worried it’s too late to spin up new Black Friday creative? With Roku Ads Manager, you can easily import and augment existing creative assets from your social channels. We also have AI-assisted upscaling, so every ad is primed for CTV.

Once you’ve done this, then you can easily set up A/B tests to flight different creative variants and Black Friday offers. If you’re a Shopify brand, you can even run shoppable ads directly on-screen so viewers can purchase with just a click of their Roku remote.

Bonus: we’re gifting you $5K in ad credits when you spend your first $5K on Roku Ads Manager. Just sign up and use code GET5K. Terms apply.

Please support our partners!

📰 Market Headlines

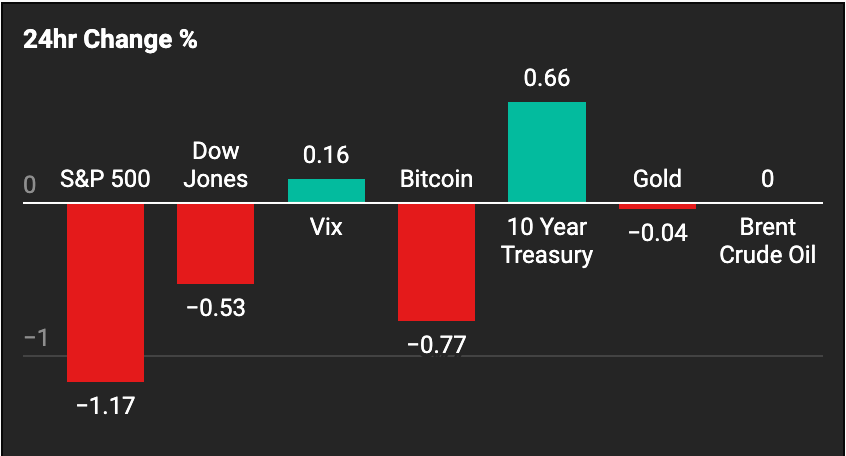

Markets tumbled on Tuesday as warnings from Wall Street banking chiefs sparked fears of a market correction.

The Dow fell 0.53%, the S&P 500 dropped 1.17%, and the Nasdaq sank 2.04%, marking the biggest one-day slide since October 10.

The sell-off followed cautionary remarks from Morgan Stanley and Goldman Sachs CEOs about stretched valuations and an AI-fueled bubble.

So, a whole lot of stocks and crypto were in the red yesterday. A lot of people are hurting right now (especially people who traded on leverage), but remember: nothing’s final until you sell your assets (unless you got liquidated because you traded on leverage).

Also, don’t trade on leverage.

So the million- (or trillion-) dollar question: “Is this a market crash or just a shake out?”

It’s important to evaluate these things as rationally as you can while also bearing in mind that no one knows the future. Nothing here is financial advice, and you always need to do your own research.

But here’s what we’re seeing:

AI companies continue to invest in expanding data centers, energy use, and chip production

AI services are actually being used by companies and individual consumers

Crypto has not seen a blow-off top peak yet, but it’s seeing more adoption than ever before

The gov. shutdown continues… but it will end at some point, and we’ll get economic data again

Rate cutting has only just begun

Quantitative tightening hasn’t even ended yet (Dec 1). When easing starts, liquidity will flow

Bear markets are born out of euphoria, not out of fear; it doesn’t feel like we hit euphoria yet

Now, bears have counterarguments, and they are quite good ones. They reference things like a rising VIX (measure of volatility), market breadth weakening, sell-offs on good earnings, etc. Which are good points. But again, even bull markets have to correct in order to go higher. And yes, Palantir closed the day at -8% yesterday, but the S&P 500 was only down 1%. That’s nothing.

We particularly like Twitter analyst Lin’s take. He says simply that “The easy money is over,” not making any wild claims about bull or bear, market top or bottom.

So, are we at a market top or is this just a correction? The good news is that you don’t have to know. You just need to be prepared. So maybe now is not the time to be all in or completely out of the market. Smart money might be waiting to see what happens next, holding some cash but also still holding stocks/crypto.

What we’re more interested in is “what’s going to happen today in markets?” And that’s what we’re going to be covering.

In other news, AMD crushed revenue expectations and forecast Q4 revenue of $9.6 billion, well above the $9.15 billion estimate. The chipmaker reported Q3 sales of $9.25 billion versus $8.74 billion expected, driven by data center infrastructure spending on AI chips. AMD's stock has more than doubled this year, even outpacing Nvidia's gains.

The ongoing government shutdown continues blocking key economic data releases. The shutdown has suspended nearly all government economic indicators, including this Friday's nonfarm payrolls report, at a critical moment when the Fed needs employment data to guide December rate decisions. Investors are relying on private sector reports like ADP payrolls instead.

Treasury Secretary Scott Bessent declared the housing market is in "recession" due to Fed interest rate policies. Home sales have stalled at 4 million annually for two and a half years, compared to the pre-pandemic average of 5 million, while mortgage rates hit 6.17% despite recent Fed cuts.

Shopify reported that AI-driven commerce is exploding. Traffic from AI tools jumped 7x since January, and AI-powered purchases surged 11x. The e-commerce platform's partnerships with ChatGPT, Perplexity, and Microsoft Copilot are positioning it as the infrastructure backbone for what CEO Harley Finkelstein calls "agentic commerce."

🤖 AI/Future/Tech News

OpenAI has now signed $816 billion worth of deals this year.

The White House blocked Nvidia from selling its Blackwell chip to China, reserving top AI hardware for US use only.

🪙 Crypto

📊 IPOs and Earnings

Uber missed on adjusted profit despite 20% higher booking volumes. Shares fell 5.1%.

Shopify beat on revenue with $2.84 billion versus expectations of $2.8 billion, but missed slightly on income. Shares dropped 6.9%.

Arista Networks beat forecasts driven by AI data center demand. Shares were flat premarket.

Spotify topped Q3 estimates with 12% revenue growth and 713 million users. Shares rose 1.4%.

BP beat expectations slightly as strong refining margins offset lower oil prices. Shares gained 0.6%.

Marriott International beat on EPS, posting $2.37 versus $2.28 expected. Shares added 1.1%.

Apollo Global Management beat profit estimates, buoyed by asset management gains. Shares rose 0.9%.

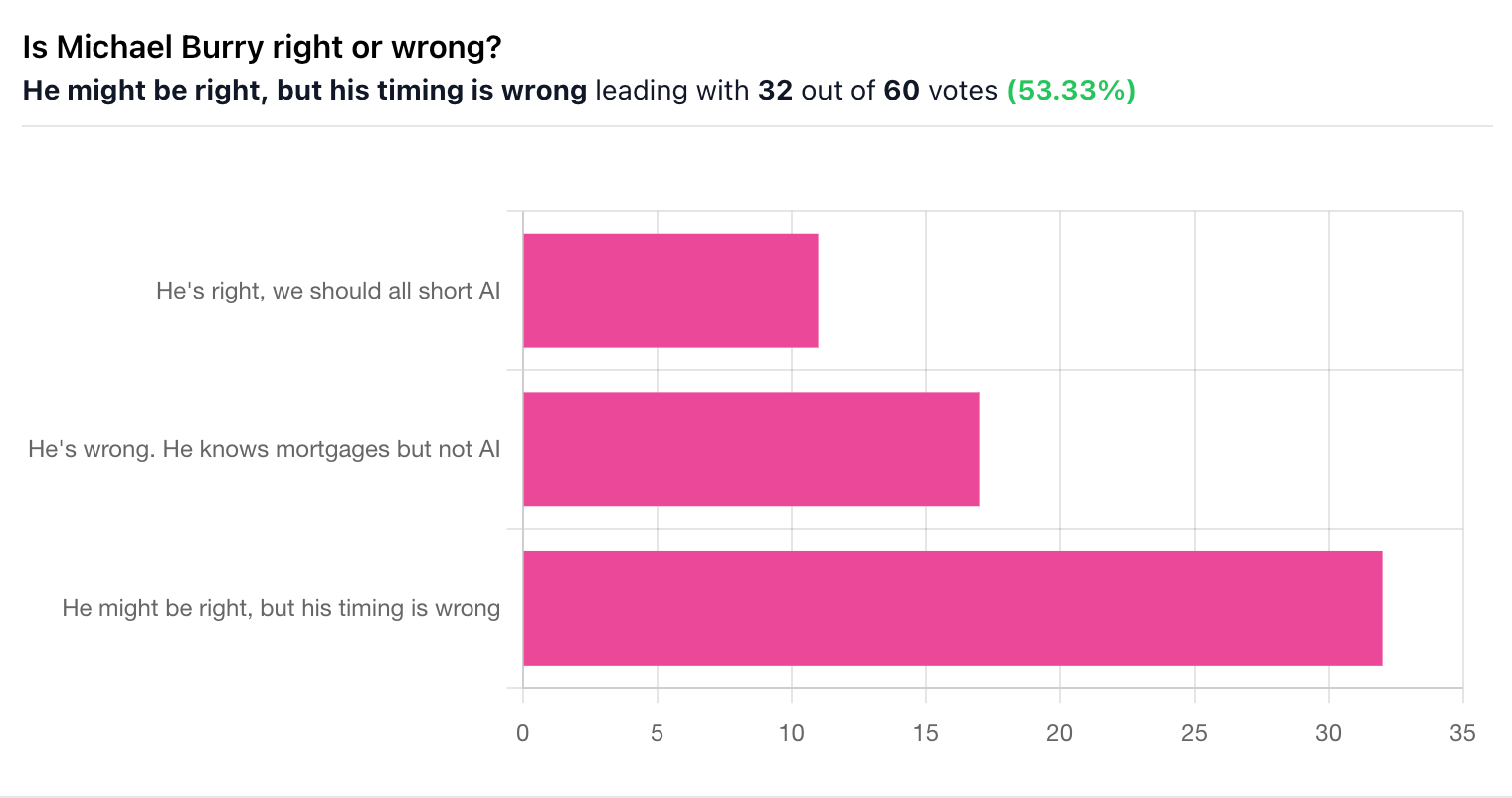

🎙 What Do You Think?

Your response to market downturn yesterday:

🎤️ What you said last time

🧠 The Missing (Market) Links

President Trump reportedly said that Chinese President Xi Jinping is a “friend of mine, as much as he can be.”

Trump also just said that “the stock market will hit many more record highs.”

A fascinating thought on why following whale traders might actually be a bad strategy.

Spotify is prepping a US price hike after global increases boosted revenue 12%.

📜 Quote of the Day

In investing, what is comfortable is rarely profitable ”

📢 We want to hear from you.

We love hearing from you, and we deeply appreciate your feedback.

⭐️ What did you think of today's edition?

That’s all for today. Did we miss anything? Smash the reply button to let me know.

Cheers,

Brandon & Blake of Invested Inc

Thumbnail image: Wikimedia

The information provided in Stocks & Income is for informational and educational purposes only and should not be construed as financial advice, investment advice, or a recommendation to buy or sell any securities. Stocks & Income is not a registered investment advisor, broker-dealer, or licensed financial planner. Always do your own research and consult with a licensed financial advisor before making any investment decisions. We may hold positions in or receive compensation from the companies or products mentioned. Disclosures will be made where applicable.

Stocks & Income, AltIndex, Finance Wrapped, The Chain, and Future Funders are all owned by Invested, Inc.