📰 Market Headlines

US stocks soared Thursday after President Trump unveiled a US-UK trade deal and signaled optimism for upcoming China talks.

The Dow rose 0.6% along with the S&P 500, and the Nasdaq jumped 1%—and Bitcoin crossed the $100,000 barrier.

Crypto had a field day: Coinbase bought Deribit for $2.9 billion. Robinhood announced blockchain-based derivatives trading in the UK. The SEC dropped its case against Ripple. And Bitcoin broke $100,000—making it the 5th-largest asset in the world. But we’ll be watching Ethereum (+7%) and Solana (+11%) more closely; if BTC dominance has peaked at 65% (now 63%), this could be the start of a major altcoin rally.

The US-UK agreement includes billions in increased market access for American exports (particularly agriculture), but maintains the baseline 10% tariff—a practice that could become standard across all upcoming US trade deals. Markets seemed to respond positively to the deal not because the negotiations were particularly sensational, but because they happened at all, signaling stability.

“You better go out and buy stocks now,” Trump said, before comparing the US to a rocket ship taking off. Sentiment is up, but still, we’re a bit hesitant because of one key metric: U.S. Treasury yields. Try as he might, Trump hasn’t been able to lower them even with trade talk announcements—and with the Fed refusing to lower rates on their end, financial conditions could stay tight.

Boeing shares catapulted 4.2% after Commerce Secretary Howard Lutnick announced at a US trade briefing that the UK would purchase $10 billion worth of aircraft. The deal took place the day after the US cut tariffs on jet engines and steel, implying that upcoming winners of this market could be determined by large trade agreements signed after international trade deals are reached.

Cardinal Prevost of Chicago was named the first American Pope, taking the name Leo XIV. We’re curious what his first comments about AI, crypto, and trade will be—and how they might shape the economy going forward.

Big Tech Has Spent Billions Acquiring AI Smart Home Startups

The pattern is clear: when innovative companies successfully integrate AI into everyday products, tech giants pay billions to acquire them.

Google paid $3.2B for Nest.

Amazon spent $1.2B on Ring.

Generac spent $770M on EcoBee.

Now, a new AI-powered smart home company is following their exact path to acquisition—but is still available to everyday investors at just $1.90 per share.

With proprietary technology that connects window coverings to all major AI ecosystems, this startup has achieved what big tech wants most: seamless AI integration into daily home life.

Over 10 patents, 200% year-over-year growth, and a forecast to 5x revenue this year — this company is moving fast to seize the smart home opportunity.

The acquisition pattern is predictable. The opportunity to get in before it happens is not.

Past performance is not indicative of future results. Email may contain forward-looking statements. See US Offering for details. Informational purposes only.

😱 Fear and Greed Index

🧠 Make yourself heard

What will Bitcoin's high in 2025 be?

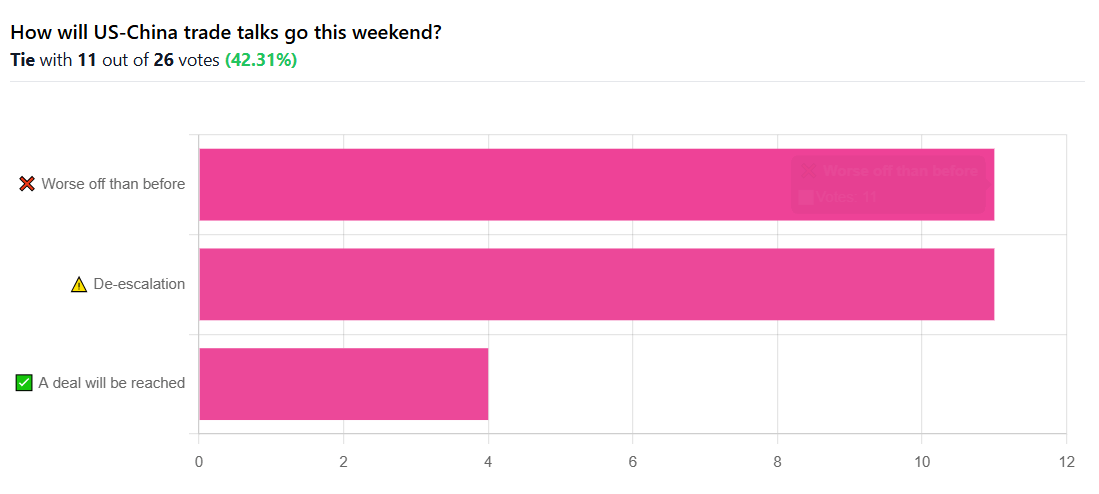

⚔️ Trade Wars

Trump said an 80% tariff on China “seems right” leading up to trade talks this weekend.

The United States slashed duties on British autos from 27.5% to 10% for a quota of 100,000 vehicles.

Import taxes on UK steel and aluminum dropped from 25% to zero, while British farmers gained a tariff-free quota for 13,000 metric tons of beef.

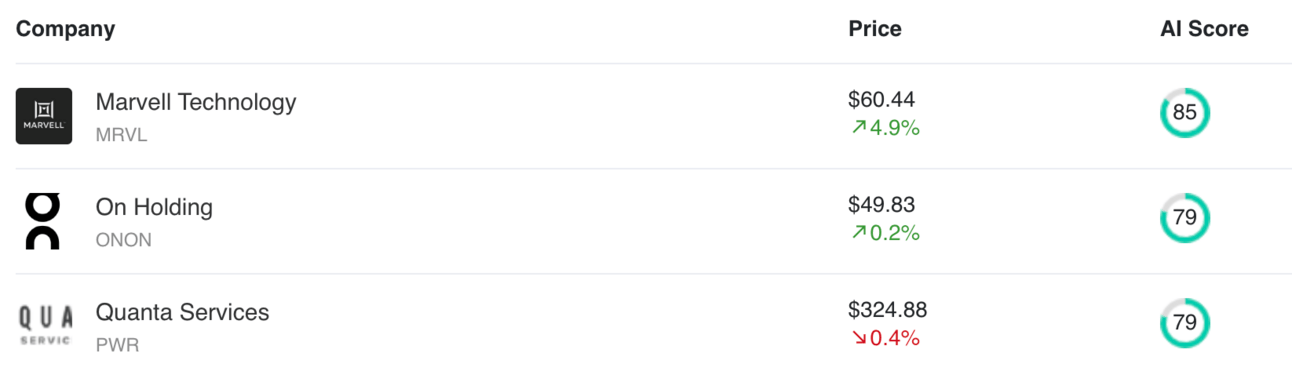

🥇 AltIndex’s Top Stock Picks

Here are the stocks with the highest AltIndex AI Score, which assesses a stock's mid-term market outperformance potential (6+ months) by analyzing financials as well as alternative data like job postings, web traffic, downloads, and social media trends.

📊 Alternative Investing News

Specialty insurer Kinsale Capital fell 18% from all-time highs despite maintaining an impressive 82% combined ratio through recent wildfire impacts.

Agricultural commodity markets remained unusually quiet, according to broker Mike North, who noted new crop forward sales lag significantly behind typical levels.

🤖 AI/Future/Tech News

Google launched implicit caching for its Gemini 2.5 models, promising up to 75% cost savings by automatically reusing repetitive prompts.

Meta is piloting super-sensing facial recognition in its upcoming smart glasses, codenamed Aperol and Bellini.

Instagram has spent hundreds of millions—“maybe a billion or two,” according to executive Adam Mosseri—on creator incentives and infrastructure.

🪙 Crypto

Ethereum surged past $2,400 for the first time since early March following its Pectra upgrade.

Arizona became the second state to establish a Bitcoin reserve, following New Hampshire.

💡 Ideas, trends, and analysis

Bill Gates plans to give away $200 billion by 2045 through his foundation, doubling the $100 billion already spent.

American worker confidence in finding a new job within three months, if unemployed, fell to 49.2%—the lowest since March 2021.

Analysts estimate Google’s share of the search market may have dropped to 65–70%, down from the 90% often cited, as ChatGPT and Meta AI usage climbs.

Goldman Sachs now puts US recession risk at 45%, citing stalled inflation progress, rising layoffs, and the lingering drag of tariffs.

🌍 International Markets

🇬🇧 Bank of England Governor Andrew Bailey cautioned that economic uncertainty will persist despite the UK-US trade agreement.

🇮🇳 Tesla lost its India country head Prashanth Menon, right before its market entry, with Chinese team members now taking charge.

🇯🇵 Japan's non-monetary gold exports surged to 4.7 times higher than a decade ago, sparking questions about the origin of these ingots.

🇨🇦 Shell's LNG Canada facility, the country's first large-scale export terminal for the fuel, is geared up to begin overseas shipments as soon as late June.

🇳🇱 European gambling giant FDJ United saw revenues plunge 41% in the Netherlands after the country hiked gambling taxes to 34.2%.

🎤 What you said last time

🚚 Market movers

Kraft Heinz demanded notice from coffee suppliers 60 days before any tariff-related price hikes, requiring automatic reversal if tariffs are removed.

A Manhattan court sentenced former Celsius CEO Alex Mashinsky to 12 years for crypto fraud.

Citigroup will face a revived $1 billion lawsuit alleging it helped conceal fraud at Mexican oil contractor Oceanografía.

📊 Earnings this week

Toyota reported expecting operating income to drop 21% for fiscal 2026; shares fell 0.52%.

Shopify reported Q1 earnings that beat revenue estimates; shares fell 0.53% on a surprise earnings miss.

McKesson beat Q1 earnings, but shares plunged 4.45% ahead of its scheduled earnings report.

Brookfield Corporation reported Q1 net income up 550.72% from the previous quarter; shares surged 3.08%.

🧠 Miscellanea

A Soviet Venus probe's 500-kg lander named Kosmos 482 from 1972 is set to careen back to Earth between May 9-11.

Humans have charted just 0.001% of the deep seafloor, an area only slightly larger than Rhode Island, despite oceans covering 71% of our planet.

A 47-year-old Florida man joined Yellowstone's most predictable statistic by getting gored by a bison after approaching the animal too closely.

📺 What to watch today

That’s all for today. Did I miss anything? Smash the reply button to let me know.

Cheers,

Brandon with Stefan & Wyatt