🔔 The Opening Bell

Good morning.

Wall Street is all smiles after President Trump's Japan deal sent stocks soaring, which is great—but Japan’s bond market is imploding. Today, we’re taking a look at what they might do to fix it and how Bitcoin could be poised to soar as a result.

Meanwhile, tech earnings are painting a mixed picture: Alphabet beat expectations but spooked investors with plans to boost capital spending, while Tesla reported disappointing Q2 numbers and dropped 8%.

The saving grace? Promises of that long-awaited affordable model in 2025.

But the wildest story might be Elon Musk's other venture: Neuralink.

More on these stories below.

🌾 Farmland: The real asset investors turn to in uncertain times

With public markets whipsawing and real estate in flux, smart investors are rotating into assets that are real, scarce, and essential.

U.S. farmland checks all three boxes — and has the performance to back it up.

Over the past 30 years, farmland has delivered stock-like returns with about one-third the volatility.

Intrinsic value. Food is indispensable. You can’t just print more of it

Stable. Positive historical correlation to inflation

Income-generating. It generates steady cash flow,

Utility. Real-world demand regardless of economic cycle

FarmTogether sources and manages institutional-grade farmland investments, giving accredited investors access through both individual properties and a diversified fund.

Right now, the standout opportunity is Landmark Mandarin Grove — a producing citrus orchard in California’s Central Valley:

🍊 80-acre grove growing Tango and Golden Nugget mandarins

💧 Dual water sources: surface water and private well

📈 Targeting 11.1% net IRR and 9.4% net cash yield

📆 10-year unlevered hold with seasoned local operator

Prefer a fund-based approach? FarmTogether’s Sustainable Farmland Fund offers exposure to a curated portfolio of U.S. farms across multiple regions and crops. It’s targeting:

🌱 8–10% net IRR with 4–6% annual distribution

🪵 Properties in CA, OR, CO, and OK — citrus, grapes, pecans, and row crops

⏳ 2-year lockup, evergreen structure

For investors looking to rebalance into resilient, income-producing assets, farmland is emerging as a compelling alternative.

Investments are open to accredited investors only.

Historical data is not indicative of future results and may not reflect fees which may reduce actual returns. Any historical information is illustrative in nature and may not represent future results, therefore any investor investing through the FarmTogether platform may experience different returns from examples and projections provided on the website. You should not make investment decisions based solely on the information and charts contained in this email.

FarmTogether does not provide tax advice or guidance. Any information provided within this document is for reference only. We recommend consulting a tax professional for your individual tax situation.

📰 Market Headlines

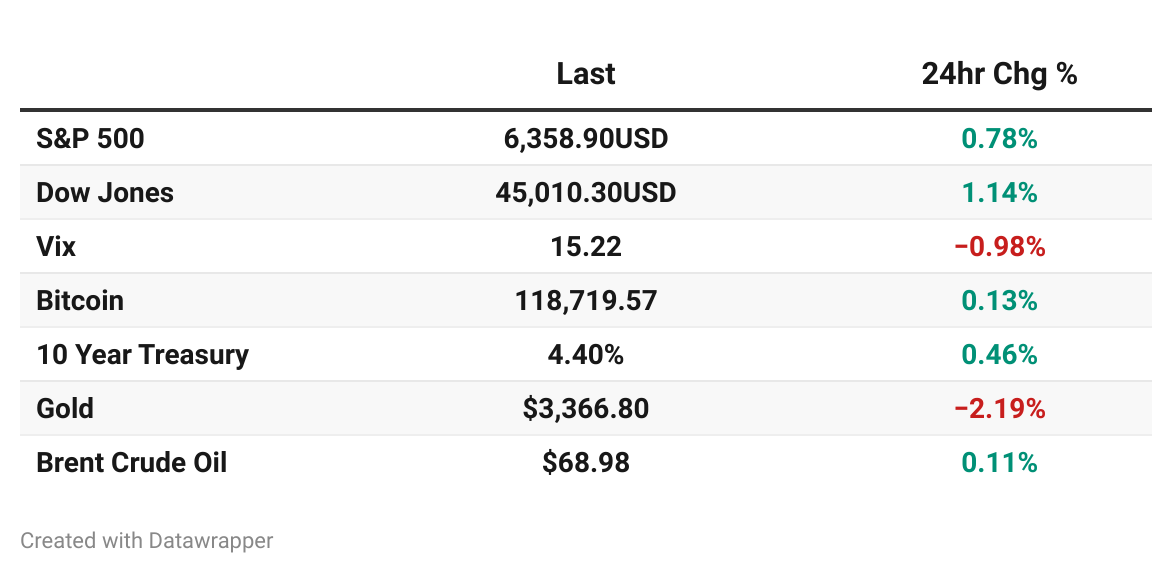

US stocks climbed on Wednesday after a trade deal with Japan sparked optimism.

The Dow rose 1.14%, the S&P 500 gained 0.78%, and the Nasdaq added 0.61%, with both the S&P and Nasdaq notching record closes.

Alphabet $GOOGL ( ▲ 1.43% ) beat expectations with Q2 earnings, driven by strong advertising and cloud performance. However, a planned increase in capital expenditures to $85 billion sent shares down 1%.

Tesla $TSLA ( ▼ 1.49% ) reported a slight miss on Q2 earnings, with revenue at $22.50 billion, down 9% year-over-year. Plans for a more affordable model in 2025 kept investor interest alive—but shares still sank 8% today.

Elon Musk's Neuralink expects to generate $1 billion in annual revenue by 2031, planning to implant brain chips in 20,000 people yearly across five major clinics.

The company projects 2,000 surgeries annually by 2029 at $50,000 each, ramping to 10,000 procedures by 2030 with three device versions treating paralysis, blindness, and Parkinson's.

Neuralink has raised $1.3 billion at a $9 billion valuation, though fewer than 10 patients currently have implants in clinical trials.

Treasury Secretary Scott Bessent fueled claims of political bias in the Fed's economic forecasts, aligning with President Trump's call for a significant rate cut.

Supreme Court hands President Trump another victory, allowing him to fire Democratic commissioners from the Consumer Product Safety Commission despite Congressional job protections.

Justice Kagan warned the 6-3 ruling "all but overturned" 90 years of precedent protecting agency independence.

🇯🇵 Japan’s Bond Market: A Cracking Foundation, and BTC’s Best Friend?

What is Japan’s dysfunctional bond market telling us about Bitcoin’s price? And what did their Central Bank just do that has heads turning toward BTC with renewed interest?

To answer those two questions, we need some context for where Japan is at right now. The White House’s new trade deal with Japan is good for the US—Japan will invest $550B into our economy and will still pay a baseline 15% tariff. In short, 90% of all profits from the deal go to the US.

Which begs the question—why in the world would Japan say “yes” to a deal like that?

The answer might be as simple as this: Japan can’t afford to say no. That’s how bad the situation is with their economy; Japan’s debt-to-GDP ratio is over 260% (Australia’s is 49.6% for comparison), and government bond demand is drier than it’s been in 14 years.

Indeed, Japan is in what economists call a potential “sovereign debt crisis.” (We’ll get to its effect on Bitcoin in a moment)

Its 30-year bond yield reached 3.195%, the highest ever, on July 15. The 10-year yield is at 1.6%, the highest since 2008’s housing market crash. Remember, a bond is just a fixed-income investment in government debt for a specific amount of time.

These rapidly rising treasury yields are heavily affecting other countries’ economies, too—namely that of the US, which has a rising debt-to-GDP ratio itself (124%) and a 10-year yield of 4.43%. We can get into that another day, though.

What you need to understand is that investors are less likely to trust that a country will repay its debt when yields are high like this. This has a compounding effect of further increasing Japan’s treasury rates—because demand is decreasing, driving rates higher, which decreases demand further… you get it. This dynamic has created what Bitwise’s head of European research André Dragosch calls a “fiscal debt doom loop.”

But how does this affect Bitcoin?

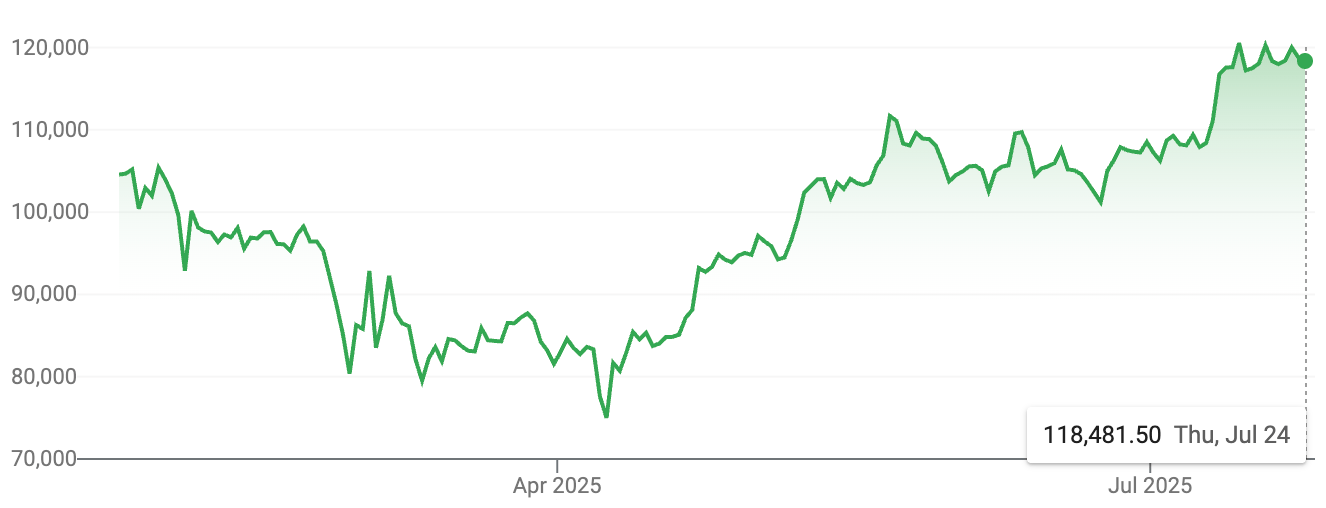

Look at these two charts. The first is Bitcoin’s price over the past six months, and the second is Japan’s 30-year yield rate. See the similarities?

They aren’t a perfect 1:1 match, but we’re especially intrigued by the way they seem to sync up more from April to now.

It appears that Japanese investors (and the world at large) are investing more in non-government-dependent assets like Bitcoin when Japan’s Treasury yields go higher—because it’s a hedge against the potential risk that Japan could default on its debt. And the world at large cares about that default risk because Japan’s bond market deeply affects that of the US, which majorly affects every other country in the world.

So moving forward, how will Japan solve its debt crisis? Arthur Hayes, co-founder of BitMex, predicted in his 2024 essay “Shikata ga Nai” that Japan’s strategy for getting Treasury yields in check would be monetary easing (typically lowering interest rates + injecting liquidity). And he thinks if that happens, the liquidity burst would send Bitcoin’s price to the moon.

And in fact, just last week, Japan made a subtle but fiscally monumental move that aligns with Hayes’ prediction—and could be a major signal that Bitcoin investors are in for the ride of a lifetime.

Remember to always do your own research.

Are you prepping for the Japan bond market unwinding?

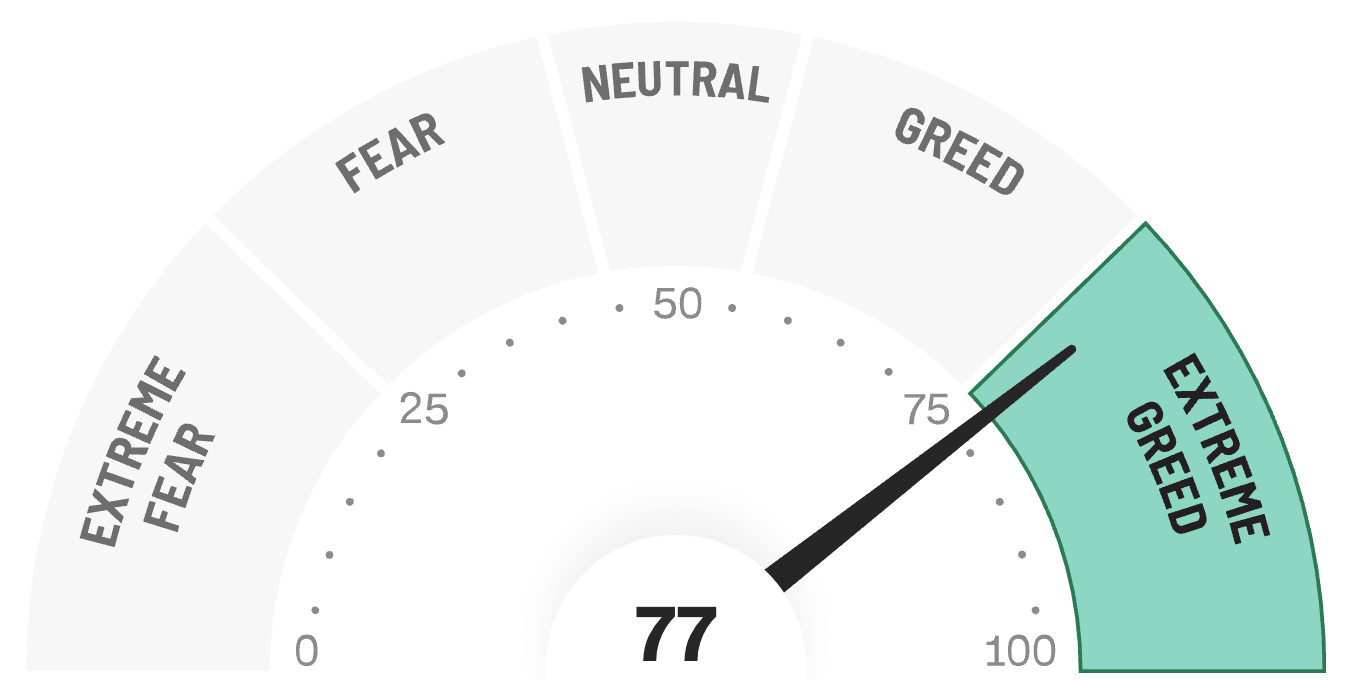

😱 Fear and Greed Index

🧠 The Missing (Market) Links

Google CEO Sundar Pichai advised young professionals to work with smarter colleagues to boost career growth.

David Royce, a successful serial entrepreneur, credited his 6th-grade teacher for shaping his leadership style.

Bank of America’s board approved a new $40 billion buyback program, set to begin August 1.

Japan's 40-year bond auction tumbled to its weakest demand in 14 years, with the bid-to-cover ratio dropping to 2.127.

🪙 Crypto

BlackRock’s Bitcoin ETF out-earned its S&P 500 sibling, generating $187.2 million on $52 billion in assets.

The SEC green-lit Bitwise’s multi-asset ETF (BITW), then whipsawed markets by freezing the launch.

The Senate’s new crypto bill hands oversight to the SEC, with Senator Cynthia Lummis pushing for a new framework to replace the Howey Test.

💰 Alternative Investing News

The US House approved the SEC test bill, potentially allowing more individuals to qualify as accredited investors, expanding access to private markets.

Private equity firms, including Clearlake Capital and Platinum Equity, submitted bids for Forward Air, as the company seeks strategic alternatives.

Private equity groups flipped $41 billion of investments via continuation funds in the first half of 2025, marking a record 19% of all sales by the industry.

🤖 AI/Future/Tech News

The White House released a new AI policy plan under President Donald Trump.

$9.8 billion in Q2 ad sales vaulted YouTube to a 13% year-over-year revenue jump, beating analyst expectations.

Meta researchers developed a gesture-controlled wristband using muscle signals to interact with computers.

Proton debuted Lumo, an AI assistant that encrypts all chats and keeps no logs.

🌍 International Markets

🇮🇳 India's economy held firm amid global uncertainties, with retail inflation easing to a six-year low of 2.1% in June.

🇸🇦 Saudi Arabia bolted to the top as the buyer of Russian fuel oil in June, driven by soaring summer energy demands, according to LSEG data.

🇰🇷 South Korea posted a 0.6% GDP rebound in the second quarter, driven by a pickup in exports after a 0.2% contraction in the first quarter.

🇦🇺 Australia's recovery slumped with Westpac's Leading Index dropping to just 0.03% in June, forecasting sluggish growth of 1.7% for 2025.

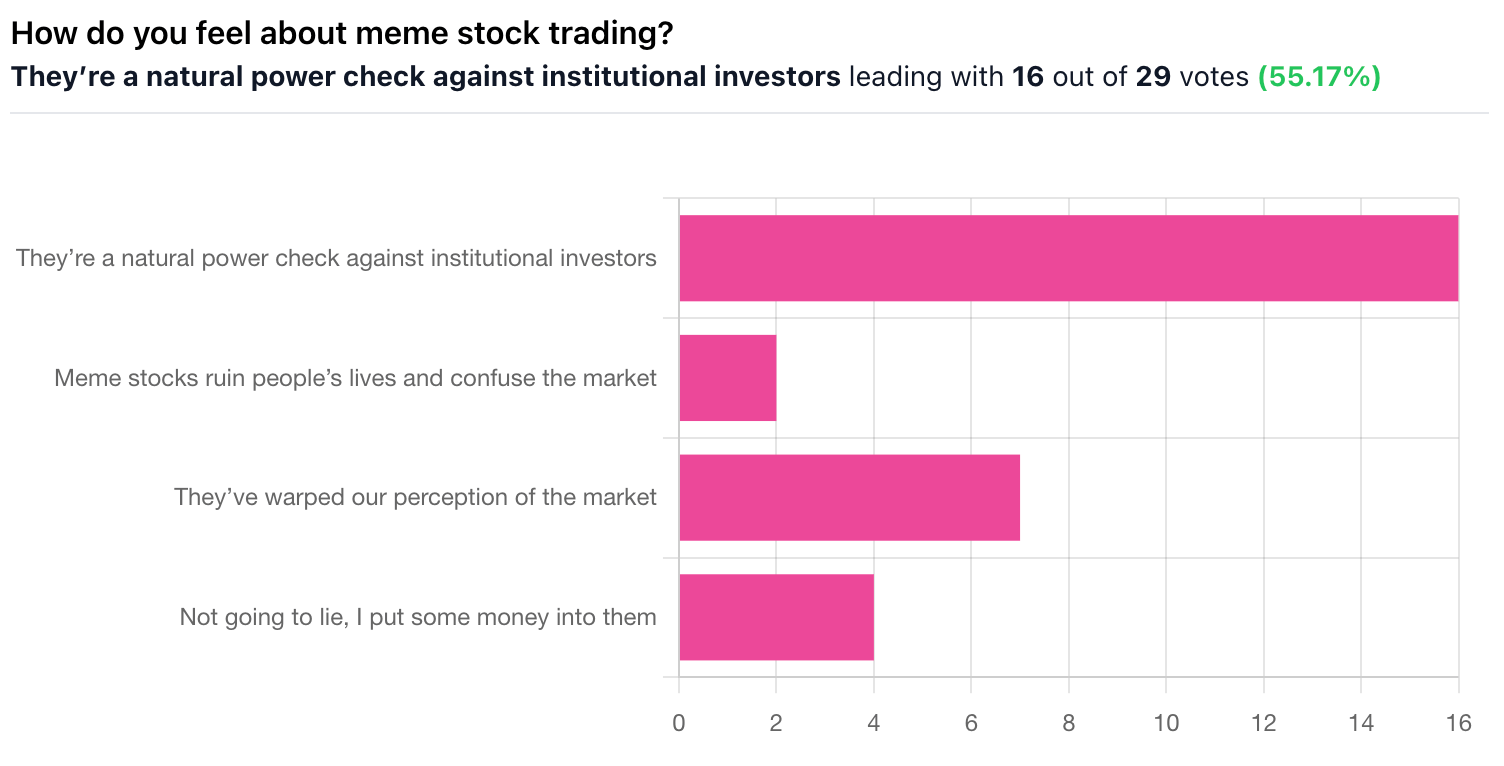

🎤️ What you said last time

“Can we consumers power check the institutions but also recognize it can warp realities?”

“As an older millennial, I'm starting to feel like social media was a mistake.”

🚚 Market movers

Mattel slashed its 2025 forecast due to tariff uncertainties, causing shares to drop 4.5%.

Chevron cut 575 jobs in Houston following its acquisition of Hess, as revealed in a recent filing.

Apple launched AppleCare One, a $19.99 per month subscription covering multiple devices.

Uber will pilot a feature allowing women drivers and riders to pair more frequently.

📊 Earnings

Alaska Air reinstated its full-year profit forecast due to improved travel demand, and shares rose 1.55%.

AT&T exceeded profit estimates and added 401,000 subscribers, but shares slid over 3%.

Chipotle cut its same-store sales forecast after a 4.9% traffic decline; shares tumbled 9%.

General Dynamics posted a profit and revenue beat, driven by strong marine orders; shares rose 5%.

IBM exceeded earnings expectations and raised cash flow guidance, but shares fell 5% due to slightly lower software margins.

O'Reilly met Q2 sales expectations with a 5.9% increase, so shares held steady.

📢 We want to hear from you

We love hearing from you, and we deeply appreciate your feedback.

⭐️ What did you think of today's edition?

📺 What to watch today

That’s all for today. Did I miss anything? Smash the reply button to let me know.

Cheers,

Brandon with Stefan & Wyatt

Shibuya Crossing image: Guwashi999, flickr

The information provided in Stocks & Income is for informational and educational purposes only and should not be construed as financial advice, investment advice, or a recommendation to buy or sell any securities. Stocks & Income is not a registered investment advisor, broker-dealer, or licensed financial planner. Always do your own research and consult with a licensed financial advisor before making any investment decisions. We may hold positions in or receive compensation from the companies or products mentioned. Disclosures will be made where applicable.