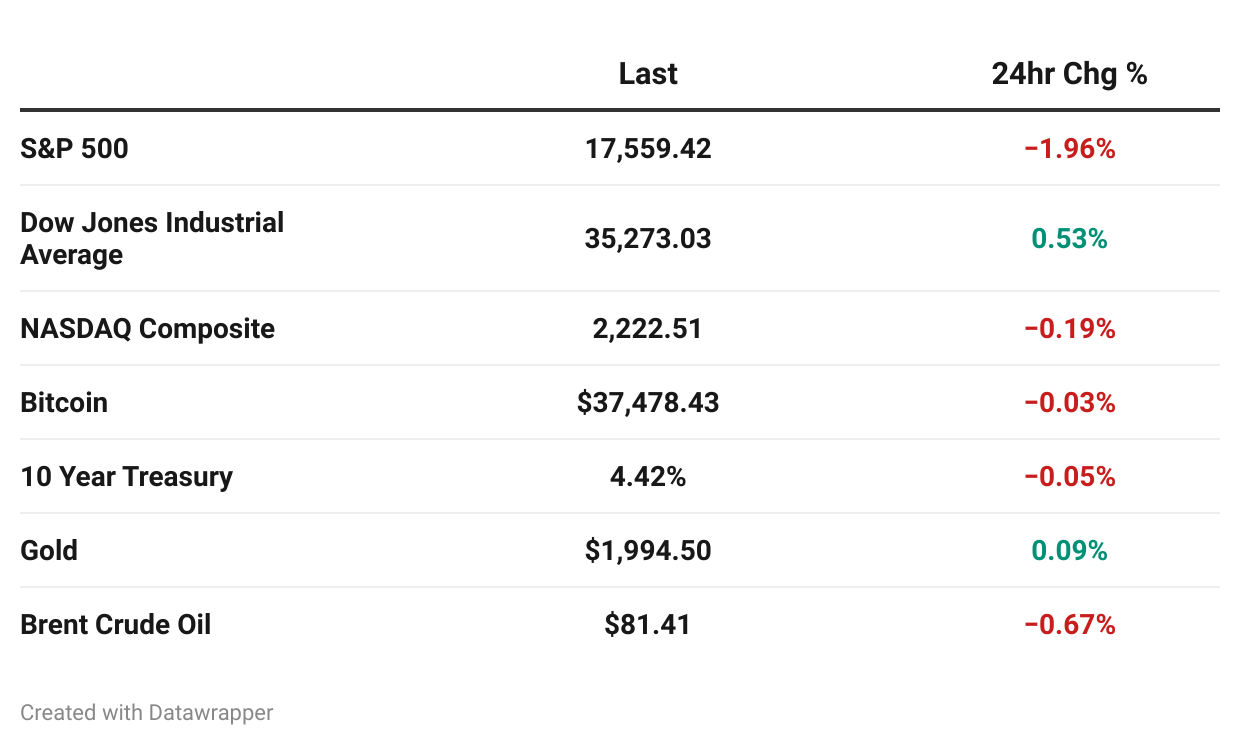

*past 24-hour performance

💨 TL;DR

It’s an abbreviated day in the markets.

Consumer confidence in the US is falling.

Novo Nordisk and Nissan are investing heavily in manufacturing capacity.

The Germany economy continues to struggle.

📰 Market Headlines

American markets were closed yesterday for Thanksgiving.

European shares wavered after the latest economic data highlighted Germany’s struggle to recover from an energy-induced downturn last winter and the mounting impact of higher borrowing costs.

The University of Michigan's latest consumer survey released Wednesday found consumer sentiment fell for the fourth month in a row in November, while households' inflation expectations climbed for the second straight reading.

The downturn in the US housing market isn't ending anytime soon, Fannie Mae warned. That's because mortgage rates are set to stay elevated if the US avoids a recession. Even if the US does tip into recession, tight financial conditions will still weigh on home sales.

The housing market could soon face an unprecedented improvement in affordability, according to Morgan Stanley analysts.

Brent Crude Oil was down slightly ahead of the forthcoming OPEC+ meeting. The 23-nation OPEC alliance of oil producers has delayed its next meeting by four days to Nov. 30. Bloomberg reported the delay is due to a rift between Saudi Arabia and some African nations over output quotas to arrest falling oil prices.

🧠 What do you think?

How much are you spending for Black Friday this year?

🕶️ Market Vibes

🎰 Market Forecasts and Futures

The global capacitor market was estimated at a value of US$ 31.7 billion in 2021. It is anticipated to register a 6.4% CAGR from 2022 to 2031, and the market is likely to attain US$ 58.67 billion by 2031.

😱 Fear and Greed Index

🎤 What you said

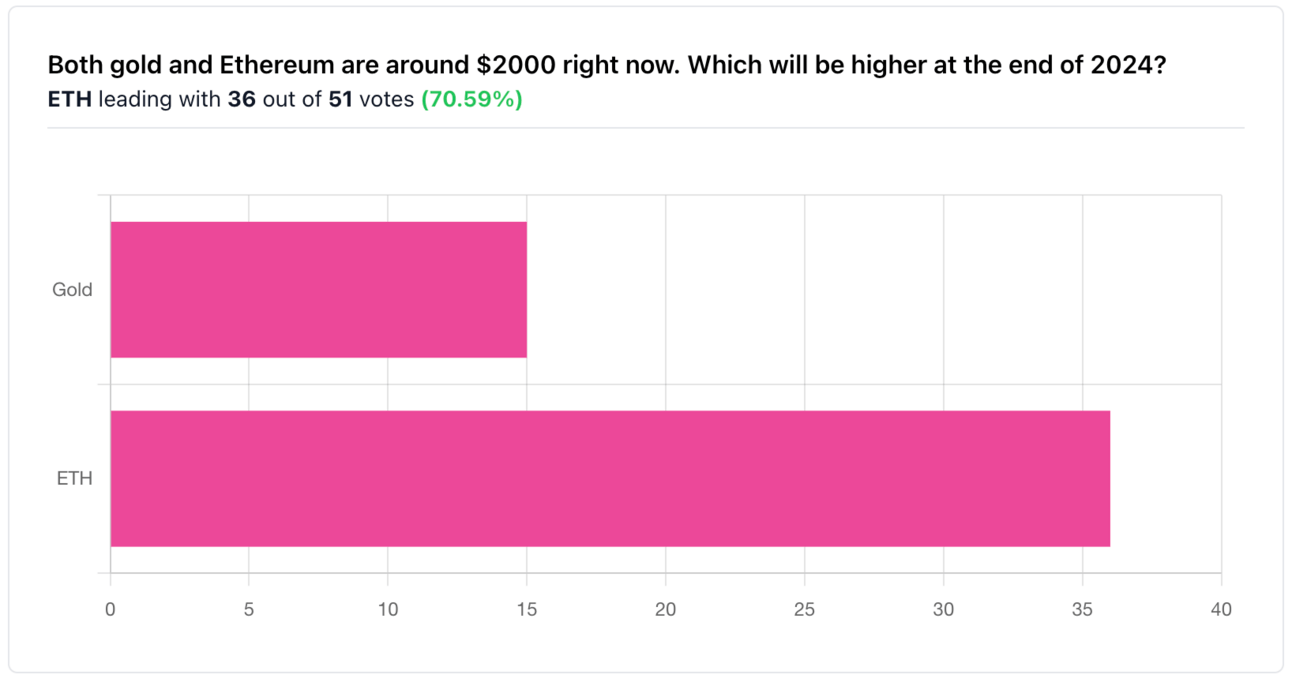

Strong support Wednesday for Ethereum, with some commenters predicting the cryptocurrency could double in 2024.

Traveling, stayed home last year

“Gold is slow and steady, Ethereum is volatile, undervalued and has a utility that is growing, crypto in general, is becoming mainstream ”

A golden moment for private credit 🤝

The most interesting thing about the private credit market is what’s happening today.

The market is opening up to ordinary retail investors for the first time ever. It's a golden moment.

Percent is the only platform exclusively dedicated to private credit. They provide accredited investors access to a wide variety of high-yield, short-duration offerings (9-month average).

These shorter-term investments are more responsive to current market conditions and interest rates. This means you can regularly calibrate your investments to meet your needs.

Get as much as 20% APY and more (That’s high)

Investment minimums as low as $500 (That’s low)

Swaggy readers can earn up to a $500 bonus with their first investment (Neat)

PS - Check out this guide to investing in private credit: How to analyze risk & reward in alternative lending. This is smart, in-depth stuff. Check it out.

SPONSOR

📊 Stocks

Brought to you by our friends at Public.com, my favorite online broker.

Winners and losers

Nissan is investing more than $2 billion on its EV and battery business in the UK.

Novo Nordisk, who makes Ozempic and Wegovy, has announced more than $8 billion in manufacturing investments.

Hibbett stock soared 10% on Tuesday after the company posted solid results for the fiscal third quarter of 2024 and raised its full-year guidance.

Ideas and analysis

Seven Nasdaq 100 companies have made up the vast majority of the index’s gains this year. Public lets you invest in all of them at once with their Magnificent Seven plan.

📊 Income

The growing importance of fixed income futures.

The ten dividend-paying stocks Wall St is most bullish on.

Eurozone bond yields are marching higher.

An interest rate cut by India’s central bank next year can boost the country’s bond market, which has already witnessed its biggest-ever low-grade local debt sale this year

If you want to invest in US stocks from companies that pay high dividends but don’t want to do the research yourself, check out Public’s High-Income Dividend-Paying plan. It follows the top 20 holdings by weight from the iShares Core High Dividend ETF (HDV).

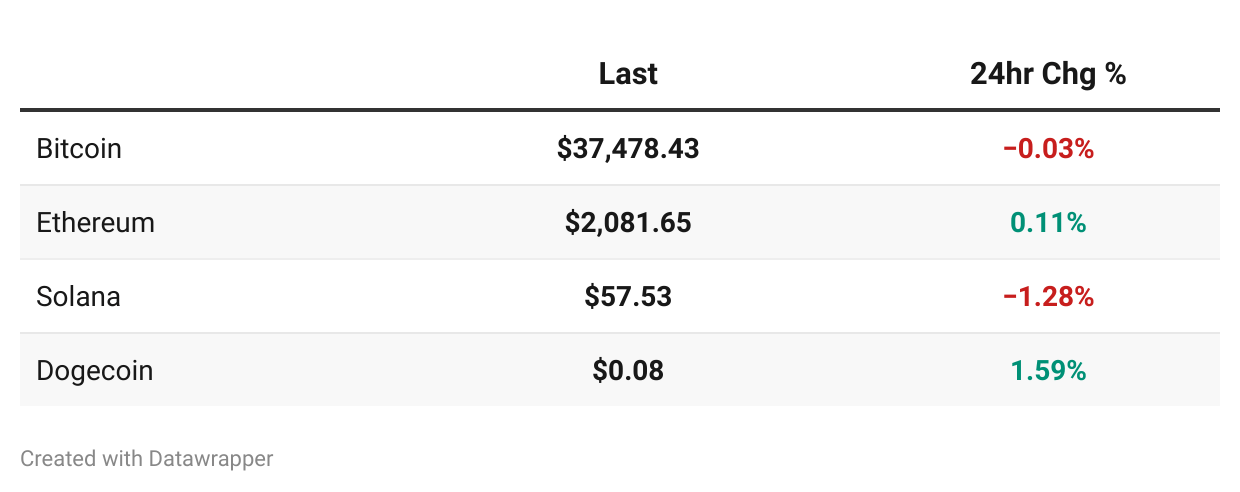

📊 Crypto

🌍 Global Perspectives

🇸🇦 Riyadh Air is betting on a tourist surge to Saudi Arabia.

🇳🇬 The Nigerian central bank’s decision not to hold its monetary policy committee this week has deepened uncertainty over how its new governor plans to tackle the currency crisis in Africa’s biggest economy.

🇩🇪 Germany's economy shrank slightly in the third quarter.

🇹🇷 Turkey’s central bank raised rates to 40% to tackle inflation.

🇨🇳 Everything you need to know about China’s child pneumonia outbreak.

🇨🇩 A directive from the Democratic Republic of Congo’s central bank has lenders in the country concerned they may need to sell stakes of as much as 45% within three years.

🇨🇳🇺🇾 Uruguay and China have agreed to pursue a bilateral trade pact.

💎 Wealth Watch

Two strategies for a lower mortgage rate that you probably haven’t thought of.

Four tips to stretch your Black Friday budget.

It's the cheapest Thanksgiving Day for drivers since 2020.

Five things investors should know about a coming recession.

The IRS has decided to postpone tax enforcement deadlines set by Congress.

Family offices are keeping a “watch and wait” approach to their portfolios, but they shifted a modest amount of cash to a broad range of asset classes for the third straight quarter.

🗳️ Outside the Box

In the US, the American Dream is now a work of fiction.

The slowing US economy, state by state.

An Iowa school district has apologized to parents after emailing an announcement with a "quote of the day" that was actually attributed to Heinrich Himmler.

The Black Friday and Cyber Monday scams to avoid this year.

How to use ChatGPT for holiday gift ideas.

📺 What to Watch Today

Has Black Friday peaked?

That’s all for today. Did we miss anything? Smash the reply button to let us know.

Cheers,

Wyatt

Notes

Please read this disclaimer. The authors of Alt Assets, Inc. are not attorneys, investment advisers, accountants, tax professionals or financial advisers and any of the content should not be taken as professional advice. They are self-taught accredited investors, sharing information, research, entertainment and lessons learned based solely on their own experience and circumstances. Individual results may vary. The published content is unique, based on certain assumptions and market conditions at the time of publishing, and is intended to serve solely as research, not financial advice. For entertainment purposes only. Not investment advice. Alts I LLC (the “Fund”) is an affiliate of Alt Assets, Inc. and the Fund has conducted a private placement offering under Rule 506(c) of Regulation D of the Securities Act of 1933, as amended. The Fund may invest in one, several, or all of the alternative asset classes that Alt Assets, Inc. publishes content about on its site. Any of the Fund’s investments that have positive designations on the Alt Assets, Inc. site are purely coincidental, as the Fund is actively managed and guided by its own investment parameters, as summarized in the relevant private placement memorandum. Alternative investing involves a high degree of risk, including complete loss of principal and is not suitable for all investors. Past performance does not guarantee future results. The newsletter may contain affiliate links, meaning that Alts.co and its associated entities may receive compensation for referring customers to the noted companies. We recommend seeking the advice of a financial professional before you make any investment in an alternative asset class or any associated entities, and we accept no liability whatsoever for any loss or damage you may incur.