Good morning.

Today, we have a special Monday morning primer edition for you, because this week is about to get wild. We’ll hit you with what’s happening and how you can consider preparing.

Trump meets China’s Xi Thursday with a potential trade deal that removes 100% tariff threats. The Fed decides rates Wednesday with Powell's press conference immediately following. And 20% of the S&P 500 reports earnings… including most of the Magnificent 7.

But here's what matters for your portfolio this week: how do you position when everything's moving at once?

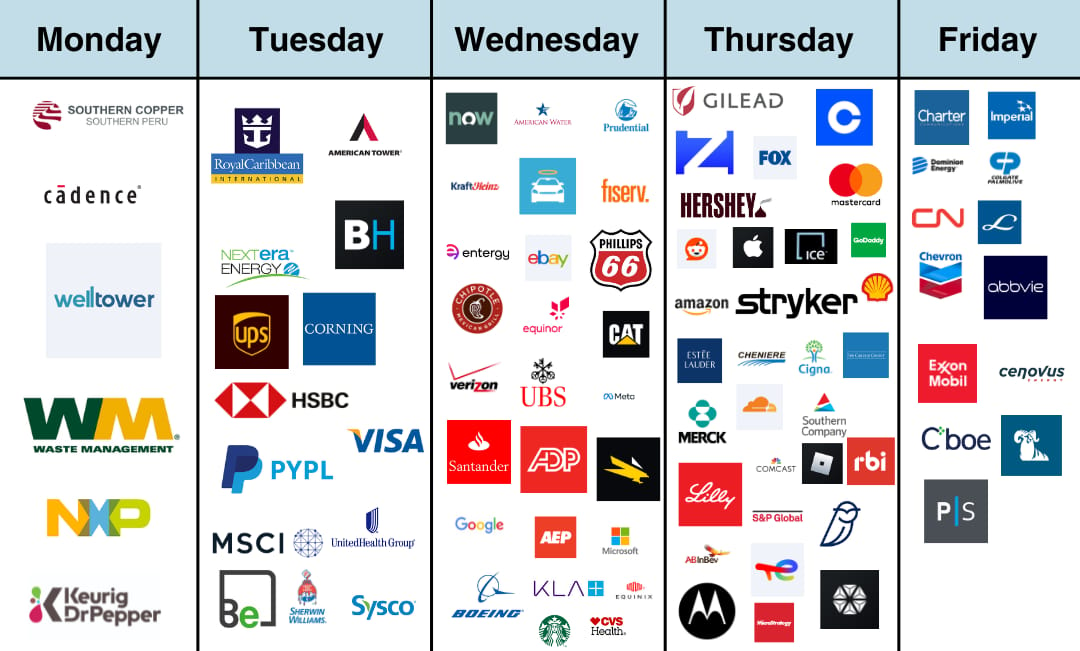

📆 The Week Ahead

Tuesday: Visa, UnitedHealth earnings

Wednesday: Fed rate decision + Powell press conference + Microsoft, Google, Meta, Boeing, Verizon earnings

Thursday: Trump-Xi meeting + Apple, Amazon, Eli Lilly earnings

Friday: Exxon, Chevron earnings

Investors are laser-focused on Mag 7 capital expenditure guidance. OpenAI's nearly $1 trillion in infrastructure buildout plans this month (per CNBC) have raised questions about whether AI spending is sustainable or heading for a cliff.

Trump says there will be "so much critical mineral and rare earth that you won't know what to do with them," per Fortune, suggesting the trade deal includes significant commodities components.

Now we’ll share how you can prepare ⬇️

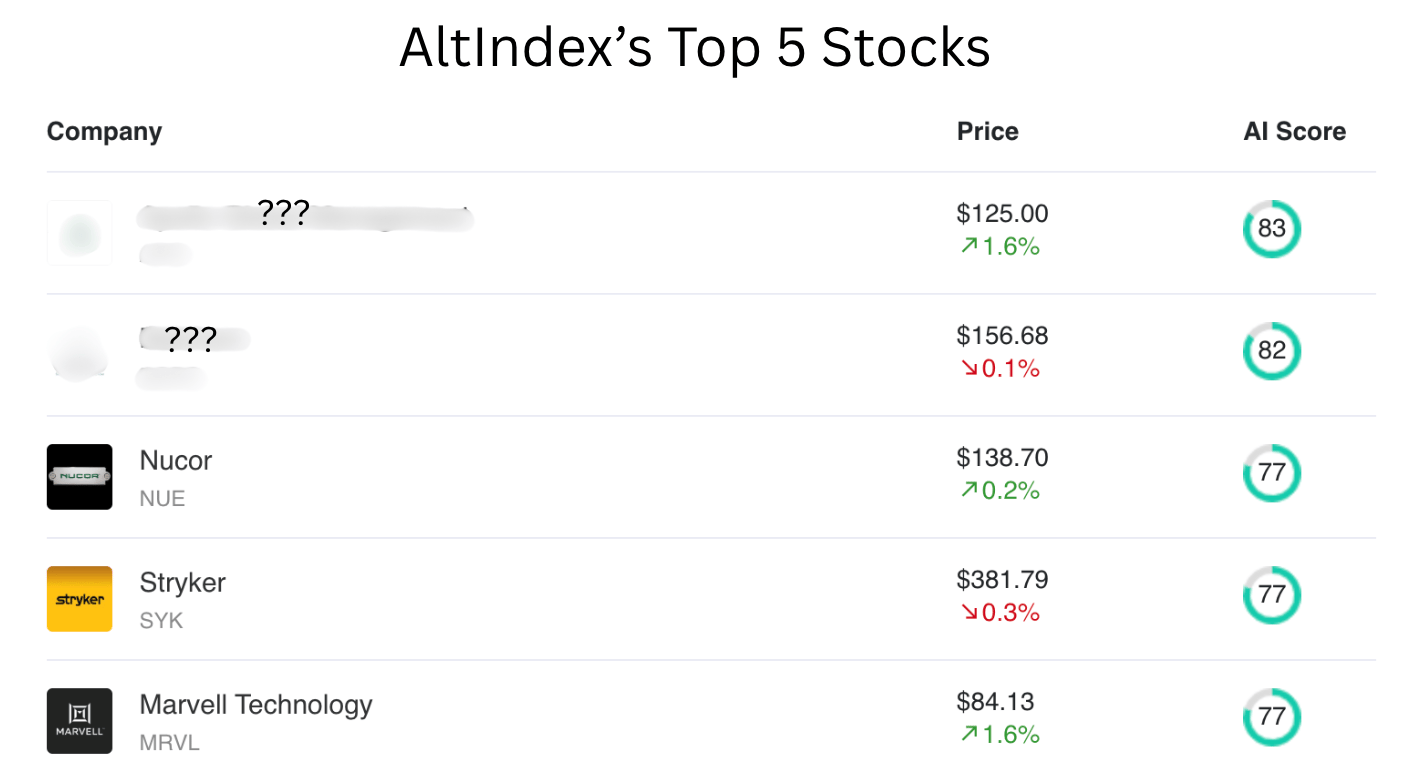

🥇 But First: AltIndex’s Top 5 Stocks Today

AltIndex’s top stock picks are constantly adapting to market data and social sentiment, so you better believe that we’ll be keeping our eyes glued to their top picks this week.

Here’s their top 5 right now (before the craziness of the week hits). Can you guess what the top two are at the moment?

💹 Portfolio Practicals

That’s what’s happening this week. Now here’s what investors can do.

1. Check Options Pricing on Your Holdings

If you own stocks reporting earnings this week, look at the implied move from options pricing. This tells you what the market expects in terms of volatility.

Here’s an example: If Microsoft options are pricing a 5% move, that's the breakeven threshold for option buyers. If you think the move will be smaller, consider holding or even selling premium. If you think it'll be bigger, you might want to take profits before the report or add hedges.

Most brokerage platforms show "expected move" on the options chain (check Apple’s expected move chart for Thursday here). Alternatively, you could calculate it manually: (ATM straddle price / stock price) ≈ expected % move.

2. Watch Fed Language on Wednesday, Not Just the Rate Decision

The market already expects the Fed to hold or cut 25bps. What matters is Powell's commentary on.

Future rate path given recent inflation data

Reaction to potential China trade deal

Assessment of labor market conditions

Honestly though, the FOMC is still divided (a lot of the Fed’s members have different ideas on how to fix the economy), so the signals might not be super clear from Powell.

Here’s a positioning tip. If Powell sounds more hawkish than expected (fewer cuts ahead), rate-sensitive sectors like REITs and utilities could get hit. If he's dovish, growth stocks might benefit.

3. Trade Deal Risk/Reward

If the China deal closes Thursday as expected:

Beneficiaries: Industrials, materials, exporters, semiconductors

Potential losers: Safe havens like gold and Treasuries if risk-on sentiment surges, rare earth miners (because China would sell the US rare earths again.

Bottom Line:

With the Fed, Trump-Xi, and Mag 7 earnings all hitting in 72 hours, volatility will spike. The temptation is to trade every headline.

You don’t have to do that. Maybe wait until Friday to reassess. Let the dust settle, see which narratives won, then position for the next week. Chasing intraday moves during event-heavy weeks just might destroy your returns.

📊 IPOs and Earnings

Eli Lilly agreed to acquire Adverum Biotechnologies for up to $261.7 million, offering $3.56 per share plus potential milestone payments of $8.91 tied to approval and sales targets; Adverum shares popped about 3%.

Blackstone posted Q3 revenue of $3.1 billion, down 15.7% year over year, while fee-related earnings jumped 26% to $1.5 billion; shares fell after strong fundraising of $54 billion and record $1.24 trillion in AUM.

📈 Earnings

🎙 What Do You Think?

Are you trading the news this week or watching and waiting?

🎤️ What you said last time

“Liked the section on risks a lot. Usually I just get plugged ideas with no mention of downsides.”

🧠 The Missing (Market) Links

Beyond Meat's wild meme-stock ride took another twist as the company dropped prelim Q3 results Friday.

MrBeast just filed a trademark for "MrBeast Financial" covering crypto exchanges, payment processing, and investment management.

Japan’s Nikkei index just broke 50,000 for the first time ever, rising 65% since the crash in April.

China’s rare‑earth magnet exports to the US collapsed nearly 30% YoY in September, the second monthly drop.

Brent crude rebounded to $61.32 a barrel after five‑month lows as traders debated whether the oil market remains oversupplied.

President Trump’s talk of importing Argentine beef sent futures swinging, while ranchers protested the proposal amid record prices and cattle herds at their smallest since 1951.

📜 Quote of the Day

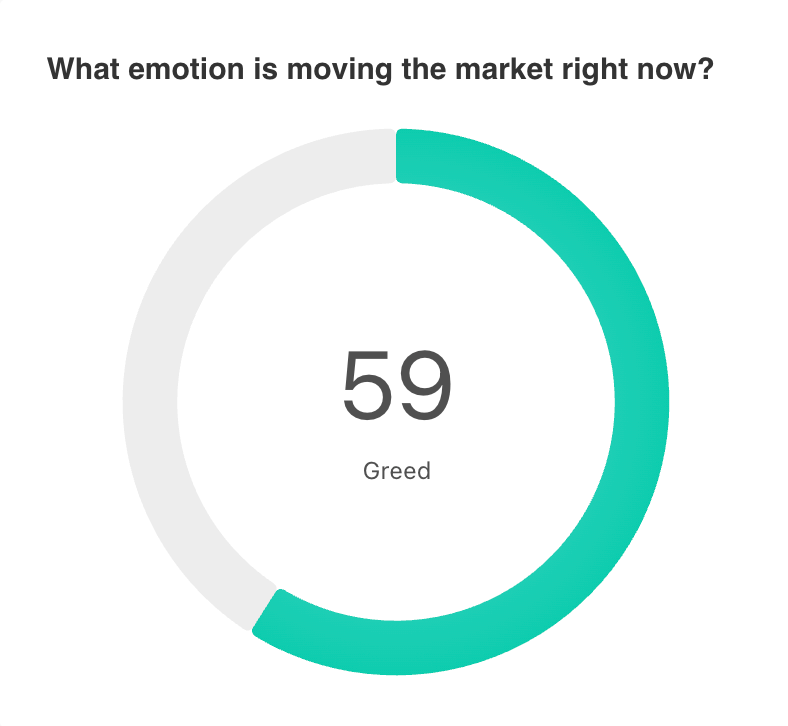

Be fearful when others are greedy, and greedy when others are fearful.”

📢 We want to hear from you.

We love hearing from you, and we deeply appreciate your feedback.

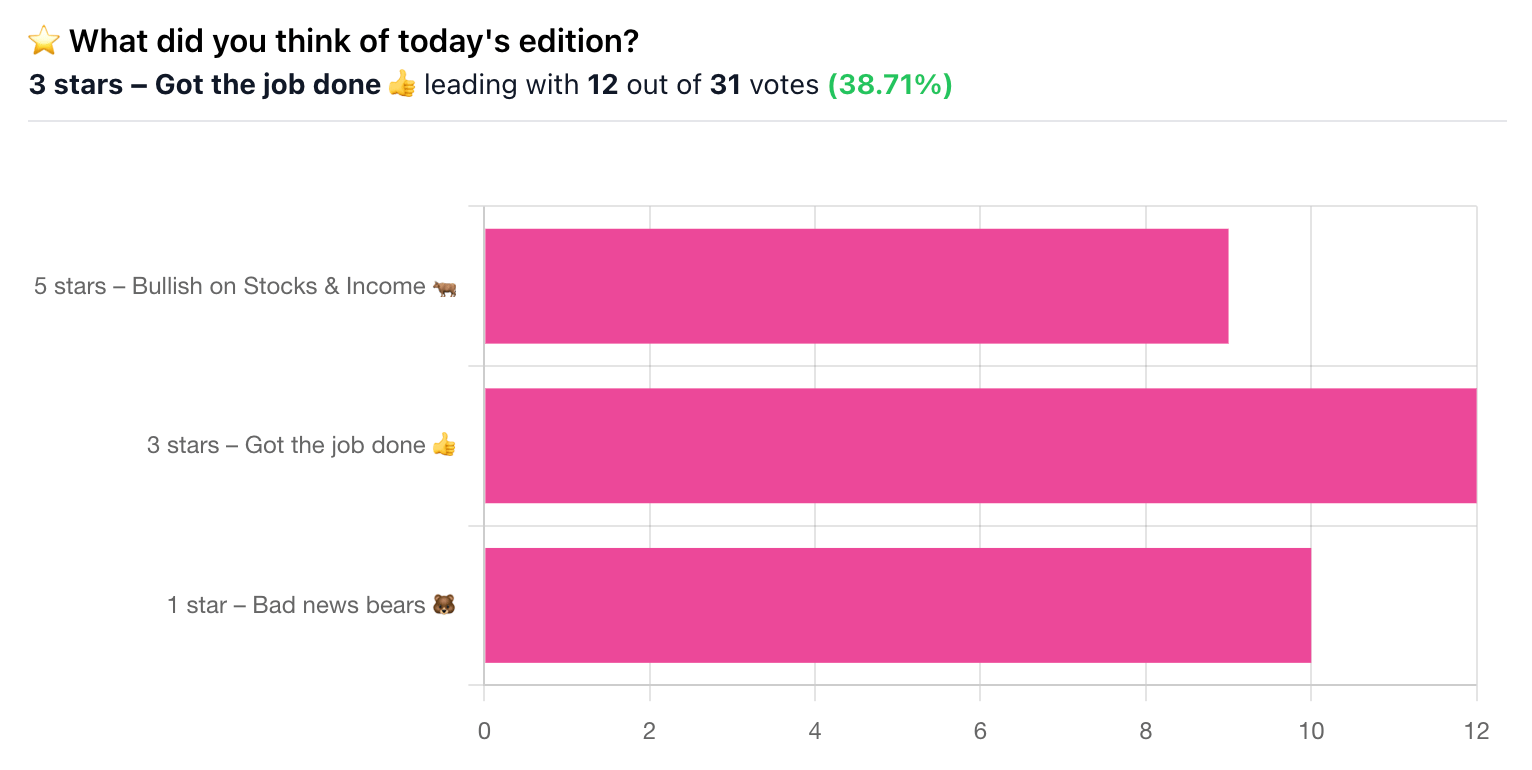

⭐️ What did you think of today's edition?

That’s all for today. Did we miss anything? Smash the reply button to let me know.

Cheers,

Brandon & Blake of Invested Inc

The information provided in Stocks & Income is for informational and educational purposes only and should not be construed as financial advice, investment advice, or a recommendation to buy or sell any securities. Stocks & Income is not a registered investment advisor, broker-dealer, or licensed financial planner. Always do your own research and consult with a licensed financial advisor before making any investment decisions. We may hold positions in or receive compensation from the companies or products mentioned. Disclosures will be made where applicable.

Stocks & Income, AltIndex, Finance Wrapped, The Chain, and Future Funders are all owned by Invested, Inc.