Good morning.

Fed Chair Jerome Powell just gave his speech at Jackson Hole, and he sounded as doveish as markets could have hoped for. The Fed looks ready for a rate cut in September.

And is the Bitcoin bull market over, or just getting started? Twitter analysts weigh in.

Buyers of Kanye West’s meme coin are largely in the red after the price plummeted over the course of a day and a half.

Tomorrow, we’re sending you a guide to real estate investing in 2025—but today, our partners at Pacaso are giving you the opportunity to buy shares in their private real estate company:

In partnership with Pacaso

Big investors are buying this “unlisted” stock

When the founder who sold his last company to Zillow for $120M starts a new venture, people notice. That’s why the same VCs behind Uber and eBay also backed Pacaso. They made $110M+ in gross profit to date. They even reserved the Nasdaq ticker PCSO. Now, you can join, too.

Paid advertisement for Pacaso’s Regulation A offering. Read the offering circular at invest.pacaso.com. Reserving a ticker symbol is not a guarantee that the company will go public. Listing on the NASDAQ is subject to approvals.

Please support our partners!

📰 Market Headlines

Stocks retreated Thursday ahead of Fed Chair Powell's highly anticipated Jackson Hole speech today, with all major indexes closing in the red.

But during his speech, the S&P 500, Nasdaq, and Bitcoin rose during the speech.

The Fed is open to a rate cut in September. Powell suggested that downside risks to employment are rising during his Jackson Hole speech. Polymarket shows that odds of a September cut are now at 89%. Also of note—Powell seemed to be hinting at stagflation in the economy: “Risks in inflation are tilted to the upside, and risks to employment are tilted to the downside." Here are some possible consequences of rate cuts right now.

Bitcoin was down almost 9% over the past 8 days until Powell’s speech, when it rose 2.5% on the outlook of a probable rate cut in September. Also in support of the bull case for BTC, many prominent figures on Twitter are raising the point that it would be strange for the cryptocurrency to have topped out already this cycle when no bull market peak indicators have flashed yet. August and September are also historically down months for BTC, with a resurgence in October (called “Uptober” on Crypto Twitter).

Walmart shares tumbled 3.2%, marking their second day of struggle, after the retail giant missed quarterly profit expectations despite raising its full-year outlook.

Meanwhile, beauty company Coty’s stock plummeted over 20% after the beauty products maker forecasted lower current-quarter sales due to weak US consumer spending. Consider it a canary in the consumer discretionary coal mine—right in line with poor performance from Target and Walmart. Ross shares are up 2% pre-market after beating earnings expectations yesterday, though.

Home sales rebounded slightly in July, rising 2.0% to an annual rate of 4.01 million units after hitting a nine-month low in June. The housing market is a mess right now—we wrote a mega thread covering every relevant data point and chart we could find.

Kanye West’s meme coin turned into a disaster for investors almost immediately as $YZY dropped from $3.15 to just $0.67 at the time of writing (a 78% drawdown). Two pieces of information for you to consider:

The crypto wallet that made the first trade on $YZY is the same trader that made $100 million on $TRUMP coin. Is this insider trading or just a chronically online Twitter user?

Every Rapper celebrity meme coin on Solana has gone to zero so far—and $YZY could very easily follow suit if its current price trend continues.

😱 Fear and Greed Index

🪙 Crypto

The US Justice Department backed off from prosecuting crypto developers as unlicensed money transmitters. One official said, "Merely writing code, without ill intent, is not a crime".

Hong Kong’s new spot Bitcoin and Ether ETFs debuted with the Bitcoin ETF trading HK$9 million and the Ether ETF just HK$1 million in volume.

A single victim lost 783 BTC, worth about $91.4 million, in a social engineering scam where an attacker posed as hardware wallet support.

🤖 AI/Future/Tech News

Crusoe Energy Systems raised $1 billion in equity and debt at a $10 billion valuation, aiming to cement its role as a critical infrastructure provider.

Hundreds of thousands of private Grok chatbot conversations became searchable on Google, exposing loads of illicit chats.

GameStop countered Sony’s $50 PS5 price hike with a limited-time trade-in bonus, as tariff-driven costs rippled through the gaming hardware market.

🚨 Trending on Reddit

Interestingly, Reddit mentions of all companies are down across the board—because everyone is posting about Jerome Powell’s speech.

Opendoor chatter is spiking on r/WallStreetBets, with users split between calling $OPEN a meme stock and backing Anthony Pompliano’s take that retail investors are acting more like a decentralized hedge fund.

Reddit Inc. remains obsessed with itself after its triple-digit rally. Some users are still bullish, but the comment threads are starting to sound like a pre-selloff group therapy session.

🤫 Insider Trading

📊 IPOs and Earnings

Intuit reported Q4 revenue of $7.75 billion, beating estimates of $7.57 billion; shares are down 5.79% today.

Workday beat Q2 expectations with a revenue of $2.24 billion; stock stayed nearly flat as investors digested the numbers.

Ross Stores declared a quarterly cash dividend of 0.405 per share payable next month; shares are up 0.87% today.

Zoom settled a lawsuit with investors over claims of misrepresenting encryption strength during the pandemic boom; shares increased 9.42% today.

MINISO Group surged 6.38% after posting 18.9% revenue growth and projecting 37.3% EPS growth.

🎙 What Do You Think?

What will Powell do at the next FOMC meeting in September?

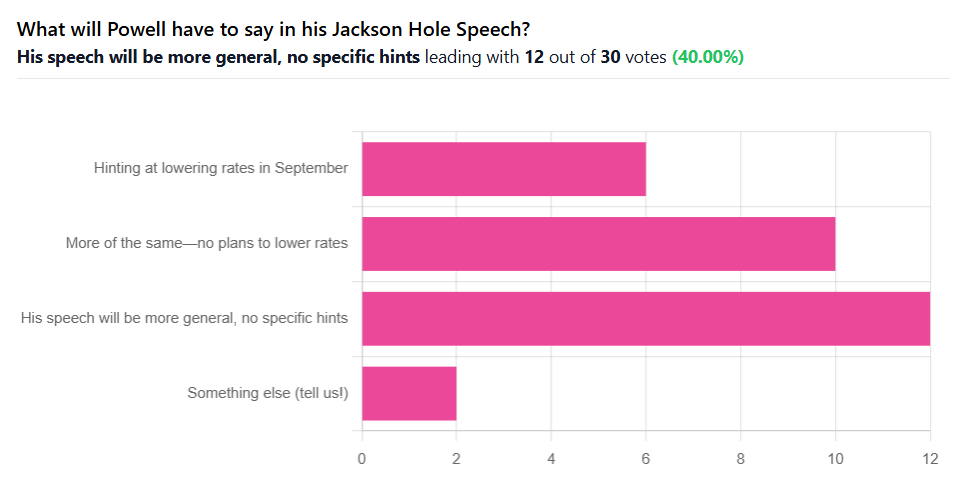

🎤️ What you said last time

“I don't think they will actually cut this year, but the bubble will pop if he doesn't pretend like it's part of the plan. He will make a noncommittal statement that sounds like they will cut soon, but probably won't till at least late Q4.”

🎪 Crowdfunding Showcase

RISE Robotics is raising funds to revolutionize heavy machinery with its patented Beltdraulic™ technology. Think hydraulics without the oil mess: their fluid-free actuators use belts and pulleys to deliver the power of traditional systems at half the operating cost with zero emissions.

The company, backed by MIT and Rhode Island School of Design alumni, has already generated $9.3 million in revenue and landed a spot in the U.S. Air Force's $46 billion contract program. Get in early →

🧠 The Missing (Market) Links

Wealthy investors are using 351 conversions to dodge capital gains by seeding ETFs before launch. Heads up, the strategy requires at least $1 million.

Homebuyers canceled 15.3% of US purchase agreements in July, the highest rate for that month since 2017.

The Pentagon just moved to stockpile cobalt for the first time since 1990. The $500 million contract covers up to 7,500 tons over five years.

US corn exports doubled year-over-year last week, hitting 2.8 million tons and blowing past analyst forecasts.

Labor Day travel is cheaper this year. Domestic airfare is down 6%, hotel stays are shorter, and gas prices are back to 2021 levels.

📜 Quote of the Day

“The big money is not in the buying and the selling but in the waiting.”

📢 We want to hear from you

We love hearing from you, and we deeply appreciate your feedback.

⭐️ What did you think of today's edition?

That’s all for today. Did we miss anything? Smash the reply button to let me know.

Cheers,

Brandon & Blake

Thumbnail image: Federalreserve, Flickr

The information provided in Stocks & Income is for informational and educational purposes only and should not be construed as financial advice, investment advice, or a recommendation to buy or sell any securities. Stocks & Income is not a registered investment advisor, broker-dealer, or licensed financial planner. Always do your own research and consult with a licensed financial advisor before making any investment decisions. We may hold positions in or receive compensation from the companies or products mentioned. Disclosures will be made where applicable.