Good morning.

Breaking: Trump has announced a Greenland deal framework and called off the NATO tariffs.

Markets are up. Classic TACO trade timing, as we suspected.

Today:

3 stock signals nobody looks at (and 15 stocks they’re highlighting)

Trump announces Greenland deal framework: US to get land, minerals

Ubisoft cancels six games, stock falls over 35%

Siri will be a full-on chatbot soon, with Google’s help

Let's get into it.

In partnership with AltIndex

What Your 2026 Could Look Like:

Imagine waking up to a notification that a stock you've never heard of just saw a 4,000% spike in Reddit mentions overnight. Sentiment is overwhelmingly bullish. You have time to research it before the market even opens.

You check AltIndex. The stock's web traffic is up 80% month-over-month. They're hiring aggressively. A Congress member with a strong track record just bought $200K worth.

You do your own research. The fundamentals check out. You take a position before the crowd arrives.

Two weeks later, the stock is up 50%. You were early. For once, you were on the right side of the information curve.

This isn't hypothetical. Things like this happened with stocks like IREN (up 585% after a buy signal), PLTR (Reddit mentions predicted the surge), and dozens of others in 2025.

Please support our partners!

📰 Market Headlines

Markets bounced back sharply on Wednesday after President Trump called off threatened tariffs against Europe.

The Dow soared 550 points, the S&P 500 climbed 1.2%, and the Nasdaq gained 1.2%.

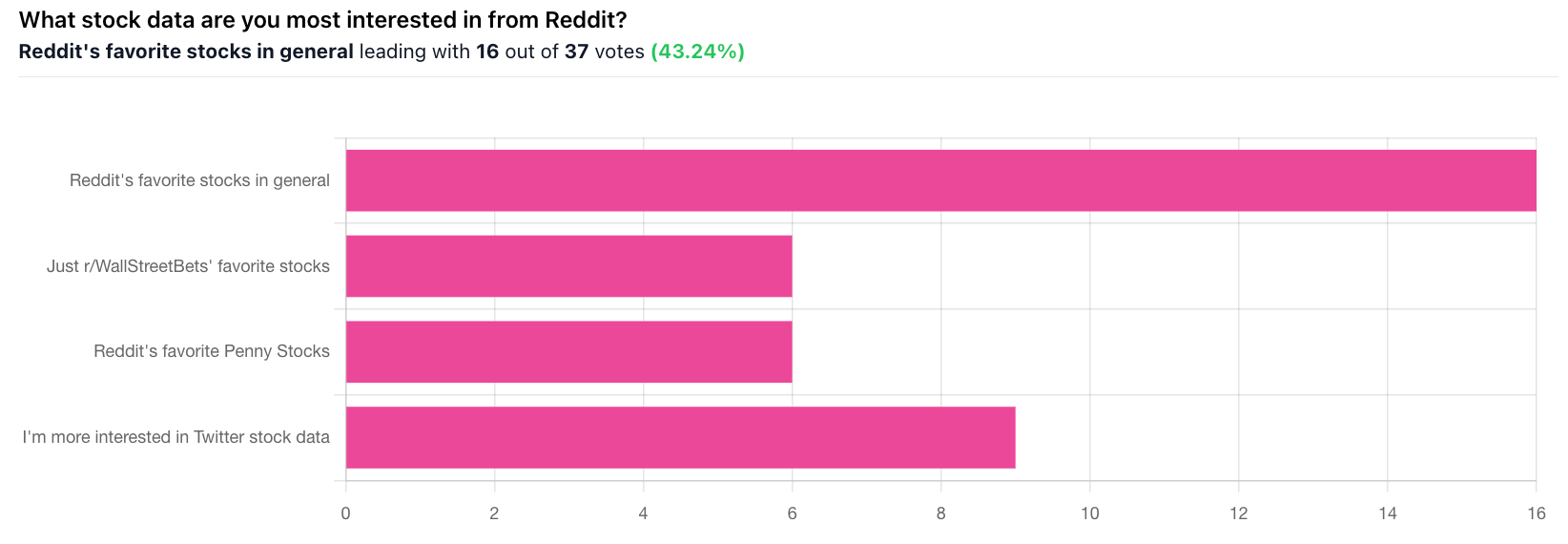

When it comes to picking potential high-growth stocks, there are three key data signals that not many people look at: company headcount growth, job listing growth, and employee business outlook. AltIndex factors all three of them into its stock ratings, and it has highlighted 15 companies with extremely high numbers on all three metrics →

Trump announced a Greenland deal framework and called off the NATO tariffs. It seems like the whole Greenland episode is following the exact TACO framework that we mentioned earlier this week. There aren’t any other official announcements about a deal yet, but here are the details so far:

The US may gain small, targeted parcels of land in Greenland for military bases (probably what Trump wanted all along)

The US will likely have a stake in Greenland mineral rights

The deal is “forever,” according to Trump

It’s specifically for the purpose of blocking Russian and Chinese influence on the US through Greenland

It will involve the US "Golden Dome" system, which Denmark is ready to help with

Ubisoft (UBI) shares fell over 35% after the studio canceled six new games and announced plans to shut down some of its studios. The company is restructuring in a bid to stop the losses it has faced ever since Covid hit in 2019.

Apple plans to turn Siri into a full chatbot later this year, code-named Campos. The new AI assistant will replace the current Siri interface and compete directly with ChatGPT and Gemini. Apple shares climbed 1.7% on the news; Alphabet, which is supplying the underlying tech, rose 2.6%.

A House committee approved bipartisan legislation that would give Congress arms-sale-style oversight over AI chip exports to China. The bill would outright ban Nvidia's Blackwell chips from being sold to China for two years, pushing back on President Trump's recent decision to ease export controls.

Natural gas futures spiked more than 50% in two days as a dangerous freeze descended on the eastern two-thirds of the US. Prices hit $4.875/mmbtu, their highest since December 8th, with traders calling it "the most impactful storm of the winter so far."

🤖 AI/Future/Tech News

Anthropic's revenue run rate has more than doubled since last summer, topping $9 billion at the end of 2025. The AI startup's latest funding round is oversubscribed, with Coatue, GIC, and Iconiq each committing over $1 billion.

European consumers fueled a tech backlash after US threats over Greenland, pushing boycott apps like NonUSA from No. 441 to No. 1 on Denmark’s App Store.

Anthropic revised Claude’s 80-page “Constitution,” expanding its ethical framework and publicly raising questions about AI consciousness during CEO Dario Amodei’s Davos appearance.

In partnership with Attio

Introducing the first AI-native CRM

Connect your email, and you’ll instantly get a CRM with enriched customer insights and a platform that grows with your business.

With AI at the core, Attio lets you:

Prospect and route leads with research agents

Get real-time insights during customer calls

Build powerful automations for your complex workflows

Join industry leaders like Granola, Taskrabbit, Flatfile and more.

Please support our partners!

🪙 Crypto

Ark Invest projects bitcoin's market cap will hit $16 trillion by 2030, implying a price around $761,900 per BTC.

President Trump told Davos attendees he wants to sign crypto market structure legislation "very soon," framing digital assets as central to US competition with China.

🚚 Market Movers

Verizon's $20 billion acquisition of Frontier Communications closed Tuesday.

Bumble's chief product officer, Michael Affronti, is out as CEO, and Whitney Wolfe Herd restructures leadership.

Netflix shares slid after Q4 earnings disappointed investors with weak margin guidance.

Bending Spoons is cutting Vimeo staff globally just months after acquiring the video platform for $1.38 billion.

🍷 Alternative Investment of the Day: Wine

Fine wine drew renewed attention as an alternative asset after data showed roughly 10.6% annualized returns over the past 15 years, putting it broadly in line with long-term equity performance while offering low correlation to stocks and bonds.

The appeal centered on limited supply and resilience during inflationary periods, though there are real frictions such as storage, insurance, authentication, and weaker liquidity compared with public markets, making wine a niche diversifier rather than a core holding.

❓ Market Trivia Corner

Who's the 4th richest in the world after Musk, Page, and Brin?

🎤️ What you said last time

🎪 Crowdfunding Showcase

Turn TikTok, YouTube Shorts, or any video into a playable game in minutes. Overplay, a New York startup backed by Mark Cuban, just crossed $4.1M raised from 1,680+ investors on Wefunder and is still open to new checks. Cuban joined as both investor and strategic advisor after the company appeared on Shark Tank.

🧠 The Missing (Market) Links

How The Weeknd went from working at American Apparel to becoming the highest-paid musician in 2025.

Massachusetts is the best state to raise a family for the fourth year running, despite childcare costs topping $44,000 annually.

Feeling fried at work? A tech management expert says responding more slowly to emails actually makes you more productive.

An executive coach who's worked with leaders at Google, Amazon, and Apple says these five phrases in one-on-ones separate people who get promoted from people who don't.

📜 Quote of the Day

The most important thing to do if you find yourself in a hole is to stop digging.”

📢 We want to hear from you.

Your feedback matters to us! Let us know what you liked or didn’t like about today’s edition.

⭐️ What did you think of today's edition?

That’s all for today. Did we miss anything? Smash the reply button to let me know.

Cheers,

Brandon & Blake of Invested Inc

The information provided in Stocks & Income is for informational and educational purposes only and should not be construed as financial advice, investment advice, or a recommendation to buy or sell any securities. Stocks & Income is not a registered investment advisor, broker-dealer, or licensed financial planner. Always do your own research and consult with a licensed financial advisor before making any investment decisions. We may hold positions in or receive compensation from the companies or products mentioned. Disclosures will be made where applicable. Past performance doesn’t guarantee future results.

Stocks & Income, AltIndex, Finance Wrapped, The Chain, and Future Funders are all owned by Invested, Inc.open