Good morning.

A thousand dollars a month in passive income. No work required. Just money showing up in your account quarter after quarter, year after year.

That's what a properly constructed dividend portfolio can deliver. And while $12,000 a year might not replace your job, it can cover your groceries, your car payment, or a vacation fund without touching your principal.

The question most investors have is simple: how much capital do you actually need, and which stocks should you buy?

Today we're breaking down the math, the strategy, and specific dividend investments worth considering. This is practical portfolio construction for real income, not theory.

In today's edition:

💵 The Simple Math: How Much You Need to Generate $1,000/month

🎯 Why High-Yield Dividends Are Often Traps (and What to Look for Instead)

📊 Dividend Aristocrats Worth Considering for Your Portfolio

🔄 Reinvesting vs. Taking Cash (and Why it Matters)

📈 ETF Options for Diversified Dividend Exposure

Let's begin.

In partnership with AltIndex

💵 Get AltIndex’s Top-Rated Dividend Stocks

AltIndex has rated 10 stocks as its top dividend picks for maximum growth while getting paid real cash.

Check the list below with a free 7-day trial and start building out your $1,000/month dividend portfolio today.

Please support our partners!

The Math Behind $1,000 a Month

To generate $1,000 per month in dividends, you need $12,000 annually (shocker!). The amount of capital required depends entirely on your portfolio's average dividend yield:.

At 3% average yield: $400,000 invested

At 4% average yield: $300,000 invested

At 5% average yield: $240,000 invested

At 6% average yield: $200,000 invested

Most quality dividend portfolios fall somewhere in the 3-5% range. Anything significantly higher usually comes with elevated risk.

If those numbers feel daunting, remember that dividend portfolios compound over time. A $100,000 portfolio yielding 4% generates $4,000 annually. Reinvest those dividends for 10 years with even modest price appreciation, and you could double or triple your way toward that $1,000/month goal.

The journey takes time, but the destination is worth it.

Why You Should Avoid High-Yield Traps

When building a dividend portfolio, the temptation is to chase the highest yields. Why settle for 3% when you can get 10%, or even 20%?

Because those high yields are often warning signs, not opportunities.

Companies paying unsustainably high dividends are usually doing one of two things: returning too much cash to shareholders instead of reinvesting in the business, or struggling financially and propping up their dividend to attract investors before an eventual cut.

When a dividend gets cut, the stock price typically crashes. You lose both the income stream and your principal.

Red flags to watch for:

Yields above 10% (especially in the 20-60% range)

Payout ratios above 60% (but if it’s a well-known company like Coca-Cola or Sysco, that’s usually fine)

Declining revenue or net income (the dividend is masking business problems)

Recent dividend cuts or inconsistent payment history

The best dividend stocks have moderate yields (2-6%), growing earnings, and payout ratios that leave room for business reinvestment. These companies can maintain dividends through recessions and grow them over time.

Dividend Aristocrats to Consider

The S&P 500 Dividend Aristocrats are companies that have increased their dividends every year for at least 25 years. This track record matters because it demonstrates financial strength, management discipline, and commitment to shareholders.

Here are five Aristocrats worth researching:

Coca-Cola (KO)

Dividend yield: 2.95%

Payout ratio: 65.04%

Annual dividend: $2.04

Consecutive years of growth: 53 years

Dividend growth rate: 5.22%

Coca-Cola is the classic dividend stock. Loved by Buffett and countless income investors, KO gives you modest but reliable yield backed by one of the strongest brands in the world. The payout ratio is on the higher end but likely sustainable given their consistent cash flows.

NextEra Energy (NEE)

Dividend yield: 2.76%

Payout ratio: 70.09%

Annual dividend: $2.27

Consecutive years of growth: 31 years

Dividend growth rate: 10.04%

NextEra is a utility and renewable energy leader with impressive dividend growth for the sector. The 10% growth rate is well above most dividend stocks. Wall Street analysts give NEE a Strong Buy rating with a price target implying 12% upside, making it attractive for both income and potential appreciation.

Walmart (WMT)

Dividend yield: 0.92%

Payout ratio: 33.30%

Annual dividend: $0.94

Consecutive years of growth: 50 years

Dividend growth rate: 11.32%

Walmart's yield is low, but the dividend growth rate is exceptional at 11.32%. The low payout ratio (33%) means plenty of room for continued increases. With a Strong Buy rating from 28 analysts and 13% upside potential, WMT offers dividend growth plus price appreciation opportunities.

Sysco Corporation (SYY)

Dividend yield: 2.87%

Payout ratio: 92.92%

Annual dividend: $0.54

Consecutive years of growth: 49 years

Dividend growth rate: 4.48%

Sysco is a foodservice distribution giant with nearly five decades of dividend growth. The payout ratio is concerning at 92.92%, which leaves little room for growth unless earnings improve. However, analysts see 18% upside potential. This is a higher-risk income play given the elevated payout ratio.

Caterpillar (CAT)

Dividend yield: 1.06%

Payout ratio: 29.36%

Annual dividend: $6.04

Consecutive years of growth: 32 years

Dividend growth rate: 7.75%

Caterpillar has a low yield but an extremely healthy payout ratio at just 29%. This gives management massive flexibility to raise dividends during good times and maintain them during downturns. The 7.75% dividend growth rate means your income stream should roughly double every nine years through dividend increases alone.

Dividend ETF Options

If researching individual stocks feels overwhelming, dividend ETFs offer instant diversification with professional management. Here are four worth considering:

Dividend yield: 7.22%

Annual dividend: $1.25

Dividend growth rate: 0.26%

DIV offers the highest yield on this list but the lowest growth rate. This is pure income play for investors who need cash flow now and care less about dividend growth.

Dividend yield: 4.64%

Annual dividend: $1.95

Dividend growth rate: 1.95%

SPYD focuses on the highest-yielding stocks in the S&P 500. The 4.64% yield is attractive without being dangerously high, and modest dividend growth helps offset inflation over time.

Dividend yield: 3.96%

Annual dividend: $1.19

Dividend growth rate: 8.29%

SPDV combines decent yield with impressive dividend growth at 8.29%. This fund balances current income with growing payouts, making it a strong choice for long-term income investors.

Dividend yield: 3.93%

Annual dividend: $2.04

Dividend growth rate: 1.30%

RDIV screens for companies with high dividend revenue quality. The yield is solid and the fund focuses on sustainability over maximum current yield.

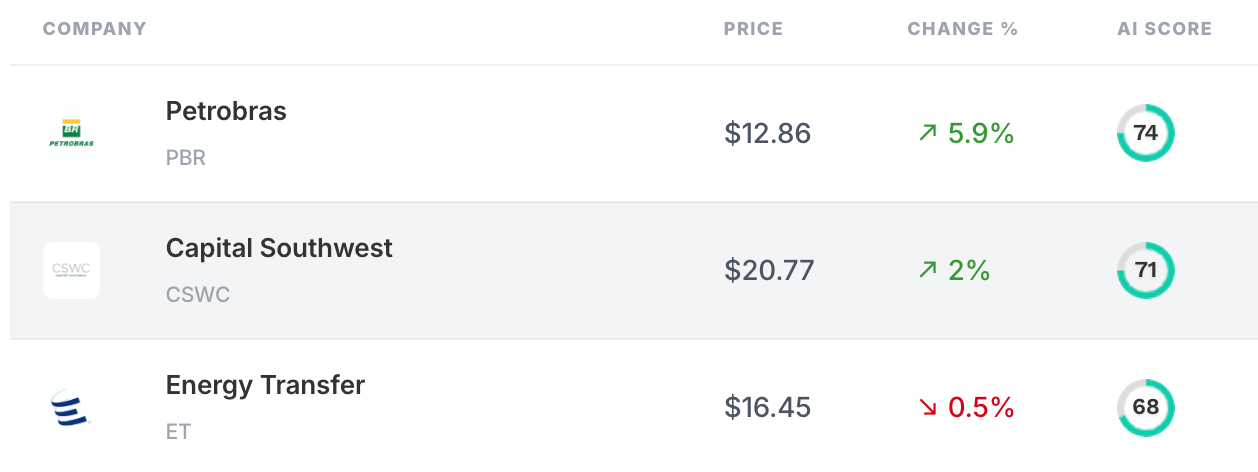

AltIndex’s Top 3 Dividend Stocks:

Here are the three dividend stocks that AltIndex’s AI thinks are the most primed for real price growth in the coming six months:

Reinvesting vs. Taking Cash

The decision to reinvest dividends or take them as cash depends entirely on your financial situation and goals.

Reinvest if: You're still building wealth and don't need the income now. Reinvesting dividends accelerates compounding dramatically. A $100,000 portfolio yielding 4% with dividends reinvested could grow to $250,000+ over 20 years even without additional contributions.

Take cash if: You need the income for living expenses, or you've reached a point where you want to enjoy the fruits of your investing. There's nothing wrong with using dividends for their intended purpose: providing income.

The hybrid approach: Many investors reinvest dividends during their accumulation years and switch to taking cash in retirement. You can also take some as cash while reinvesting the rest.

Tip: Remember that dividends are a feature of an investment, not the sole purpose. If your goal is long-term wealth building, you should still allocate significant capital to growth investments alongside your dividend positions. A portfolio that's 100% dividend stocks will likely underperform a balanced approach over most time horizons.

Building Your Portfolio

Here's a sample allocation for someone building toward $1,000/month in dividend income:

40% Dividend Aristocrats (KO, WMT, CAT, NEE, and others)

30% Dividend ETFs (SPDV, SPYD for diversification)

20% Growth-oriented dividend stocks (companies with lower yields but higher growth potential)

10% Cash or flexibility (for opportunistic purchases when good dividend stocks get cheap)

This structure gives you reliability from Aristocrats, diversification from ETFs, growth potential from rising dividend payers, and dry powder to take advantage of opportunities.

As your portfolio grows and you get closer to your income goal, you can adjust allocations based on whether you need more current yield or more dividend growth.

Bottom Line

Building a $1,000/month dividend portfolio requires substantial capital: likely $200,000 to $400,000 depending on your average yield. That's a long-term goal for most investors.

But the beauty of dividend investing is that it works whether you're starting with $5,000 or $500,000. Every dollar invested in quality dividend stocks starts generating income immediately and compounds over time.

The key is avoiding high-yield traps, focusing on companies with sustainable payout ratios and growing earnings, and giving your portfolio time to compound. A 25-year-old starting today with $10,000 and contributing $500 monthly to dividend stocks could reasonably reach $1,000/month in dividend income by their mid-40s.

Dividend investing rewards patience and discipline. The companies on this list have been paying and growing dividends for decades. They'll likely continue doing so for decades more.

Your job is to buy quality, reinvest consistently, and let compounding do its work.

⭐️ What did you think of today's edition?

🫡 See You Next Week

That’s all for today’s special edition. We hope you got value from it. Reply and let us know if you did.

Until next week,

— Brandon & Blake

The information provided in Stocks & Income is for informational and educational purposes only and should not be construed as financial advice, investment advice, or a recommendation to buy or sell any securities. Stocks & Income is not a registered investment advisor, broker-dealer, or licensed financial planner. Always do your own research and consult with a licensed financial advisor before making any investment decisions. We may hold positions in or receive compensation from the companies or products mentioned. Disclosures will be made where applicable.

Stocks & Income, AltIndex, Finance Wrapped, The Chain, and Future Funders are all owned by Invested, Inc.