Good morning.

Welcome to 2026. May your trades be ever in your favor.

The new year is off to a hot start:

The IPOs that could flood the market: SpaceX, OpenAI, Anthropic

Defining your money personality could help build serious wealth this year

China’s getting another Nvidia competitor

Google was the top-performing Mag 7 member in 2025

Let’s start the year right.

In partnership with AltIndex

New Year, New Portfolio (Ends @ Midnight Tonight!)

Last call!

Most New Year's resolutions about building wealth fail by February.

Make 2026 different. Stop gambling on gut instincts. Start using the data that actually moves markets.

AltIndex tracks Reddit sentiment, Congress trades, insider activity, and hiring trends. Then their AI analyzes it all to generate stock ratings.

The results: AltIndex’s AI-powered picks beat the S&P 500 by nearly 30% during a 6-month test in 2025.

Right now: 50% off for an entire year. That’s less than 30 cents per day. And you get to start with a 7-day free trial!

This is a New Year's deal, so it won't last long. Get the same alternative data and AI stock picks that outperformed the market, at half price.

The sales ends tonight at 12 AM! Use code ALTNEWYEAR26.

Please support our partners!

📰 Market Headlines

Markets ended 2025 near record highs, but divisions at the Fed and widening economic inequality set the stage for a turbulent year ahead.

Futures are up on the first trading day of 2026.

2025 was Google’s best year since 2009, rising a massive 65%. The way that a lot of people view the company in light of its TPU chip production: “Nvidia is great because it makes good chips, but wait till they realize that Google has an Nvidia inside of it already.”

Tesla shares are up 1.3% pre-market ahead of the release of its fourth-quarter car delivery stats. It’s expected to have delivered 440,900 vehicles, which is 11% less than this time last year. Any lower than that could bring the stock down, but any positive surprise might push TSLA higher.

Three mega IPOs are preparing to launch as early as this year. SpaceX, OpenAI, and Anthropic represent the three most valuable private US tech companies, and their public debuts could provide massive liquidity tests for markets already stretched by record valuations. Traders are torn over wether these IPOs represent great opportunities for retail investors or just exit liquidity for private investors.

Baidu (BIDU) shares jumped 12% pre-market after the tech giant from China announced plans for a Hong Kong IPO for its semiconductor unit, Kunlunxin. This means Kunlunxin will move from only supplying Baidu with chips internally to being a fully functioning chip maker like Nvidia or AMD.

Here’s a clip of Warren Buffett teaching you how to calculate the intrinsic value of a stock, which is the true, underlying worth of a company based on its fundamentals (key for value investing).

Homegoods stocks rose on news that President Trump is pausing a 30% upholstered furniture tariff and a 50% kitchen cabinet tariff. Wayfair (W) is up 2.4%, RH (RH) rose 3.5%, Williams-Sonoma (WSM) shares are up 1.3%.

Britain’s FTSE 100 index passed 10,000 points for the first time ever today. Cheers, Brits!

Singapore’s economy just posted its fastest growth quarter since 2021 (+5.7%). It could be worth checking to see if your 401(K) or IRA have any exposure to foreign nations’ economies if you want to be diversified.

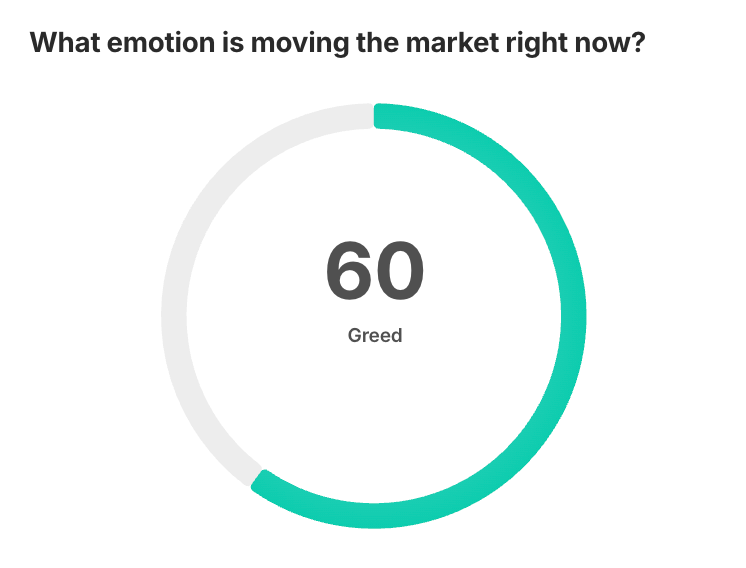

😱 Fear & Greed Index

We have seen an absolutely huge shift toward greed in AltIndex’s Fear & Greed indicator (47 → 60).

Some of the biggest changes we’re seeing are increased stock prices across the board, job listings, and employee counts at companies.

See all the data here on AltIndex.

🤖 AI/Future/Tech News

OpenAI consolidated teams to overhaul audio models for an audio-first device launching in 2026.

European banks planned to slash 200,000 jobs by 2030 as AI efficiency targets 30% gains in back-office operations.

🪙 Crypto

UK crypto users must now share account details with tax officials starting yesterday.

Bitcoin treasury companies face M&A wave in 2026 as consolidation looms. Over 200 new digital-asset treasuries launched in 2025.

🚨Trending on Reddit

Micron Technology chatter jumped as users regretted missing the 2018 buy-in at $37, while others flexed how MU quietly boosted their portfolios.

Ondas Holdings (ONDS) mentions spiked after the firm landed $10M in new orders and hit its $9.58 price target within a day. Redditors compare it to Rocket Lab and discuss call-option plays.

❓Market Trivia Corner

What was the most valuable company by market cap in 2005?

🎤️ What you said last time

🚚 Market Movers

Apple scaled back Vision Pro production and marketing after weak early sales, signaling fading enthusiasm for its pricey headset.

Elon Musk said Neuralink would begin high-volume brain implant production by 2026 using fully automated surgery.

Sapphire Foods and Devyani International are merging in a $934 million deal to form India’s largest Yum Brands franchisee, running more than 3,000 outlets.

Coca-Cola will cut 75 jobs at its Atlanta headquarters in February as part of a broader reorganization.

🎪 Crowdfunding Showcase

Unsmudgeable targets a universal annoyance: smudged glasses. Founded by materials scientist Swarna Shiv after 16 years of personal frustration and 500+ experiments, the Boston-based startup has created a permanent, PFAS-free coating that makes fingerprints vanish instead of smearing. The tech outperforms current anti-smudge coatings by 250% and integrates seamlessly into existing eyewear manufacturing.

The company already has five enterprise pilots (one paid, two LOIs, two trials) and backing from investors, including Tim Draper, Om Capital, and MassChallenge. With a $4.5M valuation cap and 20% early-bird discount, Unsmudgeable is raising on Wefunder to bring its patent-pending coating to the $585B eyewear market.

🧠 The Missing (Market) Links

Warren Buffett says Berkshire Hathaway has a “better chance I think of being here 100 years from now than any company I can think of” (CNBC).

Both Bernie Sanders and Ron DeSantis are speaking out against AI data center construction.

New business idea: drone-based solar panel cleaning.

The student loan tax bomb returned. Borrowers faced tax bills up to $12,000 on forgiven balances starting this year.

A neuroscientist said tiny experiments beat New Year’s resolutions by rewiring the brain for real habit change.

Here’s why Warren Buffett says “Don’t worry too much about starting salaries” when it comes to starting your career.

📜 Quote of the Day

📢 We want to hear from you.

We love hearing from you, and we deeply appreciate your feedback.

⭐️ What did you think of today's edition?

That’s all for today. Did we miss anything? Smash the reply button to let me know.

Cheers,

Brandon & Blake of Invested Inc

The information provided in Stocks & Income is for informational and educational purposes only and should not be construed as financial advice, investment advice, or a recommendation to buy or sell any securities. Stocks & Income is not a registered investment advisor, broker-dealer, or licensed financial planner. Always do your own research and consult with a licensed financial advisor before making any investment decisions. We may hold positions in or receive compensation from the companies or products mentioned. Disclosures will be made where applicable. Past performance doesn’t guarantee future results.

Stocks & Income, AltIndex, Finance Wrapped, The Chain, and Future Funders are all owned by Invested, Inc.open