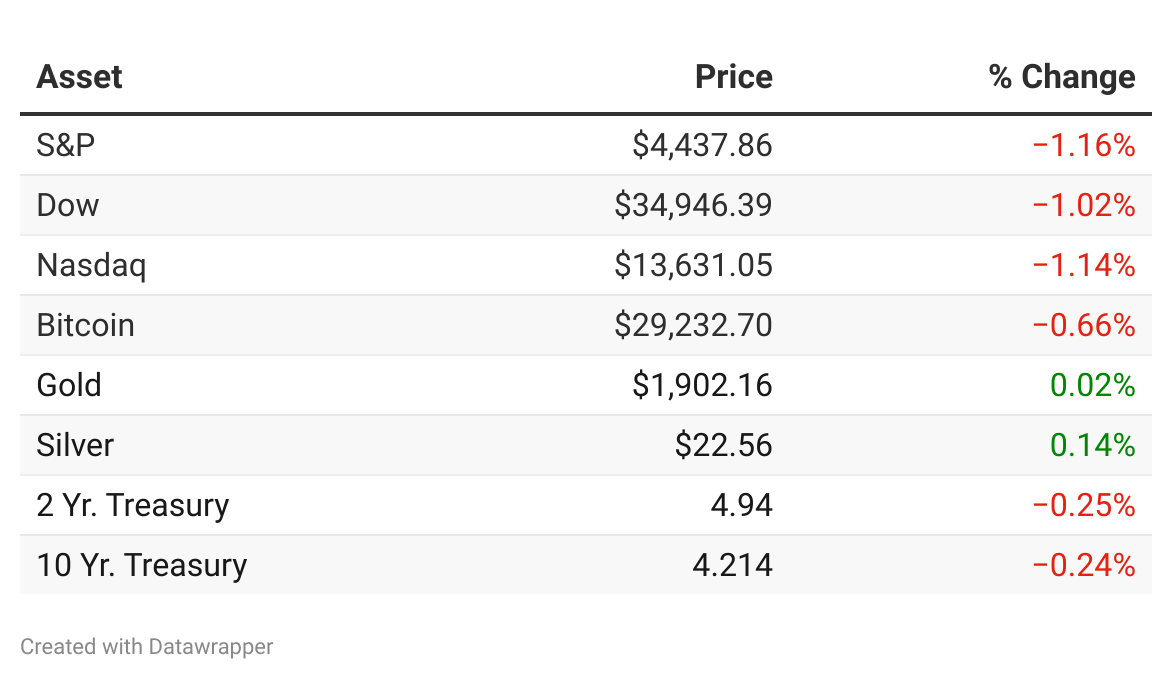

*past 24-hour performance

Shoppers boost retail sales: Americans increased their retail spending in July for the fourth month in a row, a sign the strong labor market is continuing to drive consumer spending despite the Fed’s rate increases (WSJ)

Home-improvement boom is tapering off: Home Depot (HD) beats earnings estimates but reports a 2% drop in revenue and 1.8% fewer transactions, compared with the same period a year earlier (Axios)

Builder confidence falls: After steadily rising for 7 consecutive months, builder confidence retreated in August as rising mortgage rates near 7% and stubbornly high shelter inflation have further eroded housing affordability (NAHB)

F45 maxes out: F45 Training (FXLV), the global fitness franchisor which was once worth $1.4 billion, has delisted from the NYSE and suspended its financial reporting after a series of challenges have affected its operations (Fitt)

Simplify enters the Arena: Simplify Inventions, home to the founder of 5-Hour Energy and owner of several TV news stations, has agreed to acquire a majority stake (65%) in the publisher of Sports Illustrated and Men’s Journal, The Arena Group (AREN); stock rose 22% (Axios)

You can read our favorite backdoor way to play Arena Group here.

Some Tesla’s are now $10k cheaper: Tesla (TSLA) rolled out cheaper versions of its Model S and Model X vehicles in the U.S. as competition in the electric vehicle space continues to ramp up (CNBC)

Iger’s job just got tougher: TSG Entertainment, which helped finance hits including “Avatar” and the “Deadpool” franchise for Twentieth Century Fox, is suing the studio and its parent company Disney (DIS) for alleged breach of contract (WSJ)

Intel backs out of chip deal: Intel (INTC) has terminated its plans to acquire Israeli contract chipmaker Tower Semiconductor (TSEM) as it was unable to get timely regulatory approvals for the $5.4 billion deal (Reuters)

Clean energy, dirty supply chain: First Solar (FSLR), a leading U.S. solar panel manufacturer, said that an independent audit had found that migrant workers in its operations in Malaysia were victims of forced labor; props for the transparency (NYT)

Big oil’s next big move: Buffett-backed Occidental Petroleum (OXY) agreed to buy Canadian startup Carbon Engineering for $1.1 billion as the oil producer expands to remove carbon dioxide from the atmosphere (Fortune)

Yen and Yang: Japan’s economy dazzled last quarter, boasting 6% annualized growth, double what analysts were predicting (BNN)

Why aren’t investors selling stocks to buy bonds? History has taught stock market investors that stocks always come back. Buy when there is blood in the streets and so on. But we’ve never seen anything like this in the bond market. Read more »

No, small banks aren’t holding the bag on half-empty office towers: Contrary to a widespread figure, local and regional lenders don’t hold 70% of US commercial real estate debt. It’s closer to 32%. Read more »

A closer look at “Cut your losses early; let your profits run”: Most people are naturally inclined to patiently, and painfully, stick with losing decisions for too long while cashing out of winning decisions too quickly. Here’s why that’s a bad idea. Read more »

Cable and broadcast combined have fallen to less than 50% of all TV viewing for the first time ever (CNN)

Fourteen days across the Atlantic, perched on a ship’s rudder (BBC)

Millions of kids are missing weeks of school as attendance tanks across the US (NY Post)

Elon Musk’s X is throttling traffic to websites he dislikes (Washington Post)

The race to tap the Moon's immense value (Axios)

Share Stocks & Income → Get Our Free Report

We just launched our brand new report: 5 Stocks Paying 10% Yields... You Probably Haven't Heard Of.

Want access? All you have to do is refer 1 friend to Stocks & Income with your personal referral link and we will send the report to you for free.

You can also copy/paste the link here: {{rp_refer_url}}

Thunderclap Research is a professional investment research firm focused on understanding and profiting from market anomalies.

We take both a quantitative and qualitative approach to research extensively on strategies for established money managers and everyday retail investors.

We are a small, self-funded team of real humans going up against the hype-filled, sensational news outlets in the world. You can check out a selection of our other publications below.