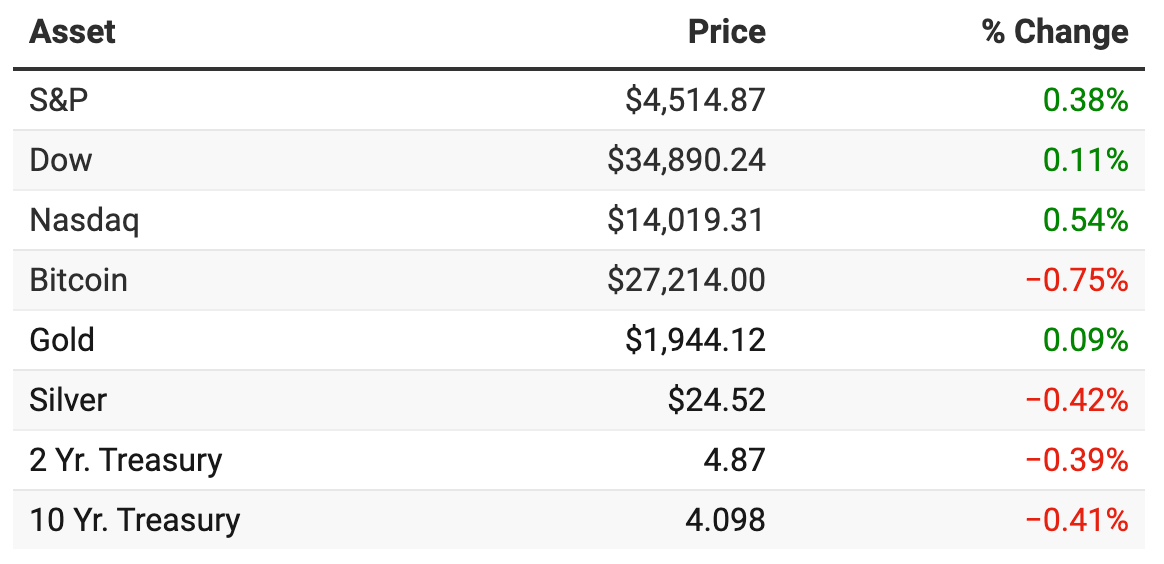

*past 24-hour performance

Gabon coup to impact metals prices: Prices for manganese, a metal used in steel products, could rise after French miner Eramet (ERMAY) suspended mining operations in Gabon, which became the latest African nation to suffer a military coup (Marketwatch)

Throwing rocks: Manhattan federal prosecutors are investigating Tesla’s use of company funds on a secret project that had been described internally as a “glass house” for Elon Musk (WSJ)

Credit card rate hikes: Visa (V) and Mastercard (MA) are planning to increase credit card fees for merchants starting in October and April. The changes could result in merchants paying an additional $502 million annually in fees (WSJ)

Salesforce leans into AI: Salesforce (CRM) shares popped after it said its profit expanded last quarter as it cut costs and leaned into new products that incorporate AI (Yahoo)

Eurozone alarm signals: The eurozone’s inflation rate in August came in higher than expected, remaining at the same level as July, a sign the European Central Bank may be on course to press ahead with a further interest-rate hike in September (WSJ)

Big money to battery recycling: Redwood Materials, a battery recycling startup founded by Tesla's former CTO, has raised $1B. The company is now valued at $5B (Electrive)

Labor market officially at pre-pandemic levels: The U.S. job market in August added 177,000 jobs, missing estimates by 23,000 jobs. The figure is a significant decline from the 371,000 jobs added in July (Axios)

UBS posts record profits: Switzerland’s UBS Group (UBS) has posted the largest quarterly profit ($29 billion) on record for a lender as a result of the emergency takeover of rival Credit Suisse (CNBC)

Embracing sabbaticals, sunsetting retirement age: The retirement system is broken. Most rapidly aging developed countries try to balance the budget by increasing the retirement age — leading to massive unrest such as in France earlier this year. But, is there a chance for a better solution that would be attractive to voters and better for the economy? Read more »

Money is the biggest point of contention in relationships, new survey shows: In today’s high-inflation world, finances are an unending source of stress for many Millennials and Gen Z who are priced out of the housing market and battling higher costs for everyday items. About one third of respondents in a new study said they had ended a relationship over disagreements about money. And more than 40% say they fight about finances on a monthly basis. Read more »

Google made a watermark for AI images that you can’t edit out (The Verge)

Xi likely to skip G20 meeting in India, preventing a Biden meetup (Reuters)

Why the first auction for offshore wind in the Gulf of Mexico was a bust (Semafor)

OpenAI is on track to scrape together $1 billion in annual sales from ChatGPT (Insider)

McConnell again freezes for 30 seconds, still plans to serve his term (Politico)

Thunderclap Research is a professional investment research firm focused on understanding and profiting from market anomalies.

We take both a quantitative and qualitative approach to research and focus extensively on strategies for established money managers and everyday retail investors.

We are a small, self-funded team of real humans going up against the hype-filled, sensational news outlets in the world. You can check out a selection of our other publications below.