📰 Market Headlines

Another mixed day in the global economy, with a mixture of negative forecasts and hopeful updates...

The S&P 500 has been mostly even this week, with big winners like Palantir (+20%) and WeBull (+250%).

The 10-year Treasury yield surged as high as 4.9% as investors dumped US assets, but has since dropped to a slightly less concerning 4.3%.

“More people are bringing lunch to work. That’s a bad economic indicator” via WSJ.

Hedge Funds have sold global stocks over the last 30 days at the fastest pace in more than 12 years, according to Goldman Sachs.

Europe stocks surged higher from Tariff Exception news and Europe’s pausing of countermeasures until July.

👑 KingsCrowd: The Bloomberg terminal for startups

The ratings agency for startup investing.

Private markets are booming, but most startup investing still happens in the dark. KingsCrowd is becoming the trusted data layer for startup investing.

They track, analyze, and rate 5,000+ startup deals each year — giving investors the same tools and research they get in public markets.

Now they’re raising funds, and letting you buy into the company itself.

Why invest in KingsCrowd?

First-mover in a massive fragmented market

$4m projected 2025 revenue

2,000+ paying users | 30k+ newsletter subs

Raising $2.5m at a (very reasonable) $13.9m valuation

Express interest

Clicking the the button below will:

Take you to an Expression of Interest form

Give KingsCrowd permission to email you

To express interest in KingsCrowd without giving permission to email, click here.

📊 Ideas, trends, and analysis

OpenAI is working on it’s own social network, like X. They say ChatGPT may be making users more lonely.

AI. AI. AI. 74% of CEO’s acknowledged they may lose their jobs if they can’t make significant AI-driven gains.

A summer of layoffs looms as 92% of workers brace for recession.

The 25% auto tariffs are going to significantly impact Japanese car brands, especially Nissan which has been struggling.

🧠 Make yourself heard

How are you approaching this bumpy market?

I am...

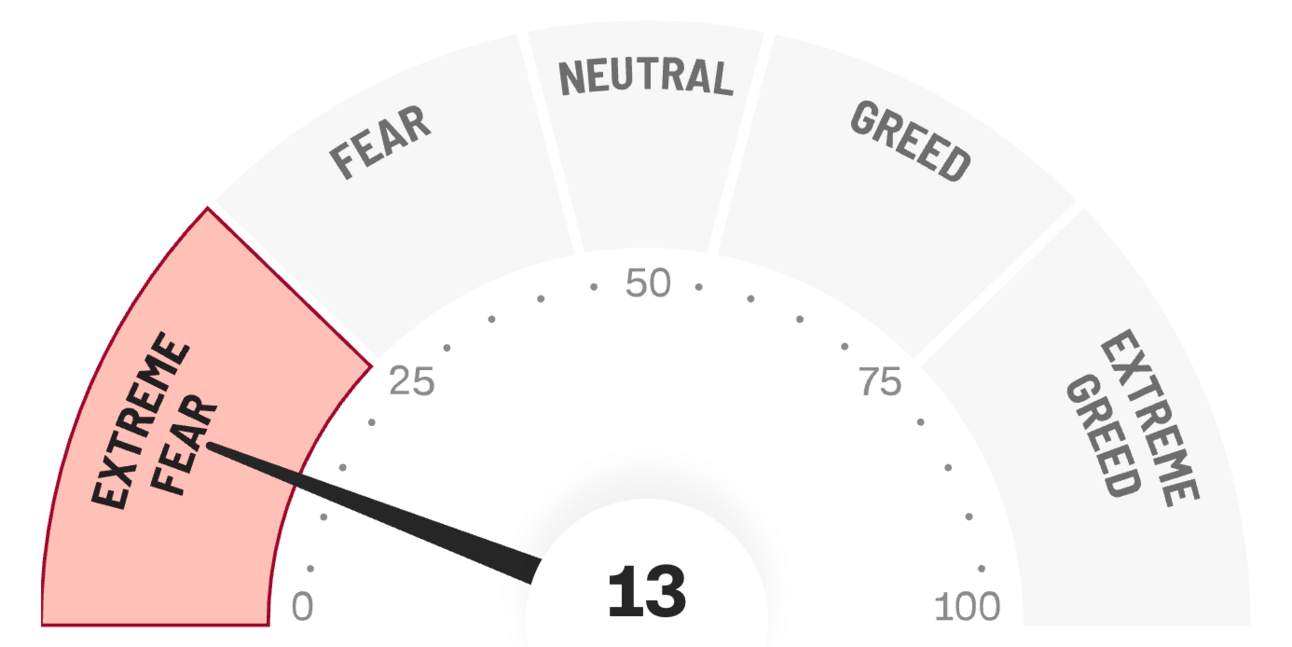

😱 Fear and Greed Index

📊 Earnings this week

📊 Crypto

The Crypto market overall is up this week with Solana (+20%), Bitcoin (+9%), XRP (13%) and Etherium (8%) leading the way.

Execs from companies like Coinbase and NYSE shared their wishlists with the SEC at their 2nd Crypto Roundtable.

South Korea blocks 14 Cryptocurrency Exchanges on the Apple Store.

🎤 What you said last time

You overwhelmingly think a recession is coming. Several readers also sent in more detailed responses, including first party anecdotes from business owners saying they’ve never seen more job applicants, among other things.

Hard to argue against these results with housing, jobs, the market and so many other factors pointing towards struggles in the short term.

Assuming we, Stocks & Income subscribers & writers both, all see an impending recession, how can we get ahead of this? Great time to lean conservative & alternative (consider precious metals), while watching for opportunity.

📺 What to watch today

That’s all for today. Did I miss anything? Smash the reply button to let me know.

Cheers,

Brandon Harris