Macro is more important than ever, and yesterday I talked about a fund looking to take advantage of that.

A copper supply shock is coming ⛏️

You may have heard that Chile, the world’s largest copper supplier, is looking to nationalize its mining industry. This could cause international mining companies to flee.

The world’s 2nd and 3rd largest suppliers are Peru and the Democratic Republic of the Congo. Politics and war are affecting copper supply in both of these countries as well.

In a nutshell, the copper market is in a difficult spot right now.

This supply crunch threatens 45% of the world’s copper supply. But it could be extremely bullish for copper prices and specific mining companies that have a ready stockpile of copper.

Fat Tail Investment Research publishes several deep dive into those mining companies.

If you’re interested in this world, they have a daily publication called Fat Tail Daily.

📰 Market Headlines

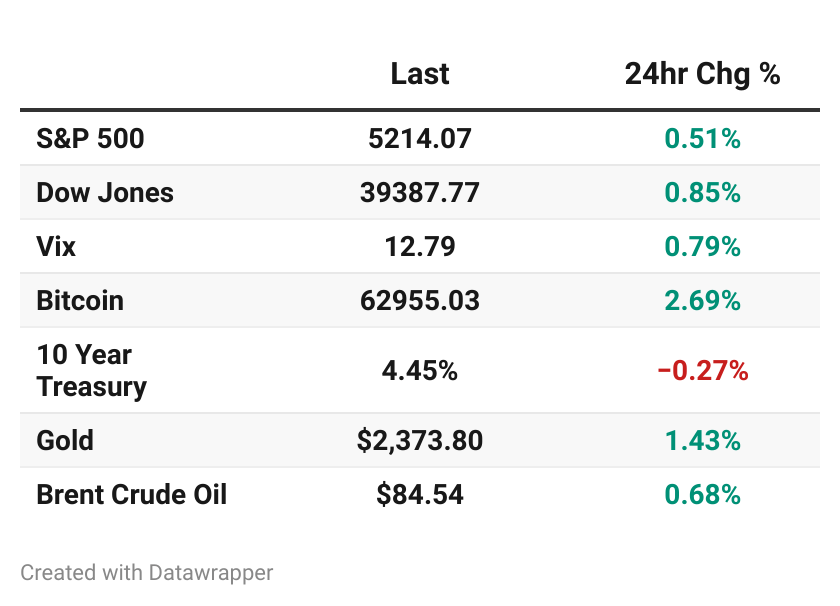

Markets bumped up a bit, lifted by signs of a cooling labor market and renewed optimism for a potential rate cut by fall.

The Dow notched its seventh straight daily gain. The S&P 500 climbed 0.5% and the Nasdaq edged up 0.2%.

Weekly jobless claims rose more than expected to 231,000, the highest level in over 8 months.

Mortgage rates dipped back toward 7% this week, the first decline in five weeks.

Treasury yields retreated, with the 10-year yield falling to 4.45%, down from 4.7% two weeks ago.

Meanwhile, the Bank of England is toying with summer rate cuts.

🕶️ Market Vibes

🎰 Market Forecasts and Futures

Markets have given up on a June cut. November is now the earliest likely(ish) date.

😱 Fear and Greed Index

🎤 What you said last time

Just about in line with the national average. I’d love to hear from the people who approve of the job Congress is doing right now.

📈 Trends you need to know

Possibly the saddest chart you’ll see all week, interest in adopting rescue dogs has plummeted since the Covid peak.

🧠 What do you think?

💬 Have your say

🐕 Why has interest in dog adoption plummeted near all time lows

📊 Stocks

Get $20 free shares at public.com using code ALTSCO.

Winners and losers

Earnings, upgrades, and acquisitions

Roblox cut its annual bookings forecast, causing shares to plummet 23%—their steepest drop in over two years.

Airbnb shares tumbled nearly 7% after weak Q2 forecasts.

Warner Bros. Discovery stock climbed 3% following Q1 earnings and news of a streaming bundle deal with Disney.

Planet Fitness Q1 revenue grew 11.6%, boosting shares over 10%.

YETI issued full-year 2024 EPS guidance that beat consensus estimates; shares surged over 11%.

Yelp slid 5.8% despite Q1 EPS beating estimates as revenue fell slightly short of expectations.

Akamai Technologies reported Q1 earnings that topped targets while revenue missed; shares plummeted 8.8%.

Market movers

Apple apologized for possibly one of the worst advertisements of all time.

TikTok began automatically labeling AI-generated content with "Content Credentials," a digital watermarking technology.

The US Supreme Court ruled in favor of a music producer in a copyright damages case against Warner Music over a Flo-Rida song.

India has delayed caps on market share for its popular digital payment method UPI, benefiting Google Pay and Walmart-backed PhonePe.

Ideas, trends, and analysis

Public college tuition plummeted 3.3% in 2023, the largest drop since 1980.

US online retail spending jumped 7% from January to April.

China's exports and imports returned to growth in April as demand improved.

The average 30-year mortgage rate dipped to 7.09% after five straight weeks of increases.

April's tractor inventory levels surged by almost 107% year-over-year, their highest levels since the 1980s farm crisis.

🌍 Global Perspectives

🇮🇷 Iran said it will change its nuclear doctrine if Israel “threatens its existence.”

🇮🇳 Prime Minister Narendra Modi's BJP party is skipping the election in Kashmir for the first time since 1996.

🇪🇺 🇺🇦 The EU agreed to fund Ukrainian weapons with profits from frozen Russian assets.

🇿🇼 Zimbabwe is crafting plans to enforce the usage of its new gold-backed ZiG currency.

📊 Crypto

Bitcoin's 200-day moving average broke $50,000 for the first time.

Crypto trading volume plummeted 43.8% to $6.58 trillion in April, the first decline in seven months.

Bitcoin mining giant Core Scientific reported $210.7 million in Q1 net income and 2,825 BTC mined.

WisdomTree's crypto app launched in New York despite opposition from a major shareholder over the firm's DeFi push.

🧠 Errata

Malaysia is trading orangutans for palm oil.

A Japanese food supplier recalled over 100,000 packs of bread after rat parts were found in the loaves.

A huge asteroid the size of the Great Pyramid of Giza skimmed past Earth at 56,000 mph today—nobody noticed.

A Brazilian horse was rescued after being stranded on a roof for days during massive floods that have killed over 100 people.

📺 What to Watch Today

Steve Jobs is rolling in his grave

That’s all for today. Did I miss anything? Smash the reply button to let me know.

Cheers,

Wyatt