Good morning.

Stocks stumbled into December as the Dow fell 400 points.

Meanwhile, gold hit a six‑week high, silver surged to record levels (again), and Apple closed at a record high after what some analysts called its “quietest supercycle ever.”

Shopify crashed mid-Cyber Monday and gold’s rally reminded us that rate cuts can turn “boomer metal” into a momentum trade.

More below on the week’s biggest movers, AI breakthroughs, and why manufacturing might be the market’s newest weak link.

Let’s get into it!

In partnership with RAD Intel

$1K Could’ve Made $2.5M

In 1999, $1K in Nvidia’s IPO would be worth $2.5M today. Now another early-stage AI tech startup is breaking through—and it’s still early.

RAD Intel’s award-winning AI platform helps Fortune 1000 brands predict ad performance before they spend.

The company’s valuation has surged 4900% in four years* with over $50M raised.

Already trusted by a who’s-who roster of Fortune 1000 brands and leading global agencies. Recurring seven-figure partnerships in place and their Nasdaq ticker is reserved: $RADI.

This is a paid advertisement for RAD Intel made pursuant to Regulation A+ offering and involves risk, including the possible loss of principal. The valuation is set by the Company and there is currently no public market for the Company's Common Stock. Nasdaq ticker “RADI” has been reserved by RAD Intel and any potential listing is subject to future regulatory approval and market conditions. Investor references reflect factual individual or institutional participation and do not imply endorsement or sponsorship by the referenced companies. Please read the offering circular and related risks at invest.radintel.ai.

Please support our partners!

📰 Market Headlines

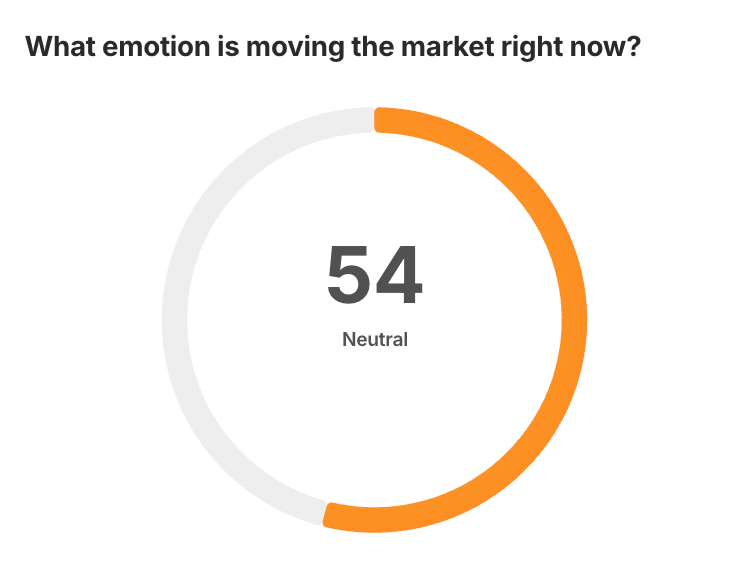

Markets stumbled to start December.

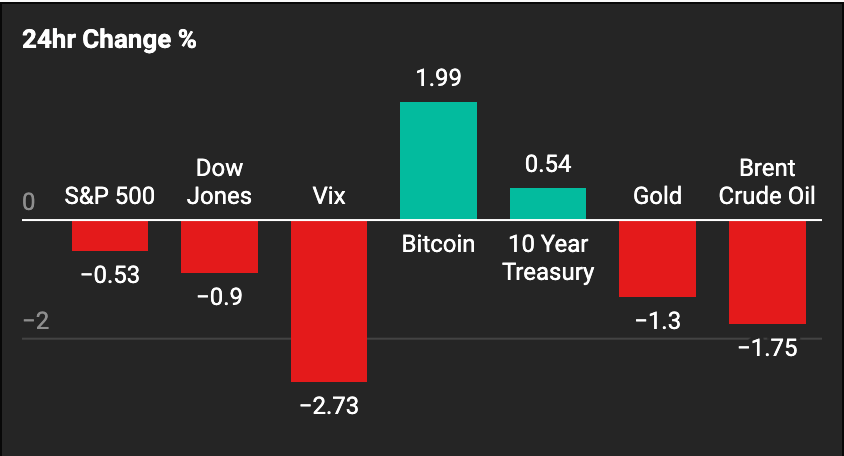

The Dow dropped 0.9% (over 400 points), the S&P 500 slipped 0.5%, and the Nasdaq went down 0.4%.

However, futures were up slightly this morning pre-market.

Nvidia invested $2 billion in Synopsys (SNPS), tightening its grip on the chip-design stack. The deal deepens their partnership to integrate Nvidia GPUs into Synopsys’ design software, helping the company shift from CPU to GPU computing. Synopsys shares rose after the announcement, signaling investor confidence despite recent export-related weakness.

The Federal Reserve ended quantitative tightening yesterday (read: the Fed isn’t taking liquidity out of the economy anymore) and injected $13.5 billion into the economy yesterday.

Shopify suffered a major Cyber Monday outage, disrupting thousands of merchants before service was restored. The issue stemmed from login authentication failures that hit both online stores and point-of-sale systems. Shopify said it had fixed the problem and would continue monitoring performance.

Gold hit a six-week high and silver reached a record as investors piled into safe havens. Overall, gold rose to $4,239 per ounce, and silver jumped 3.7% to $558.49. The dollar weakened to a two-week low as markets bet heavily on a December rate cut.

Gasoline prices fell to a four-year low, averaging $3.00 a gallon. Cheap oil and flat demand drove the decline, though prices remain above President Trump’s $2 target. Drivers in Texas paid $2.57 per gallon, while Californians shelled out $4.56. Analysts say prices could dip closer to $2 if crude stays near $60 a barrel.

Apple’s (AAPL) Chief of Artificial Intelligence just resigned.

Alphabet (GOOGL) posted 4 consecutive months of 10%+ gains for the first time ever.

Vanguard just listed Blackrock’s Bitcoin ETF after reversing its years-long anti crypto stance.

Read Michael Burry’s (from The Big Short) letter to investors where he called the bottom during November of the 2008 housing market crash.

In partnership with Alts.co

These guys go way beyond stocks and bonds

Alts is the go-to newsletter for investors who are tired of the same public market ideas.

Each week, Stefan and Wyatt surface real opportunities in overlooked asset classes — from tequila barrels, to K-Pop music rights, to film financing bridge loans.

This isn’t just a newsletter though. They create special purpose vehicles (SPVs) so you can invest directly into each deal alongside the community.

If you’re an accredited investor, Join 135,000 subscribers and see what you’ve been missing.

Please support our partners!

🤖 AI/Future/Tech News

A self-driving Waymo taxi with passengers apparently drove straight through an active police standoff.

Nvidia launched Alpamayo-R1, an open model for autonomous driving built on its Cosmos system to improve vehicle reasoning.

🪙 Crypto

Anthropic is testing exploits in smart contracts with its AI, and their models are getting scary good at it.

A House report exposed "Operation Chokepoint 2.0," confirming Biden-era regulators pressured banks to cut ties with 30+ crypto firms.

🚨Trending on Reddit

Apple (AAPL) trends as Redditors debate how the company profits from the AI boom, taking 30% of every AI subscription while pocketing $50 billion a year from Google to stay the iPhone’s default search engine.

Robinhood (HOOD) heats up as traders rage over restricted trades, accusing the platform of blocking their profits and fueling widespread distrust.

📊 IPOs and Earnings

Credo Technology (CRDO) beat fiscal Q2 2026 estimates with revenue up 29% to $223 million and EPS of $0.67 versus $0.42 expected; shares rose ~12% in after-hours trading on strong datacenter demand.

New Fortress Energy (NFE) missed Q3 2025 estimates with EPS of -$2.02 versus -$0.64 expected and revenue down nearly 30% year-over-year; shares fell but later jumped on a $3.2 billion Puerto Rico LNG deal.

MongoDB (MDB) beat Q3 2026 estimates with revenue up 19% to $628.3 million and EPS of $1.32 versus $1.16 expected; the company raised full-year guidance after strong 30% Atlas growth.

🎙 What Do You Think?

What metric is the most important on its own?

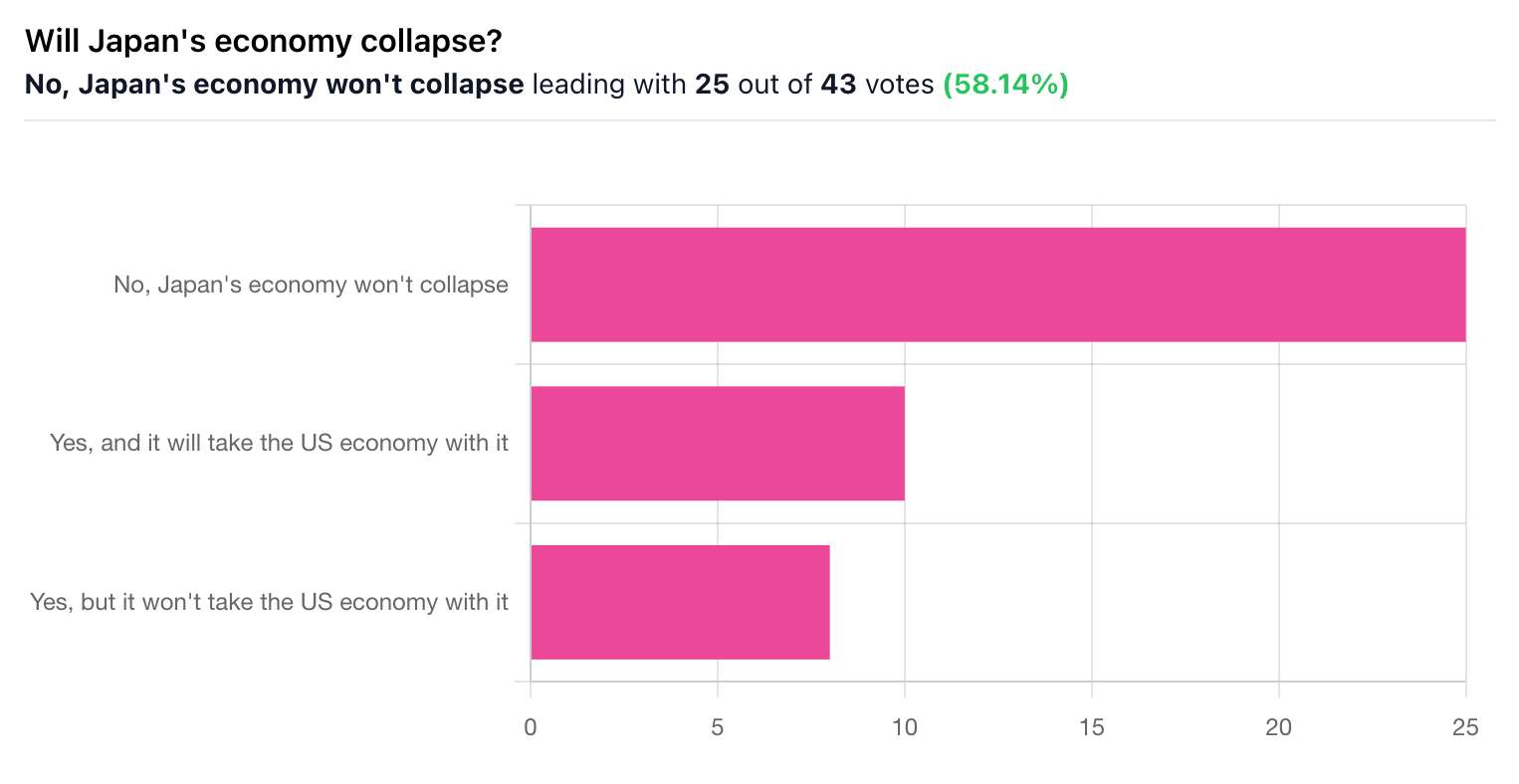

🎤️ What you said last time

“Collapse is a ridiculously strong word for what is happening.”

🧠 The Missing (Market) Links

Investor Shelby Davis turned $50,000 into almost $1 billion after beginning to invest at age 38. He did it through 1.5x leveraged insurance stocks.

This couple started a side hustle from their basement for $2,000 that now brings in almost $300,000 a year.

Senator Tom Cotton asked the DOJ to investigate Temu and SHEIN for counterfeiting after a probe found nearly half their merchandise is likely fake.

Rockefeller Center's ice rink topped a study as the world's most crowded attraction, with 41% of visitors complaining about crushing lines.

📜 Quote of the Day

The individual investor should act consistently as an investor and not as a spectator”

📢 We want to hear from you.

We love hearing from you, and we deeply appreciate your feedback.

⭐️ What did you think of today's edition?

That’s all for today. Did we miss anything? Smash the reply button to let me know.

Cheers,

Brandon & Blake of Invested Inc

The information provided in Stocks & Income is for informational and educational purposes only and should not be construed as financial advice, investment advice, or a recommendation to buy or sell any securities. Stocks & Income is not a registered investment advisor, broker-dealer, or licensed financial planner. Always do your own research and consult with a licensed financial advisor before making any investment decisions. We may hold positions in or receive compensation from the companies or products mentioned. Disclosures will be made where applicable.

Stocks & Income, AltIndex, Finance Wrapped, The Chain, and Future Funders are all owned by Invested, Inc.