*past 24-hour performance

💨 TL;DR

The Fed held rates steady and gave dovish guidance.

Markets soared across the board.

Tesla recalls nearly all its cars (over-air).

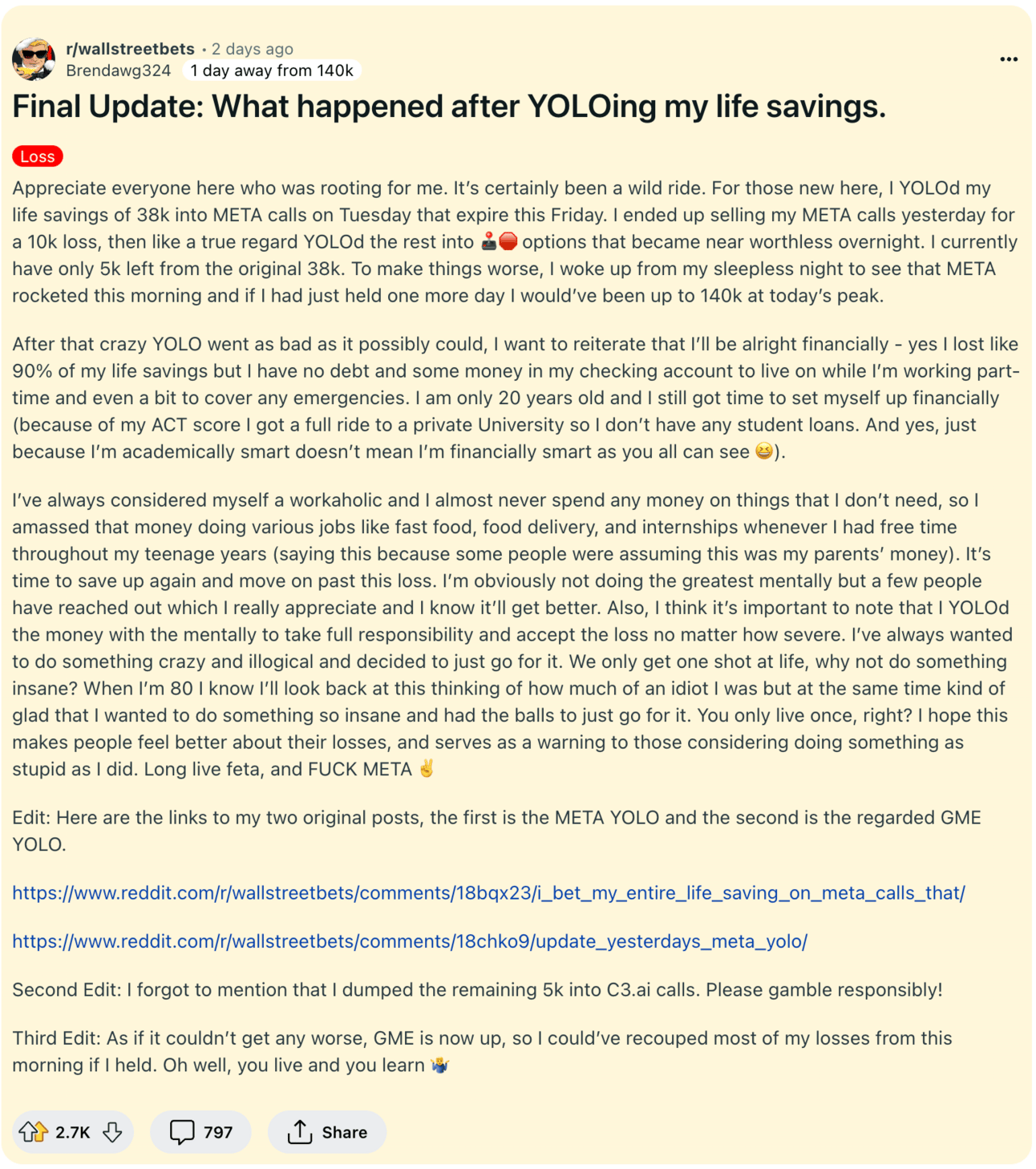

Don’t be like this guy.

Trade options like the pros.

If you want to learn to trade options effectively, we’ve got the thing for you.

No crazy schemes.

No speculation.

Just institutional-grade strategies that yield outstanding risk-adjusted returns.

We’ve teamed up with Benedict Maynard — the guy who literally wrote the book on options trading — to show you how the pros do it.

Twice a month, you’ll learn a new options trading strategy. How it works, why it works, and how to implement it in today’s markets.

Prices will go up when we launch, but the first 50 people to sign up lock in a 50% discount for life. Just use the code Forever100.

📰 Market Headlines

Markets everywhere ripped off the back of a rate freeze and dovish guidance from the Fed. The Dow hit a new record high, and the S&P and Nasdaq boomed as well.

Along with the decision to hold, committee members penciled in at least three rate cuts in 2024, assuming quarter percentage point increments. Four more cuts are anticipated in 2025 and another three in 2026 to lower the rate to 2.25%.

Despite the clear guidance, markets are forecasting six cuts in 2024.

Bitcoin and gold both surged on the news.

The IAEA

asdf

The US House of Representatives has voted to formalize its impeachment inquiry into President Joe Biden.

🕶️ Market Vibes

🎰 Market Forecasts and Futures

The International Energy Agency said evidence of softening global oil demand is mounting and a slowdown is expected to continue in 2024.

The IEA said oil market sentiment had turned “decidedly bearish” in recent weeks, even after some members of OPEC+ on Nov. 30 announced a new round of voluntary production cuts for the first quarter of next year.

End-of-year forecasts

Macro forecasts

😱 Fear and Greed Index

🧠 What do you think?

🗳️ Poll: Will American credit card debt increase again in Q4?

🎤 What you said last time

Shohei’s taking a bigger gamble than most people realize.

It’s weird, but whatever

“The dollar will be worthless by the time he gets paid!”

📊 Stocks

Want to invest like Buffet? With Public.com, you can emulate Berkshire Hathaway’s portfolio with just a few clicks.

Winners and losers

Earnings, upgrades, and acquisitions

Adobe beat earnings but cut guidance. Shares were down 6%.

Market movers

Ideas, trends, and analysis

Seven undervalued growth stocks.

Is Novo Nordisk a buy?

Despite immediate-term headwinds, strategists say they’re overweight Europe stocks versus the U.S.

Why have Starbucks shares lost $11 billion? It’s not the boycotts.

Alts are perfect for SDIRAs

In this issue, we'll show you why self-directed IRAs (or SDIRAs) are the perfect vehicle for investing in alternatives.

Alto allows you to invest in alternative assets with their retirement funds. You can transfer cash from any existing 401(k) or IRA or initiate a new contribution to invest in alternatives. Alto helps you with all the administrative stuff.

They've recently launched Alto Marketplace, a platform that connects individual accredited investors to private alternative opportunities.

Their suite of integrated partners includes some names you might recognize:

Startups (with AngelList)

Peer-to-peer lending (with Prosper)

Real estate (with CalTier)

Artwork (with MasterWorks)

Infrastructure (with InfraShares)

Optimize your retirement strategy, diversify your portfolio, and minimize your tax burden with a tax-advantaged retirement account from Alto.

Create an Alto IRA today. Go to altoira.com/marketplace to learn more.

Disclaimer:

Alto Marketplace offerings are currently available only to accredited investors. Private securities involve risk and may result in significant losses. Important disclosures apply. Alto does not provide investment advice. Consult an investment advisor to determine whether an investment is appropriate for your portfolio.

SPONSOR

📊 Income

Markets have entered a “new paradigm” as the global order fragments, while heightened recession risk means that “bonds are back.”

South Korean, Indian, Malaysian, Indonesian, and Thai bonds had their biggest month since May in November.

📊 Crypto

Prices as of Saturday 2am EST.

JPMorgan expects ether to outperform bitcoin and other cryptocurrencies in 2024.

🌍 Global Perspectives

🇨🇳 China’s leaders pledged to step up measures to revive the country’s flagging economy but stopped short of issuing a stimulus package.

🇪🇺 Europe’s economy is in a bad way.

💎 Wealth Watch

Almost half of Gen Z think being financially compatible is more important than being physically attracted to their partner.

Why your car insurance is more expensive these days

5 personal finance resolutions for 2024.

🗳️ Outside the Box

Unrelated, Bird flu is surging again on poultry farms.

Guide to holiday season tipping.

📺 What to Watch Today

📈 Trends you need to know

Search results are from our friends at Glimpse, my favorite way to spot trends.

Some recalls are bigger than others, but they’ve been getting less frequent.

That’s all for today. Did we miss anything? Smash the reply button to let us know.

Cheers,

Wyatt