Good morning.

Markets rallied for a third straight day yesterday, fueled by soaring rate-cut odds and a fresh wave of AI-driven earnings surprises.

The Dow ripped more than 600 points, Apple and Alphabet hit new records, and traders are now pricing in 80% odds of a December cut.

And Nvidia is getting defensive, calling itself “a generation ahead of the industry.”

Let’s get into it.

In partnership with Elf Labs

Rosé Can Have More Sugar Than Donuts?

No wonder 38% of adults prefer health-conscious beverages. AMASS Brands is raking in sales by tapping into this trend. They’ve earned $80M+, including 1,000% year-over-year

growth, thanks to products like their top-selling zero-sugar rosé. They even reserved the Nasdaq ticker $AMSS. Join celebs like Adam Levine and Derek Jeter as an AMASS investor and get up to 23% bonus shares today.

This is a paid advertisement for AMASS’s Regulation CF offering. Please read the offering circular at https://invest.amassbrands.com

Please support our partners!

📰 Market Headlines

Markets climbed for the third straight day on Tuesday, with the Dow jumping over 600 points and Apple and Alphabet hitting fresh record highs as rate cut bets gathered steam.

The Dow surged 1.4%, the S&P 500 rose 0.9%, and the Nasdaq gained 0.7% despite early weakness. Fed Governor Chris Waller’s Monday comments about a potential December cut sent rate‑cut odds soaring to over 80%.

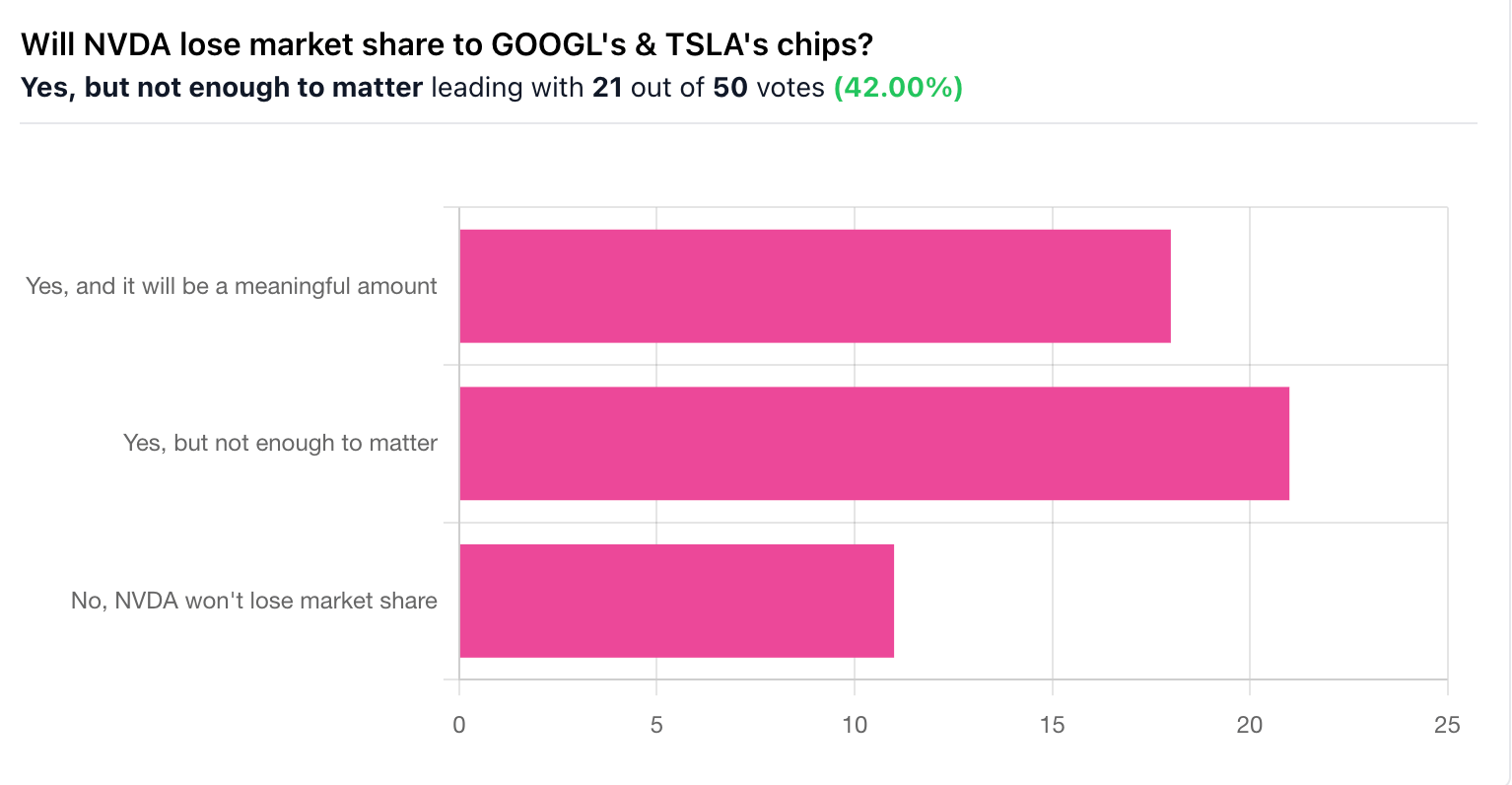

Nvidia said that it is “a generation ahead of the industry” in response to Meta considering using GOOGL’s chips instead. NVDA shares fell 5% yesterday in the midst of the news.

Prediction markets are now pricing in an 80% chance of the Fed cutting rates in December after weakening labor data from ADP (-13.5k jobs/week avg) and a mixed PPI report.

Dell (DELL) missed revenue expectations but offered a strong forecast driven by AI sales, presenting a mixed picture for the hardware sector. The stock is up 5.15% premarket. Here are the numbers:

EPS: $2.59 (adjusted) vs. $2.47 expected

Revenue: $27.01 billion vs. $27.13 billion expected

Bitcoin appears to be mounting a slight comeback; it sits at $86,000 right now, up from 6.6% from earlier this week. This Bitcoin liquidation heatmap shows that $94,000 is the next liquidation squeeze level, followed by $98,000, according to FX Evolution.

HP is following the Amazon playbook: they will cut 4,000 to 6,000 jobs while betting $1 billion on AI transformation. CEO Enrique Lores told Yahoo Finance that AI will replace "many things that today we have to do using people" as the company expects $1 billion in annualized savings by fiscal 2028. Fourth-quarter revenue rose 4.2% to $14.6 billion, slightly below estimates, with PC sales up 8% but printing revenue falling 4%.

Gas prices dropped below $3 per gallon in over half of US states ahead of Thanksgiving travel. The national average hit $3.05, matching last year's levels, with some Oklahoma stations hitting $1.99 per gallon for the first time since 2021.

In partnership with Alts.co

These guys go way beyond stocks and bonds

Alts is the go-to newsletter for investors who are tired of the same public market ideas.

Each week, Stefan and Wyatt surface real opportunities in overlooked asset classes — from tequila barrels, to K-Pop music rights, to film financing bridge loans.

This isn’t just a newsletter though. They create special purpose vehicles (SPVs) so you can invest directly into each deal alongside the community.

If you’re an accredited investor, Join 135,000 subscribers and see what you’ve been missing.

Please support our partners!

Crypto

Grayscale and Franklin launched US spot XRP ETFs that pulled in $67.4 million and $62.6 million on debut, topping Bitcoin, Ethereum, and Solana funds.

Altcoin ETFs drew $164 million into XRP, $96.6 million into ETH, and $58 million into SOL, while Bitcoin ETFs lost $151 million.

Dogecoin’s ETF opened flat with zero inflows and just $1.4 million in trading volume.

Trending on Reddit

💵 Alternative Investment: Private Debt

Defaults climbed across the $1.7 trillion private credit market as middle-market borrowers showed signs of strain. Kroll Bond Rating Agency reported a record 61 companies rated CCC-, signaling severe liquidity pressure among private equity-backed firms.

The stress came from higher borrowing costs and slowing revenue growth, which squeezed margins for leveraged borrowers that thrived in the low-rate era. Large private-credit lenders tightened terms, and investors braced for more restructurings heading into 2026.

📊 IPOs and Earnings

Alibaba beat fiscal Q2 expectations with revenue up 5% to $34.8 billion and cloud sales surging 34% on AI demand; shares rose 4% in premarket trading.

Kohl’s reported quarterly revenue of $4.1 billion, down 5% year over year, but beat EPS estimates with improved inventory management; stock gained 2.7% in early trading.

Workday surpassed Q3 revenue estimates with 17% growth to $2.2 billion, maintained full‑year margin guidance, and announced new AI‑driven HR tools; stock edged up 1.5% in late trading.

Dick’s Sporting Goods missed sales estimates but raised its full‑year outlook following its Foot Locker acquisition and 5.7% same‑store sales growth; shares fell nearly 3%.

Best Buy beat Q3 earnings expectations on disciplined cost management and raised its holiday quarter forecast; shares gained 4.5% premarket.

Urban Outfitters posted record quarterly profit, up 15% year over year, driven by strength at its Anthropologie brand and online channel; shares rose 5% in extended trading.

Abercrombie & Fitch exceeded Q3 estimates with net sales up 20% and operating margin above 14%, its highest since 2008; stock jumped 7% after hours.

🎙 What Do You Think?

Are you talking about markets at Thanksgiving or no?

🎤️ What you said last time

“NVDA cannot even deliver the chips on order so no impact. ”

🎪Crowdfunding Showcase

Kadeya wants to make single-use bottles obsolete. The Chicago startup has built the world’s first closed-loop beverage system, a network of reusable smart bottles and automated sanitizing kiosks that dispense filtered water or flavored drinks and then clean and restock the same bottles.

Founded by an engineer with experience at Siemens and GE, Kadeya already partners with industrial worksites, universities, and city sustainability programs to cut waste and track hydration data. Its patented system has recycled over 25,000 bottles in pilot programs and attracted backing from Techstars, the Department of Energy, and Chicago’s mHUB accelerator.

The company is now raising to scale production and expand distribution partnerships across North America.

🧠 The Missing (Market) Links

A report revealed that OpenAI needs to raise $207 billion by 2030 in order just to stay in business (and still be unprofitable).

Nvidia cited Michael Burry in a letter to their sell side analysts. Burry refuted their claims in detail here.

A small Wisconsin town rejected Microsoft's AI data center plans after residents cited noise, environmental impact, and even skittish horses.

The job market showed underlying weakness. Excluding healthcare and hospitality, US employment fell by 6,000 jobs through September, fueling theories of a global AI hiring pause.

Oil prices slid more than 1% following reports that Ukraine agreed to a peace deal framework, a move that could unleash Russian oil back into the market.

📜 Quote of the Day

In the short run, the market is a voting machine, but in the long run, it is a weighing machine.”

📢 We want to hear from you.

We love hearing from you, and we deeply appreciate your feedback.

⭐️ What did you think of today's edition?

That’s all for today. Did we miss anything? Smash the reply button to let me know.

Cheers,

Brandon & Blake of Invested Inc

The information provided in Stocks & Income is for informational and educational purposes only and should not be construed as financial advice, investment advice, or a recommendation to buy or sell any securities. Stocks & Income is not a registered investment advisor, broker-dealer, or licensed financial planner. Always do your own research and consult with a licensed financial advisor before making any investment decisions. We may hold positions in or receive compensation from the companies or products mentioned. Disclosures will be made where applicable.

Stocks & Income, AltIndex, Finance Wrapped, The Chain, and Future Funders are all owned by Invested, Inc.