Good morning.

Elon Musk and OpenAI are gearing up for battle in court, Musk’s odds of winning are rising. Musk had this to say about it: “I’ve lost a few battles over the years, but I’ve never lost a war.”

Meanwhile, prediction markets are growing fast, and a lot of that growth might be coming from teens and college students who are otherwise too young to gamble. Is that a good thing or a bad thing? We think you know the answer.

In today’s edition:

TSMC crushed earnings; CEO doesn’t think there’s an AI bubble

Musk’s odds of winning suit vs. OpenAI rise above 50%

Teens might be fueling prediction markets’ $701.7B growth

AI spending races toward $2.5 trillion and chip supply is already sold out

Let’s get to it.

In partnership with BigTrends

Free Playbook: Inside the NVDA Options Master Process

NVDA is still one of the market’s primary momentum drivers, and its price action creates opportunity for traders who know what they’re doing.

Moving into 2026, those swings are still coming fast, but only structure keeps you on the right side of them.

That is why BigTrends built the NVDA Options Master.

It’s a straightforward, rules-driven way to trade NVDA’s directional momentum using two timeframes and predefined risk parameters.

Inside, you’ll discover:

How they sync daily + intraday charts to avoid low-quality signals

A clear framework for trading momentum continuation and pullbacks

How partial profits around +50 percent help reduce exposure while momentum plays out

This is a process designed for the pace of today’s market.

Measured, repeatable, and built for the conditions these guys are seeing in early 2026.

Please support our partners!

📰 Market Headlines

US stocks bounced back Thursday after two straight days of losses.

The Nasdaq climbed 0.5%, the S&P 500 went up 0.5%, and the Dow gained 0.7%.

Elon Musk’s suit against OpenAI is on its way to jury trial, but things are already heating up outside of court. The basis of the lawsuit? That OpenAI misled Musk about its nature as a nonprofit while accepting billions of dollars in funding. (Musk was one of OpenAI’s founders.)

Kalshi odds of Elon winning rose from 33.5% to 54% after Elon made some posts on X about the case. That includes this one: “I’ve lost a few battles over the years, but I’ve never lost a war.” This suit could put a serious damper on OpenAI’s IPO goals in 2026.

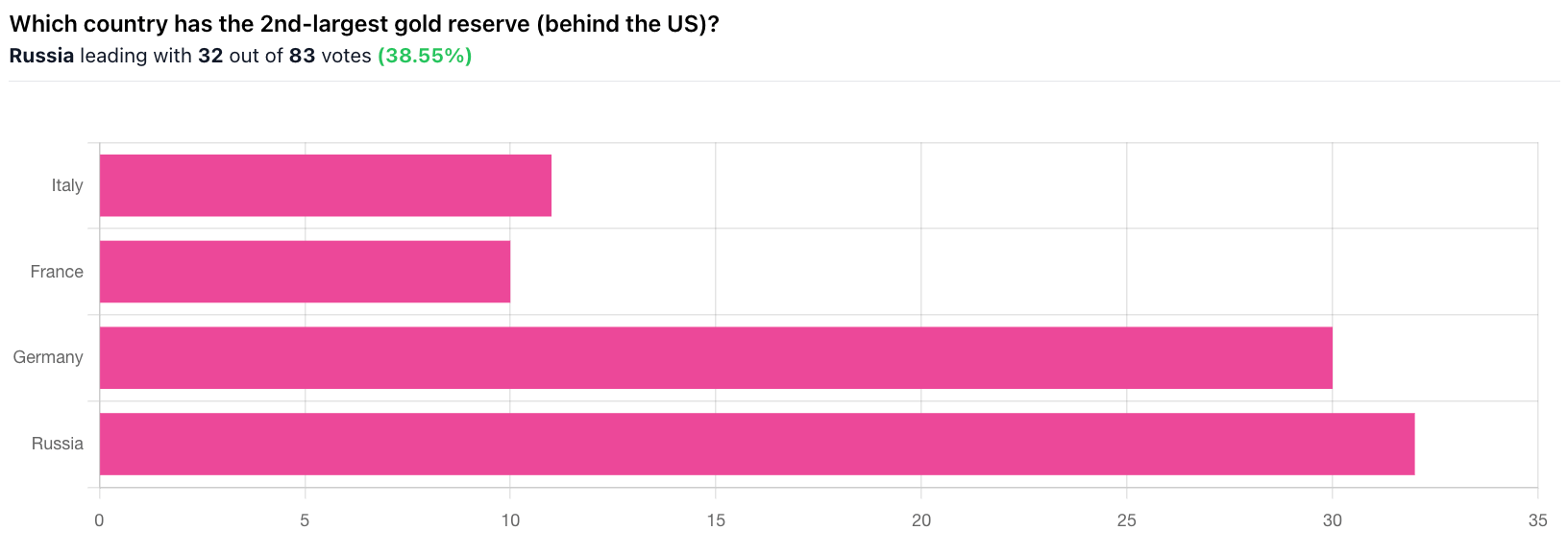

Prediction markets might be gaining traction from a specific demographic: teens and college students, who would otherwise be too young to gamble legally. The legal gambling age in many states is 21, but you only have to be 18 to use prediction markets (outside of some exceptions).

Yesterday was a record-breaking day of volume for prediction markets: they did $701.7 million in transactions, breaking the previous all-time high… which was set just the day before, at $666.6 million.

TSMC, the world's largest contract chipmaker, posted a 35% jump in fourth quarter profit and announced plans to ramp up investment to $56 billion in 2026. CEO C.C. Wei dismissed bubble fears and said demand for semiconductors will "continue to be very fundamental." He also said that he’s “confident that the growing demand from customers is real.” Sounds like he doesn’t think there’s a bubble! The strong outlook lifted chip stocks, with Nvidia bouncing back 2% and ASML shares jumping 6%.

AI spending is projected to hit $2.53 trillion in 2026 and reach $3.33 trillion in 2027, according to Gartner. The bulk will go toward infrastructure, with companies expected to drop $1.36 trillion building the backbone of their AI futures this year. AI chip manufacturers have sold out their inventory for the next 18 to 24 months.

Oracle was sued by bondholders who claim the database giant failed to disclose plans to raise additional debt when it borrowed $18 billion in September. Several weeks after issuing the notes, Bloomberg reported that banks were providing a $38 billion debt offering to help fund data centers. Oracle's bonds began trading with yields similar to lower-rated issuers as concerns about credit risk grew.

🤖 AI/Future/Tech News

US senators pressed X, Meta, Alphabet, Snap, Reddit, and TikTok to explain safeguards against sexualized AI deepfakes, demanding records on moderation.

The Wikimedia Foundation revealed paid AI data partnerships with Amazon, Meta, Microsoft, Mistral, and Perplexity, positioning Wikimedia Enterprise as a revenue engine.

🪙 Crypto

Tim Lee’s Bitmine has invested $200 million in MrBeast’s media platform.

The Senate Banking Committee yanked its vote on the CLARITY Act after Coinbase pulled support, citing concerns over a "de facto ban" on tokenized equities and expanded SEC authority.

🤫 Insider Trading

📊 IPOs and Earnings

BlackRock reported assets under management climbed 22% to a record $14 trillion, with Q4 revenue jumping 23% to $7 billion, beating analyst expectations of $6.76 billion. Adjusted earnings per share of $13.16 topped forecasts, and shares rose 1%.

First Horizon posted Q4 revenue of $888 million, up nearly 22% year-over-year, with EPS of $0.52 compared to $0.43 a year earlier, exceeding revenue estimates by 3%; shares gained 0.8%.

🎙 Make yourself heard

🎤️ What you said last time

🧠 The Missing (Market) Links

South Korea’s ex-president Yoon is facing a 5-year jail sentence for his attempted use of martial law last year.

Warren Buffett says kindness is the one quality he uses to measure people—"everybody can do it," and it costs nothing.

US sports bars are evolving beyond chewy and dense. Brands are rolling out soft, cake-like textures with high protein to blend indulgence with functionality for everyday consumers.

📜 Quote of the Day

📢 We want to hear from you.

We love hearing from you, and we deeply appreciate your feedback.

⭐️ What did you think of today's edition?

That’s all for today. Did we miss anything? Smash the reply button to let me know.

Cheers,

Brandon & Blake of Invested Inc

Thumbnail image: Wikimedia, 1924848uejdjfik

The information provided in Stocks & Income is for informational and educational purposes only and should not be construed as financial advice, investment advice, or a recommendation to buy or sell any securities. Stocks & Income is not a registered investment advisor, broker-dealer, or licensed financial planner. Always do your own research and consult with a licensed financial advisor before making any investment decisions. We may hold positions in or receive compensation from the companies or products mentioned. Disclosures will be made where applicable. Past performance doesn’t guarantee future results.

Stocks & Income, AltIndex, Finance Wrapped, The Chain, and Future Funders are all owned by Invested, Inc.open