Good morning.

We’ve officially entered the “Elon vs. Everyone” era again. Tesla shareholders voted $878 billion payday, the largest in corporate history, while his rivals (and regulators) sharpen knives.

Meanwhile, Nvidia leads a tech sell-off after Washington said there would be “no federal bailouts for AI.” Translation: the government loves innovation... just not enough to co-sign your trillion-dollar data center loans.

Other highlights:

Nancy Pelosi is retiring after an investing career that day traders would envy.

President Trump’s shutdown saga hits day 37, and Polymarket odds point to a 46+ days of total shutdown time.

Nvidia can’t sell ANY chips to China, not even the scaled-back versions it was planning to ship.

Let’s get to it.

In partnership with Roku

The Smartest Free Crypto Event You’ll Join This Year

Curious about crypto but still feeling stuck scrolling endless threads? People who get in early aren’t just lucky—they understand the why, when, and how of crypto.

Join our free 3‑day virtual summit and meet the crypto experts who can help you build out your portfolio. You’ll walk away with smart, actionable insights from analysts, developers, and seasoned crypto investors who’ve created fortunes using smart strategies and deep research.

No hype. No FOMO. Just the clear steps you need to move from intrigued to informed about crypto.

Please support our partners!

📰 Market Headlines

Markets tumbled on Thursday as tech stocks led a broad selloff.

The Dow dropped 0.8%, the S&P 500 fell 1.1%, and the Nasdaq plunged 1.9%.

Tesla (TSLA) approved Musk’s ~$1 trillion pay package, the largest CEO compensation in history. What does this mean? Well, if Elon Musk grows Tesla’s market cap to $8.5 trillion, delivers 20 million vehicles, sells 10 million Full Self-Driving subscriptions, $1 million Optimus humanoid robots, and launches 1 million robotaxis (all over the next decade), he’ll receive stock compensation equal to about $1 trillion. Essentially, it’s a big reward set up to incentivize Elon to make Telsa successful, and he only gets paid if he meets those milestones. Seems like a smart kind of package to give to any CEO for the sake of doing investors proud.

Another huge note from Tesla: Elon Musk stated yesterday that Tesla might just have to make its own “gigantic chip fab.” That means Tesla might be entering the semiconductor chip game alongside Nvidia and AMD. Absolutely WILD to think about that.

The US is blocking Nvidia’s (NVDA) plans to sell scaled-back chips to China. This probably explains why Nvidia CEO Jensen Huang said that China is “nanoseconds behind the US” and that they will win the AI race; whether that’s true or not, it would serve Nvidia’s interests as a company to sell to China. At first, the plan was to just block Nvidia from selling its Blackwell chips (the most advanced ones it makes) to China and to only sell lower-power chips. Now, they won’t be allowed even to do that much.

Trump AI czar David Sacks declared “no federal bailout” for the AI industry. The comment came after OpenAI CFO Sarah Friar mentioned seeking government guarantees for chip financing, which CEO Sam Altman quickly denied. Sacks emphasized that if one AI company fails, others will take its place, cooling investor enthusiasm for the sector.

Congresswoman Nancy Pelosi is retiring next year. Investors everywhere are mourning, as they won’t be able to copy her trades anymore. All jokes aside, Pelosi has been one of the most successful political investors of all time… on an average salary of $142,000, her net worth has grown by an estimated $282,000,000. Really makes you wonder about the insider trading rumors. See all recent Congress trades on AltIndex.

Polymarket odds currently have the government shutdown lasting past Nov 16th. That would make the total length of shutdown time 46+ days, by far the longest ever. One Twitter trader bets the shutdown will last into January of next year. We don’t even want to think about what that could do to the country, much less the stock market.

Interesting: Google (GOOGL) just invested in Figma (FIG). The tech giant filed its 13F (quarterly asset report), and it includes an investment in the recently IPO’d design platform company. At bare minimum, this shows some conviction in Figma’s potential for growth. In other news, Google sold off some of its Strategy (MSTR) position, implying that it’s not convinced Michael Saylor’s Bitcoin treasury strategy will continue to pay off.

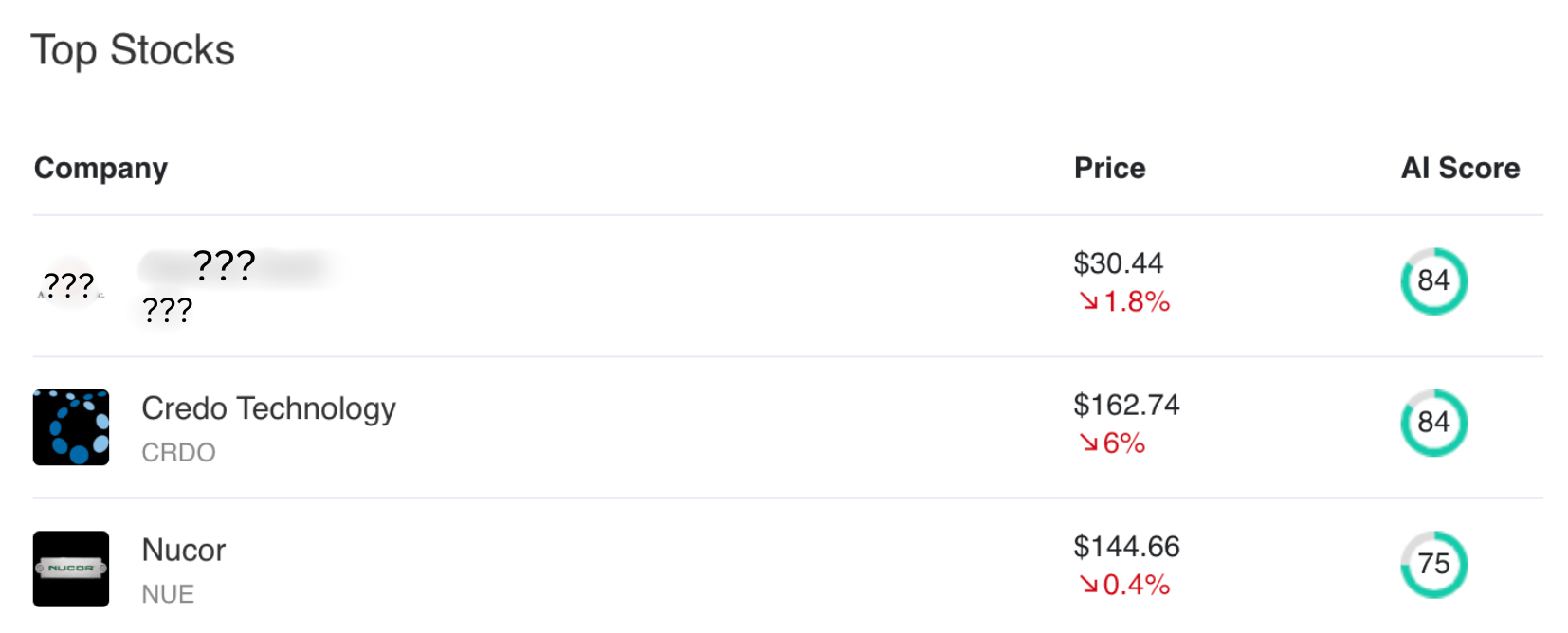

🚨 Top 3 Stocks from AltIndex

Markets are crazy right now, but that doesn’t stop stocks from throwing key signals. Our AI at AltIndex has picked up on some major alternative data, and these three stocks are showing the most strength relative to the field:

Nucor and Credo have been hanging around our top 10 for a while, but what’s at number one today?

🤖AI/Future/Tech News

Google unveiled Ironwood, its seventh-generation AI chip, over four times faster than its predecessor. Anthropic planned to use up to 1 million units to run Claude.

OpenAI said it surpassed $20B revenue this year and aimed for hundreds of billions by 2030. The firm signed $1.4 trillion in infrastructure deals to build data centers.

Analysts warned the AI bubble might be near its peak, with 95% of firms reporting little or no ROI despite $252 billion in private investment last year.

🪙 Crypto

BTC slid 4.5% to near $100,000 as ETF outflows topped $500 million, signaling institutional caution.

Ethereum dropped 5.3% and Solana fell 8.2% as liquidity rotated out of higher-beta names.

🤫 Insider Trading From AltIndex

📊 IPOs and Earnings

Airbnb missed Q3 profit forecasts on higher costs but beat revenue at $4.07 billion, with shares slipping 2% after hours.

Ralph Lauren beat estimates with revenue up 17% and EPS of $4.93, lifting full-year guidance and sending shares up 6%.

Dropbox met expectations with $642 million in revenue and $0.65 EPS, but weak guidance pulled shares down 3%.

Texas Roadhouse beat with 12% revenue growth and EPS of $1.28, driven by strong traffic; shares rose 4%.

Warner Bros. Discovery missed with revenue down 10% to $9.3 billion; shares slid 6% after hours.

Expedia missed profit estimates despite 5% revenue growth to $3.9 billion; stock sank 8%.

Warby Parker beat expectations with 15% revenue growth and slimmer losses; shares jumped 6%.

Kenvue missed slightly with $3.6 billion revenue and $0.30 EPS, pushing shares down 5%.

🎙 What Do You Think?

🎤️ What you said last time

🧠 The Missing (Market) Links

The 10-year Treasury yield fell more than 6 basis points to 4.089% after Supreme Court justices expressed skepticism over President Trump's tariff plans.

Turkey prices are up 25% this Thanksgiving as bird flu wiped out flocks. A 15-pound bird now costs $31, up from $25 last year.

Flight cuts hit 40 major airports as unpaid air traffic controllers buckle under the longest government shutdown in US history.

Nuclear verdicts against trucking companies are crushing the broader economy. Every $1 million in tort costs wipes out $2 million in GDP.

Grain markets cooled down after a two-week rally as wheat futures gave back gains and tested key technical levels.

📜 Quote of the Day

The most important quality for an investor is temperament, not intellect”

📢 We want to hear from you.

We love hearing from you, and we deeply appreciate your feedback.

⭐️ What did you think of today's edition?

That’s all for today. Did we miss anything? Smash the reply button to let me know.

Cheers,

Brandon & Blake of Invested Inc

Thumbnail image: Wikimedia

The information provided in Stocks & Income is for informational and educational purposes only and should not be construed as financial advice, investment advice, or a recommendation to buy or sell any securities. Stocks & Income is not a registered investment advisor, broker-dealer, or licensed financial planner. Always do your own research and consult with a licensed financial advisor before making any investment decisions. We may hold positions in or receive compensation from the companies or products mentioned. Disclosures will be made where applicable.

Stocks & Income, AltIndex, Finance Wrapped, The Chain, and Future Funders are all owned by Invested, Inc.