Good morning.

The "everything rally" just went nuclear. Gold topped $3,900, Bitcoin hit a new all-time high, stocks are printing fresh records, and Japan's Nikkei surged 4.26% to 47,717 on massive stimulus expectations from the new Prime Minister. OpenAI just took a 10% stake in AMD, sending shares up 25% premarket as the company plans to deploy 6 gigawatts of AMD Instinct GPUs.

But there's a problem underneath all this: US manufacturing contracted for the seventh straight month (ISM at 49.1), the government shutdown continues with no jobs data in sight, and Japan's bond yields are hitting record highs, raising fears of a Yen carry trade unwind that could destroy global risk assets. Goldman Sachs CEO David Solomon warned a drawdown "wouldn't surprise me" in the next 12-24 months.

Markets are flying completely blind into record territory. The question is whether this is healthy liquidity or a warning sign that everything's too good to be true.

In partnership with Alts.co

These guys go way beyond stocks and bonds

Alts is the go-to newsletter for investors who are tired of the same public market ideas.

Each week, Stefan and Wyatt surface real opportunities in overlooked asset classes — from tequila barrels, to K-Pop music rights, to film financing bridge loans.

This isn’t just a newsletter though. They create special purpose vehicles (SPVs) so you can invest directly into each deal alongside the community.

If you’re an accredited investor, Join 135,000 subscribers and see what you’ve been missing.

Market Headlines

Stocks closed at record highs Friday with the Dow hitting 47,000 for the first time as Wall Street shrugged off the ongoing government shutdown.

The Dow rose 0.5%, the S&P 500 climbed 0.1%, and the Nasdaq slipped slightly after Tesla shares fell.

OpenAI took a 10% stake in AMD, sending shares up 25% in premarket trading. The AI giant plans to deploy up to 6 gigawatts of AMD Instinct GPUs, marking a major diversification away from Nvidia and validating AMD's position in the AI infrastructure race. The deal adds another massive customer to AMD's growing enterprise pipeline.

Japan's Nikkei 225 hit a record high of 47,717, surging 4.26% on the new Prime Minister's stimulus plans. Investors are piling into Japanese equities on expectations of massive fiscal spending, tech subsidies, and defense investments under PM Takaichi. The rally cements Japan as Asia's top-performing market this quarter, but there's a catch: long-term Japanese bond yields also hit record highs, raising the risk of a Yen carry trade unwind that could force capital repatriation and pressure global risk assets.

Gold, Bitcoin, and stocks are all hitting new highs simultaneously in what traders are calling the "everything rally." Gold topped $3,900, Bitcoin printed a fresh all-time high, and US equity indexes continue pushing records despite a prolonged government shutdown. The broad-based strength signals massive liquidity, but some analysts see it as a systemic risk signal, especially with the US stock market cap now resting at 305% of M2 money supply, the highest since the 2000 dot-com peak.

US manufacturing contracted for the seventh straight month, with ISM coming in at 49.1. The persistent weakness signals softening industrial demand, yet markets continue rallying in a data vacuum created by the government shutdown. With no official jobs reports available, traders are positioning based on limited information and Fed rate cut expectations.

The "AI Utility Trade" is gaining serious traction as Bitcoin miners like Cipher Mining, Iris Energy, and TeraWulf sign long-term contracts to convert their power-rich facilities into GPU hosting sites. The thesis: these companies control massive power infrastructure that AI companies desperately need, making them the picks-and-shovels play beyond chips.

Eos Energy surged 12% in overnight trading on speculation it's the storage supplier for a $100 billion mega data-center project tied to Google and Amazon, according to analyst Shay Boloor. No official confirmation yet, but the rumor highlights how infrastructure plays around AI are attracting serious attention.

Tesla is teasing a "big reveal" for Tuesday, sparking speculation around drones, robotics, or other AI platforms beyond cars. Options activity is expected to spike ahead of the announcement.

Google's AI market share is surging. Gemini now holds 13.7% of the GenAI market, nearly double the 6.5% from a year ago. The narrative is shifting to how incumbents like Google can leverage their massive distribution advantages to win the AI war, even if they weren't first movers.

Martin Shkreli shared research from Acadian on "quantum insanity," pointing to academic work questioning some of the hype around quantum computing applications. The paper adds to growing skepticism about which emerging technologies will actually deliver returns versus which are just capital black holes.

Critical Metals shares jumped 58% on reports the US government is considering taking a strategic stake in the company, part of the broader push for domestic critical mineral supply chains.

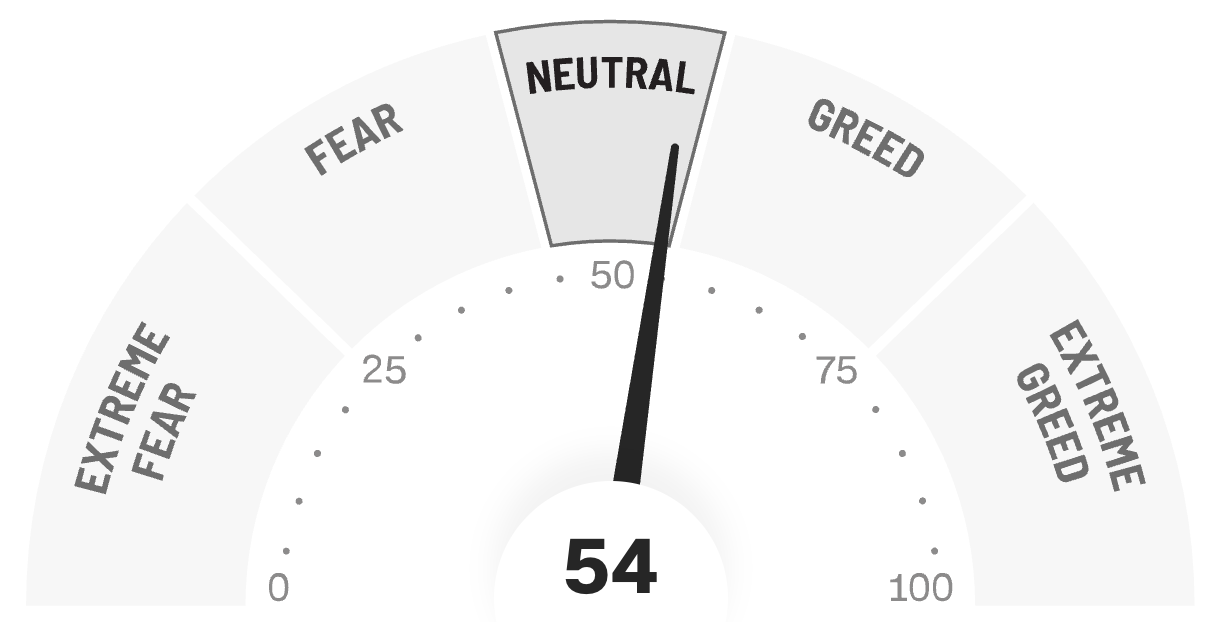

😱 Fear & Greed Index

🤖AI/Future/Tech News

AI chipmaker Cerebras Systems withdrew its planned US IPO days after raising $1.1 billion at an $8.1 billion valuation, citing strategic timing despite strong investor appetite for AI listings.

OpenAI appeared to walk back Sora’s copyright policy after backlash from rights holders. CEO Sam Altman said creators will gain granular control over character use and share in video generation revenue.

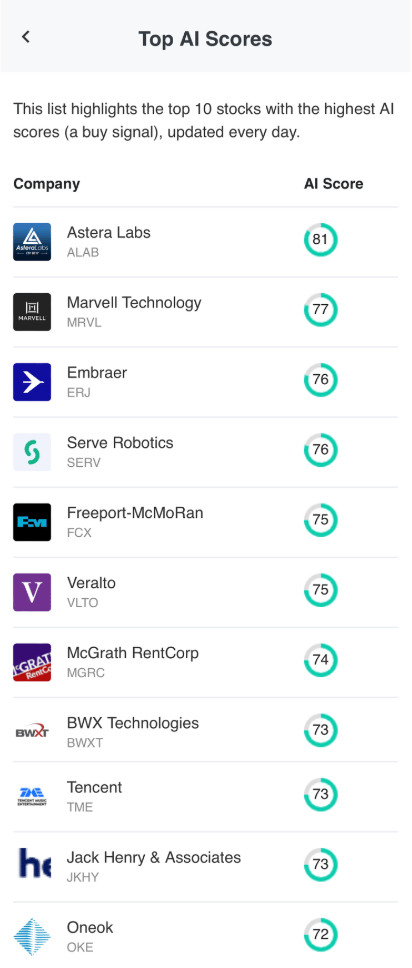

AltIndex’s Top 10 Stock Picks Today

Over a six-month time frame, AltIndex’s top picks beat the S&P 500 by 28.5%.

And AltIndex’s AI model rated the 10 stocks below as the strongest “buys” over the next 6 months. Past performance doesn’t guarantee future gains, but we’re still interested in what our model has to say.

Some of these tickers have been at the top for a long time (ALAB, SERV, FCX, TIME, OKE), but others are much newer faces (VLUTO and JKHY especially).

If you’d like to see the analysis and data points behind these ratings, click below and explore each stock’s page.

🤫 Insider Trading

🚚 Market Movers

Firefly is buying national security tech firm SciTec for $855 million in cash and stock, sharpening its defense analytics portfolio. The deal follows Firefly’s Nasdaq debut in August, when shares surged 55.6%.

Spirit moved to ditch 87 aircraft leases as part of its bankruptcy restructuring, trimming its fleet by nearly 100 planes. The carrier blamed overcapacity and weak demand in the budget travel market.

Shell warned that Trump’s halt on offshore wind projects is “very damaging” to investment after $679 million in federal funding was canceled for 12 wind farms, shaking confidence in the renewables sector.

🎙 What Do You Think?

What would you like to see in our next Saturday Deep Dive?

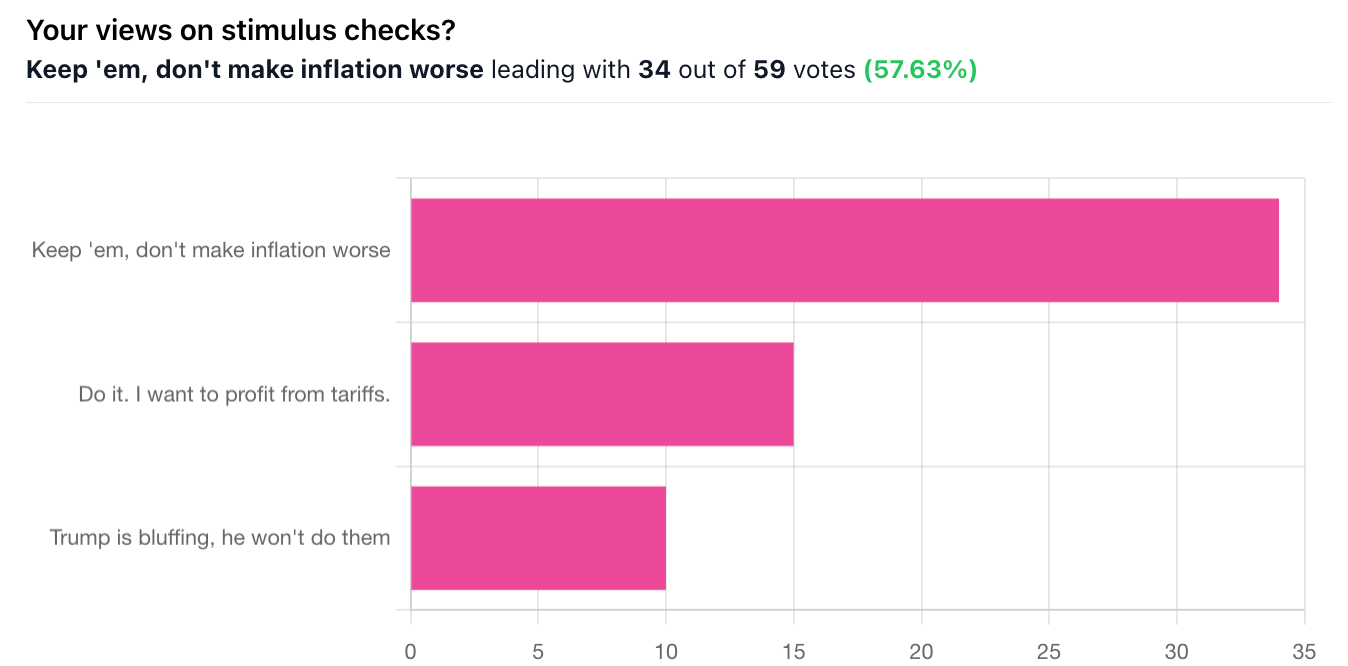

🎤️ What you said last time

“Trying to spend yourself out of debt doesn’t work! How about some fiscal responsibility? Pay down the record-level national debt!”

“I really don't care, either way. I'm good. But if you want to hand me a check, go for it.”

📈 Trending on Reddit

Archer Aviation (ACHR): People are actively discussing the potential partnership between Archer Aviation and Tesla (TSLA), with speculation driven by recent videos and strong rumors. However, there is also skepticism as some point out that Tesla has not officially mentioned anything about ACHR, leading to debates about the validity of these assumptions.

Netflix (NFLX): People are actively discussing the recent fall in Netflix's stock price, which is largely attributed to Elon Musk's call for a boycott of the streaming giant. The controversy stems from an animated show on Netflix featuring a transgender character, leading Musk to accuse Netflix of pushing transgender messaging in kids' shows. Despite the backlash, analysts suggest that it might not pose as significant a threat to Netflix as anticipated due to its large subscriber base and market cap.

🧠 The Missing (Market) Links

Wall Street’s momentum traders just logged their best run in three years, cashing in on a “winners keep winning” streak even as macro data soured.

Sales of $1M+ homes jumped 8.4% year-over-year, making them the fastest-selling segment of the US housing market while the rest of the market stalled.

The US hit Italian pasta with a 91.7% tariff, doubling prices and sparking outrage in Rome, which ships nearly $800 million worth of pasta to America each year.

📜 Quote of the Day

Debt is like any other trap, easy enough to get into, but hard enough to get out of.

📢 We want to hear from you.

We love hearing from you, and we deeply appreciate your feedback.

⭐️ What did you think of today's edition?

That’s all for today. Did we miss anything? Smash the reply button to let me know.

Cheers,

Brandon & Blake of Invested Inc

Thumbnail image: Federalreserve, Flickr

The information provided in Stocks & Income is for informational and educational purposes only and should not be construed as financial advice, investment advice, or a recommendation to buy or sell any securities. Stocks & Income is not a registered investment advisor, broker-dealer, or licensed financial planner. Always do your own research and consult with a licensed financial advisor before making any investment decisions. We may hold positions in or receive compensation from the companies or products mentioned. Disclosures will be made where applicable.

Stocks & Income, AltIndex, Finance Wrapped, The Chain, and Future Funders are all owned by Invested, Inc.