Good morning.

We’re deep in the trenches of earnings season again today, with Home Depot posting disappointing performance and leaving investors looking expectantly at Lowe’s.

Meanwhile, two Reddit stocks did quite well on positive news in after-hours trading, and we’re intrigued to see what the rest of today holds for them.

And “SPAC King” Chamath Palihapitiya actually included the phrase “no crying in the casino” in the SEC filing for his next SPAC.

Our partner Pacaso is giving you the opportunity to buy private shares of its business:

In partnership with Pacaso

Big investors are buying this “unlisted” stock

When the founder who sold his last company to Zillow for $120M starts a new venture, people notice. That’s why the same VCs behind Uber and eBay also backed Pacaso. They made $110M+ in gross profit to date. They even reserved the Nasdaq ticker PCSO. Now, you can join, too.

Paid advertisement for Pacaso’s Regulation A offering. Read the offering circular at invest.pacaso.com. Reserving a ticker symbol is not a guarantee that the company will go public. Listing on the NASDAQ is subject to approvals.

Please support our partners!

📰 Market Headlines

US stocks closed little changed on Monday as investors awaited Fed Chair Powell's Jackson Hole speech on Friday and digested US-Ukraine peace talks.

The S&P 500 edged down 0.01%, the Dow slipped 0.08%, and the Nasdaq gained 0.03%.

Home Depot missed on earnings today for the second quarter in a row, and this time, it also missed on revenue. The home improvement store maintained its guidance for the rest of the year, but investors don’t seem convinced—shares were down 2% in pre-market trading. Traders may be watching Lowe’s earnings report closely tomorrow; if Lowe’s outperforms, their play might be to go long $LOW or short $HD.

$HD Earnings per share: $4.68 vs. $4.71 expected

$HD Revenue: $45.28 billion vs. $45.36 billion expected

Palo Alto shares rose 5% pre-market after delivering stronger-than-expected Q4 earnings and raising fiscal 2026 guidance. Not only did $PANW post both revenue and earnings beats, but it also confirmed plans to acquire CyberArk, an Israel-based identity security provider, for $25 billion (by far its largest purchase ever). r/WallStreetBets was talking a lot about the company’s news and earnings before its stock price took off. Traders may be looking for a pullback before jumping in, but you never know—it’s anyone’s guess whether this earnings-and-M&A-driven run still has legs.

$PANW Earnings: 95 cents adjusted vs. 88 cents expected

$PANW Revenue: $2.54 billion vs. $2.5 billion expected.

Intel just secured a $2 billion investment from Japan’s SoftBank, which is also a large backer of OpenAI. Shares jumped 6% in after-hours trading on the news (r/WallStreetBets was on it again). Some investors are confused about the move, as $INTC has essentially spent a lot of money recently to position itself as a chip maker without securing any big customers—but both SoftBank and the White House must see something beyond the 60% stock price drawdowns of last year in Intel. The US Government is reportedly in talks to acquire a 10% stake in Intel.

“SPAC King” Chamath Palihapitiya said “no crying in the casino” for retail investors if they lose their money in his upcoming company. This is no joke; he actually used the phrase in the SEC filing for his newest SPAC (special-purpose acquisition company). Some of Palihapitiya’s previous SPACs are ones you’re undoubtedly familiar with, including Virgin Galactic, Opendoor, and SoFi. The purpose of the new one, called “American Exceptionalism Acquisition Corp,” is to acquire a company in the energy field. This goes without saying, but… invest at your own risk. Here’s his track record.

😱 Fear and Greed Index

Markets haven’t surged into “extreme greed” since July 23—but it’s hard to believe that just four months ago, the index sat at a 3 in “extreme fear.”

🪙 Crypto

Bitcoin plummeted after hitting an all-time high last week, triggering over $530 million in liquidations across the crypto market in 24 hours.

Michael Saylor's Strategy added 430 bitcoin last week, bringing its total holdings to 629,376 coins worth about $72 billion.

The US Treasury sought public input on combating illicit crypto activity following the GENIUS stablecoin act.

🤖 AI/Future/Tech News

Musk’s X endured a 44% plunge in new Android installs year-over-year in July, dragging total mobile downloads down 26%.

🚨 Trending on Reddit

GameStop mentions are heating up again, thanks to chatter on X about a $1 billion capital raise and a Bitcoin pivot. Bulls are hyped on Ryan Cohen’s latest buy and big institutional inflows. Bears think it’s just another distraction. Either way, $GME is back in the meme arena, again.

Meme stock fatigue is creeping into the conversation. A Financial Times piece making the rounds warns of pump-and-dump scams draining retail portfolios.

🤫 Insider Trading

🚚 Market Movers

Gallagher closed its $13.45 billion acquisition of AssuredPartners, the largest US insurance broker deal ever.

Starlink stumbled into its second outage in two weeks just as SpaceX launched more satellites to expand the network.

Allianz Life confirmed a data breach affecting 1.1 million customers. Hackers stole names, addresses, and Social Security numbers from a Salesforce-hosted database.

Texas AG is investigating Meta and Character.AI for allegedly marketing AI chatbots as mental health tools to minors without proper oversight.

John Deere cut 238 jobs across Iowa and Illinois after weak farm equipment sales and a 9% drop in quarterly revenue. Shares fell 6% after the report.

🎙 What Do You Think?

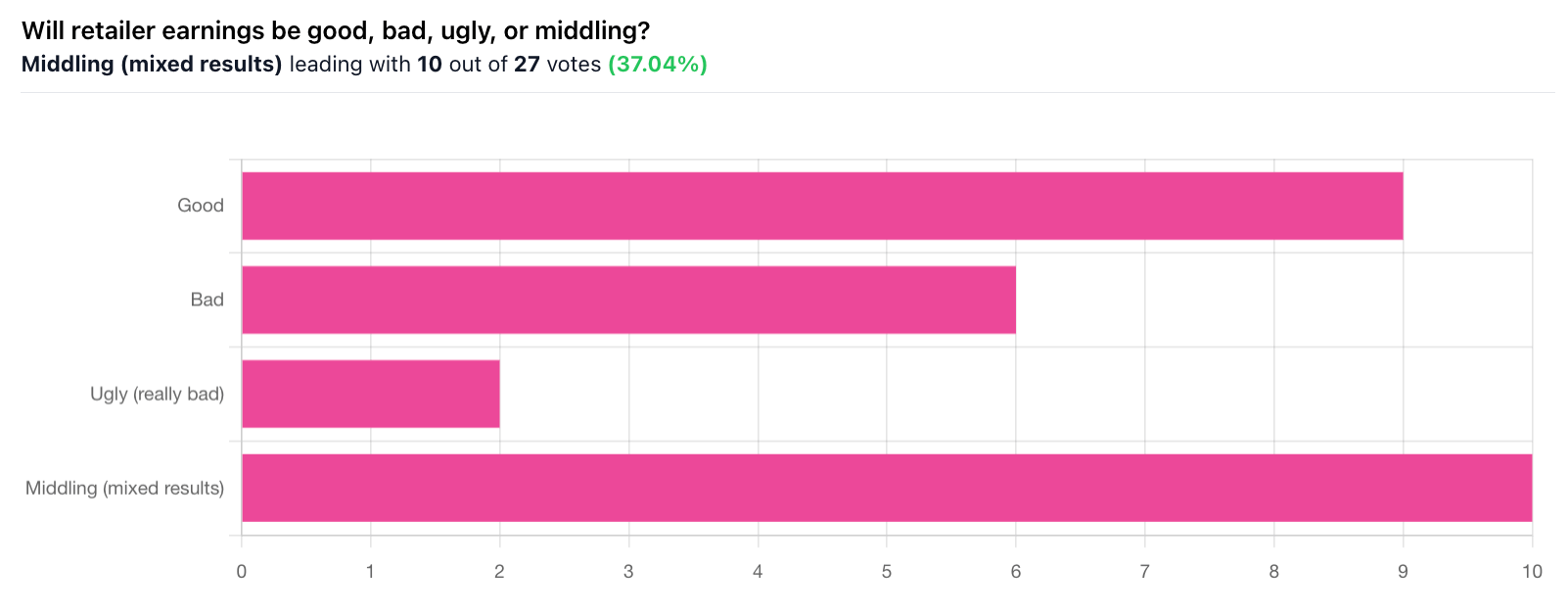

How will Lowe's earnings do vs. Home Depot's?

🎤️ What you said last time

“The Tariffs will have an effect on the price of goods.”

🎪 Crowdfunding Showcase

Bond wants to be your AI-powered bodyguard. The personal security startup, already used by Apple, Disney, and Ralph Lauren, has handled over 1.25 million security requests and is preparing to go public. Their Wefunder round is nearly sold out, with $664K raised. Get in before it closes →

🧠 The Missing (Market) Links

Research found IPO "pops" wildly overstated. The study revealed big first-day surges (like Figma's recent 250% jump) were driven by a small number of "superfan" investors willing to pay premium prices.

Bank of America warned the mega-cap stock era "may be done." Their research showed the 50 largest stocks have outperformed the S&P 500 by a staggering 73 percentage points since 2015.

Vanguard filed plans to launch its first actively managed stock-picking ETFs. The passive-investment pioneer will convert three existing mutual funds into ETFs targeting dividend growth, growth stocks, and value stocks..

OpenAI's Sam Altman says an AI bubble is brewing, comparing it to the dotcom boom: "Investors are overexcited" even as the company preps for a $6 billion stock sale valuing it at roughly $500 billion.

📜 Quote of the Day

“The most contrarian thing of all is not to oppose the crowd but to think for yourself.”

📢 We want to hear from you

We love hearing from you, and we deeply appreciate your feedback.

⭐️ What did you think of today's edition?

That’s all for today. Did I miss anything? Smash the reply button to let me know.

Cheers,

Brandon & Blake

The information provided in Stocks & Income is for informational and educational purposes only and should not be construed as financial advice, investment advice, or a recommendation to buy or sell any securities. Stocks & Income is not a registered investment advisor, broker-dealer, or licensed financial planner. Always do your own research and consult with a licensed financial advisor before making any investment decisions. We may hold positions in or receive compensation from the companies or products mentioned. Disclosures will be made where applicable.