🔔 The Opening Bell

Good morning.

Astronomer’s CEO resigned after a viral kiss-cam moment with his HR Head at a Coldplay concert triggered 22,000 news articles in 24 hours.

Meanwhile, China’s rare earth exports to the U.S. just spiked 660% in a single month, the EU is scrambling to avoid a 30% tariff spike by August 1, and the market is sending a clear signal to investors:

Good earnings aren’t good enough anymore.

We're unpacking all that (and more) in today’s Stocks & Income.

📰 Market Headlines

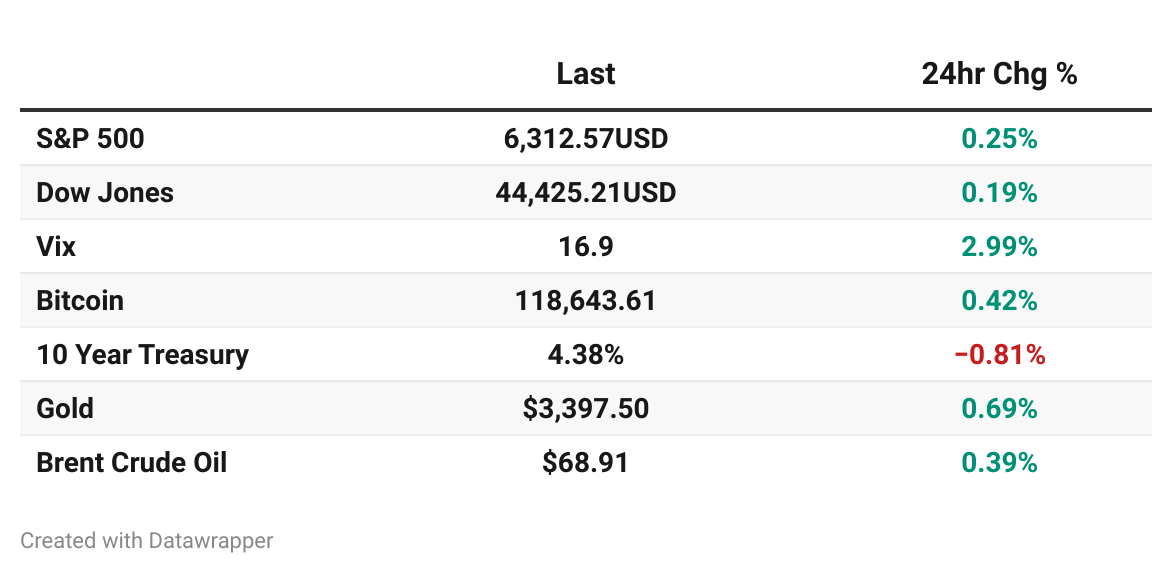

Markets edged near all-time highs last week:

Nasdaq: +1.6%

S&P 500: +0.7%

Dow: Flat

The Fed has entered its blackout period ahead of the July 30 meeting. Odds of a rate cut this month? Just 5%, down from 13% a few weeks ago.

Social Security goes digital: Starting September 30, paper checks are done. About 520,000 recipients (mostly low-income or unbanked seniors) will need to switch to direct deposit or prepaid debit cards.

🇨🇳 The Rare Earth Scramble Is On

China’s rare earth exports to the U.S. jumped 660% in June, driven by American companies stockpiling materials for batteries, defense systems, and clean energy tech.

The rush comes as tariffs loom large:

The EU is negotiating to avoid a 30% tariff spike on exports to the U.S., with one strategist calling it a potential “total car crash” for Europe if no deal is reached by August 1.

📉 “Good Isn’t Good Enough” This Earnings Season

It’s not just one-off reactions—markets are unimpressed strong earnings across the board.

Netflix beat expectations, raised full-year guidance, and… saw its stock drop 5%. (Side note: AltIndex actually rates Netflix as a buy, interestingly enough)

JPMorgan and Bank of America posted solid earnings too, but investors yawned.

What’s going on?

It seems like a shift in investor psychology. Decent numbers aren’t enough anymore. Investors want bigger beats, larger upside catalysts, or bold forward guidance—not just good results in a relatively positive macro environment, like $NFLX ( ▲ 13.77% ), $JPM ( ▼ 1.9% ), and $BAC ( ▼ 4.72% ).

It’s also a potential sign that much of this year’s optimism may already be priced in. If good reports aren’t moving stocks, weaker ones could hit harder than expected.

What’s your take on the market’s lack of response to good earnings reports?

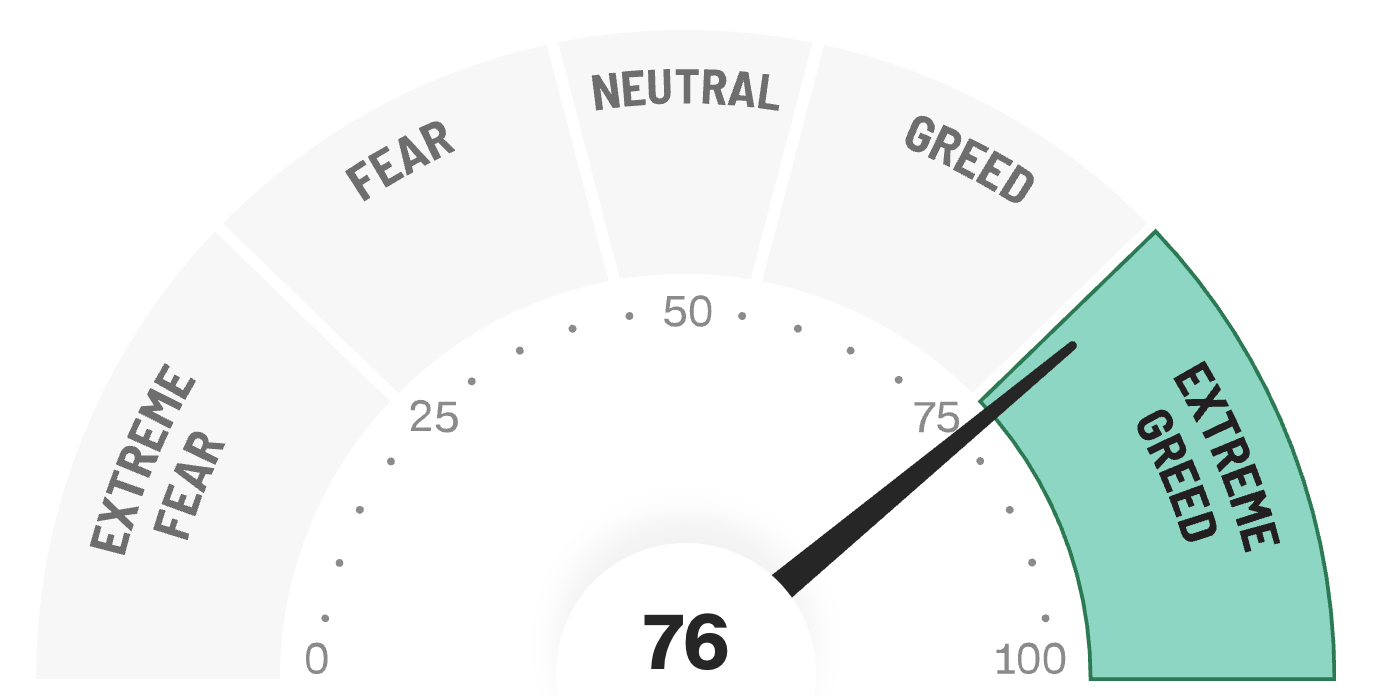

😱 Fear and Greed Index

🌾 Farmland: The real asset investors turn to in uncertain times

Over the past 30 years, farmland has delivered stock-like returns with about one-third the volatility.

Intrinsic value. Food is indispensable. You can’t just print more of it

Stable. Positive historical correlation to inflation

Income-generating. It generates steady cash flow,

Utility. Real-world demand regardless of economic cycle

FarmTogether sources and manages institutional-grade farmland investments, giving accredited investors access through both individual properties and a diversified fund.

Right now, the standout opportunity is Landmark Mandarin Grove — a producing citrus orchard in California’s Central Valley:

🍊 80-acre grove growing Tango and Golden Nugget mandarins

💧 Dual water sources: surface water and private well

📈 Targeting 11.1% net IRR and 9.4% net cash yield

📆 10-year unlevered hold with seasoned local operator

Prefer a fund-based approach? FarmTogether’s Sustainable Farmland Fund offers exposure to a curated portfolio of U.S. farms across multiple regions and crops. It’s targeting:

🌱 8–10% net IRR with 4–6% annual distribution

🪵 Properties in CA, OR, CO, and OK — citrus, grapes, pecans, and row crops

⏳ 2-year lockup, evergreen structure

For investors looking to rebalance into resilient, income-producing assets, farmland is emerging as a compelling alternative.

Investments are open to accredited investors only.

Historical data is not indicative of future results and may not reflect fees which may reduce actual returns. Any historical information is illustrative in nature and may not represent future results, therefore any investor investing through the FarmTogether platform may experience different returns from examples and projections provided on the website. You should not make investment decisions based solely on the information and charts contained in this email.

FarmTogether does not provide tax advice or guidance. Any information provided within this document is for reference only. We recommend consulting a tax professional for your individual tax Situation.

📈 Charts We’re Looking at

🚑 Biggest outflow from healthcare stocks in 5 years—are investors finally rotating out?

📈 Coinbase IPO investors are finally in the green (for the first time… since the IPO)

💻 Semis hit 11% of the S&P 500, a historic first for the chip sector

🐶 Dogecoin’s rally is back—yes, that chart is actually green again

🪙 Crypto

Bitcoin hit a new all-time high, with 99.85% of all Bitcoin addresses now profitable.

Ethereum broke through the $3,600 barrier, fueled by approximately $727 million in institutional ETF inflows in 24 hours.

Analysis shows Bitcoin price may surge 1.8% for every 10,000 BTC added to ETFs, potentially reaching $150,000 by October.

💰 Alternative Investing News

Blackstone pulled out of an investor group bidding for TikTok's US operations after President Donald Trump extended the divestment deadline by 90 days to September 17, 2025.

At least 13 states have introduced 26 bills to clamp down on private equity investment in healthcare after the collapse of systems like Steward Health Care.

🤖 AI/Future/Tech News

Perplexity launched Comet, an AI-powered browser that can summarize articles, manage inboxes, accept LinkedIn invites, and even place Amazon orders.

Meta refused to sign the EU’s AI rules, calling them “overreach” and warning they could stifle frontier model development across Europe.

DuckDuckGo rolled out a filter to hide AI-generated images from search results, using curated blocklists to cull low-quality content.

Anthropic tightened usage limits on its $200/month Claude Code plan without notice.

📗 Recommended Reading

Do you like newsletters? We like newsletters.

Here are some newsletters our readers tend to enjoy, covering topics like:

Finance

AI

Wealth building

Health

And more.

💡 Ideas, trends, and analysis

Census data ranked Scarsdale as America’s wealthiest suburb.

An executive order from President Trump compelled Mexican trucking companies to organize English classes for their drivers.

Nearly 3 billion birds have vanished from North America since 1970; a recent study found declines are now accelerating even in traditional strongholds.

⚔️ Trade wars

President Trump confirmed new 25% import taxes on Mexico and Canada will take effect on Tuesday.

The European Union formulated a retaliation plan for a possible no-deal tariff scenario with the US.

The US Department of Transportation moved to restrict Mexican flights and threatened to dissolve the Delta Air Lines-Aeromexico joint venture.

🌍 International Markets

🇬🇧 UK inflation persisted at 3.6% in June, while unemployment hit a four-year high of 4.7%

🇯🇵 Japan's Prime Minister Shigeru Ishiba vowed to stay in office after his ruling coalition lost a significant number of seats in the upper house election.

🇷🇺 Russia faced "unprecedented" EU sanctions that slashed its oil price cap from $60 to $47.6 per barrel.

🇨🇦 The Bank of Canada may pause its rate-cutting cycle at 2.75%.

🚚 Market movers

Microsoft stopped using engineers in China to support Department of Defense cloud systems after a ProPublica report raised national security concerns.

Netflix used AI to generate a building collapse scene in The Eternaut, completing it 10 times faster than traditional VFX and slashing costs.

Union Pacific leaked merger talks with Norfolk Southern, testing market reaction to a potential coast-to-coast rail giant.

Republic National is cutting 1,756 jobs and exiting California, citing rising costs and supplier shifts.

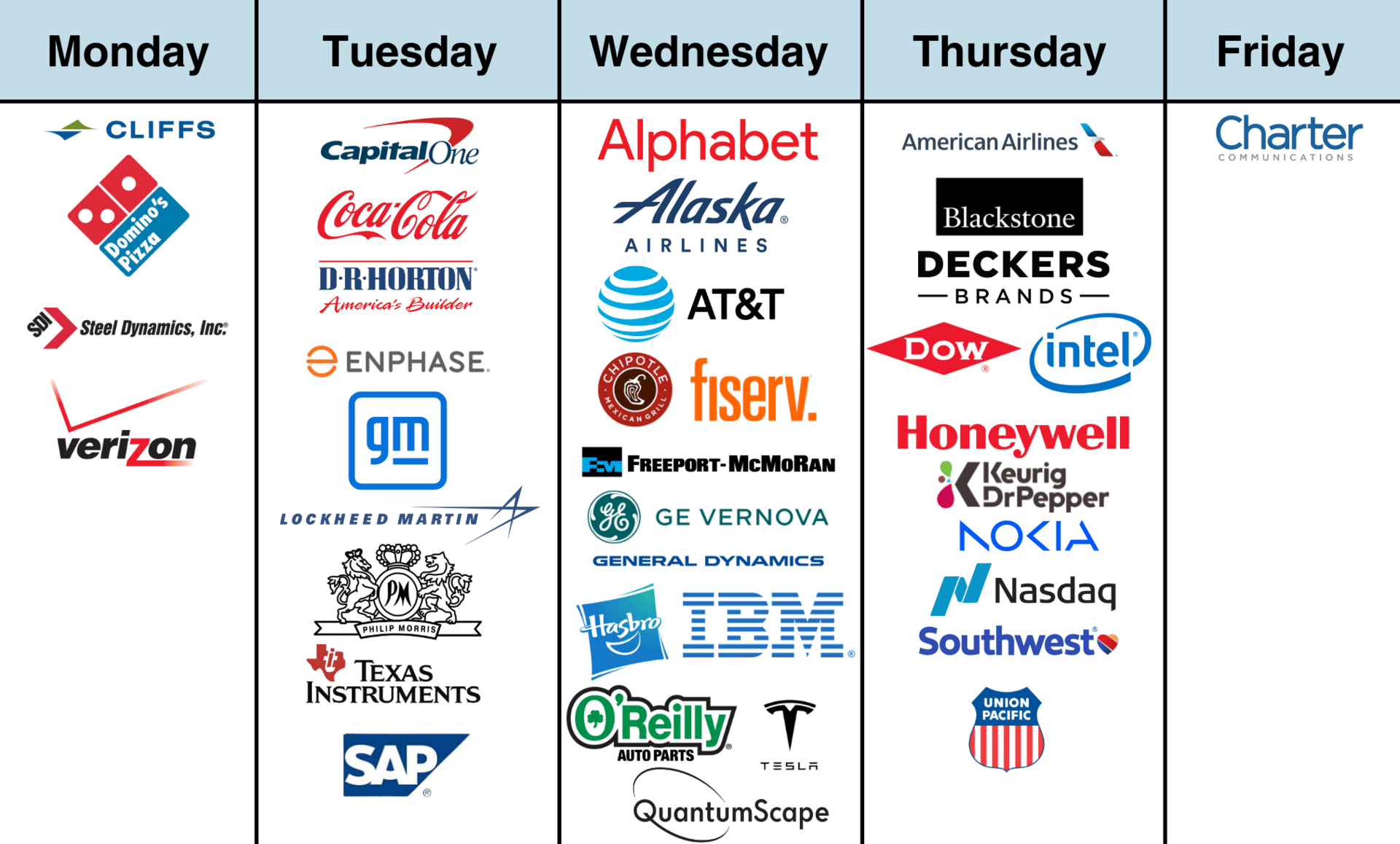

📊 Earnings

📢 We want to hear from you

We love hearing from you, and we deeply appreciate your feedback.

⭐️ What did you think of today's edition?

📺 What to watch today

That’s all for today. Did I miss anything? Smash the reply button to let me know.

Cheers,

Brandon with Stefan & Wyatt

The information provided in Stocks & Income is for informational and educational purposes only and should not be construed as financial advice, investment advice, or a recommendation to buy or sell any securities. Stocks & Income is not a registered investment advisor, broker-dealer, or licensed financial planner. Always do your own research and consult with a licensed financial advisor before making any investment decisions. We may hold positions in or receive compensation from the companies or products mentioned. Disclosures will be made where applicable.