Good morning.

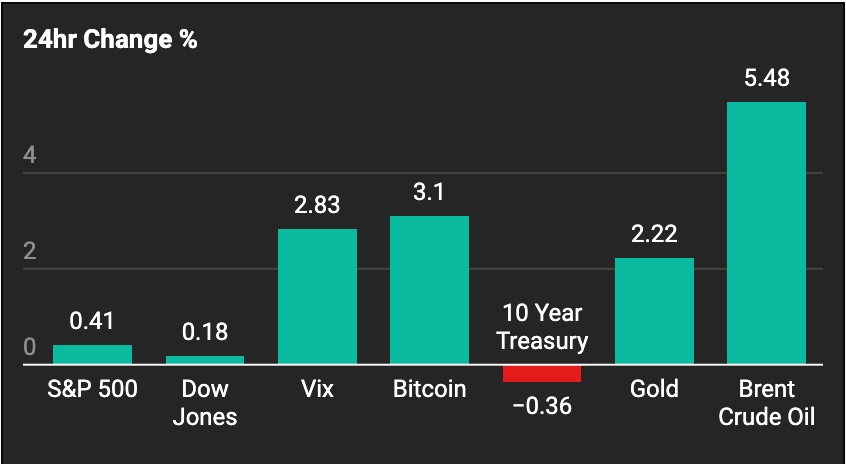

It’s been the best September for the S&P 500 since 2010, but the news wouldn’t have you know it.

The government just shut down, but history says that's actually bullish: the S&P 500 has posted an average 13% gain in the year following shutdowns, and ended higher 86% of the time. Bank stocks are down on the news, but pharma is surging after Pfizer and Merck struck deals that could reshape drug pricing.

Meanwhile, Tesla just had its best month in years with a 33% September rally, gold hit $3,900 for the first time ever (and is now the most overbought since 1980), and CoreWeave signed a $14.2 billion AI infrastructure deal with Meta. OpenAI's partnership with Stripe is crushing payment stocks, and Chamath just launched another SPAC with a simple message: "I'm Back."

More below.

In partnership with Alts

These guys go way beyond stocks and bonds

Alts is the go-to newsletter for investors who are tired of the same public market ideas.

Each week, Stefan and Wyatt surface real opportunities in overlooked asset classes — from tequila barrels, to K-Pop music rights, to film financing bridge loans.

This isn’t just a newsletter though. They create special purpose vehicles (SPVs) so you can invest directly into each deal alongside the community.

If you’re an accredited investor, Join 135,000 subscribers and see what you’ve been missing.

Please support our partners!

Market Headlines

Stock futures dropped Wednesday as the government shutdown began.

Dow futures fell 234 points (0.5%), while S&P and Nasdaq futures declined 0.6% and 0.7%.

Bank stocks led the premarket slide, with Citigroup down 0.9% and JPMorgan, Wells Fargo, Goldman, and Morgan Stanley all lower.

But the shutdown might actually be good for markets: history shows that shutdowns have been bullish 86% of the time, with the S&P 500 averaging 13% gains in the year following closure. The average shutdown lasts just 8 days, and during the 35-day 2018 shutdown, the S&P rallied 11%.

Pfizer and Merck surged nearly 7% each after separate breakthroughs. Pfizer struck a deal with the White House to lower drug prices in exchange for a three-year tariff exemption, while Merck won positive EU recommendation for its RSV treatment. The White House also launched TrumpRx, a site letting consumers buy discounted medications directly from manufacturers. The move could potentially hurt insurance and pharma companies like UnitedHealth (UNH), Cigna (CI), and Eli Lilly (LLY) while benefiting direct-to-consumer healthcare plays like Hims (HIMS).

OpenAI partnered with Stripe to add shopping features to ChatGPT, crushing payment stocks. Paycom and Block both tumbled over 4% as the market digested the implications of AI-powered commerce bypassing traditional payment processors.

Tesla rocketed 32% in September, making it the best Magnificent Seven performer. Shares have doubled since April on Elon Musk's pivot toward AI robots and robotaxis, but the rally faces a crucial test this week when sales data drops. Analysts are watching whether AI-fueled hype can survive the reality of weakening EV demand.

CoreWeave jumped 15% after signing a massive $14.2 billion deal with Meta to supply Nvidia-powered data centers through 2031. The agreement highlights the explosive AI infrastructure boom, though analysts are warning about "circular" financing risks as AI companies invest in each other at sky-high valuations.

Gold hit $3,900 per ounce for the first time ever, but the rally is flashing major warning signs. The metal posted a 90 RSI on the monthly chart, the most overbought since 1980. Silver also hit its highest quarterly close in history. When assets get this extended, sharp reversals can come into play.

Pinterest could be the surprise AI advertising winner. Mizuho set a $50 price target for PINS (nearly 50% above current levels), arguing that the company's AI-driven ad tools could steal budget share from bigger players. While Meta and Alphabet also got outperform ratings, analysts see the sharpest upside potential in Pinterest.

Chamath Palihapitiya launched another SPAC under ticker $AEXA, announcing his return with an article on X under the banner "I'm Back." It seems like all of finance Twitter groaned at once in response. Chamath is notorious for launching SPACs that end up going down only. Here’s Palihapitiya’s total SPAC performance record to date, including Virgin Galactic, Opendoor, and SoFi.

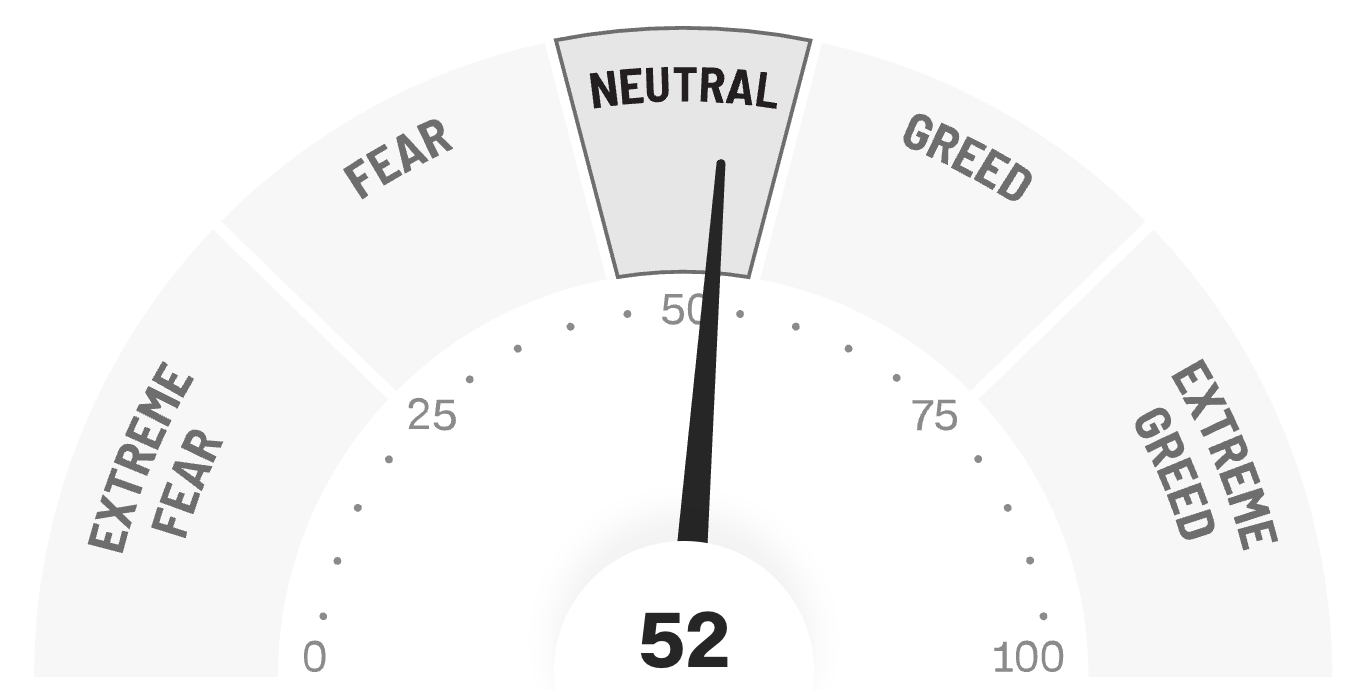

😱 Fear & Greed Index

🪙 Crypto

Ethereum gas fees jumped sharply with Layer-2 activity surging, led by Arbitrum and Base.

The FTX estate said creditors could recover up to 95% of claims in cash, with payouts expected in early 2026.

Binance agreed to a $150 million EU fine over compliance failures but avoided a trading ban.

🤫 Insider Trading

📊 IPOs and Earnings

Lamb Weston beat Q3 expectations with adjusted EPS of $0.74, nearly 39% above estimates, and shares jumped 4.8%.

Nike posted a surprise quarterly revenue increase as its turnaround effort showed early traction, and the stock gained 0.23% on the report.

AutoZone missed Q4 earnings expectations for the fifth straight quarter, though sales rose year over year; shares slipped on the report.

🚚 Market Movers

🎙 What Do You Think?

Is the Chamath SPAC hate justified or overblown?

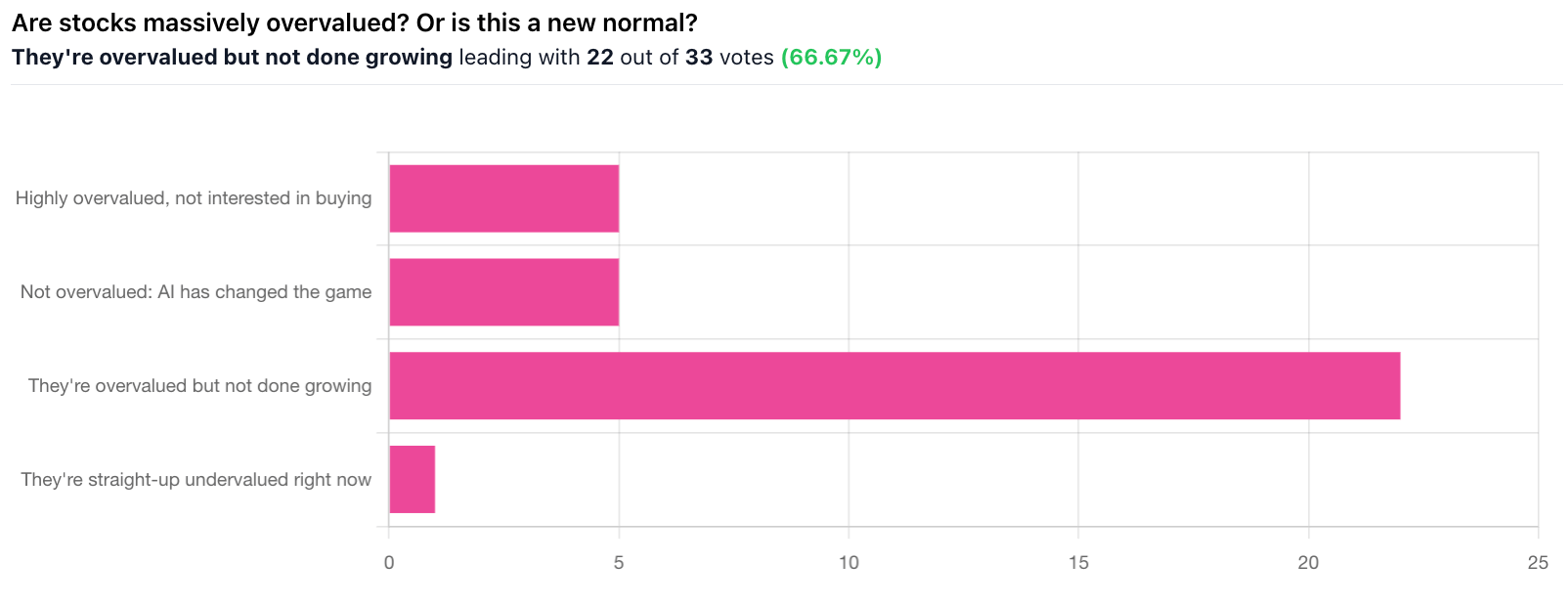

🎤️ What you said last time

“We ain't seen nothin' yet! If AI has its way, investments will grow and take the market up and up, provided no unforeseen circumstances arise.”

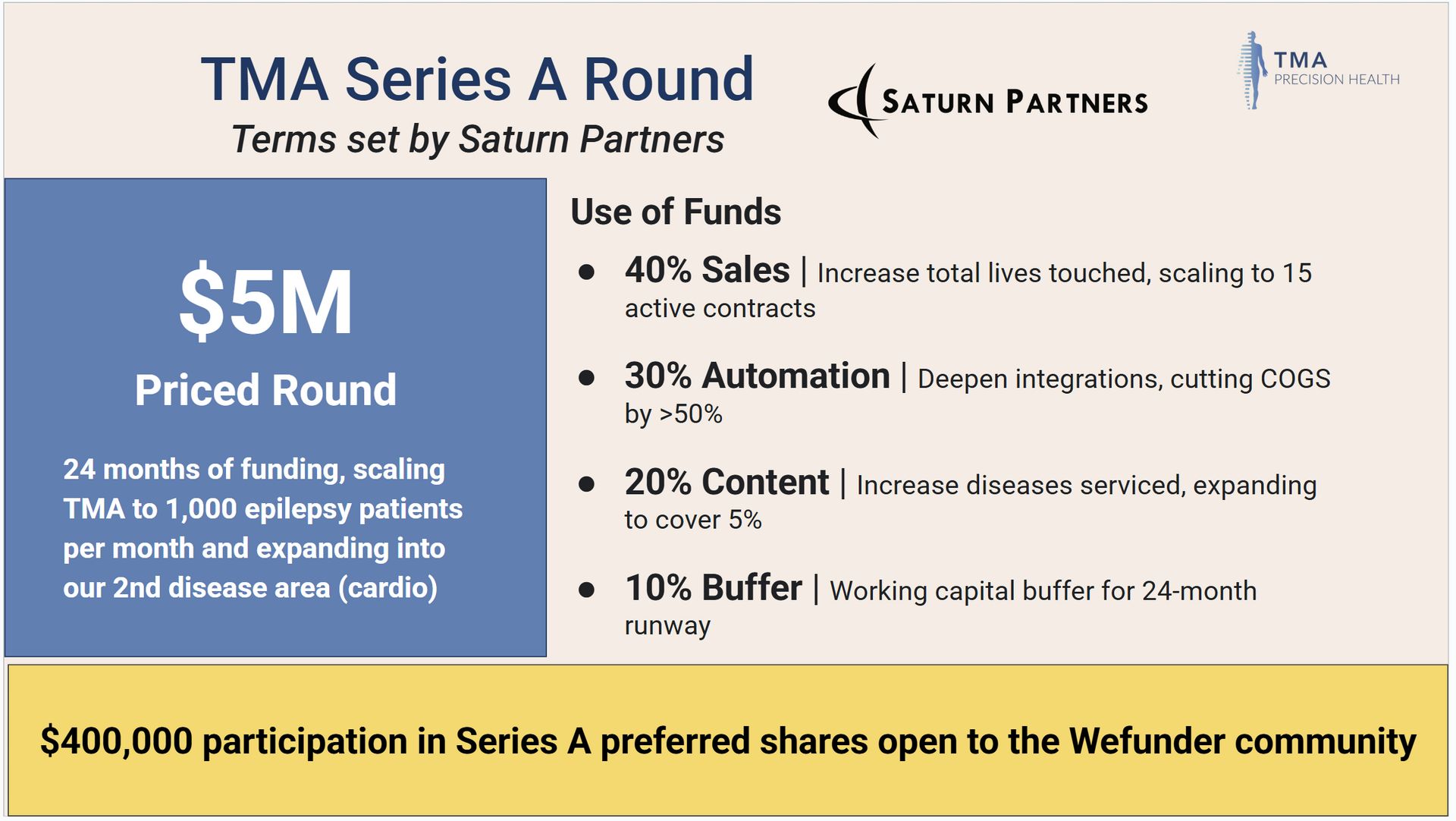

🎪 Crowdfunding Showcase: TMA Precision Health

TMA Precision Health uses AI to identify high-cost rare disease patients hiding in health plan claims data, then delivers precision medicine treatment insights in 12 weeks instead of the typical 7-year diagnostic odyssey. The company has $2.3M in contracted 2025 revenue, 90% patient opt-in rates, and active discussions with 16 health plans covering 8.5M lives. Starting with pediatric epilepsy (a $40K+ annual cost per patient market), TMA's platform saves health plans tens of thousands per patient while getting families life-changing answers faster. Visit the campaign page.

🧠 The Missing (Market) Links

Bond traders loaded up on 10-year Treasury calls, wagering on a rally to five-month yield lows as the shutdown threat grew.

Former Forbes 30 Under 30 member Charlie Javice was just sentenced to 7 years in prison for defrauding JPMorgan Chase.

There’s an unfolding battle happening over the “1-800-GAMBLER” phone number.

Some of the biggest fund gatekeepers poured cold water on hot themes like AI and crypto ETFs, calling them “investment du-jours” they’re not buying.

A former Friendly’s waiter just bought the entire chain 22 years after bussing tables there. His group now controls more than 250 restaurants.

📜 Quote of the Day

“Far more money has been lost by investors preparing for corrections, or trying to anticipate corrections, than has been lost in corrections themselves.”

📢 We want to hear from you

We love hearing from you, and we deeply appreciate your feedback.

⭐️ What did you think of today's edition?

That’s all for today. Did we miss anything? Smash the reply button to let me know.

Cheers,

Brandon & Blake of Invested Inc

Thumbnail image: Federalreserve, Flickr

The information provided in Stocks & Income is for informational and educational purposes only and should not be construed as financial advice, investment advice, or a recommendation to buy or sell any securities. Stocks & Income is not a registered investment advisor, broker-dealer, or licensed financial planner. Always do your own research and consult with a licensed financial advisor before making any investment decisions. We may hold positions in or receive compensation from the companies or products mentioned. Disclosures will be made where applicable.