Good morning.

The trading strategy that Wall Street can’t keep up with: Social arbitrage.

Where your greatest advantages are observations about your everyday world and social media data. Chris Camillo pioneered it, and we’re equipping you with a tool to do it starting today.

And is Intel’s legendary run over? More intriguing: is Tesla’s legendary run just beginning?

In this edition:

“Social arbitrage:" Harnessing Reddit for deep trading insights (5 stocks)

Trump sues Jamie Dimon & JPMorgan over alleged debanking

Intel sinks 14% even though it posted an earnings beat

Robotaxis go fully autonomous? Tesla up 3%

Let's get into it.

In partnership with Alts.co

These guys don’t just talk alternatives. They build them.

Alts is the go-to newsletter for those who want access to real deals — not just commentary.

Each week, Stefan and Wyatt uncover overlooked markets, like film financing, Ferrari arbitrage, even K‑Pop royalties.

But they don’t just talk about investing. They structure the actual investments.

Through special purpose vehicles (SPVs), members have invested over $13 million into off-market opportunities — including bridge-financed Hollywood films with first-money-out rights and completion bonds.

If you’re an accredited investor, join 200,000 others and see what you’ve been missing.

Please support our partners!

📰 Market Headlines

US stocks rallied on Thursday after Trump paused tariffs tied to Greenland negotiations.

The Nasdaq jumped ~0.8%, while the S&P 500 and Dow both gained about 0.6%.

We think Social Arbitrage is the trading strategy that will dominate in 2026 and beyond. Social arb trader Chris Camillo describes it as observational investing, watching shifts in consumer behavior, trends, or culture. He says, “Sometimes investing is just a game of being early to the obvious. Don’t overthink it.”

This leads to an obvious question: where do you get this data? The best place we’ve found is Reddit, where people are constantly talking about new trends, topics, and specifically, stocks. You have a high chance of hearing about a new stock on Reddit first. The problem is this: how do you sort through the thousands of comments to find consistent trends?

AltIndex processed 168,000 Reddit comments to arrive at these top 5 Reddit stocks, given to you for free →

President Trump filed a $5 billion lawsuit against JPMorgan and CEO Jamie Dimon, accusing the bank of terminating his accounts in 2021 for political reasons. JPMorgan says the suit "has no merit" and plans to fight it in court.

Intel (INTC) shares tanked 14% on disappointing guidance and a supply shortage due to production efficiency issues. The company did post a double beat, outdoing Wall Street’s expectations on both earnings and revenue.

Tesla popped over 3% after Elon Musk posted a video of a robotaxi operating without a safety monitor in Austin. Musk also said FSD approval in Europe and China could come as soon as next month. Meanwhile, Waymo launched in Miami, its sixth US market.

Elon Musk just spoke at the World Economic Forum, highlighting the following: Tesla’s Optimus robots will be for sale next year, SpaceX's Starship will be fully reusable this year, and robotaxis will roll out in U.S. cities by late 2026. Full speech here →

Saks Global filed for bankruptcy last week, securing $1.75 billion in financing. Many brands stopped shipping goods weeks ago. Liabilities range from $1 billion to $10 billion, and smaller suppliers could be wiped out if bills go unpaid.

Under Armour is investigating a data breach affecting 72 million email addresses. Some records included names, genders, birthdates, and ZIP codes. The company says there's no evidence that passwords or financial info were compromised.

Gold topped $4,900 per ounce for the first time ever, and silver has cleared $99. Goldman Sachs raised its year-end target for gold to $5,400, citing strong private-sector diversification into bullion. Prices have rallied 11% year to date, extending a nearly 65% gain from 2025.

🤖 AI/Future/Tech News

Google launched free SAT practice exams powered by Gemini that analyze student performance and provide personalized feedback.

Meta moved to block evidence in New Mexico's child safety lawsuit, requesting to exclude research on social media's youth mental health impact, teen suicide stories, company finances, and even Zuckerberg's college years ahead of the February 2 trial.

Substack launched a TV app for Apple TV and Google TV with a TikTok-style feed, drawing backlash from users who wrote the top comment on the announcement: "Please don't do this. This is not YouTube. Elevate the written word."

🪙 Crypto

US spot bitcoin and ether ETFs shed nearly $1 billion on Wednesday, with BTC funds posting $708.7 million in outflows and ETH funds losing $286.9 million.

Thailand's SEC finalized rules for bitcoin ETFs and crypto futures trading, letting investors allocate up to 5% of their portfolios to digital assets.

🤫 Insider Trading

📚Alternative Investment of the Day: First Editions

First-edition books with original dust jackets are gaining traction as collectible investments, with the jacket alone sometimes accounting for over 90% of a book's value. A first printing of The Great Gatsby is a prime example. Scarcity tied to survival, not just age, makes pricing stable enough for serious collectors.

🚚 Market Movers

Intel slid 5% after hours on a weak Q1 outlook. The chipmaker guided for $12.2 billion in revenue and $0 EPS, missing Wall Street's $12.6 billion and $0.08 estimates.

SpaceX is lining up Bank of America, Goldman Sachs, JPMorgan, and Morgan Stanley for what could be the largest IPO ever. The rocket company's valuation recently topped $800 billion.

Intuitive Surgical beat Q4 estimates on strong demand for its da Vinci surgical robots. Revenue hit $2.87 billion versus $2.75 billion expected, and shares climbed 3.3% after hours.

Paramount extended its $30-per-share bid for Warner Bros. Discovery to Feb. 20. WBD's board called the offer an "inferior scheme" and urged shareholders to back Netflix's $27.75 all-cash deal instead.

❓ Market Trivia Corner

Which of these ETFs has performed best in 2026 so far?

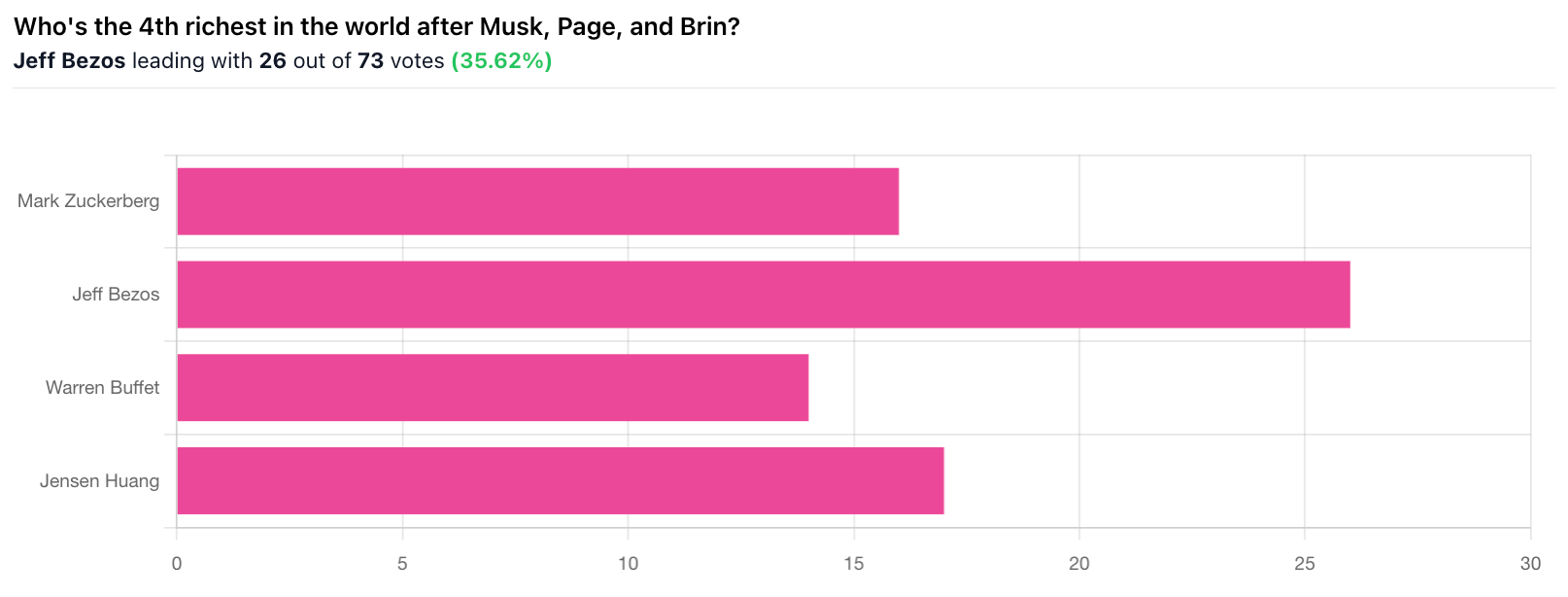

🎤️ What you said last time

🎪 Crowdfunding Showcase

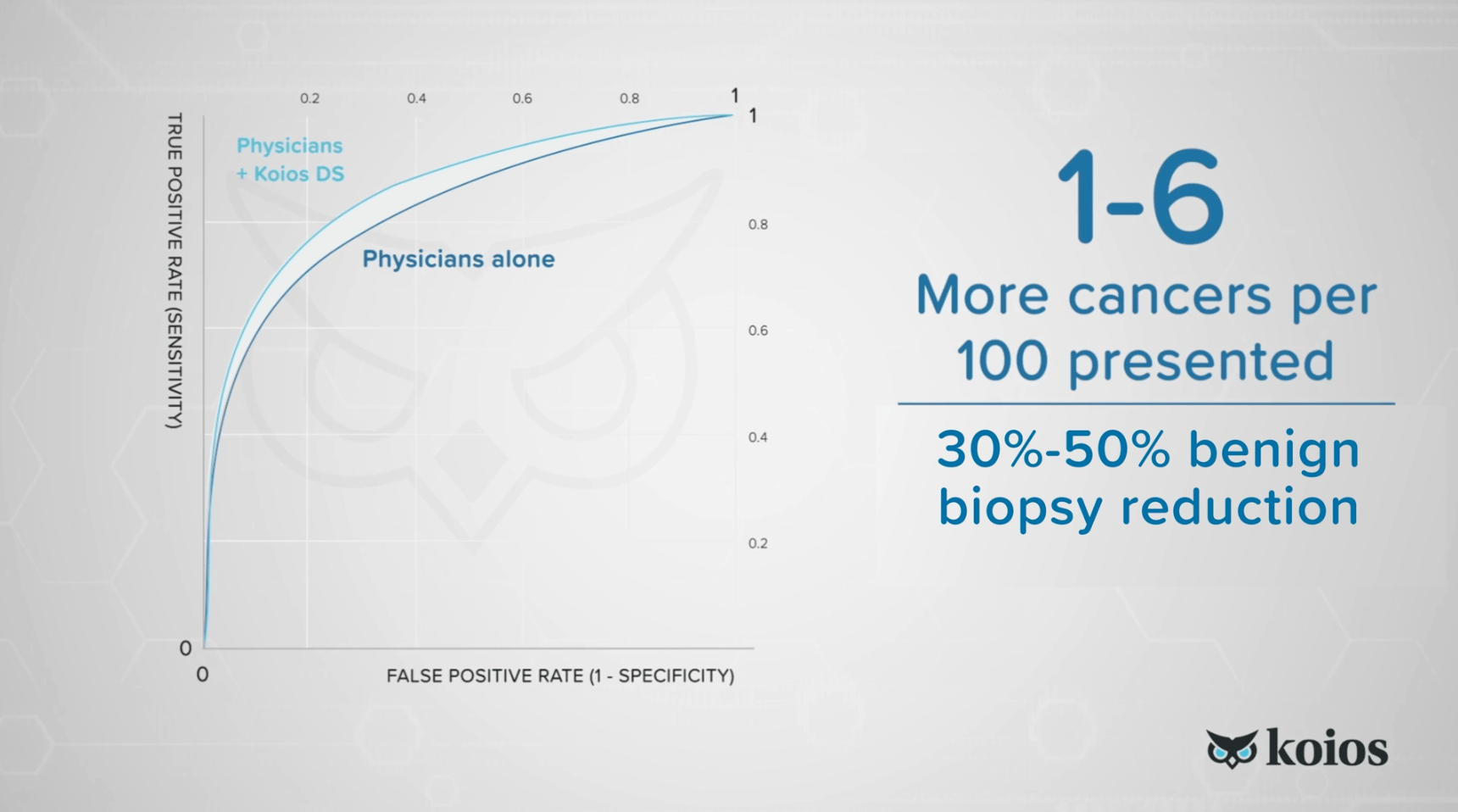

Koios Medical is raising on Wefunder with an FDA-cleared ultrasound AI already deployed in 1,000+ hospitals. Backed by Mitsui and partnered with GE Healthcare and Philips, the company says its software cuts false-positive biopsies and speeds readings while generating reimbursed SaaS revenue.

🧠 The Missing (Market) Links

This 30-year-old earns $140K working remotely from Bahrain, where she rents a 3-bed house with a pool for $2,200/month.

The global RTD cocktails market is projected to hit $17.9 billion by 2031, growing at 11.5% CAGR as younger consumers gravitate toward pre-mixed convenience.

A 2024 study found that most parents can't tell the difference between AI-generated health advice and content from actual medical professionals.

The bone-anchored hearing aids market is forecast to grow at 7.89% CAGR through 2031, fueled by AI-powered speech recognition and minimally invasive implant techniques.

📜 Quote of the Day

📢 We want to hear from you.

Your feedback matters to us! Let us know what you liked or didn’t like about today’s edition.

⭐️ What did you think of today's edition?

That’s all for today. Did we miss anything? Smash the reply button to let me know.

Cheers,

Brandon & Blake of Invested Inc

The information provided in Stocks & Income is for informational and educational purposes only and should not be construed as financial advice, investment advice, or a recommendation to buy or sell any securities. Stocks & Income is not a registered investment advisor, broker-dealer, or licensed financial planner. Always do your own research and consult with a licensed financial advisor before making any investment decisions. We may hold positions in or receive compensation from the companies or products mentioned. Disclosures will be made where applicable. Past performance doesn’t guarantee future results.

Stocks & Income, AltIndex, Finance Wrapped, The Chain, and Future Funders are all owned by Invested, Inc.open