Good morning.

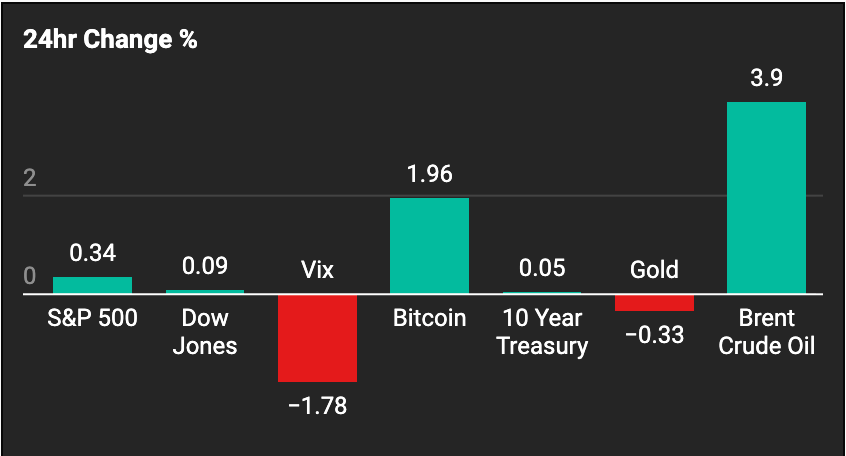

The S&P 500 closed above 6,700 for the first time ever Wednesday, and nobody seems to care that the government is shut down. Markets are treating weak jobs data as confirmation that rate cuts are locked in: ADP showed private payrolls fell 32,000 in September, the worst drop in 2.5 years, and traders immediately pushed Fed cut odds to 99% for this month.

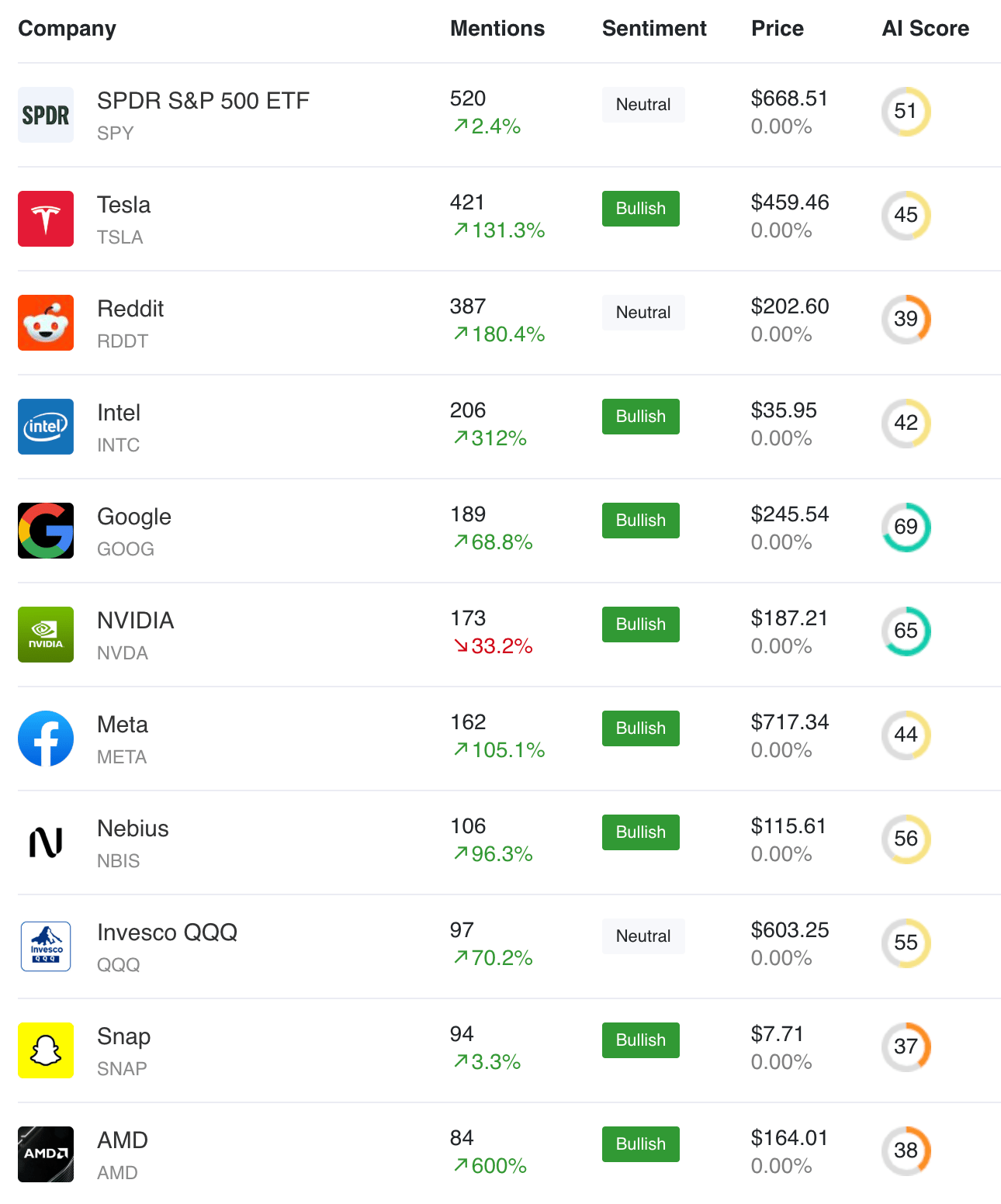

Meanwhile, the semiconductor world might be getting completely reshuffled. Intel might be getting yet another huge partnership, this time with an old rival. OpenAI hit a $500 billion valuation (matching Elon Musk's brand new net worth, ironically), and Nvidia became the first company ever to reach $4.5 trillion. That’s more than Amazon and Meta combined.

Seems like bad economic news is great for stocks, and concentration keeps getting more extreme.

Market Headlines

The S&P 500 closed above 6,700 for the first time on Wednesday as stocks pushed to fresh records.

The Dow gained 0.1% for its second straight record close, the S&P added 0.3%, while the Nasdaq climbed 0.4%.

Investors shrugged off the government shutdown, betting weak jobs data and falling Treasury yields would lock in near-term Fed rate cuts.

ADP reported private payrolls fell by 32,000 in September, missing forecasts for a 45,000 gain and marking the largest drop in 2.5 years. With the Bureau of Labor Statistics (BLS) shuttered due to the shutdown, the official jobs report will be delayed indefinitely, and the ADP data might be all the Fed gets. Rate cut odds surged to 99% for this month's Fed meeting, with December expectations jumping to 87%. The 10-year Treasury yield fell over 4 basis points to 4.106% as the "bad news is good news" trade accelerated.

Intel and AMD are in early talks about AMD becoming a foundry customer, a potential partnership that would mark a massive strategic shift between longtime rivals. No deal terms have been disclosed, but the news sent Intel shares surging 7%. The stock is up 70% over the past 6 weeks since the US government kicked off Intel’s comeback tour by buying a 10% stake.

Nvidia became the first company ever to reach a $4.5 trillion valuation, which is more than Amazon and Meta combined. The milestone highlights the extreme market concentration in AI stocks (as well as the smile on CEO Jensen Huang’s face).

Elon Musk became the first person ever to reach a $500 billion net worth, the same valuation OpenAI just achieved in its latest share sale. The irony isn't lost on anyone given the ongoing rivalry between Musk and Sam Altman.

Pfizer's drug pricing deal with the Trump administration sent European healthcare stocks soaring 4.3% (their biggest daily gain since 2008) as investors bet other drugmakers could strike similar agreements.

Meta has fallen 8 of the last 9 days for an 11% decline, with daily RSI hitting its most oversold level since the April lows. X stock market commentator Heisenberg seems to be eyeing a potential bounce.

Robinhood CEO Vlad Tenev declared "tokenization will eat the entire global financial system," doubling down on the company's crypto strategy.

Nebius is positioning itself as "the AWS of AI," according to Sergio on X, who argues that most people still don't understand what the company does. Unlike AWS, which was built for websites and later adapted for AI, Nebius is architected specifically for large-scale training and inference. The company recently signed a $17B+ multi-year deal with Microsoft to provide AI capacity.

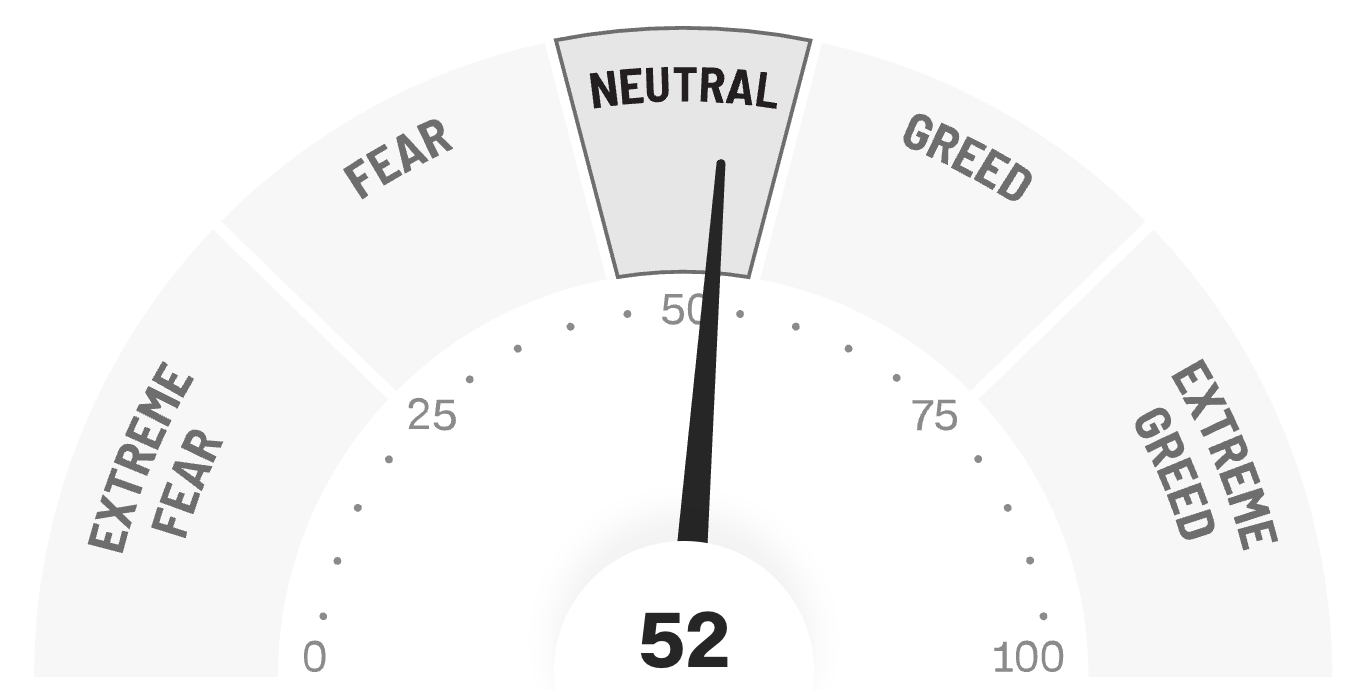

😱 Fear & Greed Index

🪙 Crypto

Vanguard may be preparing a crypto U-turn after removing a blog post critical of Bitcoin ETFs.

A Senate hearing revealed the IRS is unprepared for the flood of crypto tax filings.

The SEC approved new standards that let exchanges fast-track crypto ETFs without individual review.

👨⚖ Congress Trade Updates

🤫 Insider Trading

🎙 What Do You Think?

Who will be the first to reach a net worth of $1T?

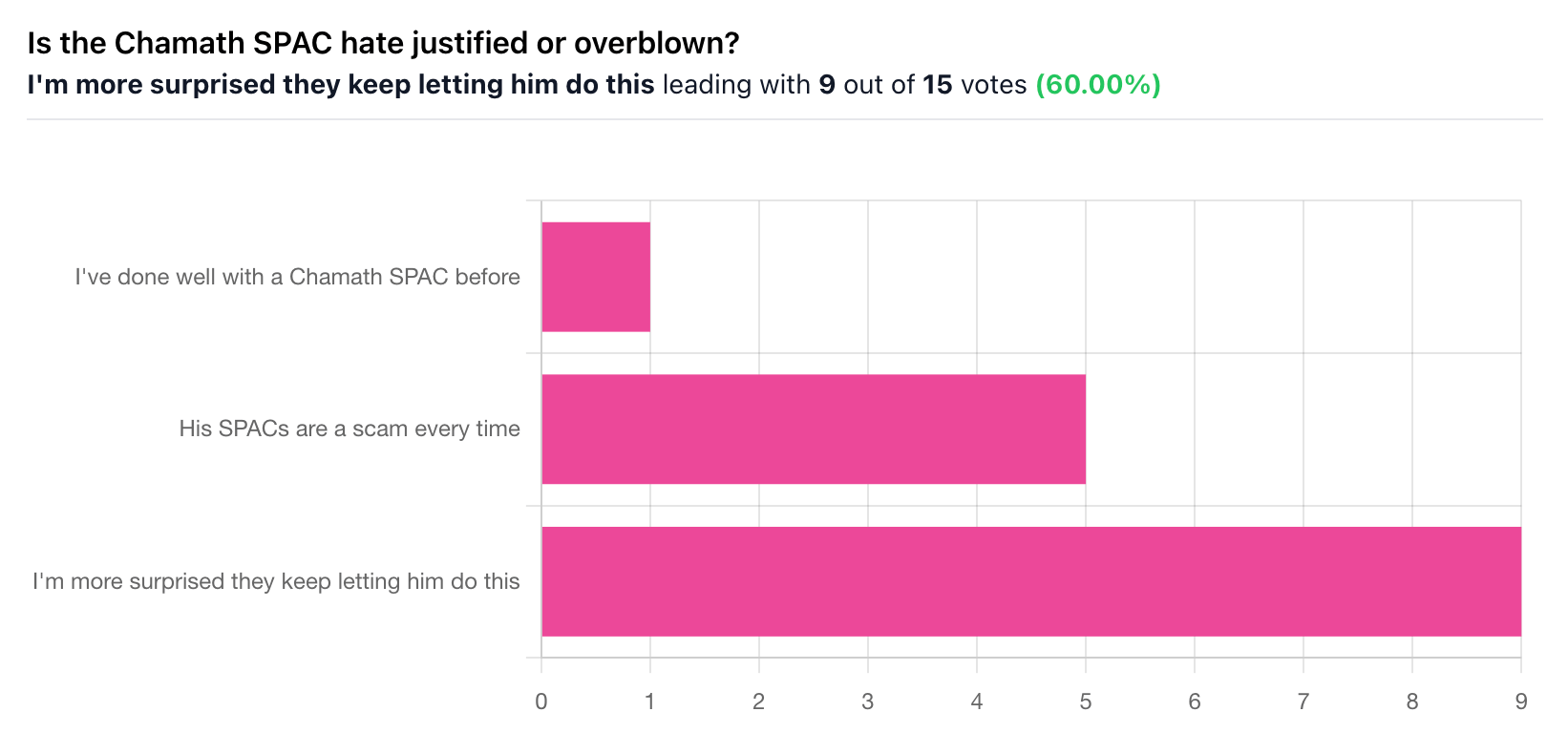

🎤️ What you said last time

🧠 The Missing (Market) Links

US electricity prices have jumped 30% since 2020, nearly doubling inflation over the past year.

Nearly 80 million Americans faced tradeoffs between power bills and basic expenses. Shutoffs climbed as regulators weighed even higher rates.

California lawmakers advanced a bill naming Bigfoot the official “state cryptid.”

📜 Quote of the Day

“The single greatest edge an investor can have is long-term orientation.”

📢 We want to hear from you

We love hearing from you, and we deeply appreciate your feedback.

⭐️ What did you think of today's edition?

That’s all for today. Did we miss anything? Smash the reply button to let me know.

Cheers,

Brandon & Blake of Invested Inc

Thumbnail image: Federalreserve, Flickr

The information provided in Stocks & Income is for informational and educational purposes only and should not be construed as financial advice, investment advice, or a recommendation to buy or sell any securities. Stocks & Income is not a registered investment advisor, broker-dealer, or licensed financial planner. Always do your own research and consult with a licensed financial advisor before making any investment decisions. We may hold positions in or receive compensation from the companies or products mentioned. Disclosures will be made where applicable.