🔔 The Opening Bell

Good morning.

Late last night, Trump announced new tariffs, raising some and surprisingly lowering others. Markets slowed down and backtracked a little, but pandemonium hasn’t ensued—or at least, not yet.

A former US trade negotiator said that Trump views the trade war as if it was a reality show.

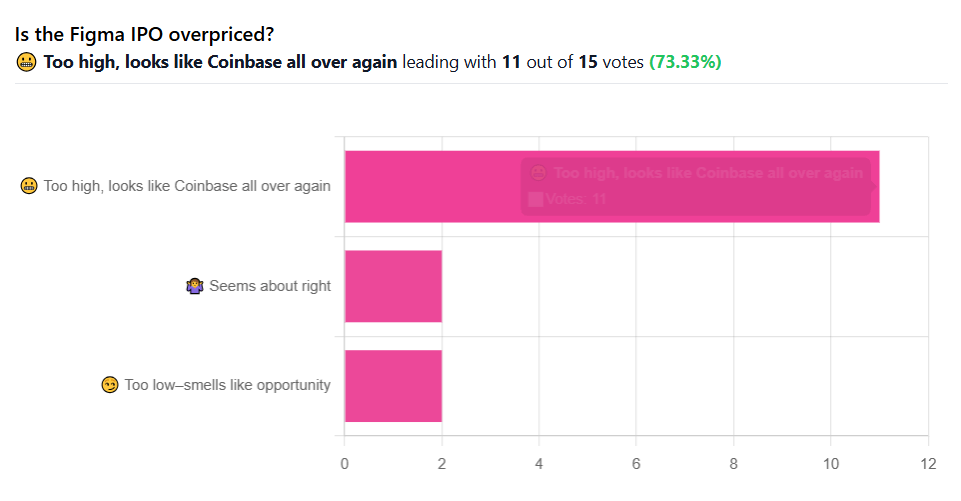

Figma’s IPO broke the market yesterday as traders sent its stock up 250% before trading was halted. It may sound like a dream, but it ended up being quite a nightmare for several individual investors who got walled out of $FIG by Robinhood and missed out on hundreds of thousands in gains.

Let’s get to it.

This Startup Is Making Plastic Obsolete

Timeplast created a plastic that dissolves in water, leaving no waste. Their tech could revolutionize the $1.3T plastic industry. That’s why 7,000+ people have already invested, and you have only a few days left to join them. Invest in Timeplast by July 31 at midnight.

This is a paid advertisement for Timeplast’s Regulation CF Offering. Please read the offering circular at invest.timeplast.com.

📰 Market Headlines

Markets closed July on a sour note, with markets sliding after strong Big Tech earnings couldn't overcome tariff deadline jitters and Fed uncertainty.

The Nasdaq fell flat, the S&P 500 fell 0.4%, and the Dow tumbled 0.7%.

President Trump announced several new tariffs last night and granted Mexico a 90-day extension on the deal deadline. Of note: he lowered the tariffs on several countries and increased Canada’s tariffs specifically. See the full list of new tariffs →

The market seems confused by the tariff updates, but it’s clear they aren’t having nearly the level of effect they did earlier in the year—and some are asking the question: are markets numb to tariffs at this point?

Apple crushed earnings expectations with revenue jumping 10% to $94 billion, as iPhone sales surged 13.5% to $44.6 billion. CEO Tim Cook attributed about 1 percentage point of growth to customers buying ahead of potential tariffs, noting the company saw "evidence in the early part of the quarter of some pull-ahead." The company also finally clarified its stance on an AI acquisition—a topic that investors have long awaited (or dreaded).

Image: Robinhood

Figma's IPO turned into a rocket launch, with shares exploding 250% from their $33 offering price to open at $85, valuing the design software company at $50 billion. Many Robinhood traders signed up to buy thousands of $FIG shares but were only given 1 stock each by the platform, losing them hundreds of thousands in profits (example). The stock briefly touched $112 before trading was halted for volatility, marking the strongest tech IPO debut of 2025. It now sits around $140 pre-market.

Did you miss Figma? Here are two more IPOs coming up this week—one in aerospace and another in compute.

Friday's jobs report looms large as the next major market catalyst. Economists expect just 104,000 jobs added in July, the weakest gain since February, as Fed Chair Powell emphasized unemployment as his key metric for rate decisions.

Did Trump’s new tariffs matter to you?

😱 Fear and Greed Index

🧠 The Missing (Market) Links

🤖 Open AI CEO Sam Altman and comedian Theo Von talked about “how people will generate wealth if AI does everything” on Von’s podcast last week.

👀 Here are Morningstar’s top 10 growth stocks for long-term investing. Always do your own research.

😬 Google’s search market share slid from 91.1% to 89.6% year-over-year. Antitrust rulings and Apple’s AI search alternatives are raising questions for the tech giant.

🔫 Brian Fontenot II, CTO of XUSD, was indicted after pitching a $100 trillion gun box as crypto collateral.

💊 Trump sent letters to 17 pharma companies demanding that they lower the cost of their drugs in the next 60 days.

✈ Avelo Airlines cut West Coast flights and refused refunds to stranded travelers, offering only vouchers for other regions.

🚚 Market movers

Epic clinched another win against Google in appeals court, forcing Google to open up Android to third-party app stores for at least three years.

Paramount Global beat Q2 earnings estimates with 46 cents per share and $6.85 billion in revenue as its $8.4 billion sale to Skydance moved closer to closing.

First Solar raised its annual sales outlook to $4.9–$5.7 billion, expecting higher prices as new tariffs boosted its competitive edge.

Blackstone emerged as the frontrunner to buy energy data provider Enverus for around $6 billion, according to sources.

CSX brought in Goldman Sachs to explore strategic options after Union Pacific’s $85 billion takeover of Norfolk Southern reshaped the freight rail landscape.

Uber Eats rolled out new AI features, including automated menu descriptions and photo enhancements for restaurants, plus rewards for customer food photos.

🪙 Crypto

SEC Chairman Paul Atkins launched Project Crypto, ordering clear rules for crypto assets and declaring that most tokens aren’t securities.

JPMorgan and Coinbase teamed up to let Chase cardholders fund Coinbase wallets with credit cards this fall.

BlackRock’s ETHA ETF snapped up $4 billion in July, outpacing Bitcoin and posting the fifth-largest inflow among all US ETFs.

BitMine Immersion Technologies raised $250 million to build an Ether treasury, naming Fundstrat’s Tom Lee as chairman.

Whale activity surged as Bitcoin rebounded from overnight losses, with analysts flagging growing concerns over threats to Federal Reserve independence.

💰 Alternative Investing News

President Trump’s copper tariff twist sent US copper prices into freefall, wiping out a hefty New York premium over London futures after refined metals were unexpectedly exempted from the new 50% import levy.

Private equity secondaries volume hit $102 billion in H1 2025 as LPs scrambled for liquidity.

🤖 AI/Future/Tech News

OpenAI announced a $1 billion Stargate Norway data center, set to launch with 100,000 Nvidia processors and powered entirely by local hydropower.

Anthropic overtook OpenAI as the top enterprise AI provider, now holding 32% of the LLM market by usage.

AI startup Anaconda landed a $1.5 billion valuation after raising over $150 million. Insight Partners led the round, with Mubadala also joining.

Fal, a generative AI platform for audio, video, and images, raised $125 million at a $1.5 billion valuation in a round led by Meritech.

China’s cyberspace regulator summoned Nvidia over security risks tied to its H20 AI chips, citing concerns about tracking and remote shutdown features.

🌍 International Markets

🇲🇽 President Trump granted Mexico a 90-day tariff reprieve on non-automotive, non-metal goods, dodging a 30% hike for now.

🇧🇷 Brazil saw a 50% US tariff slapped on most exports after President Trump escalated his feud over the prosecution of former President Jair Bolsonaro.

🇨🇳 The IMF raised its China GDP forecast more than any other country, citing a 5.9% jump in total exports for the first half of 2025.

🇿🇼 Zimbabwe’s economy was set to grow 6% this year, rebounding from last year’s drought and currency turbulence.

🇮🇷 Iran’s annual inflation rate spiked to 41.2% in July, the highest in two years, sending bread prices in Tehran up as much as 52%.

🎤️ What you said last time

📊 Earnings

Apple reported earnings up 0.17 per share after market close; shares fell 0.2% during trading.

Amazon posted Q4 results with expected revenue; shares finished up 1.7% but fell after market close.

Bristol-Myers Squibb released strong quarterlies as expected; shares still dropped 5.8% on the announcement.

Coinbase beat Q4 expectations on EPS and revenue; shares bumped 0.7% on crypto momentum.

Reddit announced earnings as anticipated; shares jumped 7.5% despite recent volatility.

Roblox posted a Q2 adjusted loss, but revenue soared 50%; shares vaulted over 10% on the revenue beat.

📢 We want to hear from you

We love hearing from you, and we deeply appreciate your feedback.

⭐️ What did you think of today's edition?

📺 What to watch today

That’s all for today. Did I miss anything? Smash the reply button to let me know.

Cheers,

Brandon with Stefan & Wyatt

The information provided in Stocks & Income is for informational and educational purposes only and should not be construed as financial advice, investment advice, or a recommendation to buy or sell any securities. Stocks & Income is not a registered investment advisor, broker-dealer, or licensed financial planner. Always do your own research and consult with a licensed financial advisor before making any investment decisions. We may hold positions in or receive compensation from the companies or products mentioned. Disclosures will be made where applicable.