Good morning.

We are in a generational news cycle right now, and heavy-hitting headlines keep coming: new core inflation data, a Mag 7 mega collaboration, and political unrest in the Middle East.

Keep one thing in mind, though: it’s important to check the pulse of every social sphere, not just the big media corps. That’s why we’re looking at Reddit’s top 10 stocks today as well.

In today's edition:

The top 10 most popular stocks on Reddit last week

Iran is in free fall: hundreds dead, currency worthless, US intervention

Inflation data came in lower than expected (positive catalyst?)

Trump to make Microsoft, others eat rising power costs for consumers

We're unpacking all that (and more) in today's issue.

In partnership with FinanceHQ

Get Expert Guidance in Planning Your Financial Future

Managing your finances alone can feel overwhelming, especially with big decisions around retirement, college funding, or managing investments. A trusted financial advisor can help you navigate with clarity and peace of mind.

FinanceHQ makes finding the right advisor easy. In just minutes, our platform asks you a few questions and introduces you to up to three pre-vetted fiduciary advisors.

Whether you’re planning for retirement, growing your wealth, or protecting your family’s future, we’ll match you to professionals who understand your goals and can help you achieve them.

Please support our partners!

📰 Market Headlines

Markets eked out fresh records Monday after early volatility over news that the Justice Department has opened a criminal investigation into Fed Chair Jerome Powell.

The Dow rose 0.2%, the S&P 500 gained 0.2%, and the Nasdaq added 0.3%.

Iran is in free fall as anti-government protests have erupted, leading to the deaths of as many as 1,000, according to Time. The White House has threatened 25% tariffs on any country that does business with Iran moving forward. The country’s currency, the rial, has effectively dropped to zero: 1.47 million rial to 1 US dollar.

Iran is ready to retaliate if the US gets seriously involved. If the White House does intervene, we expect defense stocks and gold to do well.

Reddit is constantly talking about stocks, and last week was no different. Headline after headline hit users’ social feeds, and discussion was on fire for a few particular stocks. Here are the top 10 most popular stocks on Reddit from last week.

Microsoft (MSFT) might be saving consumers money on their electricity bills next week. President Trump announced that Microsoft (followed by other big tech companies later) will apparently be making “major changes” starting this week to ensure that it doesn’t pass along rising electricity costs due to AI data center usage to consumers. The announcement seems to be part of Trump’s overall push for affordability leading up to midterm elections.

The new core CPI numbers for December came in today: inflation rose 0.2% on the month and 2.6% year over year, which were both below the expected 0.3% and 2.8%. The market responded positively to the news, likely interpreting lower inflation as support for future rate cuts in 2026.

Apple (AAPL) picked Google's (GOOG) Gemini to power an AI-upgraded Siri launching later this year. The multiyear Mag 7 mega-partnership marks a major shift in Apple's AI strategy after the company delayed the Siri overhaul in 2025. Google briefly touched a $4 trillion market cap on the news before pulling back. The deal bolsters Google's AI comeback against OpenAI and adds to its existing search engine arrangement with Apple.

JP Morgan Chase (JPM) posted a double beat, exceeding Wall Street’s expectations for both earnings and revenue. Investors are waiting to see the reports of other financial giants throughout the week, including:

Wednesday: Bank of America (BAC), Citigroup (C), and Wells Fargo (WFC)

Thursday: Goldman Sachs (GS) and Morgan Stanley (MS)

In partnership with Wispr Flow

Investor-ready updates, by voice

High-stakes communications need precision. Wispr Flow turns speech into polished, publishable writing you can paste into investor updates, earnings notes, board recaps, and executive summaries. Speak constraints, numbers, and context and Flow will remove filler, fix punctuation, format lists, and preserve tone so your messages are clear and confident. Use saved templates for recurring financial formats and create consistent reports with less editing. Works across Mac, Windows, and iPhone. Try Wispr Flow for finance.

Please support our partners!

🤖 AI/Future/Tech News

Alphabet crossed the $4 trillion market cap threshold Monday, joining Nvidia, Microsoft, and Apple in the elite club after a 65% rally in 2025.

Apple services hit record highs in 2025: 850 million weekly App Store users and $550 billion paid to developers since 2008, as Apple Music logged its best year.

🪙 Crypto

BitGo filed to raise $201 million in its IPO at a $1.85 billion valuation. The crypto custodian posted $35.3 million in net income through the first nine months of 2025.

President Trump-backed World Liberty Financial launched a lending platform powered by Dolomite as its USD1 stablecoin climbed to nearly $3.5 billion in market cap, trailing only PayPal's PYUSD among dollar-backed tokens.

❓ Market Trivia Corner

🎤️ What you said last time

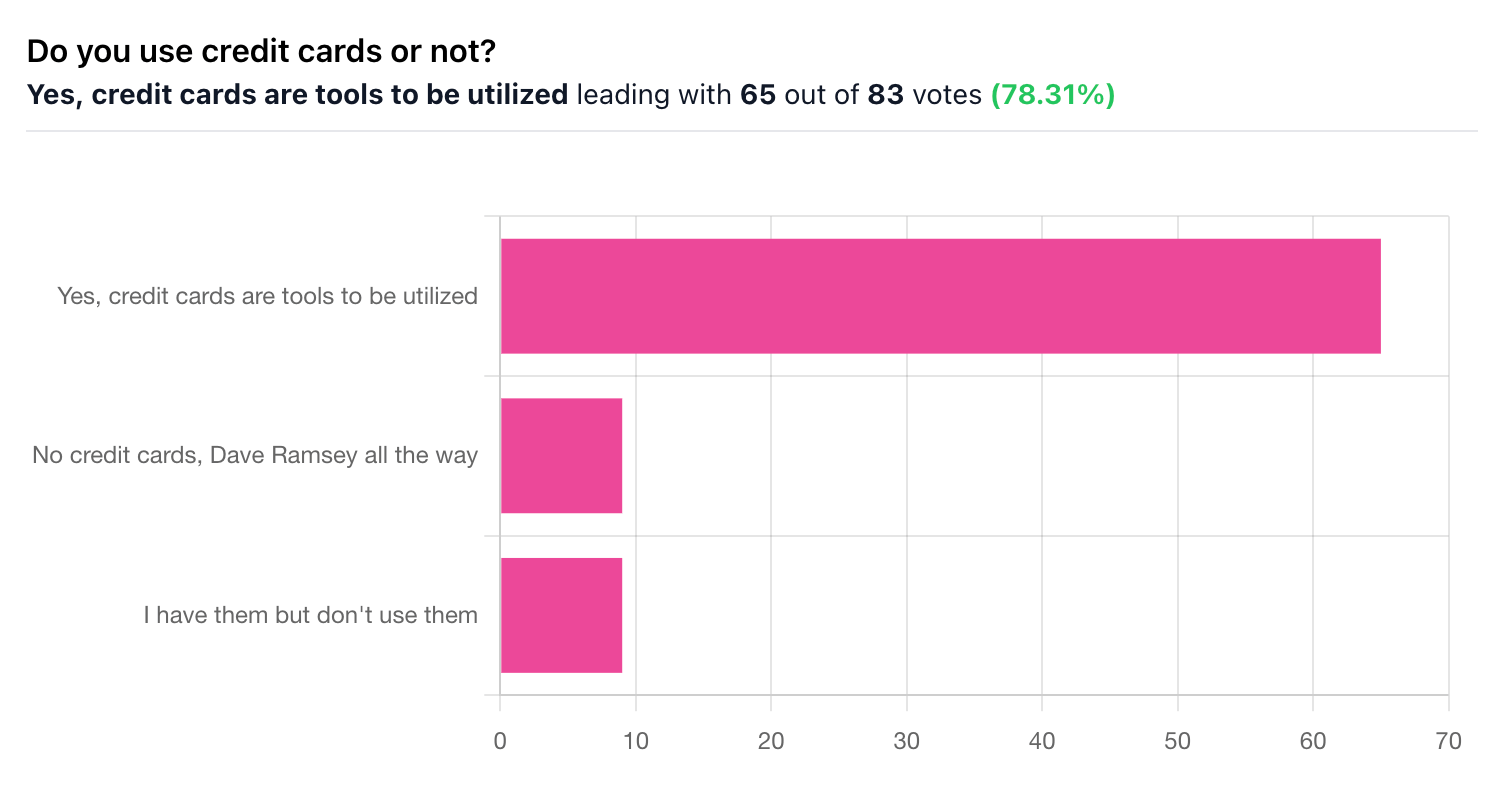

“Free money if used right. Most people don't have the discipline though.”

“Only if necessary or to get points. Dangerous otherwise.”

“Everything I can put on a credit card without a significant surcharge, I do. Pay them off weekly, always within a week's % error to know exactly what I have in liquid cash, and I make thousands in cash back/miles annually.”

🧠 The Missing (Market) Links

Did you know that if you bought the S&P 500 every time CNBC did a “Markets in Turmoil” special over the past 10 years, you’d be up 40%?

US cage-free egg prices hit an all-time low of $0.89/dozen as flocks rebounded to 140.4 million birds after avian flu repopulation.

🐮 Beefy Headlines:

Brazil surpassed the US as the top beef producer in 2025, shipping nearly $17 billion in exports as American herds shrank to 1950s levels.

China slapped a 55% tariff on beef imports above country quotas starting January 1, reshaping trade flows for Brazil and Australia.

Ground beef hit $6.78 per pound in November, up 16% year-over-year, with US cattle herds at their smallest since Eisenhower.

JBS is shuttering its California beef plant outside LA, cutting 374 jobs as tight cattle supplies squeeze meatpackers.

📜 Quote of the Day

📢 We want to hear from you.

We love hearing from you, and we deeply appreciate your feedback.

⭐️ What did you think of today's edition?

That’s all for today. Did we miss anything? Smash the reply button to let me know.

Cheers,

Brandon & Blake of Invested Inc

The information provided in Stocks & Income is for informational and educational purposes only and should not be construed as financial advice, investment advice, or a recommendation to buy or sell any securities. Stocks & Income is not a registered investment advisor, broker-dealer, or licensed financial planner. Always do your own research and consult with a licensed financial advisor before making any investment decisions. We may hold positions in or receive compensation from the companies or products mentioned. Disclosures will be made where applicable. Past performance doesn’t guarantee future results.

Stocks & Income, AltIndex, Finance Wrapped, The Chain, and Future Funders are all owned by Invested, Inc.open