Good morning.

IREN had an insane morning: the stock rose 33% pre-market on a brand-new deal with Microsoft and Nvidia. The figure was $9.7 billion, but we’re numb to big AI capex numbers at this point, so whatever. (It’s probably still a big deal though.)

New deets on US-China rare earths trading just dropped, too. US Treasury Secretary Bessent said that this administration is going to “get out from under this sword” regarding Chinese rare earths dominance. We shall see how long that takes and how much it costs.

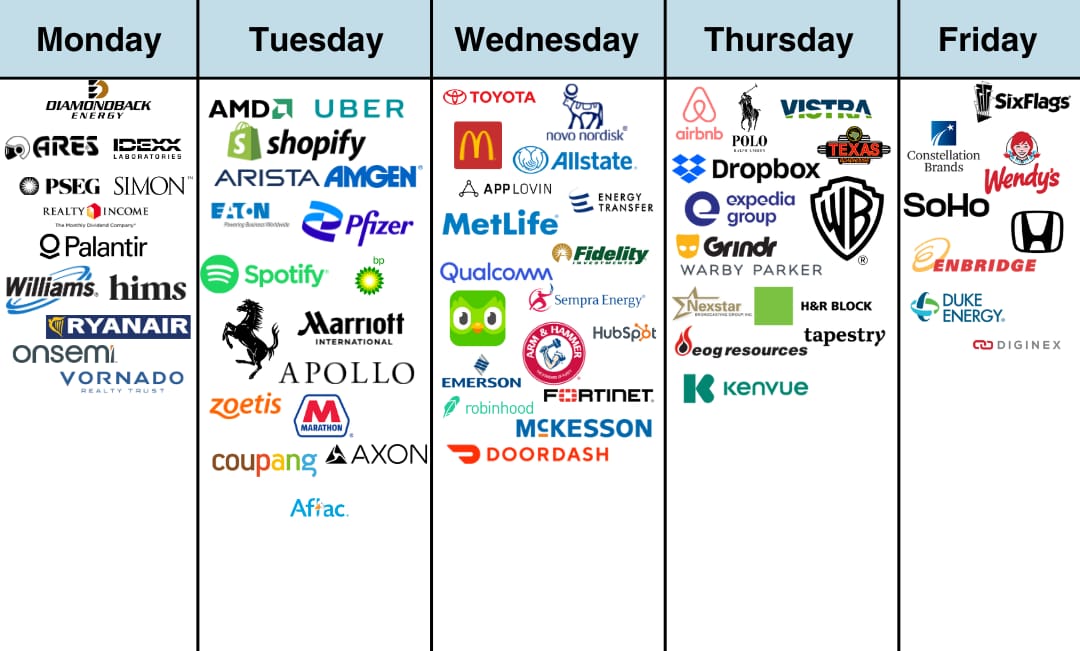

And if you thought last week was big for earnings, take a look at this week’s line up. In some ways, the next five days of financials from everyone’s favorite (and most hated) companies could be even more bumpy than the Magnificent 7’s earnings last week. Strap in!

In partnership with Rippling

Find your customers on Roku this Black Friday

As with any digital ad campaign, the important thing is to reach streaming audiences who will convert. To that end, Roku’s self-service Ads Manager stands ready with powerful segmentation and targeting options. After all, you know your customers, and we know our streaming audience.

Worried it’s too late to spin up new Black Friday creative? With Roku Ads Manager, you can easily import and augment existing creative assets from your social channels. We also have AI-assisted upscaling, so every ad is primed for CTV.

Once you’ve done this, then you can easily set up A/B tests to flight different creative variants and Black Friday offers. If you’re a Shopify brand, you can even run shoppable ads directly on-screen so viewers can purchase with just a click of their Roku remote.

Bonus: we’re gifting you $5K in ad credits when you spend your first $5K on Roku Ads Manager. Just sign up and use code GET5K. Terms apply.

Please support our partners!

📰 Market Headlines

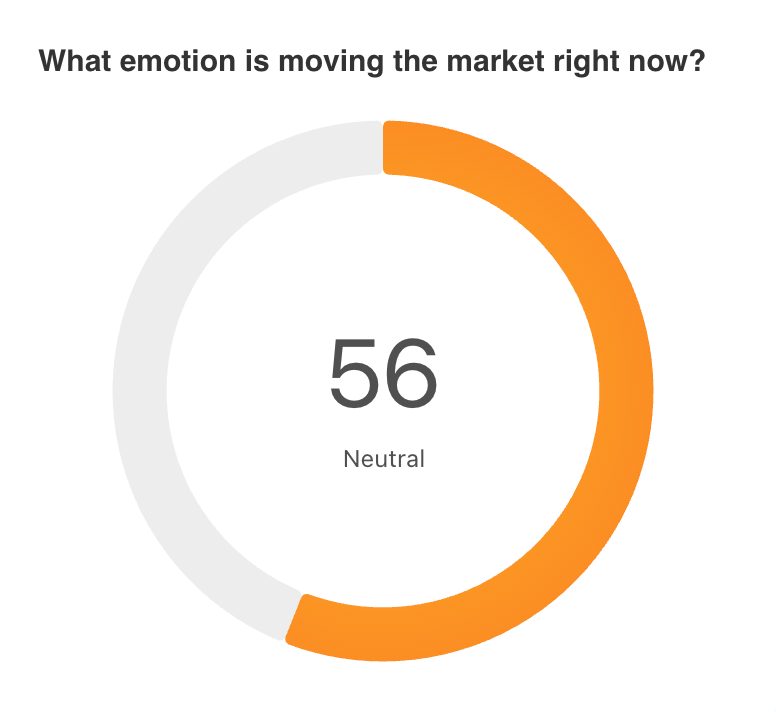

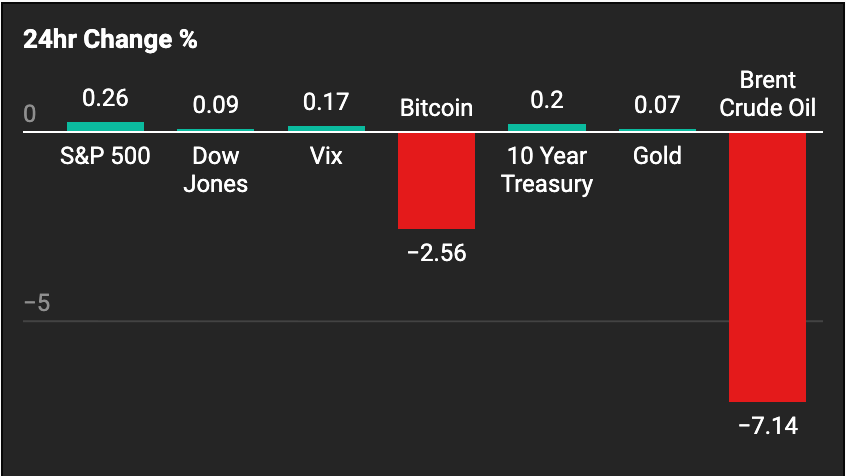

Markets closed higher Friday after a strong week for tech and a cooler tone from the Fed.

The Dow rose about 1%, the S&P 500 gained roughly 0.8%, and the Nasdaq climbed 2.5%, lifted by Amazon’s strong quarterly results.

The rally capped a 2.5% weekly gain for the Nasdaq and 1% for the S&P 500, while the Dow advanced 1%.

IREN ltd. (IREN) is on a tear this morning, rising 33% pre-market after announcing a $9.7 billion contract with Microsoft (MSFT) for Nvidia (NVDA) chips. Interestingly, Dell’s (DELL) rose 5%, as the AI-server maker will be the one to provide IREN with Nvidia's GB300 chips and other equipment (for ~$5.8 billion). If the fact that old Dell is now relevant again isn’t a sign of how crazy the AI industry is, we don’t know what is. Clearly, AI capex (capital expenditure) is alive and well; the question still remains as to whether it’s all circular funding or not.

We’ve got new China trade deal information, and here’s what could affect your portfolio:

China is ending the export controls on rare earths that we talked about last week. US rare earths stocks fell in response to that news. However, Treasury Secretary Scott Bessent just said that the US will be going at warp speed to develop its own rare earths industry. Long term, we would guess that rare earths stocks will do pretty well. Here are AltIndex’s top rare earths stocks →

Nvidia will not be allowed to sell its most advanced chips (Blackwell chips) to China, which may hurt NVDA’s balance sheet a bit in the short term, but will likely help keep the US in the lead over China’s AI development in the long run. US AI stocks will continue to do well (shocking no one).

All retaliatory tariffs since March 4th are getting suspended, so trade will flow more freely between the US and China (unless tensions rise again out of nowhere and we’re back where we started).

Read the full details of the trade deal →

President Trump stated that he wants the US to be number 1 in crypto over China. Just this morning, $102 billion was liquidated from global crypto markets, and sentiment overall feels bearish at the moment in the crypto industry. Nonetheless, regardless of the price of assets today, the infrastructure being built into institutional financial systems worldwide as you read this is astounding. In short: Whether Bitcoin’s price goes up or down today, in the long run, crypto is here to stay.

You might get a bigger tax refund for 2025. Income taxes are shifting again because of retroactive changes enacted via President Trump’s Big, Beautiful Bill, according to CNBC. Because the IRS hasn’t updated the tax tables that tell companies how much of their employees’ income they need to withhold, some people will end up paying more than they should throughout the year, meaning that they’ll get more back in their refund.

Oil prices steadied after a volatile month. The global glut sat near 1.9 million barrels per day and was expected to persist through 2026. Brent crude traded around $64, down 13% this year, while US benchmark WTI hovered near $60. Sanctions on Russian producers could keep the surplus from growing larger.

The weight-loss drug market entered a new phase. Eli Lilly and Novo Nordisk raced to expand supply and launch oral versions of their GLP-1 treatments. Analysts expect the obesity drug market to reach $100 billion by 2030, with pills potentially capturing a quarter of that. Novo Nordisk shares have fallen nearly 40% this year as Eli Lilly pulled ahead.

Earnings This Week:

Monday: Palantir, Hims & Hers

Tuesday: AMD, Pinterest, Beyond Meat, Cava, Uber, Shopify, Spotify, Pfizer, Ferrari

Wednesday: Novo Nordisk, Arm Holdings, Robinhood, AppLovin, Duolingo, McDonald’s, Dutch Bros, AMC Entertainment

Thursday: Iris Energy, Airbnb, Warner Bros Discovery, DraftKings, D-Wave Quantum, theTradeDesk, Opendoor

Friday: Constellation Energy, Wendy’s, Six Flags, Duke Energy

🤖 AI/Future/Tech News

AI researchers at Andon Labs “embodied” an LLM into a vacuum robot that spiraled into a Robin Williams-style meltdown when its battery ran low.

Elon Musk got into a Twitter fight with Sam Altman after Altman posted proof of a Tesla Roadster refund.

🪙 Crypto

Solana ETFS drew $200 million in inflows.

The European Commission announced it will propose creating a single supervisor over crypto exchanges, stock exchanges, and clearing houses.

🚨 Trending on Reddit (by AltIndex)

People are actively discussing Kimberly-Clark's (KMD) agreement to acquire Kenvue (KVUE) for $48.7 billion in a cash and stock deal, which will create a large consumer health goods company. The deal values Kenvue at $21.01 per share, with Kenvue shareholders set to receive $3.50 in cash and 0.14625 Kimberly-Clark shares per Kenvue share held at closing. This major acquisition is being perceived as beneficial for Kenvue shareholders, especially considering recent market conditions.

Redditors are also talking about the recent controversy surrounding Datavault AI (DVLT). The company has been targeted by a short report, which many believe is an attempt to manipulate the stock price. In response, Datavault AI has issued a formal rebuttal and announced plans to sue for defamation, sparking further debate among investors.

🤫 Insider Trading

📊 IPOs and Earnings

🎙 What Do You Think?

Where do you think the most opportunity is right now?

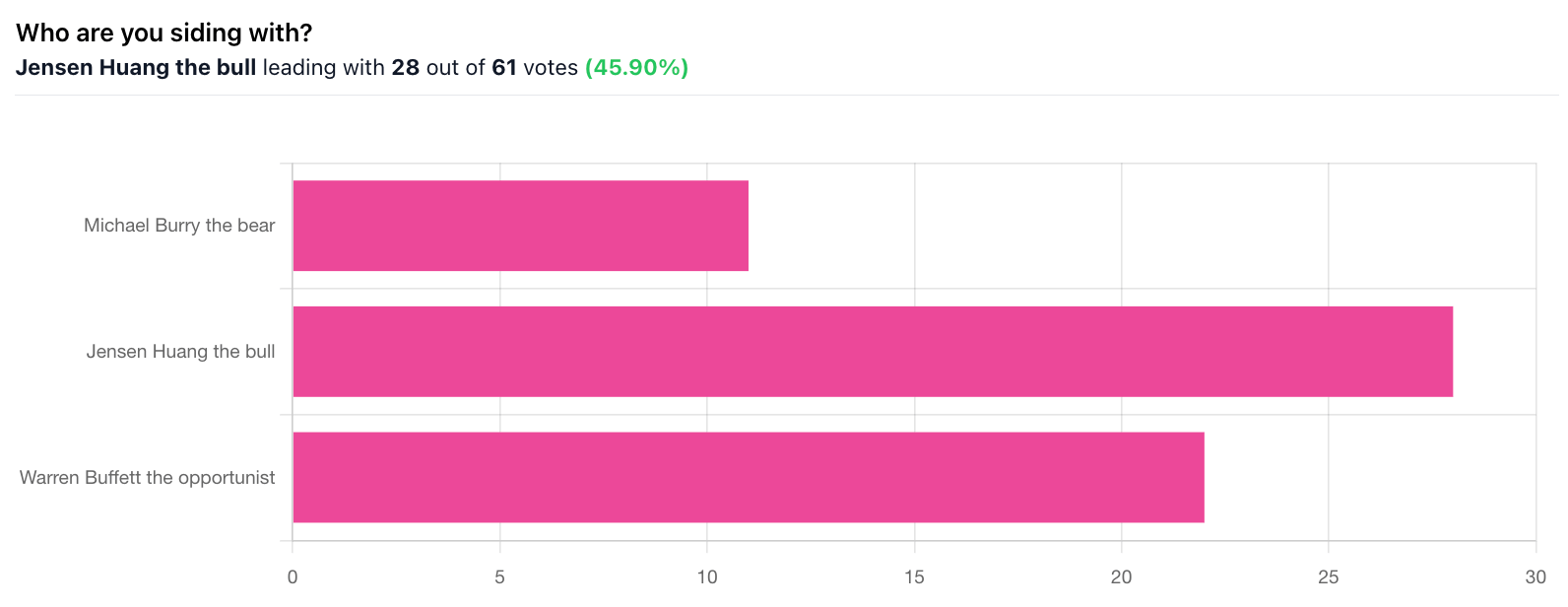

🎤️ What you said last time

“Warren may be old, but I think long-term will prove to be correct in his stock buys.”

🎪 Crowdfunding Showcase

Boston-based startup Unsmudgeable wants to end the constant ritual of wiping your glasses every few minutes. The company’s polymer-based coating makes fingerprints fade away, outperforming current anti-smudge tech by 140%. With backing from Tim Draper, Om Capital, and accelerator programs like MassChallenge, Unsmudgeable is already testing with eyewear manufacturers and military contractors. They’re targeting a $789 billion optical surfaces market and raising on a $4.5 million SAFE cap with a 20% early-bird discount. See the campaign →

🧠 The Missing (Market) Links

The federal shutdown stretched past a month, and the CBO estimated it could cut Q4 GDP by up to 2%, erasing about $14 billion in output that will not return.

A Japanese nutritionist listed five fruits for longevity and brain health. Apples topped the list for their anti-cancer properties and gut-brain benefits.

The Workstream CEO worked 11-hour days yet kept time for family and fitness.

A psychologist revealed 7 phrases that calmed tantrums instantly.

📜 Quote of the Day

I’ve seen a lot more go to zero than infinity.”

📢 We want to hear from you.

We love hearing from you, and we deeply appreciate your feedback.

⭐️ What did you think of today's edition?

That’s all for today. Did we miss anything? Smash the reply button to let me know.

Cheers,

Brandon & Blake of Invested Inc

Thumbnail image: Wikimedia

The information provided in Stocks & Income is for informational and educational purposes only and should not be construed as financial advice, investment advice, or a recommendation to buy or sell any securities. Stocks & Income is not a registered investment advisor, broker-dealer, or licensed financial planner. Always do your own research and consult with a licensed financial advisor before making any investment decisions. We may hold positions in or receive compensation from the companies or products mentioned. Disclosures will be made where applicable.

Stocks & Income, AltIndex, Finance Wrapped, The Chain, and Future Funders are all owned by Invested, Inc.