*past 24-hour performance

💨 TL;DR

Asian stock markets fell due to rising bond yields affecting Wall Street.

U.S. Federal Reserve Chair Jerome Powell indicated potential further interest rate hikes.

ICBC Financial Services in the U.S. was hit by a ransomware attack, affecting Treasury market trading.

Wall Street's winning streak ended amid rising Treasury yields and rate hike concerns.

Crude oil prices recovered slightly.

The U.S. dollar strengthened against the Japanese yen.

📰 Market Headlines

Hawkish: Federal Reserve Chair Jerome Powell said Thursday that the central bank “will not hesitate” to raise interest rates further if needed to curb inflation. (The Hill)

Oil’s Coming Down: Oil prices were up slightly on Friday but are set to fall for a third week as concerns of supply disruptions from the Israel-Hamas conflict have ebbed, allowing demand worries to reassert themselves. (Investing.com)

But: Futures markets are betting the price of oil will rise. (Reuters)

Which Way is the Wind Blowing? It’s been a rough year for renewables tech, but Macquarie CEO Shemara Wikramanayake says the wind industry is still “viable.” (Bloomberg)

Overpriced: The stock market isn’t just expensive; it is extremely pricey. And yet history indicates it can post impressive gains from the current level. (Barrons)

S&P 400? Nearly 250 companies in the S&P 500 are nursing losses in 2023, and nearly 20% fail to meet the $14.5 billion size threshold set for new members. (Financial Post)

DOA: The UK economy was flat QoQ with significant drops in several important sectors. (CNBC)

🧠 What do you think?

🕶️ Market Vibes

😱 Fear and Greed Index

🎤 What you said

Yesterday, y’all bet big on weight loss over electric vehicles.

Comment of the day:

“EV is driven by a faith that has avoided the economic realities. It’s a fad not a meaningful solution in its current form. In contrast, the drugs meet personal needs whilst contributing towards an overall reduction in healthcare costs. One approach delivers the practicalities the other has the energy of a religious cult. ( But we also need to recall that faith can move mountains usually at an unjustifiable human cost.) ”

🏢 Vetted commercial real estate

EquityMultiple lets you invest in high-yield, professionally managed commercial real estate.

Their nine-month Alpine notes offer 7.4% yield, and let you start with as little as $5k.

Their recently launched Ascent Income Fund has a higher target (11-13%) but also a higher minimum ($20,000)

EquityMulitple has a high bar for quality, only accepting 5% of investments that come their way.

Join 48,000 CRE investors using EquityMultiple.

SPONSOR

📊 Stocks

Brought to you by our friends at Public.com, my favorite online broker.

Desperate Times: AMC is selling an additional $350 million equity in an at-the-market offering to pay down debt. (FC)

Paying Up: Apple agreed to pay $25 million to settle a DOJ case alleging that the iPhone maker illegally discriminated against US citizens in hiring. (Fortune)

Leveling Up: Institutional buying (and holding) of gaming stocks like Take-Two Interactive and Roblox provides a bottom to support an already good 2023. (Insider Trades)

Dropping the Ball: Sphere Entertainment Co (the giant ball in Vegas) lost $98 million in its first quarter of operations. The CFO resigned. (Benzinga)

Time to Sober Up: Mega spirits maker Diageo reported "materially weaker" performance in Latin America and the Caribbean “resulting in lower consumption and consumer downtrading.” The region makes up 11% of the company’s sales (for now). (Reuters)

IP No: The biggest IPO stocks of 2023 have been terrible so far. Only one of the nine, though down 25% from the high, still trades above the IPO price. (Wolf Street)

Seven Nasdaq 100 companies have made up the vast majority of the index’s gains this year. Public lets you invest in all of them at once with their Magnificent Seven plan.

📊 And Income

Brought to you by our friends at Public.com, my favorite online broker.

Trend investing is back: The strategy is remarkably simple – buy the winners, sell the losers across a range of instruments. Trend strategies tend to have a low or close-to-zero correlation with equity returns. (II)

Monthly dividend stocks: If you’re looking for steady monthly income, consider these seven options. (24/7 Wall St)

Betting on a black swan: Market data shows that Israeli bonds are overvalued. Israel's AA rating is six notches above what CDS pricing implies. (Reuters)

If you want to invest in US stocks from companies that pay high dividends but don’t want to do the research yourself, check out Public’s High-Income Dividend-Paying plan. It follows the top 20 holdings by weight from the iShares Core High Dividend ETF (HDV).

💎 Wealth Watch

How to become a millionaire: Slow wealth is stickier because it doesn’t hit you all at once. You become accustomed to it in bits and pieces as opposed to experiencing a one-time jump that shocks the system. People appreciate slow wealth more than fast wealth. Read more »

How to know when it’s time to retire: Wait too long, and you might regret the extra years you gave to work. Leave too early, and you could feel lost in your new life. Read more »

Why working longer is a bad retirement plan: Working longer is among the best ways to ensure you don’t outlive your retirement savings. The problem is you can’t count on it as a strategy. Regarding retirement age, there’s a big gap in expectations versus reality. Read more »

The IRS just announced new tax brackets: Income thresholds are moving higher across the board. Make sure to check in. Read more »

🗳️ Outside the Box

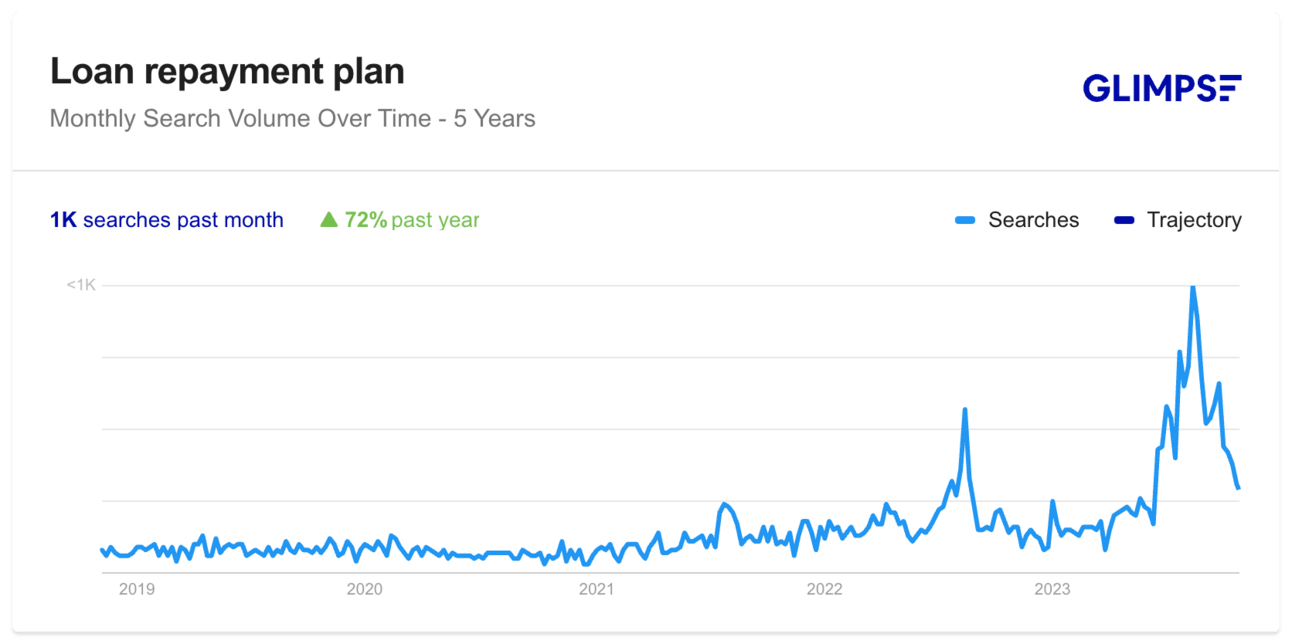

Student loans are back, and they’re hitting hard.

That’s all for today. Did we miss anything? Smash reply to let us know.

Cheers,

Wyatt

Notes

Please read this disclaimer. The authors of Alt Assets, Inc. are not attorneys, investment advisers, accountants, tax professionals or financial advisers and any of the content should not be taken as professional advice. They are self-taught accredited investors, sharing information, research, entertainment and lessons learned based solely on their own experience and circumstances. Individual results may vary. The published content is unique, based on certain assumptions and market conditions at the time of publishing, and is intended to serve solely as research, not financial advice. For entertainment purposes only. Not investment advice. Alts I LLC (the “Fund”) is an affiliate of Alt Assets, Inc. and the Fund has conducted a private placement offering under Rule 506(c) of Regulation D of the Securities Act of 1933, as amended. The Fund may invest in one, several, or all of the alternative asset classes that Alt Assets, Inc. publishes content about on its site. Any of the Fund’s investments that have positive designations on the Alt Assets, Inc. site are purely coincidental, as the Fund is actively managed and guided by its own investment parameters, as summarized in the relevant private placement memorandum. Alternative investing involves a high degree of risk, including complete loss of principal and is not suitable for all investors. Past performance does not guarantee future results. The newsletter may contain affiliate links, meaning that Alts.co and its associated entities may receive compensation for referring customers to the noted companies. We recommend seeking the advice of a financial professional before you make any investment in an alternative asset class or any associated entities, and we accept no liability whatsoever for any loss or damage you may incur.