Good morning.

No two ways about it, things look grim right now.

Yesterday was awful for markets, and today looks similar so far.

But there’s only one question to answer:

Do you buy the dip or is this the start of a market collapse?

We’re covering the key reasons for both positions today, and sharing why we feel positive about markets overall.

But first, while there are a lot of trash investments out there, TerraCycle is offering our readers a real trash opportunity:

In partnership with TerraCycle

Trash: America’s multi-trillion dollar missed opportunity

TerraCycle turns “unrecyclable” waste—from razors to coffee pods—into profit. Investors in the last round earned between 17-20% back in dividends. Now it’s your turn to invest in innovation for our planet and get 15% bonus stock.

This is a paid advertisement for TerraCycle’s Regulation CF offering. Please read the offering circular at https://invest.terracycle.com/

Please support our partners!

📰 Market Headlines

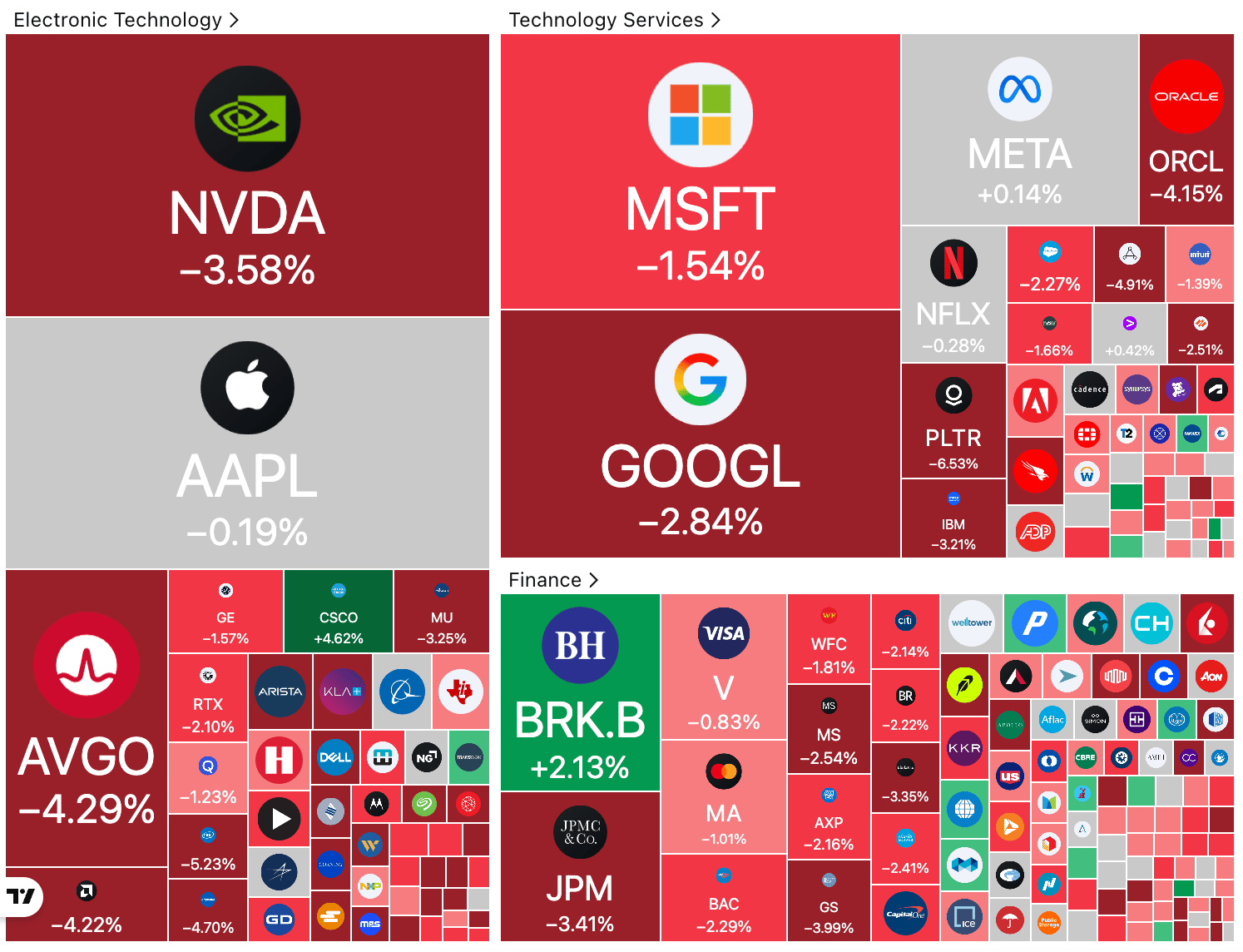

Heat map: TradingView

Markets tumbled on Thursday as investors pulled back from risk assets after the end of the record-long US government shutdown reignited uncertainty over the Federal Reserve’s next move.

The Dow dropped 797 points, or 1.6%, the S&P 500 slid 1.7%, and the Nasdaq sank 2.3% in its worst session in weeks.

Traders cut bets on a December rate cut to roughly 50%, down from 95% a month earlier, after Fed hawks signaled caution and economic data stayed murky.

Sentiment is highly bearish right now. Things look bad on the stock market, the Twitter timeline, the CNBC newsfeed, and (likely) your portfolio. Here are just some of the negative catalysts at play here:

Yesterday was Wall Street’s worst day in over a month

Bitcoin has fallen below $97,000 and is printing a death cross

Futures are down this morning too

Verizon just cut 15,000 jobs

White House says last month’s jobs data may never be released

Rate cuts in December are NOT guaranteed (see above jobs data point)

Warren Buffett’s retirement letter

Michael Burry shutting down his hedge fund

Kalshi odds: 31% chance of recession in 2026

However, if we zoom out, it becomes clear that the macro picture hasn’t changed:

The White House seems bent on propping up this bull market.

The Government’s only plan for eliminating $38 trillion in debt is to outgrow it (echoed by Elon Musk)

The US Treasury is expected to start quantitative easing soon.

The government shutdown is over, and more liquidity will enter the economy from that alone

Total AI-related global capital expenditure (CaPex) is still huge at $405B, regardless of stock prices.

$2,000 “tariff dividend” checks are likely coming.

The last three times Bitcoin experienced a death cross, it basically marked the bottom and preceded a huge rally.

So, our conclusion? If we had to take a guess, we’d guess that this is a dip, not a market collapse or severe correction. We don’t believe that the US government (or the Magnificent 7 plus OpenAI) would allow the bull market to end at this point. To be honest, if stock prices plummeted, we wouldn’t be surprised if capital expenditure just kept on going. We think these AI companies will continue to grow.

And yes, there are some similarities between this market and the dot com bubble. But you know what’s different? The US wasn’t in a race with China over the internet in 2000. But it IS in an AI race with China right now. And whether you feel that a “too big to fail” bull market propped up by the government is right or wrong, it does seem to be where we find ourselves. Of course, we could be missing the mark, and this isn’t financial advice; do your own research and make your own choices. But that’s our take.

Tech stocks led the rout yesterday. Nvidia fell 3.6%, Tesla plunged 6.6%, and Disney cratered 7.7% after missing revenue estimates. The “Magnificent Seven” collectively dropped about 2.7%, wiping out a large chunk of this month’s gains.

Cisco bucked the trend. The networking giant raised its full-year outlook on booming AI infrastructure demand, sending shares up 7%. The company now expects up to $61 billion in sales for FY2026, about $1 billion above prior guidance, and said its partnership with Nvidia is driving new data center orders.

🤫 Insider Trading

📊 IPOs and Earnings

Disney reported Q4 revenue of $22.46 billion, missing estimates as linear TV revenue fell 16% and operating income dropped 21%. Shares plunged 7.8% as investors punished the weakness in traditional media.

Applied Materials projected Q1 revenue of $6.85 billion, topping forecasts, but warned of weaker China demand in 2026 from tighter US export curbs, and shares fell over 4% in after‑hours trading.

StubHub beat revenue expectations at $468.1 million but logged a $1.33 billion loss from an IPO stock‑comp charge but REFUSED to issue guidance. Shares cratered 20%.

🎙 What Do You Think?

Pulse check after the past couple days: Bullish or Bearish?

🎤️ What you said last time

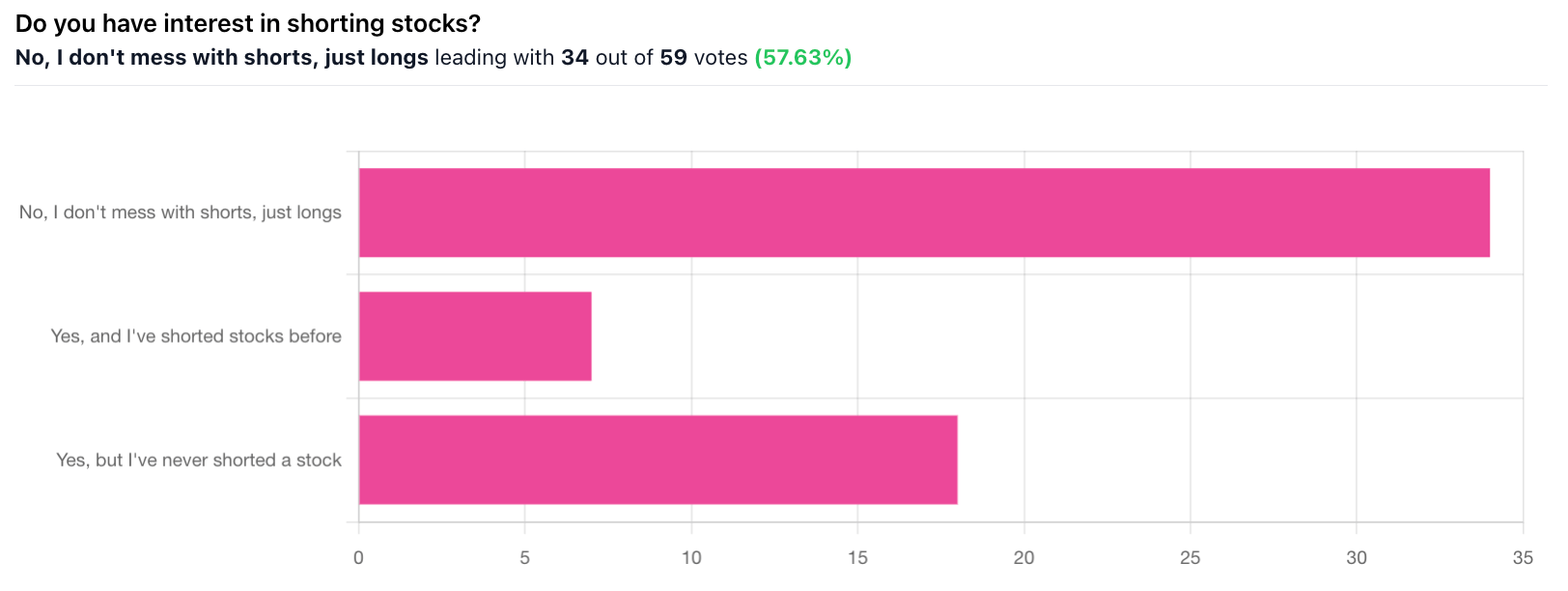

“I'm terrible at telling if a price is going down. It’s hard enough to time a sell.“

🧠 The Missing (Market) Links

Rivian’s CEO was granted a $4.6 billion pay plan after he and his dad took out second mortgages to launch the company.

Brené Brown said 40% of self-help gurus are “sheer grifters” giving predatory advice online.

A 28-year-old turned a $25K crypto bet into $400K—then said he’d never do it again.

The IRS raised 2026 limits to $24,500 for 401(k)s and $7,500 for IRAs, cutting some borrowers’ student loan bills.

📜 Quote of the Day

You can’t predict, but you can prepare.”

📢 We want to hear from you.

We love hearing from you, and we deeply appreciate your feedback.

⭐️ What did you think of today's edition?

That’s all for today. Did we miss anything? Smash the reply button to let me know.

Cheers,

Brandon & Blake of Invested Inc

Thumbnail image: Flickr, Junichi Yamashita

The information provided in Stocks & Income is for informational and educational purposes only and should not be construed as financial advice, investment advice, or a recommendation to buy or sell any securities. Stocks & Income is not a registered investment advisor, broker-dealer, or licensed financial planner. Always do your own research and consult with a licensed financial advisor before making any investment decisions. We may hold positions in or receive compensation from the companies or products mentioned. Disclosures will be made where applicable.

Stocks & Income, AltIndex, Finance Wrapped, The Chain, and Future Funders are all owned by Invested, Inc.