Good morning.

Wall Street’s sugar high didn’t last.

Stocks ripped higher early Thursday, then faceplanted by the close.

In this issue:

Nvidia’s post-earnings whiplash: up 5% premarket, down 3.3% by the bell

September jobs report: 119,000 added, unemployment up to 4.4%, Fed still divided

Feds bust four in a $2 million Nvidia GPU smuggling ring to China

Let’s get into it.

In partnership with Elf Labs

$6B Team Just Unleashed Cinderella on a $2T Market

Cinderella isn’t looking for her glass slipper— she’s busy smashing the $2T media market to pieces.

Elf Labs spent a decade at the US Patent & Trademark office in a historic effort to lock up 100+ historic trademarks to icons like Cinderella, Snow White, Rapunzel and more — characters that have generated billions for giant studios. Now they’re fusing their IP with patented AI/AR to build a new entertainment category the big players can’t copy.

And the numbers prove it’s working.

In just 12 months they raised $8M, closed a nationwide T-Mobile–supported telecom deal, launched patented interactive content, and landed a 200M-TV distribution partnership.

This isn’t a startup. It’s a takeover. And investors are sprinting to get in.

Lock in your ownership now

This is a paid advertisement for Elf Lab’s Regulation CF offering. Please read the offering circular at https://www.elflabs.com/

Please support our partners!

📰 Market Headlines

US stocks erased early gains Thursday and ended sharply lower after an initial surge faded.

The Nasdaq plummeted 2.2%, the S&P 500 dropped 1.5%, and the Dow fell 0.8% as tech stocks led a broad selloff.

Nvidia (NVDA) initially jumped 5% on strong earnings but finished down 3.3%. The reversal dragged other chip stocks lower, with Western Digital (WDC) tumbling 10% and Micron (MU) falling 9%.

Polymarket odds of a 25 bps December rate cut jumped from 33% to 61% in the past hour. It’s likely because the NY Fed’s President Williams just said he does see further room for adjustment to rates. That was after delayed September jobs report yesterday delivered positive results for employment (meaning lower chance of rate cuts), and then Morgan Stanley announced they didn’t expect a rate cut at all. Here’s why a rate cut would be good for risk-on assets →

Walmart soared 6.6% after crushing earnings expectations and raising full-year guidance. Same-store sales grew 4.5% and revenue hit $179.5 billion, beating estimates. But CFO John David Rainey warned the affordability crisis is deepening, noting food prices remain 25% higher than pre-COVID levels.

Are you invested in dividend stocks? Or maybe thinking about starting? Having semi-fixed income is a major financial asset, especially with how bumpy the market is right now. If you’d like to get started or look at adding to your portfolio, here are some free resources:

• Altindex’s top 5 dividend stocks and their yields →

• Our guide to building a $1,000/month dividend portfolio →

Bath & Body Works crashed 25% after slashing its full-year forecast and reporting disappointing Q3 results. Sales fell 1% to $1.59 billion as the retailer cited weaker discretionary spending. CEO Daniel Heaf launched a multi-year turnaround plan that could take at least two years to execute.

Federal prosecutors charged four people with illegally smuggling Nvidia GPUs to China, including 50 of the coveted H200 chips. The scheme allegedly involved a fake real estate company that served as a front for $2 million in unlicensed exports, highlighting how export controls are being circumvented.

🪙 Crypto

Spot bitcoin ETFs finally saw some positive flows, ending a five-day outflow streak and pushing BTC above $92,000 (it fell below $83,000 since then).

El Salvador defied the IMF and bought the dip, acquiring 1,090 BTC for roughly $100 million as the price slid below $90,000.

Under new leadership, SEC enforcement actions against public companies dropped 30% in fiscal year 2025.

🚨 Trending on Reddit

New Fortress Energy chatter spiked as Redditors eye a possible short squeeze. We’re seeing talk about heavy short interest and steep borrowing fees, though many warn it’s a risky bet without a clear catalyst.

Tesla threads lit up after the stock’s surprise rally. Some users are celebrating gains, others are baffled by the move, especially since it outpaced Nvidia right after Nvidia’s strong earnings.

🤫 Insider Trading

⚾️ Alternative Investment: Collectibles

Kalshi and StockX launched prediction markets tied to collectible prices, letting users bet on future average sale prices of Pokémon cards, sneakers, and Labubu figurines. StockX provides real-time sales data to power the betting contracts across categories like top-traded brands during major retail moments.

eBay rolled out a new scanning feature that delivers instant comps from two years of sales data, including Best Offer prices, by simply pointing your phone at sports cards. The free tool refreshes daily and includes PSA population data, potentially disrupting existing card pricing apps that charge for similar services.

🎪Crowdfunding Showcase

Freeland Spirits is a women-owned distillery that's been named Portland's Best for four years running. You can already find their gin and bourbon in 27 states at places like Whole Foods and Total Wine. The company is on track for $3 million in 2025 revenue with a 38% compound annual growth rate and is now raising funds to open a flagship store inside Portland International Airport. The goal is to double the business within two years.

🎙 What Do You Think?

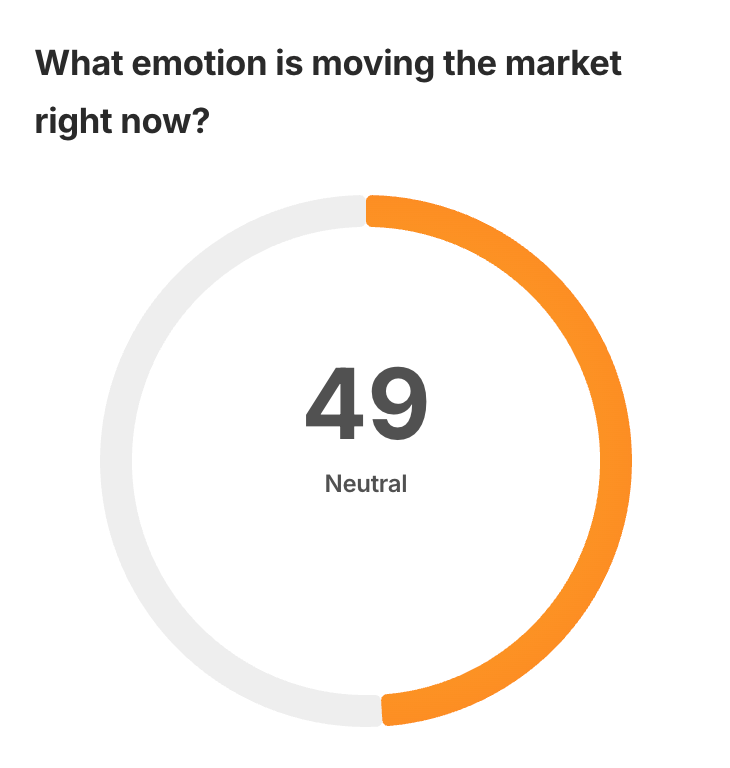

Rate cut prediction for December as of now:

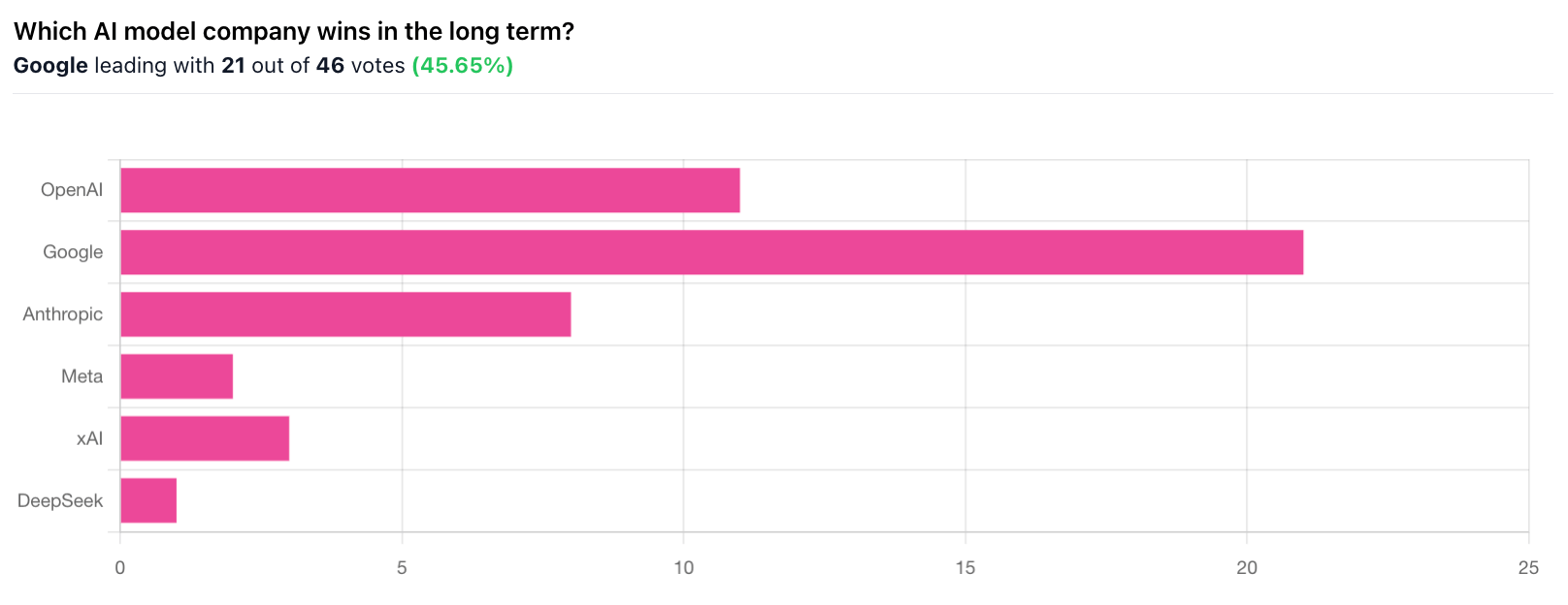

🎤️ What you said last time

“IMO- ChatGpt won the "proprietary eponym" game. They were the first to become mainstream name and will likely prosper the most long-term. They're the Kleenex of LLMs.“

🧠 The Missing (Market) Links

Swiss watch exports tumbled 47% to the US in October as President Trump’s tariffs hit luxury goods, pulling total exports down 4.4%.

US hotel occupancy slid for the eighth straight month to 65.8% in October, while average daily rates rose 1.5% to $167.71 and RevPAR dipped to $110.35.

More Americans fell behind on utility bills, with past-due balances up 9.7% year-over-year to $789. Nearly 6 million households now face collection notices.

The cost of a Thanksgiving dinner for 10 people dropped 5% from last year to $55.18, marking the third straight annual decline.

A 44-year-old CEO turned a side hustle into a $1 billion business after bankruptcy. His “superpower” was starting fast and pivoting faster.

Nearly a quarter of singles moved in early to save money. Gen Z led the trend, with 38% saying they’d cohabitate sooner for financial relief.

📜 Quote of the Day

In the short run, the market is a voting machine. In the long run, it is a weighing machine.””

📢 We want to hear from you.

We love hearing from you, and we deeply appreciate your feedback.

⭐️ What did you think of today's edition?

That’s all for today. Did we miss anything? Smash the reply button to let me know.

Cheers,

Brandon & Blake of Invested Inc

The information provided in Stocks & Income is for informational and educational purposes only and should not be construed as financial advice, investment advice, or a recommendation to buy or sell any securities. Stocks & Income is not a registered investment advisor, broker-dealer, or licensed financial planner. Always do your own research and consult with a licensed financial advisor before making any investment decisions. We may hold positions in or receive compensation from the companies or products mentioned. Disclosures will be made where applicable.

Stocks & Income, AltIndex, Finance Wrapped, The Chain, and Future Funders are all owned by Invested, Inc.