Good morning.

Sometimes reality is stranger than fiction: The Big Short’s Michael Burry is calling GameStop a genuinely solid investment. But hey: don’t knock it until you listen to his argument.

Meanwhile, the SpaceX IPO seems to be real, as Elon Musk has begun actually hiring banks for the process.

Today:

GameStop jumps 9% after Michael Burry reveals his new bet

SpaceX has lined up 4 banks to handle its IPO

UnitedHealth shares plummeted over 16% on crucial Medicare news

Get ready for the Fed’s rate decision tomorrow at 2 PM EST

Let's get into it.

In partnership with Tomorrow Investor

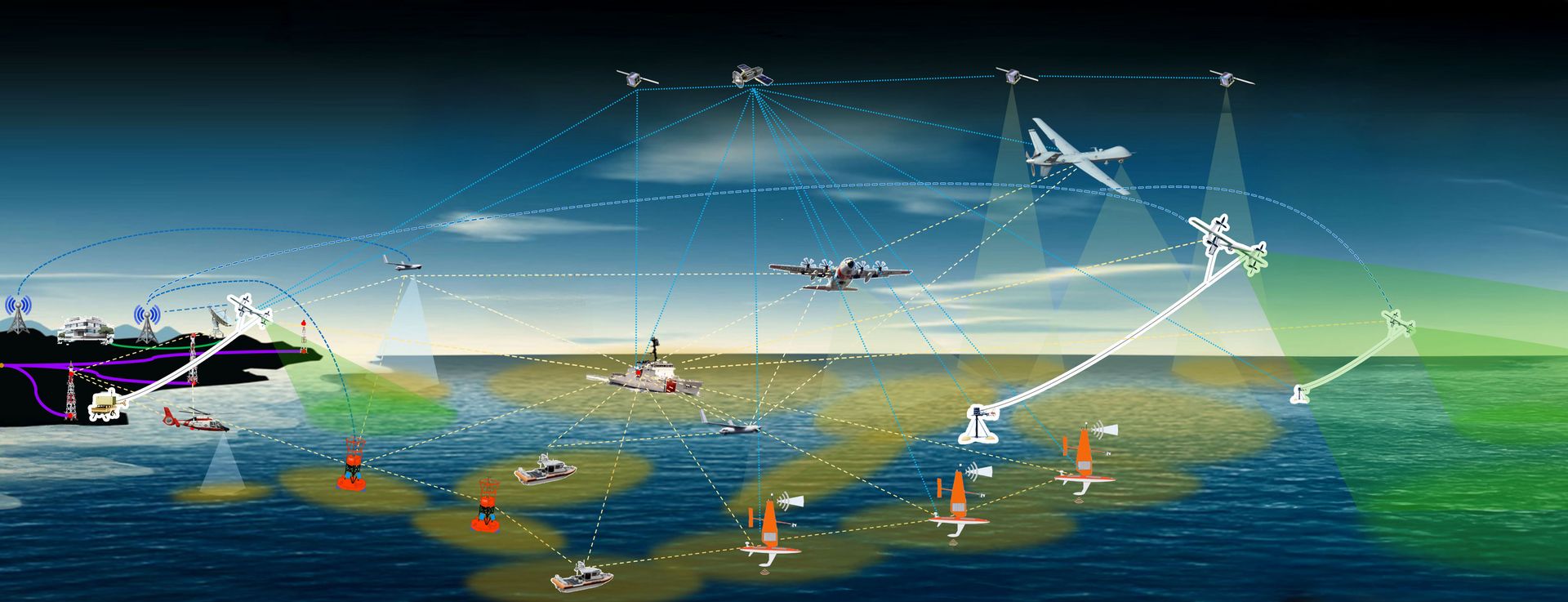

Chinese Drones Are Illegal. What Now?

The FCC just banned foreign-made drones. Every US government agency must now buy American.

That's a problem, because 90% of commercial drones are made in China.

Enter Draganfly (NASDAQ: DPRO):

Currently supplies the US Army with drone technology for intelligence and reconnaissance operations.

DPRO plans to build 7 new manufacturing plants to meet surging US government demand.

Clients include Shell, Ford, Red Bull, and emergency services across North America already rely on Draganfly's systems.

This is a reshoring play with a regulatory tailwind, existing government relationships, and immediate demand.

📰 Market Headlines

US stocks climbed on Monday to kick off a packed week headlined by Fed decisions and Big Tech earnings.

The Dow added 0.6%, the S&P 500 rose 0.5%, and the Nasdaq gained 0.4% after back-to-back weekly losses across all three indexes.

GameStop jumped as much as 8.8% after Michael Burry, the investor made famous by The Big Short, posted on Substack that he's been buying shares. "I believe in Ryan," Burry wrote, referring to CEO Ryan Cohen. "I am willing to hold long-term." Options traders piled in, pushing call volume to the highest since June.

GameStop CEO Ryan Cohen has also bought $GME shares (twice) recently along with Director Cheng Lawrence and Board Member Attal Alain, signaling confidence in their company.

UnitedHealth (UNH) shares sank over 16% premarket today on mixed earnings and far lower-than-expected Medicare Advantage plan increases from the US government. For reference, the expected increase was 4-5%, but the actual increase was only 0.09%. To add fuel to the fire, UNH’s Q4 revenue and full-year revenue outlook were both lower than expected.

Elon Musk appears to be moving forward with plans for a SpaceX IPO that would value the company at $1.5 trillion. He has lined up 4 major banks to handle the public offering: Bank of America Corp. (BAC), Goldman Sachs Group Inc. (GS), JPMorgan Chase & Co. (JPM), and Morgan Stanley (MS).

The Fed’s next rate decision drops tomorrow at 2 PM EST. Markets are overwhelmingly expecting the Fed to hold rates steady, with a 99% chance of no rate change on Kalshi.

Microsoft unveiled Maia 200, its next-gen custom AI chip built on TSMC's 3-nanometer process. The chip takes aim at Nvidia, Google, and Amazon and will power large-scale AI workloads in Microsoft's data centers before rolling out to customers.

Amazon is preparing another 14,000 layoffs as early as this week, hitting Prime Video, HR, and AWS. Combined with October's cuts, total layoffs could surpass its 2022 record of 27,000 corporate roles.

President Trump hinted he could name his pick to replace Fed Chair Powell as soon as this week. BlackRock's Rick Rieder is reportedly the favorite.

Earnings & Economic Calendar:

Today: RTX Corporation (RTX), Boeing (BA), Texas Instruments Incorporated (TXN)

Wednesday: Fed rate decision, Microsoft (MSFT), Tesla (TSLA), Meta (META), ASML (ASML)

Thursday: Apple (AAPL), Visa (V), Mastercard (MA)

Friday: Exxon (XOM), Chevron (CVX), American Express (AXP), Verizon (VZ)

🤖 AI/Future/Tech News

Anthropic launched interactive Claude apps for Slack, Canva, Figma, and Box, letting users access files directly inside the chatbot.

AI video startup Synthesia closed a $200 million Series E, doubling its valuation to $4 billion from $2.1 billion.

The EU opened an investigation into X over Grok AI generating sexualized deepfakes. X could face fines up to 6% of global turnover.

UpScrolled saw downloads spike 2,850% after TikTok's ownership change, pulling in nearly one-third of its lifetime downloads in three days.

🪙 Crypto

Japan plans to greenlight crypto ETFs, with SBI and Nomura readying products for a 2028 debut. Analysts estimate a $6.4 billion market.

Polymarket locked an exclusive deal with Major League Soccer, becoming the sole prediction market partner for MLS events.

🤫 Insider Trading

🚚 Market Movers

Nike is cutting 775 distribution center jobs as it pushes toward automation. The company has slashed over 2,300 positions since early 2024.

Meta, TikTok, and YouTube head to trial this week over claims their platforms fuel youth addiction. Zuckerberg is expected to testify. Snap settled beforehand.

🎤 What do you think?

Are you interested in GameStop as a real investment?

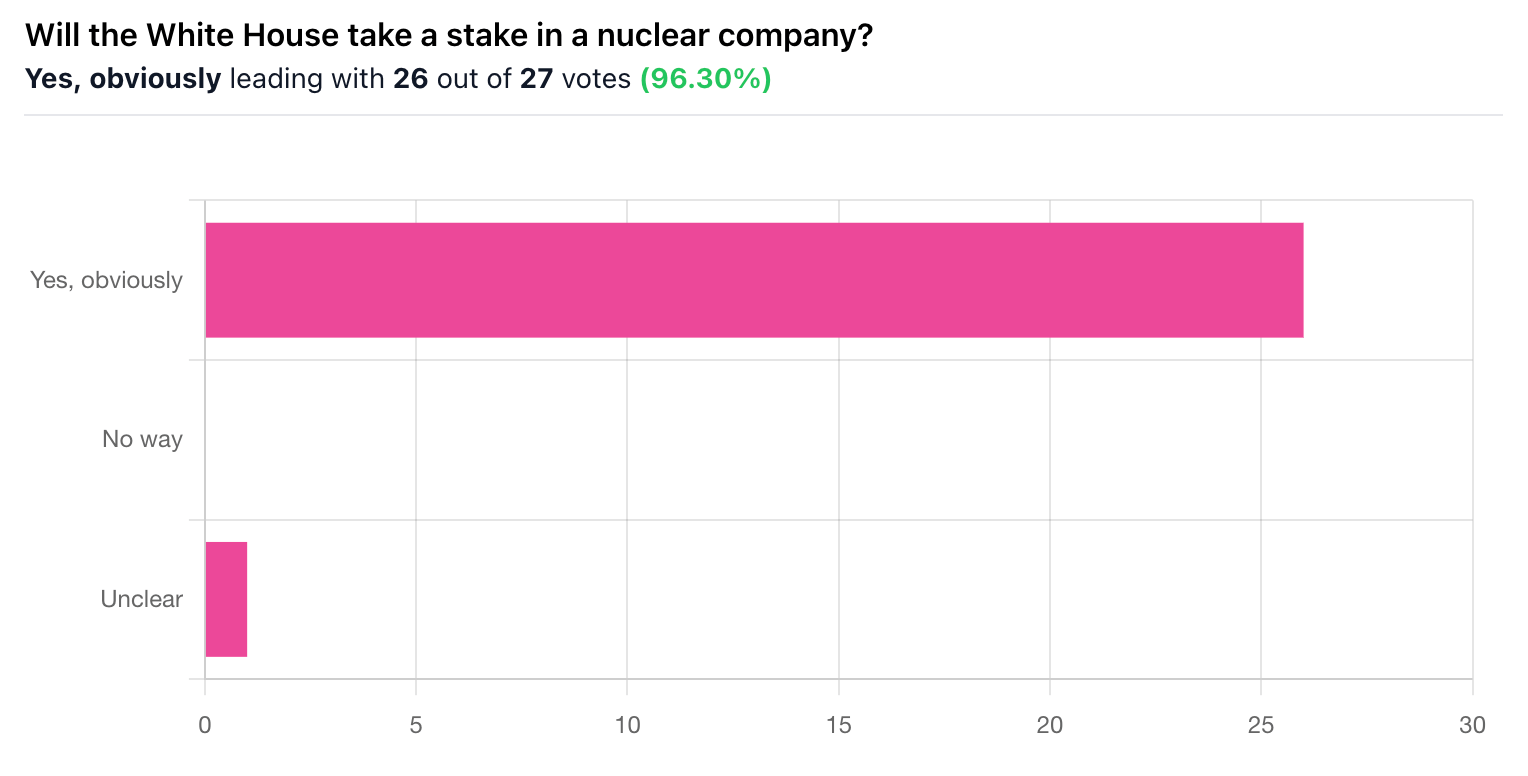

🎤️ What you said last time

️ 🎪Crowdfunding Showcase

Windlift builds autonomous tethered aircraft designed for persistent flight, enabling continuous aerial monitoring, communications, and power generation. Originally developed through US Department of Defense and Energy contracts, Windlift’s systems use proprietary flight software to stay airborne in conditions that ground traditional drones.

With patented technology and early government traction, Windlift is raising on Wefunder to scale deployment across defense, infrastructure, and commercial monitoring use cases.

🧠 The Missing (Market) Links

The Russell 2000 outperformed the S&P 500 for 14 straight days, the longest streak since 1996. Small caps are up 7.5% year-to-date versus 1% for the S&P.

Olympian Alysa Liu's father spent up to $1 million on her training. The average American family spends $1,016 yearly on their kid's sport.

The US packaging market will grow from $215 billion to $319 billion by 2035 as PFAS bans force brands toward biodegradable materials.

Only 2% of high school athletes get scholarships, and under 7% compete in college. CFPs warn: don't bank on it paying for itself.

📜 Quote of the Day

Markets don’t reward certainty, they reward preparation"

📢 We want to hear from you.

Your feedback matters to us! Let us know what you liked or didn’t like about today’s edition.

⭐️ What did you think of today's edition?

That’s all for today. Did we miss anything? Smash the reply button to let me know.

Cheers,

Brandon & Blake of Invested Inc

Thumbnail image: ccPixs.com

The information provided in Stocks & Income is for informational and educational purposes only and should not be construed as financial advice, investment advice, or a recommendation to buy or sell any securities. Stocks & Income is not a registered investment advisor, broker-dealer, or licensed financial planner. Always do your own research and consult with a licensed financial advisor before making any investment decisions. We may hold positions in or receive compensation from the companies or products mentioned. Disclosures will be made where applicable. Past performance doesn’t guarantee future results.

Stocks & Income, AltIndex by Invested Inc. (AltIndex LLC), Finance Wrapped, The Chain, Future Funders, and Dinner Table Discussions are all owned by Invested Inc.