📰 Market Headlines

Markets sputtered yesterday as UnitedHealth's massive earnings miss sparked a broad healthcare selloff, dragging down the major indexes.

The S&P 500 rose just 0.1%, the Dow shed 1.3%, and the Nasdaq slipped 0.1%.

Investors reacted strongly to UnitedHealth's earnings miss, triggering a selloff across the health insurance sector, causing peers to dip between 1% and 6%.

Netflix stock is trending up almost 10% this week after they beat earnings, posting a 13% YOY increase in quarterly revenue:

- Earnings per share: $6.61 vs. $5.71 expected

- Revenue: $10.54 billion vs. $10.52 billion expected

The International Monetary Fund (IMF) assured that, despite tariff tensions, a global recession is not on the horizon.

President Trump expressed "100% confidence" in securing a trade deal with Europe in the coming months.

The tone at The White House is positive and optimistic that trade deals will start coming in more rapidly. This includes China, who could reach a deal with the USA in “as soon as 3 weeks”.

The IRS’s free Direct File program expanded to 30 million taxpayers but faced heavy Republican scrutiny, leaving its future uncertain under the Trump administration.

The market is closed today and Monday for the Easter holiday. Please have a great weekend. Hopefully some positive news comes in over the weekend and powers us to a strong week in the market next week.

-Brandon

👑 KingsCrowd: The Bloomberg terminal for startups

The ratings agency for startup investing.

Private markets are booming, but most startup investing still happens in the dark. KingsCrowd is becoming the trusted data layer for startup investing.

They track, analyze, and rate 5,000+ startup deals each year — giving investors the same tools and research they get in public markets.

Now they’re raising funds, and letting you buy into the company itself.

Why invest in KingsCrowd?

First-mover in a massive fragmented market

$4m projected 2025 revenue

2,000+ paying users | 30k+ newsletter subs

Raising $2.5m at a (very reasonable) $13.9m valuation

Express interest

Clicking the the button below will:

Take you to an Expression of Interest form

Give KingsCrowd permission to email you

To express interest in KingsCrowd without giving permission to email, click here.

🧠 Make yourself heard

There’s a lot of optimism coming out of the White House about trade deals…

Do you think we'll get deals done soon with China & Europe?

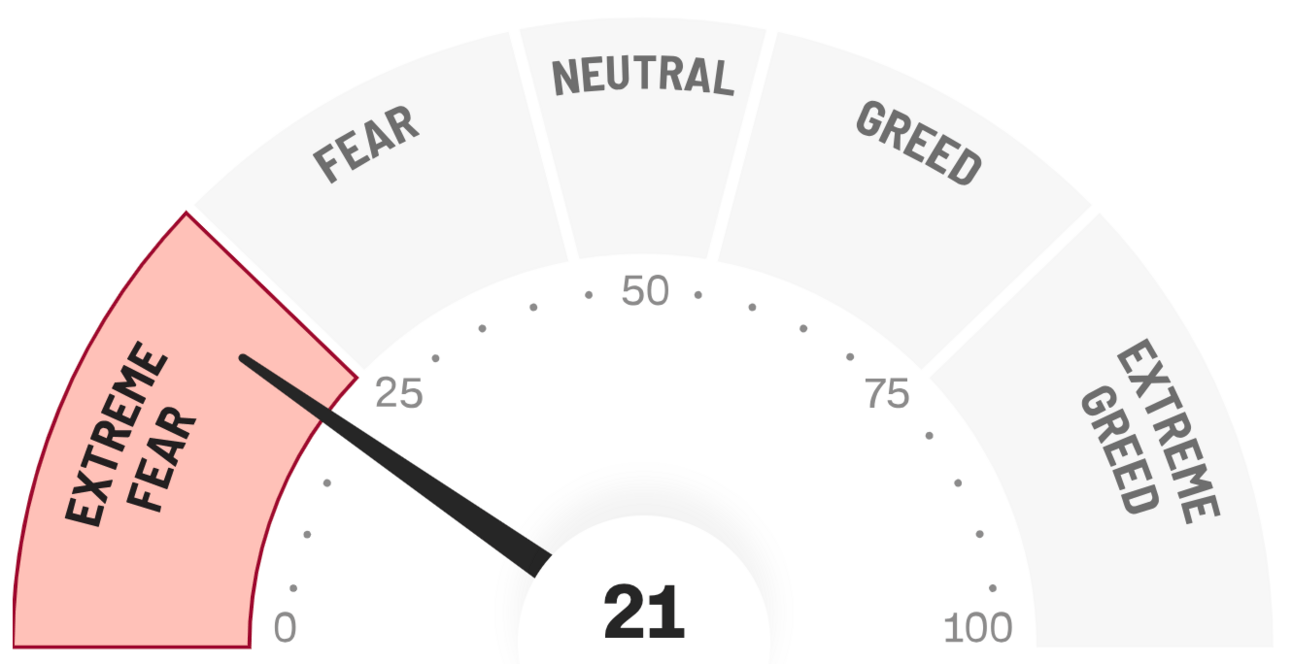

😱 Fear and Greed Index

📊 Earnings this week

Netflix beat its Q1 earnings expectations, shares jumped nearly 5% to a new high since early April.

Ally Financial reported Q1 net revenue below expectations; shares slid 2.73% at close.

American Express delivered Q1 revenue with 7% YoY growth, but shares fell 1.92% post-earnings.

D.R. Horton missed Q1 earnings expectations; shares tumbled 1.89%.

TSMC announced a $100 billion investment for three new US chip plants; shares surged 3%.

UnitedHealth Group missed Q1 EPS forecasts and lowered its 2025 guidance; shares plunged over 22%.

Market movers

A judge ruled Google held illegal monopolies in online ads, dealing a second major antitrust blow as it fought to defend its core businesses.

Shein and Temu announced a rise in US prices starting April 25 in response to Trump’s 145% tariffs on Chinese goods.

Lowe's acquired Artisan Design Group, expanding its professional services reach across 18 states and targeting a $50 billion market opportunity.

Meta removed Apple’s AI tools from Facebook, Instagram, WhatsApp, and Threads.

Kraken laid off hundreds across all departments ahead of its planned IPO.

📊 Crypto

A crypto whale purchased $120 million worth of Bitcoin on Binance, triggering a 2% price surge to $61,350.

Digital Currency Group CEO Barry Silbert admitted he should have just held his early Bitcoin bought at $7-8 instead of investing in crypto projects.

Abraxas Capital withdrew 1,107 BTC from exchanges, with hints at a bullish institutional sentiment.

📊 Ideas, trends, and analysis

India emerges as a potential trade war hedge, with only 12% of its economy dependent on exports and a strong domestic investor base.

China is calling “a lot” says Trump. Hopefully this means the “trade war” is going to end sooner rather than later.

🌍 Global Perspectives

🇵🇷 Nearly half of Puerto Rico remained without power after an island-wide blackout left 1.4 million customers in the dark.

🇮🇳 Indian authorities accused opposition leaders Rahul and Sonia Gandhi of money laundering through a shell company ahead of national elections.

🇵🇸 Aid groups warned of total humanitarian collapse in Gaza as Israel's food blockade has left thousands of children malnourished.

🇧🇿 A US citizen was killed after hijacking a small passenger plane in Belize at knifepoint.

🇷🇺 Russia demanded European apologies after Ukrainian authorities admitted their own forces were behind a civilian attack in Sumy.

🎤 What you said last time

“Save America. Fire Powell.”

🧠 Miscellanea

Astronomers detected possible chemical signs of life on a distant exoplanet 124 light-years away.

Spanish police unearthed an illegal underground range three stories below ground where weapons traffickers tested firearms for drug gangs.

A mysterious herd of goats survived over 200 years on a waterless island off Brazil's coast, possibly by adapting to drink seawater.

📺 What to watch today

That’s all for today. Did I miss anything? Smash the reply button to let me know.

Cheers,

Brandon with Stefan & Wyatt