🔔 The Opening Bell

Good morning folks,

Meme stocks had their day in the sun yesterday as Kohl’s shares skyrocketed just minutes after the opening bell in a short squeeze for the ages.

Meanwhile, the White House’s trade diplomacy is back in motion. Japan scored a deal, and so did the Philippines.

Also, the Jerome Powell resignation letter was fake.

And behind the scenes, the Pentagon is shopping around. As tensions with Elon Musk simmer, the Treasury is looking beyond SpaceX to help power the $175 billion missile defense program.

A lot’s happening, so let’s get started.

Get Top AI Stock Picks—Now in App Form

The average investor only does 6 minutes of research before buying a stock.

Is that long enough to get an edge over the market by yourself?

No, but it is long enough to use AI to inform your stock picks—now on your phone.

AltIndex uses wide-reaching alternative data and technical analysis to arrive at its stock picks.

It’s easy to incorporate into your trading flow, too, with a built-in portfolio feature and daily alerts.

Get an edge you won’t find elsewhere with AltIndex’s unique AI-powered stock picks—generating an average of 22% returns over six months.

📰 Market Headlines

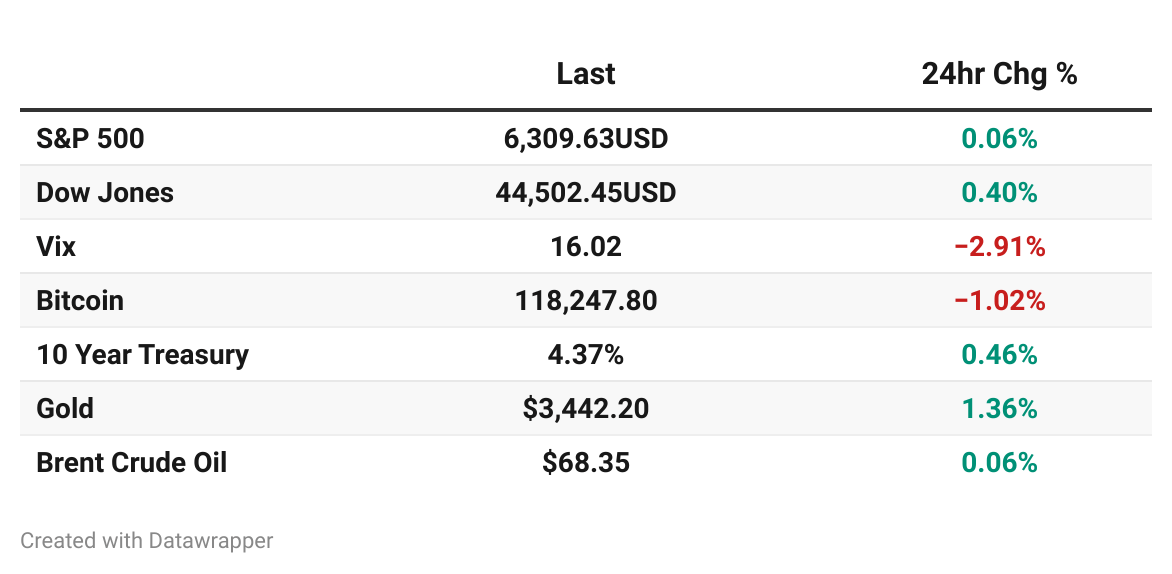

Stocks climbed modestly on Tuesday, with the S&P 500 eking out a new record amid mixed trading.

The Dow gained 0.4%, the S&P 500 added 0.06%, while the Nasdaq slipped 0.39%.

Meme stocks took center stage—retail traders sent Kohl’s $KSS ( ▼ 3.41% ) shares up by 100% just minutes after markets opened yesterday, giving notes of r/WallStreetBets and the Gamestop short squeeze of 2021. Trading was paused 10 minutes after the market opened because of volatility. Opendoor $OPEN ( ▼ 4.4% ) also caught the wave—the stock was up 20% initially but ended the day down 10%.

Here’s the new stock r/WallStreetBets is talking about the most today, though →

President Trump indicated (again) that Powell would indeed finish his term as Fed Chair; Treasury yields retreated in response. The 10-year Treasury yield dropped to 4.34%, with traders giving a 95% probability that rates will remain unchanged at next week's Fed meeting.

New trade deals announced: the US is setting a 15% tariff on Japanese goods (which includes a $550 billion Japanese investment in the US) and a 19% tariff on Philippine imports rather than the planned 20% rate.

The White House is expanding its search for Golden Dome partners beyond SpaceX. Officials are courting Amazon $AMZN ( ▼ 2.3% ) and traditional defense contractors as tensions with Elon Musk threaten SpaceX's dominance in the $175 billion missile defense program.

Wall Street pivoted to Big Tech earnings, with Alphabet $GOOGL ( ▼ 1.11% ) and Tesla $TSLA ( ▼ 2.91% ) reporting today. Tesla entered its report with its stock down nearly 18% for the year after global deliveries dropped 13.5% in the second quarter.

How do you feel about meme stock trading?

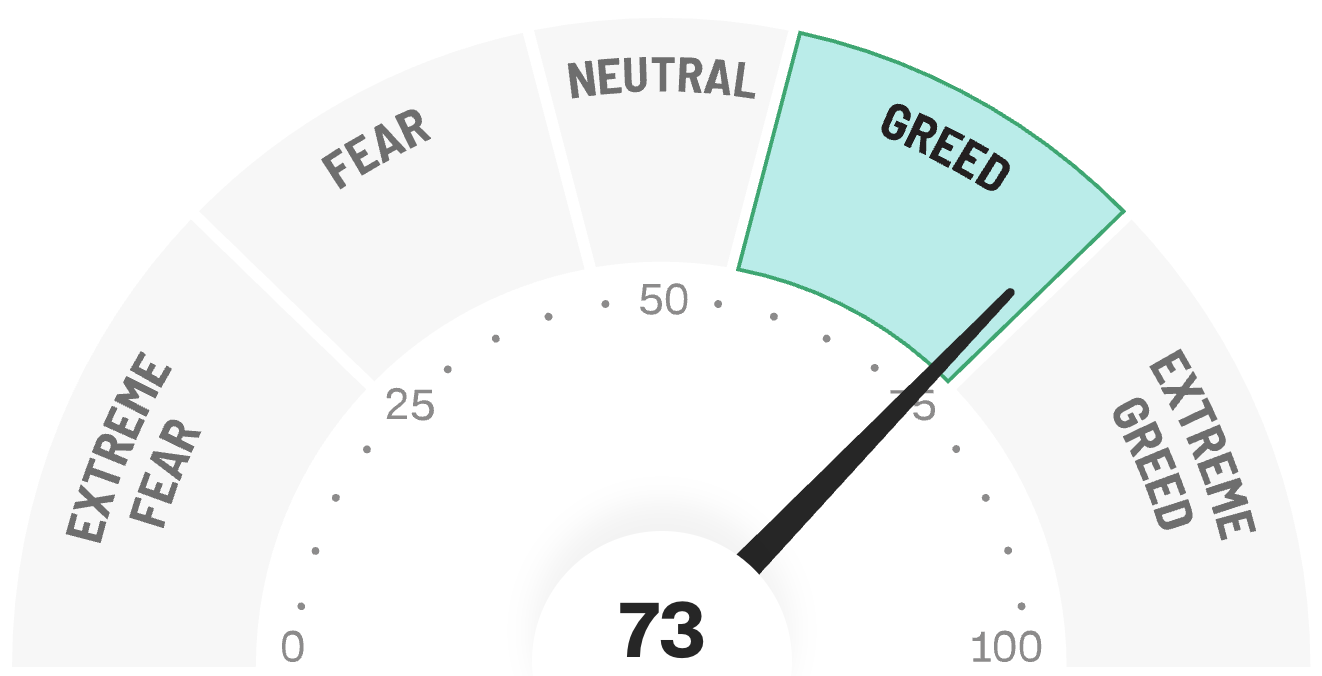

😱 Fear and Greed Index

🧠 The Missing (Market) Links

Kevin Jonas revealed he once lost 90% of his wealth on a bad business partnership, leaving him with just 10% of his money remaining.

The Nasdaq 100 hasn’t done this well since the Dot-Com Bubble—posting 60 consecutive days of closing above its 20-day moving average.

Goldman Sachs and BNY to launch digital, tokenized money market funds through Goldman’s blockchain platform.

More Americans are moving their money from checking and savings accounts to accounts with investment income

The side hustle boom is cooling as only 27% of Americans now report having a second income stream, down 9% from 2024 and at the lowest level since 2017.

Cottage cheese continues its TikTok-fueled momentum with 15% growth year-to-date, while American cheese sales have plummeted 5%.

🪙 Crypto

Congress ratified the GENIUS Act regulating stablecoins with a 308-122 bipartisan vote, while the House cleared the CLARITY Act defining digital asset classifications.

PNC Bank partnered with Coinbase to create crypto trading options for its customers.

The Senate released a 35-page draft for a market structure bill, seeking industry input by Aug. 5 on defining digital assets and regulatory frameworks.

Bitcoin miner Bitfarms announced a 50 million share buyback program, sending its stock up 18%.

FBI dropped its two-year investigation into Kraken founder Jesse Powell, returning seized devices and issuing a declination letter.

💰 Alternative Investing News

Carlyle clinched a deal to acquire a majority stake in Adastra Group, a global IT consultancy with 2,000 employees focused on data, cloud, and AI.

Olo Inc. canceled its Q2 earnings call after announcing a buyout by Thoma Bravo, but will still release results after market close on August 4.

🤖 AI/Future/Tech News

Asylon raised $26 million in Series B led by Insight Partners, expanding its robotic security services and adding robot guard dogs.

Apple warned more than a dozen Iranians in recent months that their iPhones had been targeted with government spyware.

Data quality firm Telmai snagged enterprise adoption with PropertyGuru Group and a leading fintech company.

AI chip startup Hailo unleashed its Hailo-10H processor, delivering generative AI capabilities to edge devices.

📗 Recommended Reading

Do you like newsletters? We like newsletters.

Here are some newsletters our readers tend to enjoy, covering topics like:

Finance

AI

Wealth building

Health

And more.

🌍 International Markets

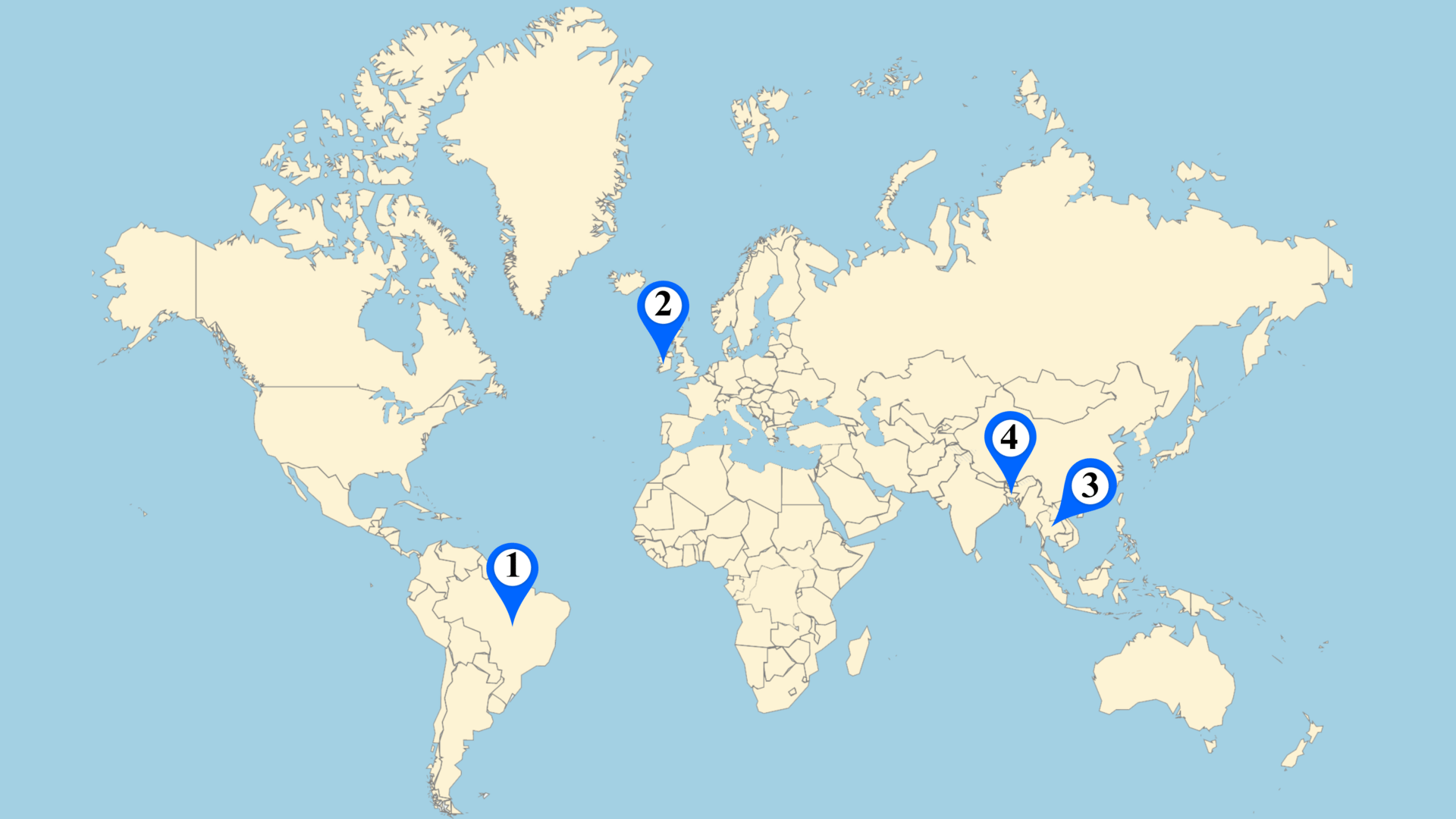

🇧🇷 A study showed that Brazil's "blue economy" contributed 2.91% of GDP in 2019, with offshore oil extraction making up 60.4% of this sector.

🇮🇪 Ireland pledged to invest its big budget surplus in infrastructure projects, focusing on long-term economic development.

🇹🇭 Thailand's cabinet named Vitai Ratanakorn, CEO of the state-run Government Savings Bank, as the next central bank governor, effective Oct. 1.

🇧🇩 Bangladesh's foreign reserves surged from $20.39 billion to over $31 billion in the past year, while inflation dropped from 12% to 9%.

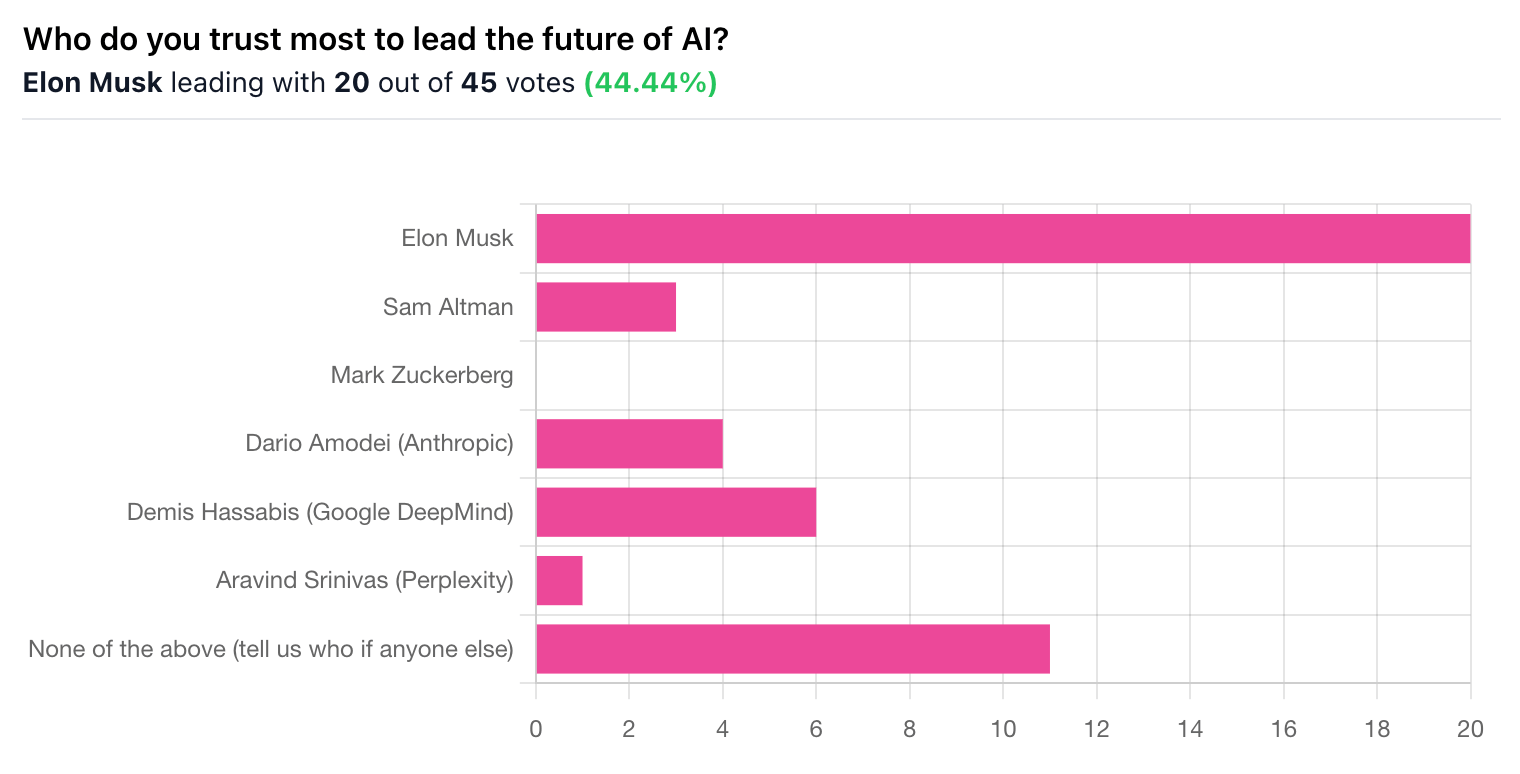

🎤️ What you said last time

And some of your write-in answers:

“Eliezer Yudkowsky”

“Thomas Massie”

“Women. I trust women to lead the future of AI.”

“No one. With great power comes great responsibility. And as history shows, our leaders don't have a great track record of doing what's right. Unless it makes them and their friends loads of money...”

🚚 Market movers

Amazon propelled its wearable ambitions by acquiring AI startup Bee.

Etsy faces a boycott over "Alligator Alcatraz" merchandise, sparking debates on its Discrimination and Hateful Content Policy.

Microsoft swooped on DeepMind’s top engineers, intensifying the AI talent war.

Sibanye-Stillwater expanded its recycling operations with the $82 million acquisition of Metallix.

📊 Earnings

Capital One reported a jump in Q2 adjusted profit per share as interest income on credit card debt rose 32.5% to 10 billion, shares rose 2.5% after hours.

Coca-Cola announced plans to launch a version of its signature drink made with US cane sugar this fall, while stocks dropped 0.59%.

General Motors shares fell 6% after reporting that President Trump's tariffs took a 1 billion bite out of its quarterly earnings.

Lockheed Martin plunged 10.8% after reporting an earnings miss due to 1.6 billion in pretax losses on legacy programs.

Philip Morris shares dropped 7% after quarterly revenue missed forecasts and shipments of its popular Zyn nicotine pouches fell short of expectations.

PulteGroup topped quarterly expectations with shares climbing 9% even as the company noted consumers face challenges from high interest rates and economic concerns.

SAP topped Q2 profit estimates with adjusted earnings per share, but shares fell 2% in extended trading.

Texas Instruments beat Q2 targets, but shares plunged 7% after issuing weak Q3 guidance.

📢 We want to hear from you

We love hearing from you, and we deeply appreciate your feedback.

⭐️ What did you think of today's edition?

📺 What to watch today

That’s all for today. Did I miss anything? Smash the reply button to let me know.

Cheers,

Brandon with Stefan & Wyatt

The information provided in Stocks & Income is for informational and educational purposes only and should not be construed as financial advice, investment advice, or a recommendation to buy or sell any securities. Stocks & Income is not a registered investment advisor, broker-dealer, or licensed financial planner. Always do your own research and consult with a licensed financial advisor before making any investment decisions. We may hold positions in or receive compensation from the companies or products mentioned. Disclosures will be made where applicable.