📰 Market Headlines

Stocks retreated Monday as President Trump's new tariff threats seemed to revive trade war worries.

The S&P 500 slipped 0.6%, ending its longest winning streak in over 20 years. The Dow slid 0.3% and the Nasdaq fell 0.8%.

States are suing Trump. 19 states sued the Trump administration over HHS layoffs—this comes after 23 states sued the HHS last month for cutting $11B in public health funds. If RFK Jr.'s job and budget cuts stand, expect major shakeups across U.S. medical systems with ripple effects for investors in the sector.

Radar outage renders Newark blind. Air traffic controllers lost radar and comms at Newark last week, with the FAA blaming “an antiquated system” that’s straining staff. United Airlines is cutting flights to ease congestion—but with the World Cup coming next year, the entire U.S. air travel system may be due for a full reboot.

Flashbacks to Signalgate with Mike Walz. TeleMessage suspended operations after a reported hack—one week after being used during a Cabinet meeting by Trump’s (former) national security advisor, Mike Waltz. Markets reacted fast: Smarsh (TeleMessage’s parent company) lost 25% valuation while cybersecurity stocks surged to record highs.

Gold hitting record highs

The price of gold keeps heating up. If the record-breaking year of 2024 wasn't enough, gold hit a major historic 2025 milestone by crossing the $3,000/ounce threshold!

Here are 3 Key Reasons:

Looming economic & political uncertainty

Increasing central bank demand

Rising National Debt - over $36 Trillion

So, could gold surge even higher?

According to a recent statement from Jeffrey Gundlach, famed American business man and investor… “Gold continues its bull market that we’ve been talking about for a couple of years, ever since it was down to $1,800.” He expects gold to reach $4,000/oz.

Is it time you learn more about precious metals?

Get all the answers in your free 2025 Gold & Silver Kit. Plus, if you request your free kit today, you could qualify for up to 10% Instant Match in Bonus Silver*.

*Offer valid on qualified orders of Goldco premium products only. Receive up to 10% in free silver based on purchase amount; cannot be combined with other offers. Additional terms apply—see your customer agreement or contact your representative for details.

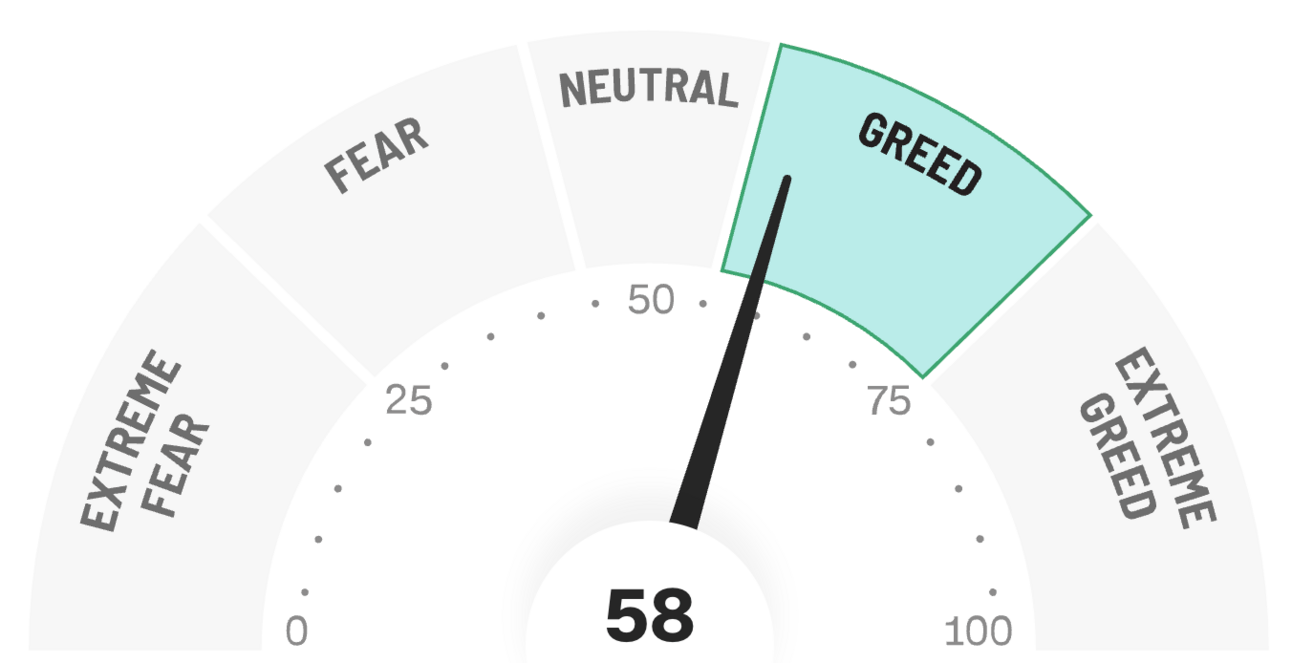

😱 Fear and Greed Index

🧠 Make yourself heard

Which S&P 500 signal matters most right now?

⚔️ Trade Wars

If trade talks fail, the EU is planning tariffs for $113B in US goods.

“We haven’t seen anything like this since the disruptions of summer 2020,” said Kyle Henderson, CEO of trade tracker Vizion, about the US’s tariff-induced import & export slump.

Temu halted all Chinese-made shipments to the US after the May 2 de minimis expiration, shifting to US-based sellers to dodge 145% tariffs.

Mattel pulled investor guidance and warned of price hikes as it fast-tracked moves out of China amid tariff uncertainty.

US de minimis imports hit 1.36 billion parcels in 2024, more than double 2020 levels, with brands like Oh Polly already raising US prices by 20%.

📊 Alternative Investing News

Citi resumed lending to private equity and credit funds, reentering the market with commitment-backed loans to compete with JPMorgan and Goldman.

A fire at Anglo’s Moranbah North mine threatened Peabody Energy’s $3.78 billion deal, as the shutdown led to a material adverse change declaration.

Lundin Mining and BHP announced their Filo del Sol site as the largest copper discovery in 30 years, with over 13 million tons identified and drilling ongoing.

🤖 AI/Future/Tech News

OpenAI confirmed its nonprofit parent would keep control while restructuring its for-profit arm to attract new investment.

Apple appealed a US court order requiring third-party payment options in the App Store after backlash over its limited compliance.

Meta AI launched a public site featuring user prompts and image results, revealing a chaotic blend of social experimentation and basic queries.

🪙 Crypto

A new bill could require crypto project members to disclose any holdings above 1% of total supply, potentially democratizing participation.

The DOJ scrapped “regulation-by-prosecution” and refocused on crypto cases tied to investor harm and national security.

World Liberty Financial, tied to President Trump’s family, secured a $2 billion Abu Dhabi-backed deal, triggering Senate Democrats’ calls to delay the GENIUS Act and probe conflicts.

11x CEO Hasan Sukkar resigned during retention issues and branding disputes, as Benchmark and a16z reaffirmed backing for the $70 million startup.

💡 Ideas, trends, and analysis

Just 16% of Americans picked stocks as the best long-term investment in April, down from 22% last year; gold rose to 23% while real estate held steady at 37%.

Unemployment for new college grads climbed to 5.8% in March, with underemployment hitting 41.2% as entry-level hiring slowed.

🌍 International Markets

🇧🇴 Bolivia boosted chia exports to China after US tariffs, with shipments set to hit $33 million and 25,000 tons annually, up from 10,000 tons across 35 countries.

🇨🇳 Beijing pushed regional cooperation with Japan, South Korea, and ASEAN to steady supply chains amid rising protectionism, but announced no new trade deal.

🇹🇼 Taiwan’s currency surged 4.2%, its sharpest jump in decades, threatening tech exporters as President Lai pursued tariff relief; a 10% rise could slash margins by 5%.

🎤 What you said last time

What you had to say about it:

“I don't see how you can even tariff a movie? Where is the point of entry? How is it assessed? Once for every play, stream, download, or screen? It makes no sense.”

🚚 Market movers

Ferrari posted a 17% increase in profits—but also warned that upcoming US tariffs on imported cars could significantly affect the company’s performance.

Bristol Myers committed $40 billion to US R&D, tech, and manufacturing over five years as tariff risks escalated.

Doordash announced its $1.2B purchase of SevenRooms, the restaurant booking platform, and a $3.9B purchase of Deliveroo, the British food delivery service company.

Skechers accepted a $9.42 billion buyout at $63/share, marking the sneaker industry’s biggest deal.

Waymo opened a 239,000-sq-ft Arizona plant to retrofit 2,000 Jaguar EVs with autonomous tech by 2026.

Credit Suisse paid $511 million to settle US DOJ tax evasion charges tied to its 2014 plea deal; UBS expected a partial credit.

PwC cut 1,500 US jobs, according to the Financial Times.

Rite Aid prepared for a second Chapter 11 filing and began HQ layoffs as store closures continued.

📊 Earnings this week

CNA Financial reported lower Q1 earnings per share, with shares slipping due to unfavorable commercial auto claims.

Ford beat Q1 earnings expectations, with shares climbing despite a broader yearly decline.

Hims & Hers Health posted strong Q1 growth and subscriber gains, sending shares higher on raised guidance and bold long-term goals.

🧠 Miscellanea

Deputies rescued a naked inmate from a ledge below razor wire at L.A. County jail, using a high-angle operation after he climbed out and ditched his clothes.

Japan’s NTT drone survived a direct lightning strike at 984 feet thanks to a Faraday cage, becoming the world’s most electrified test subject.

Scientists tracked Cluster Salsa’s fiery 50-second reentry, detecting metals like aluminum and lithium to study satellite burn-up pollution.

📺 What to watch today

That’s all for today. Did I miss anything? Smash the reply button to let me know.

Cheers,

Brandon with Stefan & Wyatt