📰 Market Headlines

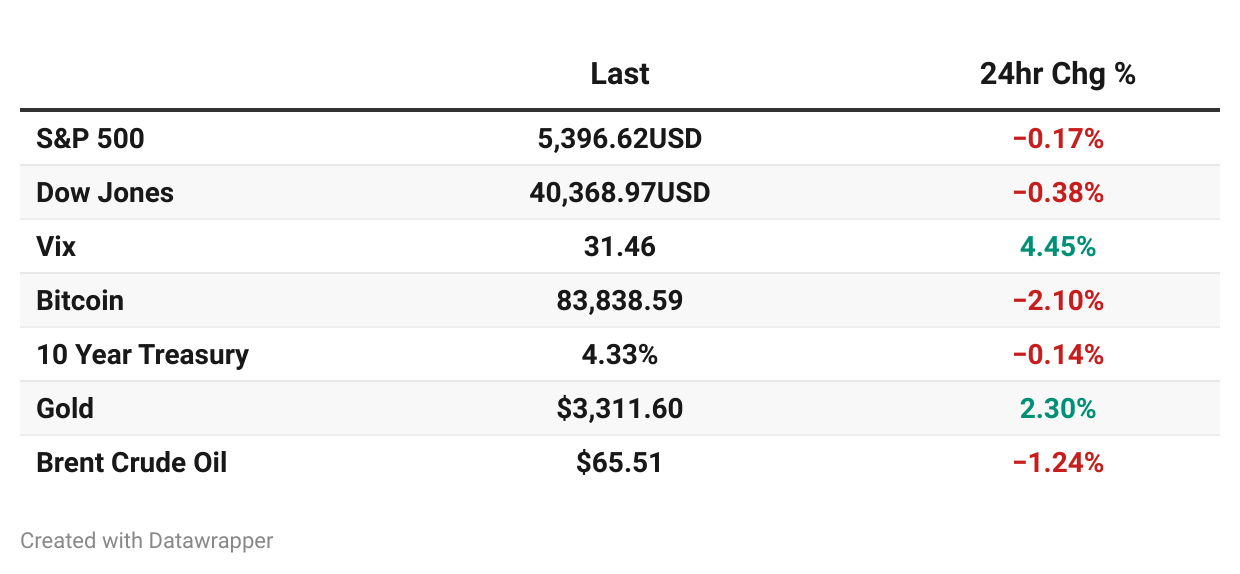

Yesterday, Markets edged higher for a third straight session as earnings optimism helped offset ongoing trade tensions.

The Dow rose 0.2%, the S&P 500 gained 0.3%, and the Nasdaq advanced 0.4%.

However, pre-market today, April 16th, is showing troubling signs for the upcoming session, with NVIDIA down almost 7% before the open today.

NVIDIA is driving tech stocks down thanks largely due to the US Government barring them from selling H20 chips to China, which will apparently lead to a $5.5 billion dollar drawdown this quarter.

President Trump threatened Harvard's tax-exempt status after freezing $2.2 billion in federal funding over the university’s refusal to meet policy demands.

About 20,000 IRS employees expressed interest in Trump’s deferred resignation offer, potentially cutting the agency’s workforce by 20% during peak tax season.

The White House considered new tariffs on semiconductors and pharmaceuticals while hinting at relief for automakers, deepening market uncertainty.

European pharma giants demanded help from EU leadership to maintain operations during threatened US tariffs.

👑 KingsCrowd: The Bloomberg terminal for startups

The ratings agency for startup investing.

Private markets are booming, but most startup investing still happens in the dark. KingsCrowd is becoming the trusted data layer for startup investing.

They track, analyze, and rate 5,000+ startup deals each year — giving investors the same tools and research they get in public markets.

Now they’re raising funds, and letting you buy into the company itself.

Why invest in KingsCrowd?

First-mover in a massive fragmented market

$4m projected 2025 revenue

2,000+ paying users | 30k+ newsletter subs

Raising $2.5m at a (very reasonable) $13.9m valuation

Express interest

Clicking the the button below will:

Take you to an Expression of Interest form

Give KingsCrowd permission to email you

To express interest in KingsCrowd without giving permission to email, click here.

🌏 Alternative investing news

Gold has hit a record high with market uncertainty and global currencies in flux.

In semi-related news, the US Dollar is down more than 3% this week and 8% YTD.

Markets continue to be choppy at best, with large spikes and declines driven mostly by geopolitical news updates coming every few hours.

In times like this, it’s worth considering less common investment vehicles like Private Credit and Hedged Equity with downside protection, which historically drive strong returns, even in challenging markets.

Where financial advisors typically suggest a 60/40 approach with stocks & fixed income, many wealth managers are downgrading bonds in favor of vehicles like private credit. More than 3x the global financial managers polled said they would be adding more private credit to their investment strategies in 2025 vs 2023.

📊 Ideas, trends, and analysis

Despite health warnings, 70% of Americans said they’d still eat hot dogs at baseball games.

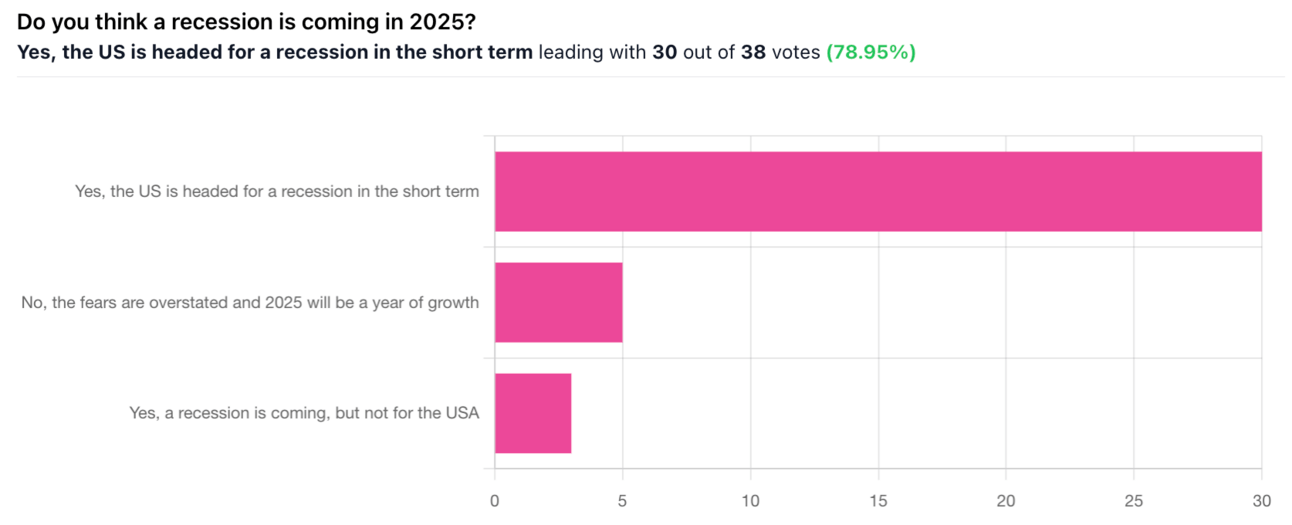

Americans increasingly believe the economy is getting worse, per CNN. In November, just 42% of Americans felt the economy was trending down. By February that percentage had increased to 49%, and in March it spiked to 53%.

🧠 Make yourself heard

There are plenty of indicators that are concerning, but also reason to believe that geopolitical progress could jolt the market(s)…

Are you bullish or bearish on NVIDIA going forward?

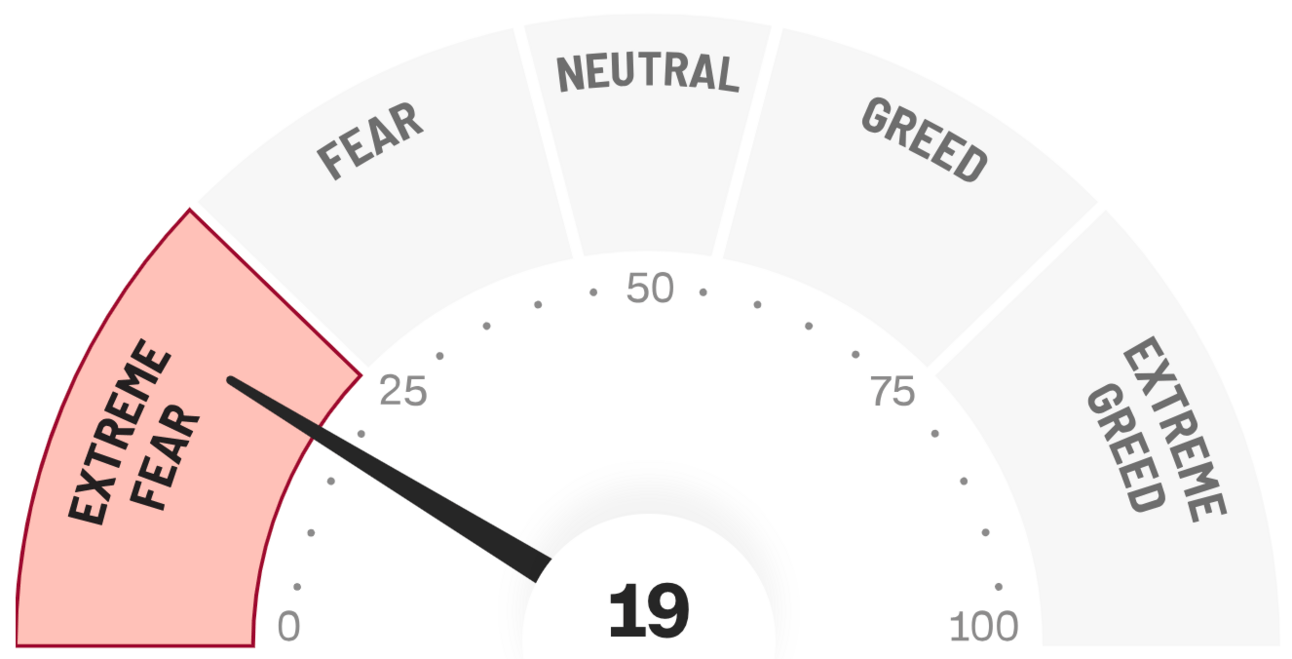

😱 Fear and Greed Index

📊 Earnings this week

Bank of America beat analysts' estimates with profit climbing 11% on stronger-than-expected net interest income; shares advanced 4%.

Citi topped Q1 expectations with profit surging 21% as fixed income trading revenue rose 8%; shares climbed 3%.

J.B. Hunt beat lowered Q1 expectations; stock reaction pending after-hours trading.

PNC reported higher Q1 profit as net interest income rose and capital markets revenue climbed 18%, sending shares up 1%.

United Airlines beat Q1 expectations but offered two profit forecasts, citing economic unpredictability.

Market movers

Nvidia risked $5.5 billion in lost sales after new US rules blocked H20 chip exports to China.

A federal judge voided the CFPB’s credit card late fee cap after the agency admitted the rule was unlawful.

GM's BrightDrop halted EV van production and cut 450 jobs due to weak demand and excess inventory.

The federal government prepared for more mass firings as thousands of employees accepted buyouts.

Forever 21’s bankruptcy plan repaid just 3% to 6% of $433 million to unsecured creditors, drawing criticism over supplier losses.

📊 Crypto

Kaiko's research suggested XRP could be next for spot ETF approval with deeper liquidity than ADA and stronger US volume than Solana.

The SEC delayed its decision on allowing staking features for Ethereum ETFs.

Senate Democrats urged the DOJ to revive its crypto crime unit over enforcement concerns.

Teucrium’s 2x XRP ETF launched strong with $5 million in first-day trading, their best debut to date.

🌍 Global Perspectives

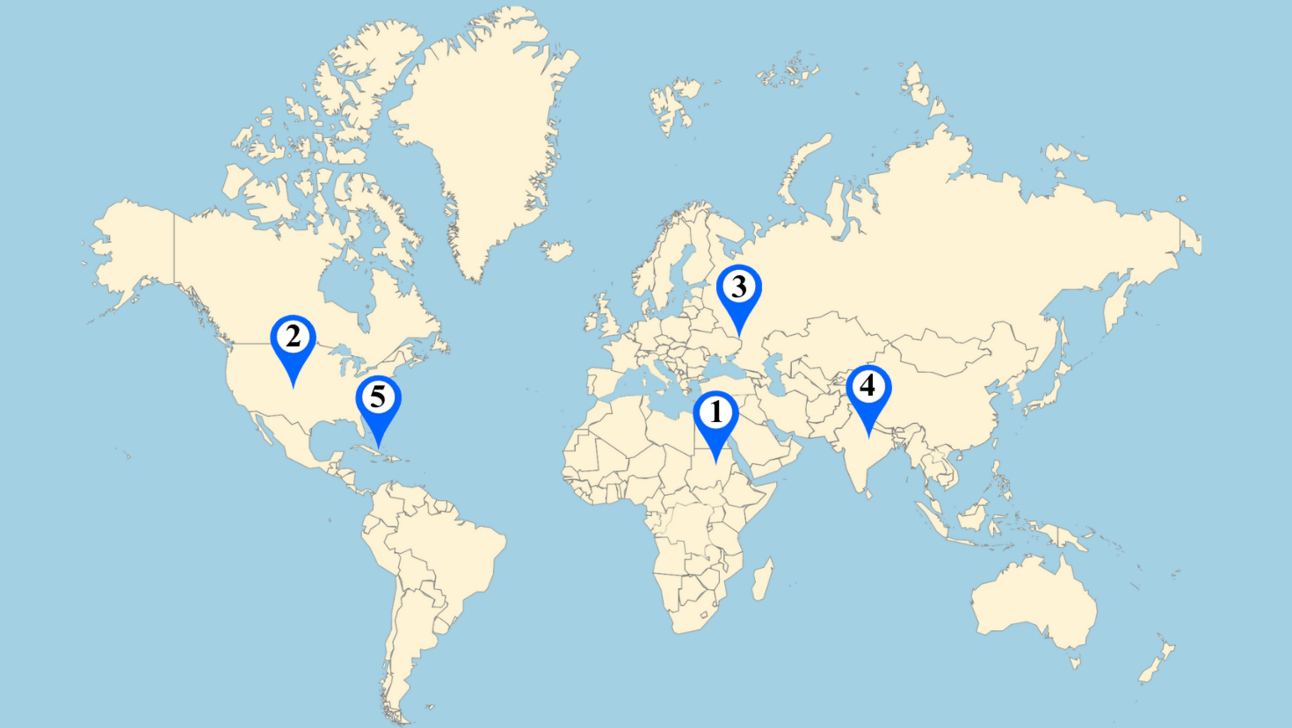

🇸🇩 Sudan’s civil war pushed half the population into hunger as famine spread to 10 regions.

🇺🇸 🇮🇷 A second US carrier entered Mideast waters ahead of nuclear talks with Iran.

🇺🇦 🇷🇺 Russian missiles killed 32 civilians in Ukraine’s Sumy during Palm Sunday.

🇮🇳 Indian opposition leaders Rahul and Sonia Gandhi faced money laundering charges tied to $300 million in property.

🇯🇲 🇬🇧 Caribbean officials demanded slavery reparations from former colonial powers at a UN forum.

🎤 What you said last time

“The recession is already here; the numbers just aren't in yet. With economic uncertainty comes pullback by the consumer. When everybody decides to prepare for uncertainty by holding on to cash, a recession is inevitable. Consumers made this decision weeks ago, as reflected in the consumer confidence survey.”

🧠 Miscellanea

Scientists mapped a mouse brain down to 500 million synapses and 84,000 neurons in a grain-sized sample.

Astronomers found the universe’s missing matter in plain sight, hidden in massive clouds of ionized hydrogen gas.

James Webb captured a star’s dying gasps forming a stunning Venn diagram 1,500 light-years away.

A woman survived internal decapitation after a high school gym accident, undergoing 37 surgeries to fuse her skull to her pelvis.

📺 What to watch today

That’s all for today. Did I miss anything? Smash the reply button to let me know.

Cheers,

Brandon with Stefan & Wyatt