Good morning.

Nvidia just hit $5T in market cap. Apple crossed $4 trillion for the first time. Microsoft locked in a 27% stake in OpenAI worth $135 billion. And here's the kicker: the S&P 500 just hit 6,900, but 80% of the companies in the index closed in the red yesterday.

Translation: Seven stocks are carrying the entire market on their backs while the rest of the economy watches from the sidelines.

But here's the twist: the S&P 500 hit 6,900, yet 80% of its companies closed in the red. The Magnificent 7 are pulling the entire market up alone. We're living in a two-tier economy where AI mega-caps exist in a different universe from everyone else.

Today the Fed decides rates at 2:00 PM (98% chance of a 25bps cut), and three Magnificent 7 companies report earnings after the bell. Markets are already pricing in the cut, so the real catalyst is whether Powell signals a shift from quantitative tightening to easing. That would mean injecting liquidity back into the system—and likely pushing stocks higher.

With mega-cap tech at $3-5 trillion valuations, predicting the next move is nearly impossible. Which brings us to options trading: the tool that lets you profit whether stocks go up or down. We know it's intimidating, but today we're breaking down the basics so you can decide if it's worth learning.

Let's begin.

In partnership with AltIndex

Reddit’s Top Stocks Beat the S&P by 40%

Buffett-era investing was all about company performance. The new era is about investor behavior.

Sure, you can still make good returns investing in solid businesses over 10-20 years.

But in the meantime, you might miss out on 224.29% gainers like Robinhood (the #6 most-mentioned stock on Reddit over the past 6 months).

Reddit's top 15 stocks gained 60% in six months. The S&P 500? 18.7%.

AltIndex's AI processes 100,000s of Reddit comments and factors them into its stock ratings.

We've teamed up with AltIndex to get our readers free access to their app for a limited time.

The market constantly signals which stocks might pop off next. Will you look in the right places this time?

📰 Market Headlines

Markets hit fresh records Tuesday as Nvidia soared 5% to an all-time high, pushing its market cap near the $5 trillion mark.

The Dow climbed 0.3%, the S&P 500 gained 0.2%, and the Nasdaq jumped 0.8%.

Nvidia hit a $5 trillion market cap; meanwhile, it’s becoming the foundational infrastructure for EVERY industry. $NVDA has announced partnerships with Eli Lilly (LLY), Uber (UBER), and Palantir (PLTR) in the past 24 hours. At this point, owning Nvidia shares is starting to feel like the new “I bought real estate in the 1970s” brag.

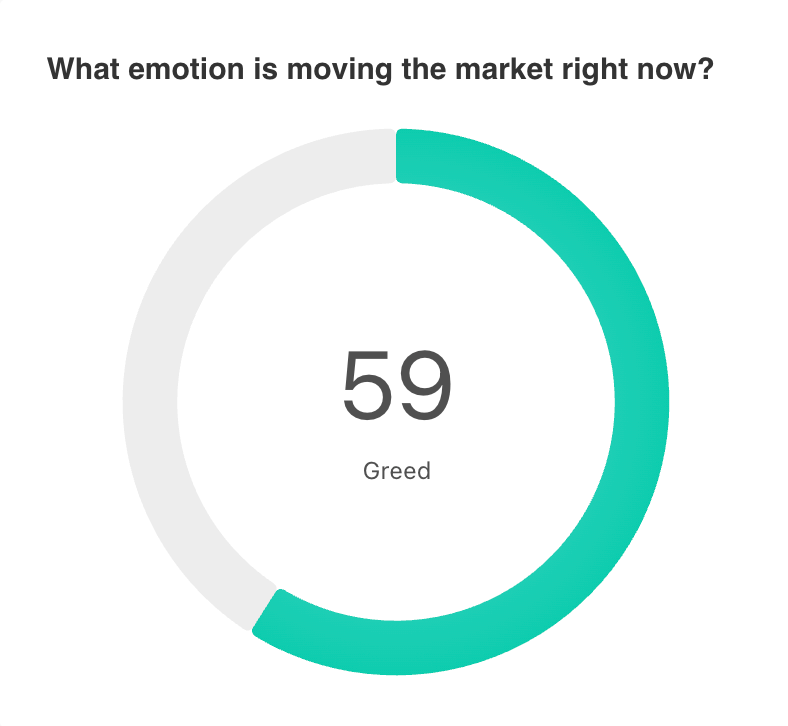

Perspective: the S&P 500 just hit a new record (6,900), but 80% of S&P 500 companies closed in the red. This means that the Magnificent 7 and a few others are pulling the entire economy up on their own. That’s the current state of the market for you: AI mega caps are living in a different world from the “real economy.”

OpenAI is eyeing an IPO. Microsoft and OpenAI finalized their for-profit restructuring deal, giving Microsoft a 27% stake valued at roughly $135 billion. The agreement lets OpenAI move forward with its public benefit corporation plans while Microsoft retains rights to OpenAI's models through 2032. The restructuring also makes it possible for OpenAI to actually IPO if it wants to.

The Fed’s rate decision comes today at 2:00 PM. Polymarket odds put the chances of a 25 bps rate cut at 98%, with a 50 bps cut at 1%, no rate change at 1%, and a rate hike at less than 1% odds. While a 25% rate cut is technically bullish for stocks, we think that it’s already priced in, so we aren’t expecting a ton of movement after this meeting. The real story is whether Fed Chair Jerome Powell pivots from quantitative tightening to quantitative easing (boosting money supply by buying gov. bonds) in his speech to day. If we switch to easing, we’re expecting markets to move upward. This is not financial advice.

Three of the Magnificent 7 report earnings today, which could lead to chaos depending on how the rate decision and quantitative tightening/easing bit go. We’ll see EPS and revenue from Microsoft (MSFT), Alphabet (GOOGL), and Meta (META).

Apple crossed the $4 trillion market cap milestone for the first time, joining Nvidia and Microsoft in the exclusive club. The iPhone 17 lineup outsold the iPhone 16 by 14% year-over-year in its first 10 days.

Eli Lilly is buying more than 1,000 Nvidia Blackwell Ultra GPUs to power an AI supercomputer for drug discovery. The setup will help Lilly train biomedical models and cut development times, with some models available to third parties through Lilly's TuneLab platform. This deal is part of Lilly's broader $50 billion expansion of its US manufacturing and R&D operations.

Nokia shares rocketed 21% to a decade-high after Nvidia announced a $1 billion investment for a 2.9% stake. The companies will collaborate on AI networking solutions and explore including Nokia's data center products in Nvidia's future infrastructure plans. The deal positions both companies to capitalize on the expected $1.7 trillion in data center spending by 2030.

On Behalf of BioNxt Solutions Inc.

From War-Torn Lab To Biotech Breakthrough

A scientist who lost his lab in Ukraine helped create a new way to deliver medicine.

💹 Portfolio Practicals: Trading Options

With tech stocks at $3-5 trillion valuations, it's nearly impossible to predict whether they'll keep climbing or face a sharp correction. Options let you profit in both directions… or hedge your bets when you're uncertain.

We know options sound intimidating. They're not for everyone. But understanding the basics gives you more tools to navigate volatile markets like this one.

Key Definitions:

Options: Contracts that give you the right (not obligation) to buy or sell a stock at a specific price before a certain date.

Call: The right to buy a stock at a set price (strike price) by a certain date. You profit if the stock goes up.

Put: The right to sell a stock at a set price by a certain date. You profit if the stock goes down.

Premium: The price you pay upfront for the option contract.

Strike Price: The predetermined price at which you can exercise the option.

Important: Options are NOT the same as leverage or margin trading. Those are separate (and riskier) strategies.

Safest Options Strategies:

Selling Covered Calls (if you own the stock and think it'll stay flat or rise modestly)

You collect premium income while holding your shares

Risk: If the stock rockets past your strike price, you miss out on gains

Selling Cash-Secured Puts (if you want to buy a stock but think it might dip first)

You get paid to potentially buy shares at a lower price

Risk: You're obligated to buy if the stock falls below your strike

More Aggressive Strategies:

Buying Calls (if you're very confident the stock will rise)

Unlimited upside potential with limited downside (you can only lose the premium)

Risk: Time decay. If the stock doesn't move fast enough, the option loses value

Buying Puts (if you're very confident the stock will fall)

Profit from downside moves without shorting the stock

Risk: Same time decay issue as calls

The Right Mindset:

Think of options as insurance, not a lottery ticket. You’re not trying to 10x your portfolio here, you’re just gaining the flexibility to adjust your position if the market moves against you. That's why you pay premiums: to maintain the option to take action.

To be clear: You don't need options to be a successful investor. Plenty of traders never touch derivatives and do just fine.

Getting Started:

Before risking real money, try paper trading on platforms like TradingView or Thinkorswim. Practice selling covered calls, buying puts as hedges, and seeing how time decay affects option prices. Once you understand the mechanics, you can decide if options fit your strategy.

The key is knowing they exist as a tool—not feeling pressured to use them before you're ready.

🤖 AI/Future/Tech News

OpenAI finished its recapitalization, forming a for-profit arm under a nonprofit. Microsoft holds 27% worth $135 billion.

NASA tested photonic AI chips in orbit to study radiation-hardened computing.

🪙 Crypto

Trump Media partnered with Crypto.com to launch "Truth Predict", a prediction market on its Truth Social platform.

The first US spot Solana staking ETFs began trading on Tuesday, alongside new ETFs for Litecoin and Hedera.

Solana's share of network fees among major blockchains plunged from over 50% to just 9%.

🎙 What Do You Think?

Will you try options trading?

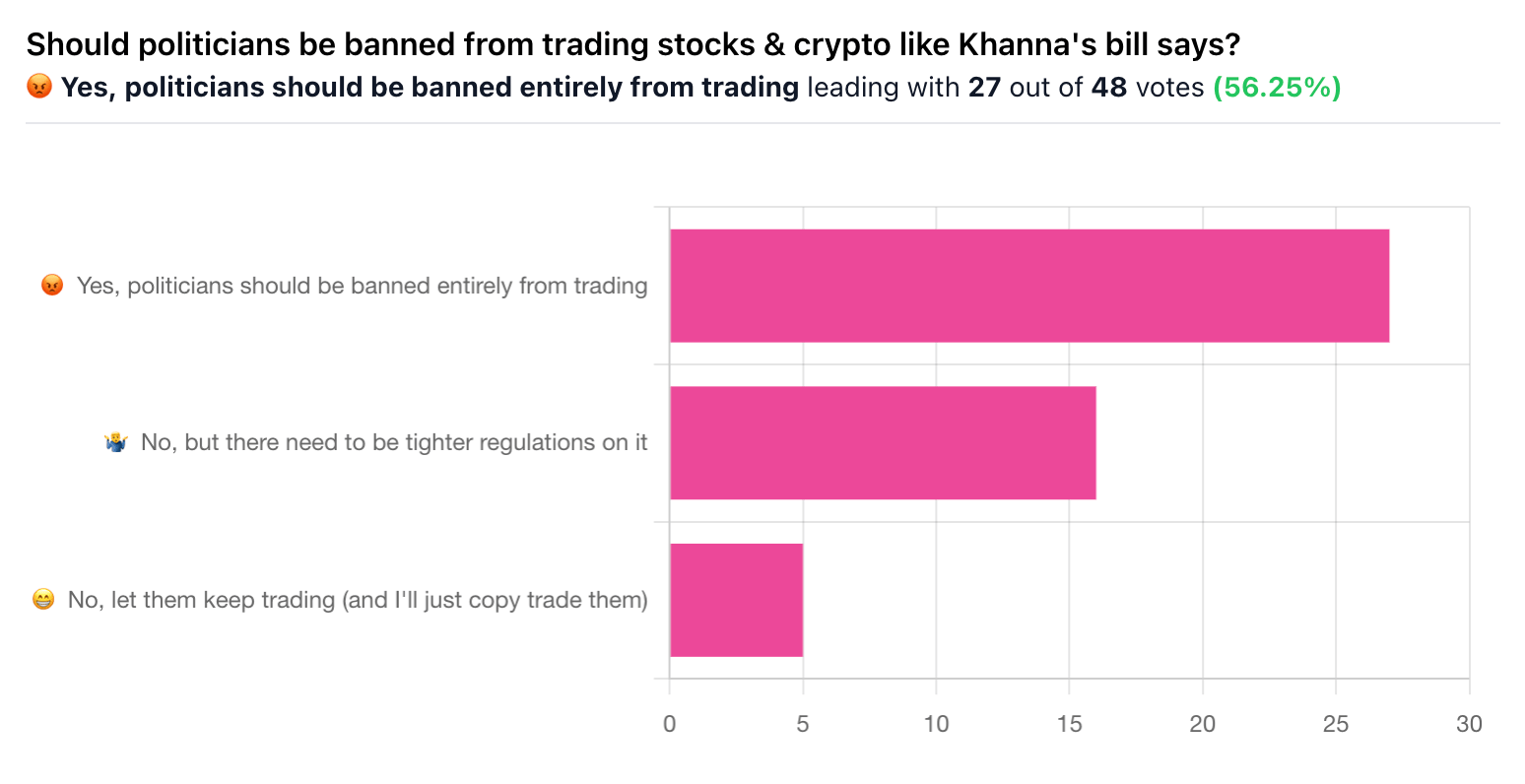

🎤️ What you said last time

🧠 The Missing (Market) Links

A new US-Japan rare earths deal overshadowed Wall Street's rally, sending most Asian markets lower.

Gold plunged to a three-week low as US-China trade optimism diminished its safe-haven appeal.

A historic cocoa shortage, with futures up 150% in a year, caused chocolate prices to spike just before the holidays.

📜 Quote of the Day

Opportunities come infrequently. When it rains gold, put out the bucket, not the thimble”

📢 We want to hear from you.

We love hearing from you, and we deeply appreciate your feedback.

⭐️ What did you think of today's edition?

That’s all for today. Did we miss anything? Smash the reply button to let me know.

Cheers,

Brandon & Blake of Invested Inc

The information provided in Stocks & Income is for informational and educational purposes only and should not be construed as financial advice, investment advice, or a recommendation to buy or sell any securities. Stocks & Income is not a registered investment advisor, broker-dealer, or licensed financial planner. Always do your own research and consult with a licensed financial advisor before making any investment decisions. We may hold positions in or receive compensation from the companies or products mentioned. Disclosures will be made where applicable.

Stocks & Income, AltIndex, Finance Wrapped, The Chain, and Future Funders are all owned by Invested, Inc.