Good morning.

The S&P 500 lost hundreds of billions in market cap yesterday as the US-China trade war continued over… cooking oil? (Check the Reddit Alert section for a tip on a stock that could benefit)

Did you buy the dip?

In other news, bank stocks are still crushing it this earnings season, and the roles of different companies in the AI industry continue to be crystallized. The question is whether their gains will be crystallized (or melted) if the market turns!

In partnership with Surf Lakes

This Technology Makes Every City a Potential Surf Destination

Topgolf revolutionized golf by turning it into a social, tech-driven game for anyone. And they’ve made billions in annual revenue doing it. Surf Lakes is applying that same model to surfing. Their patented tech creates 2,000 ocean-quality rides per hour, anywhere in the world, across all skill levels.

Surf tourism is a $65B global industry, yet fewer than 1% of people live near real waves. Licenses sold across the U.S. and Australia, with plans for a first commercial park in the works.

3x world champ Tom Curren and surf icon Mark Occhilupo have joined as ambassadors and shareholders. Even actor Chris Hemsworth has praised Surf Lakes.

You have until October 30th at 11:59 PM PT to invest in Surf Lakes.

This is a paid advertisement for Surf Lakes’ Regulation CF offering. Please read the offering circular at https://invest.surflakes.com

Please support our partners!

Market Headlines

Markets diverged on Tuesday as trade tensions with China flared and Fed Chair Powell hinted at more rate cuts ahead.

The Dow climbed 0.4%, the S&P 500 slipped 0.2%, and the Nasdaq tumbled 0.8%.

Trump’s China soybean oil comments brought the stock market and crypto down significantly yesterday. Bitcoin fell by 2.4% and Ethereum by 3.3%; see above for the stock market’s reaction. The President said he thinks that China’s refusal to buy US soybeans is an “economically hostile act,” and that the US could easily make cooking oil on its own.

Banking stocks continued a stellar earnings season as Morgan Stanley (MS) and Bank of America (BA) blew expectations out of the water. Morgan Stanley posted its best earnings beat in five years with a 45% increase in profits year over year. Meanwhile, Bank of America reported a 43% increase in investment banking revenue. See what AltIndex’s #1 banking stock pick is at the moment →

AI infrastructure deals surged as companies doubled down on chip investments. Google unveiled a $15 billion investment in India for its largest data center hub outside the US, while OpenAI partnered with Broadcom on 10 gigawatts of custom AI accelerator hardware through 2029. Check this diagram of the key picks and shovels in the AI industry (including robotics).

Powell signaled more Fed cuts are possible, telling the NABE conference that "downside risks to employment appear to have risen." His comments reinforced market expectations for continued monetary easing.

Wall Street's bubble warnings grew louder. JPMorgan CEO Jamie Dimon called elevated asset prices "a category of concern," warning that "you have a lot of assets out there which look like they're entering bubble territory." Bank of America's fund manager survey cited an "AI equity bubble" as the top global tail risk for the first time, with cash levels falling to 3.8% near their "sell" threshold.

😱 Fear & Greed Index

🤖 AI/Future/Tech News

Walmart partnered with OpenAI to let customers shop through ChatGPT using instant checkout features.

Microsoft rolled out Benchmarks, an analytics tool that tracks internal AI adoption across teams and compares usage rates against rival companies.

🤩 The AltIndex Top 5 Stocks

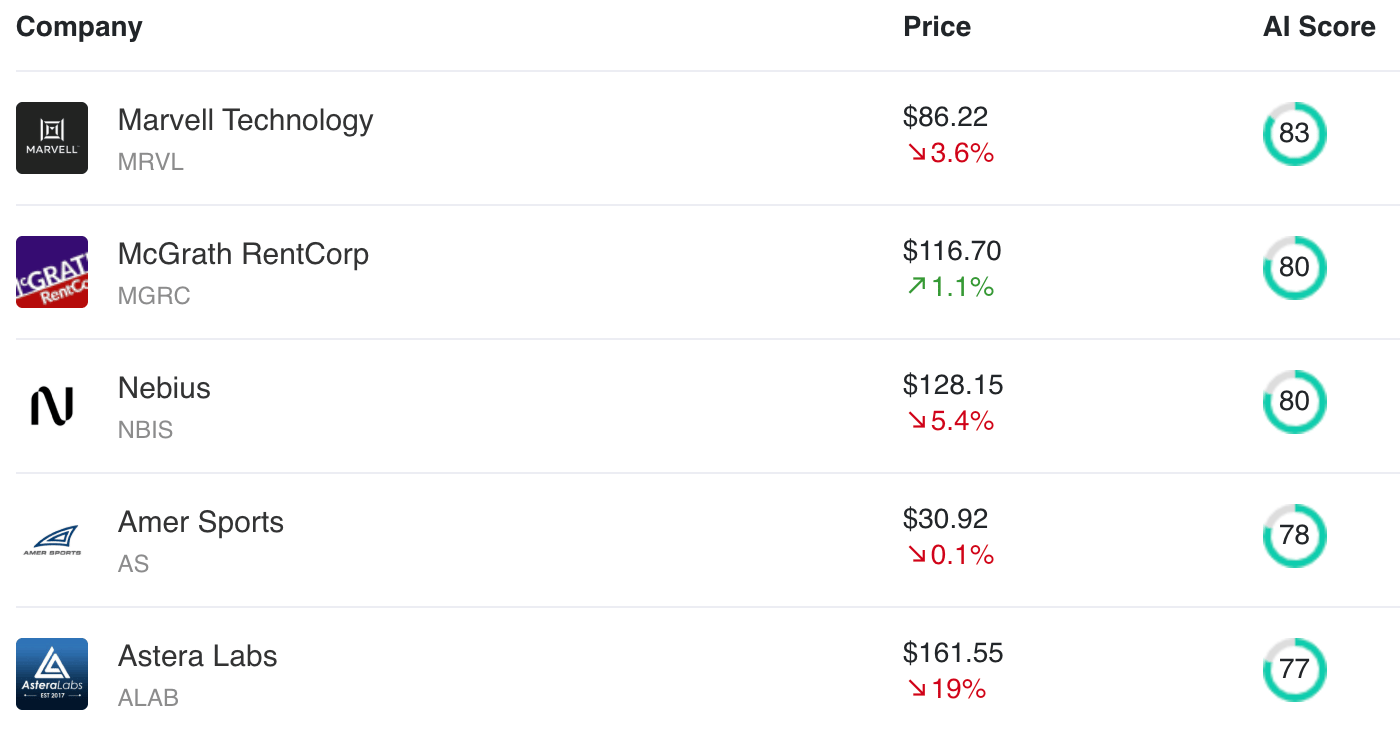

AltIndex’s AI model has a new batch of stock ratings, and these are the best of the best. For context, any score above 80 is extremely high for our model. (I have never seen a stock get a score of 90, for example.)

Are you invested in any of these, or thinking about buying? Reply and let us know!

🚨Trending on Reddit

Archer-Daniels-Midland (ADM) is getting attention on Reddit in relation to President Trump’s statements yesterday about the potential of the U.S. producing its own cooking oil instead of importing from China. They highlight ADM as a possibly significant benefactor due to their position as the largest U.S. producer of soybean and vegetable oils, which would be used in domestic cooking oil production. The discussions suggest that any policy favoring domestic processing and self-reliance in cooking oil could directly boost ADM’s margins and volume, making it a promising investment option.

Iren Limited (IREN): In the midst of IREN reaching $70, some users on Reddit are skeptical about the company's future revenue projections, even going as far as to label it as a potential "pump and dump" scheme. Others mention seeing people discuss Iren Limited's stocks in public settings, indicating a heightened interest or buzz around the company.

📊 IPOs and Earnings

Johnson & Johnson edged up 0.3% after reaffirming full-year guidance, with management citing steady medical device sales and easing supply chain pressures ahead of next week’s earnings report.

Goldman Sachs rose 1.1% as trading revenue beat early estimates on stronger fixed-income performance, signaling a strong start to bank earnings season.

BlackRock rose 1.2% on strong ETF inflows that pushed total US ETF assets past $1 trillion for the year, according to State Street data.

🎙 What Do You Think?

🎤️ What you said last time

🧠 The Missing (Market) Links

ChatGPT will apparently soon allow “erotica” for adult users, a policy shift that goes against what CEO Sam Altman has previously said.

Rare earth miner stocks jumped after President Trump’s 100% tariff threat on Chinese imports.

SoftBank’s payments arm PayPay IPO could hit a $20 billion valuation in December.

Jamie Dimon warned that auto bankruptcies like First Brands and Tricolor show “early signs of excess” in corporate lending.

📜 Quote of the Day

Compound interest is the eighth wonder of the world. He who understands it, earns it; he who doesn’t, pays it

📢 We want to hear from you.

We love hearing from you, and we deeply appreciate your feedback.

⭐️ What did you think of today's edition?

That’s all for today. Did we miss anything? Smash the reply button to let me know.

Cheers,

Brandon & Blake of Invested Inc

Thumbnail image: OTA Photos, Flickr

The information provided in Stocks & Income is for informational and educational purposes only and should not be construed as financial advice, investment advice, or a recommendation to buy or sell any securities. Stocks & Income is not a registered investment advisor, broker-dealer, or licensed financial planner. Always do your own research and consult with a licensed financial advisor before making any investment decisions. We may hold positions in or receive compensation from the companies or products mentioned. Disclosures will be made where applicable.

Stocks & Income, AltIndex, Finance Wrapped, The Chain, and Future Funders are all owned by Invested, Inc.