Good morning.

What is going on?

Michael Burry announced he’s closing down his hedge fund (yes, for real).

There appears to be a massive short squeeze on a stock we’ve never heard of.

And the government shutdown is finally over, but gold is still climbing.

We don’t know how to say this more clearly: no one in history has ever lived through a market that moves this fast. These are the most unprecedented of unprecedented times.

You are in new, uncharted territory every day.

Tread carefully but confidently. We’re breaking down the most important signals for you below.

In partnership with Coactive

Missed OpenAI? The Clock Is Ticking on RAD Intel’s Round

Ground floor opportunity on predictive AI for ROI-based content.

RAD Intel is already trusted by a who’s-who of Fortune 1000 brands and leading global agencies with recurring seven-figure partnerships in place.

$50M+ raised. 10,000+ investors. Valuation up 4,900% in four years*.

Backed by Adobe and insiders from Google. Shares at $0.81 until Nov 20 — then the price moves. Invest now.

This is a paid advertisement for RAD Intel made pursuant to Regulation A+ offering and involves risk, including the possible loss of principal. The valuation is set by the Company and there is currently no public market for the Company's Common Stock. Nasdaq ticker “RADI” has been reserved by RAD Intel and any potential listing is subject to future regulatory approval and market conditions. Investor references reflect factual individual or institutional participation and do not imply endorsement or sponsorship by the referenced companies. Please read the offering circular and related risks at invest.radintel.ai.

Please support our partners!

📰 Market Headlines

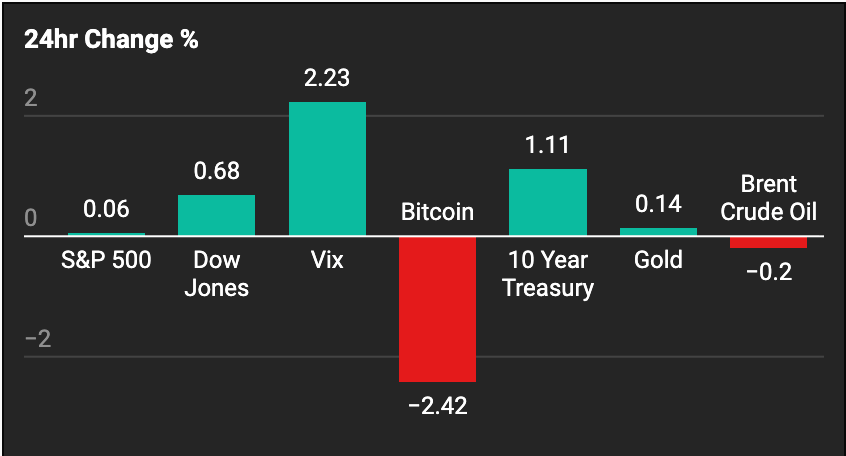

Markets closed at record highs on Wednesday.

The Dow climbed 0.68% to finish above 48,000 for the first time, the S&P 500 edged up 0.06%, and the Nasdaq slipped 0.26%.

The government shutdown is over after 43 days. The House passed the funding bill and President Trump signed it last night. The shutdown added $619 billion in new debt over just 6 weeks. Overall, the House shutdown vote was 222 members saying “yea,” and 209 members voting “nay.” We think markets will take the government restarting as positive news; combine that with lower interest rates and stimulus checks, and it could become quite a wild ride in the coming weeks (or days). When the past 4 government shutdowns ended, the S&P 500 ended the day in the green; however, S&P and Dow futures are slightly down pre-market as of writing.

Michael Burry is shutting down Scion Asset Management and returning investors’ capital. In a letter to investors, he said: “My estimation of value in securities is not now, and has not been for some time, in sync with the markets.” Some think he’s throwing in the towel with stocks entirely; others say that he’s simply recognized that markets are “fraudulent” (remember this scene in The Big Short?). What’s more, he’s going to be starting a blog on November 25th. Here’s a great writeup analyzing Burry’s posts →

It looks like SGBX is undergoing a short squeeze (AltIndex users were alerted earlier here), and the stock is already up 29% pre-market. SGBX shares have an overwhelming 297.04% short interest % float, meaning that the number of shares currently sold short is almost three times the total number of shares available for public trading. We wouldn’t be surprised if the stock explodes further today. Do with this information what you will, and this isn’t financial advice.

Gold hit $4,200/oz on news of the government shutdown ending mixing with inflation worries, rate cuts, and stimulus checks. Gold will always be a hedge against inflation and the debasement of the Dollar, and that’s what we’re seeing here: people have more faith in the precious metal than in USD.

Cisco jumped nearly 8% after beating earnings expectations and raising full-year guidance. Revenue rose 8% to $14.9 billion, marking its fourth straight quarter of growth. AI infrastructure orders hit $1.3 billion, and the company forecast up to $61 billion in annual sales.

Quantum stocks have tumbled as much as 44% on the month. Yesterday, Rigetti Computing (RGTI) missed on revenue expectations, not helping the case. There’s a heated battle between bears (like Martin Shkreli) and bulls (like Shay Boloor) on social media over whether the industry is a total bubble or just beginning to take off.The penny was officially retired on Wednesday as the last one-cent coin was minted in Philadelphia. The coin cost nearly four cents to produce, and its removal is already causing headaches for retailers forced to round prices.

The penny was officially retired on Wednesday as the last one-cent coin was minted in Philadelphia. The coin cost nearly four cents to produce, and its removal is already causing headaches for retailers forced to round prices.

🤖 AI/Future/Tech News

Waymo began highway trips in Phoenix, Los Angeles, and the Bay Area, shaving some routes by up to 50%.

Elon Musk’s X botched a security update, locking users out after a two-factor switchover to the x.com domain failed.

A German court ruled OpenAI violated copyright law by training ChatGPT on licensed music without permission.

Get Every AltIndex Signal for Free (7-Day Trial)

If you’re only investing based on earnings reports, CNBC articles, and yesterday’s news, it’s time to look deeper.

AltIndex is giving you access to all of its signals, stock ratings, and alerts for free. Get your 7-day trial now.

🤫 Insider Trading

📊 IPOs and Earnings

Disney beat earnings estimates but fell short on revenue; the stock was down 4.32% pre-market earlier this morning.

Firefly Aerospace reported Q3 revenue up 38% year over year to $30.8 million and raised its full-year outlook to $150-158 million; stock surged 15%.

🎙 What Do You Think?

Do you have interest in shorting stocks?

🎤️ What you said last time

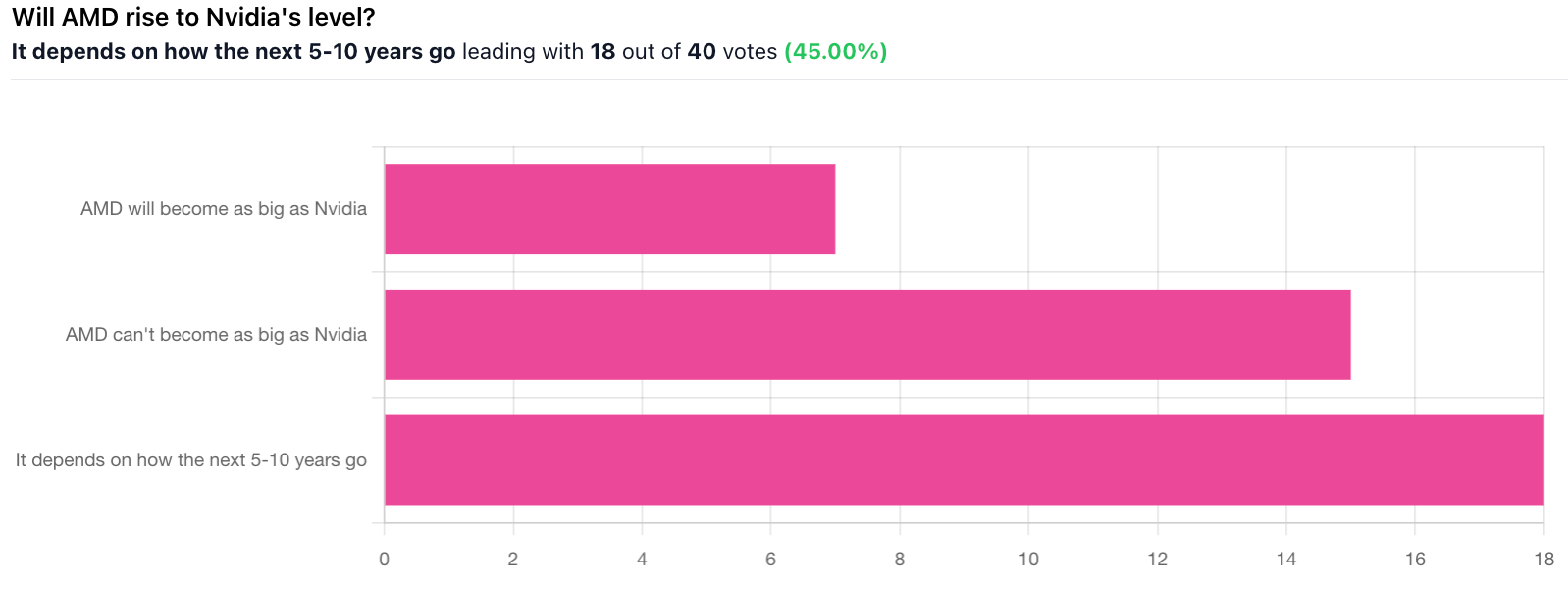

“I think there's room in the space for more than just Nvidia to hold the spotlight. There will be a few big players in this dystopian future we headed into. Can't wait...'“

🧠 The Missing (Market) Links

Read a Twitter breakdown of how Elon Musk might actually be building his own “Full-Stack Semiconductor Supply Chain.”

Interesting: the last time the government reopened after a shutdown, Bitcoin’s price tripled over the following five months.

This CEO filed for bankruptcy, then flipped $5,000 on a credit card into a $1 billion business by manually fulfilling Amazon orders at night.

Student loan borrowers faced a potential tax bomb worth $10,000+ starting January 1, 2026, when debt forgiveness becomes taxable again.

Google productivity expert said adults are assigning homework to themselves to beat burnout and stay mentally sharp.

📜 Quote of the Day

The punches you miss are the ones that wear you out.”

📢 We want to hear from you.

We love hearing from you, and we deeply appreciate your feedback.

⭐️ What did you think of today's edition?

That’s all for today. Did we miss anything? Smash the reply button to let me know.

Cheers,

Brandon & Blake of Invested Inc

Thumbnail image: Flickr, Junichi Yamashita

The information provided in Stocks & Income is for informational and educational purposes only and should not be construed as financial advice, investment advice, or a recommendation to buy or sell any securities. Stocks & Income is not a registered investment advisor, broker-dealer, or licensed financial planner. Always do your own research and consult with a licensed financial advisor before making any investment decisions. We may hold positions in or receive compensation from the companies or products mentioned. Disclosures will be made where applicable.

Stocks & Income, AltIndex, Finance Wrapped, The Chain, and Future Funders are all owned by Invested, Inc.