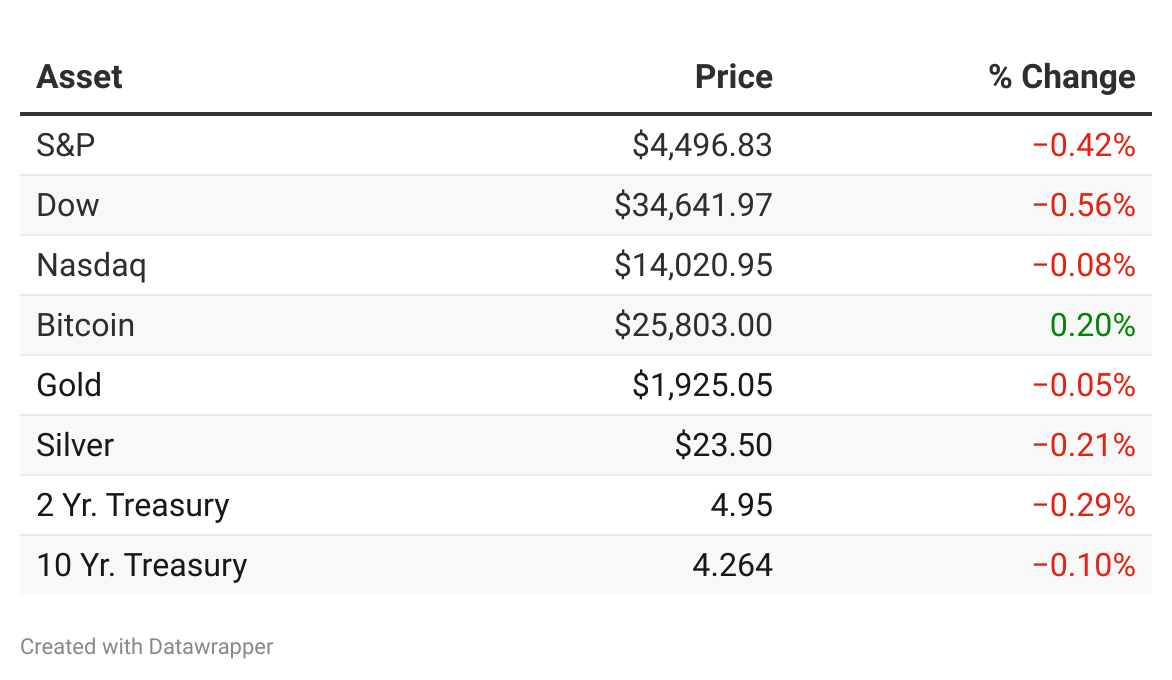

*past 24-hour performance

Saudi Arabia to extend voluntary cut: Oil prices spiked more than 1% yesterday after Saudi Arabia and Russia announced a fresh extension to their voluntary supply cuts (Reuters)

Chip wars heat up: China is set to launch a new state-backed investment fund that aims to raise about $40 billion for its semiconductor sector, as the country ramps up efforts to catch up with the U.S. and other rivals (Reuters)

No quick solution: Both sides of a dispute that has left nearly 15M cable TV subscribers without ESPN or other networks affiliated with Disney (DIS) are directing customers to other services where they can watch television (AP)

Vivek’s anti-ESG ETF firm hits $1 billion: Strive Asset Management, an anti-activism fund company co-founded by Republican presidential hopeful Vivek Ramaswamy, has crossed $1 billion in assets even as it comes under legal scrutiny (Bloomberg)

Apple & Arm strengthen relationship: Apple (AAPL) has signed a new deal with Arm for chip technology that "extends beyond 2040," according to Arm's IPO documents filed on Tuesday (Reuters)

Cars get an “F” in data privacy: Most major manufacturers admit they may be selling your personal information, a new study finds, with half also saying they would share it with the government or law enforcement without a court order (AP)

FTC, Amazon battle to begin soon: The FTC is likely to sue Amazon (AMZN) this month according to sources (Bloomberg)

Strike cost money: Warner Bros. Discovery (WBD) has lowered its 2023 EBITDA forecast to $10.5 billion to $11.0 billion, a hit of $300 – $500 million, “predominantly due to the impact of the strikes” (Hollywood Reporter)

Beware the risks of blindly investing in AI: At the beginning of August, Upstart (UPST) was one of the best performers in the Nasdaq, its rally for the year peaking at 445% amid the euphoria about AI. Its market value has since fallen by half, showing how difficult it can be for companies to live up to the hype. Read more»

Is Now the Time to Invest in Emerging Markets? Emerging-markets stock ETFs offer exposure to higher-growth markets, but they also can be volatile. Here is a look at the pros and cons of these investments. Read more »

The housing market is stuck: Low inventory, high mortgage rates, and high prices have put the housing market into a state of unaffordability that's weighing on house hunters, current homeowners, and even real estate investors. Read more »

The baseball player-turned-spy who went undercover to assassinate the Nazis’ top nuclear scientist (Smithsonian)

“Project Moohan” is Google and Samsung’s inevitable Apple Vision Pro clone (Ars Technica)

How Yahoo sparked a renaissance under new owners (Axios)

This summer’s top scams (CNBC)

Treadmills sales soar as high-energy demand for Peloton bikes fizzles (NYP)

The average annual home-insurance premium for Floridians has tripled in five years (WSJ)

Thunderclap Research is a professional investment research firm focused on understanding and profiting from market anomalies.

We take both a quantitative and qualitative approach to research and focus extensively on strategies for established money managers and everyday retail investors.

We are a small, self-funded team of real humans going up against the hype-filled, sensational news outlets in the world. You can check out a selection of our other publications below.