Good morning.

Markets rebounded Monday after a brutal week, but the comeback felt fragile.

Big news last night though: SpaceX acquired xAI in a $1.25 trillion merger, making it the world's most valuable private company. Musk says it’s about future data centers in space, but it looks more like it might be about xAI needing cash… like, today.

And that wasn’t all in the world of tech. OpenAI is quietly shopping for alternatives to Nvidia chips, and Palantir just absolutely crushed its earnings with 137% US commercial revenue growth.

Today:

Elon Musk buys Twitter for the 3rd time

Palantir continues to prove Michael Burry wrong

Let's get into it.

But first, a miner that just found at-surface copper:

This is not financial advice. Always do your own research. Past performance doesn’t guarantee future results.

In partnership with IDEX Metals

|

Copper is like the new oil. This Idaho miner just hit high-grade oxide copper from surface. AI. EVs. Defense. Energy transition. They all need copper, and supply can't keep up. Copper use in data centers could increase sixfold by 2050 (BHP estimate). BloombergNEF warns of a multi-million-ton supply gap by the mid-2030s. Meanwhile, a new U.S. copper district is taking shape in Idaho. In late 2023, Hercules Metals reported a copper discovery that triggered the biggest staking rush in 40 years. Barrick, BHP, Rio Tinto, and Teck all followed capital into the region. 10 km from Hercules sits IDEX Metals (TSX.V: IDEX, OTCQB: IDXMF). IDEX controls the Belt's second-largest land position, but with a critical advantage: While neighboring projects drill through 200+ meters of basalt to reach copper, IDEX's Freeze Project exposes oxide copper at surface. Phase 1 drilling in 2025 hit continuous copper mineralization in all six holes. A larger drill program is planned for 2026. As the U.S. races to secure domestic copper supply, IDEX is advancing one of Idaho's most accessible copper systems. |

|

Tomorrow Investor |

📰 Market Headlines

Markets kicked off February with a rally, shaking off last week's precious metals crash and AI trade jitters.

The S&P 500 rose 0.5%, the Nasdaq climbed 0.6%, and the Dow jumped 1% (over 500 points).

SpaceX acquired xAI in a deal valuing the combined company at $1.25 trillion, making it the world's most valuable private company. Musk says the merger is about building data centers in space, because "global electricity demand for AI simply cannot be met with terrestrial solutions."

However, it appears that the real immediate benefit of the merger might be funding for xAI. SpaceX is set to raise up to $50 billion in its IPO this year (if it doesn’t merge with Tesla). So xAI would then have access to that cash for its current pressing data-center-building needs.

Also, people are joking on social media that this acquisition marks the third time that Musk has bought Twitter: once in his initial 2022 purchase, another time when xAI acquired it, and now a third time as SpaceX acquired xAI.

OpenAI is shopping around for Nvidia alternatives, according to Reuters, frustrated with chip speeds for inference tasks like coding. The ChatGPT-maker has held talks with Cerebras and Groq, though Nvidia swooped in and licensed Groq's tech in a $20 billion deal. NVDA stock fell over 2%.

This news comes after investor concerns over Nvidia’s non-committal language about investing “up to” $100 billion in OpenAI. CEO Jensen Huang has been riding a fine line, assuring news reporters that he sees OpenAI as “one of the most consequential companies of our time,” but also refusing to confirm the specific amount of investment his company will make.

Here’s a clip of Jensen Huang getting agitated (by his very polite standards) by a reporter in China who wouldn’t drop the subject. To be fair to Huang, the reporter seems to either intentionally or accidentally misunderstand him in our opinion.

Palantir crushed earnings, posting 70% revenue growth to $1.4 billion and guidance that blew past estimates. US commercial revenue surged 137% to $507 million. Shares popped 8% after hours.

President Trump and India’s Prime Minister struck a trade deal, slashing US tariffs on Indian goods from 50% (including a 25% "secondary" tariff for Russian oil purchases) down to 18%. Modi reportedly agreed to stop buying Russian oil and drop trade barriers against US goods "to ZERO."

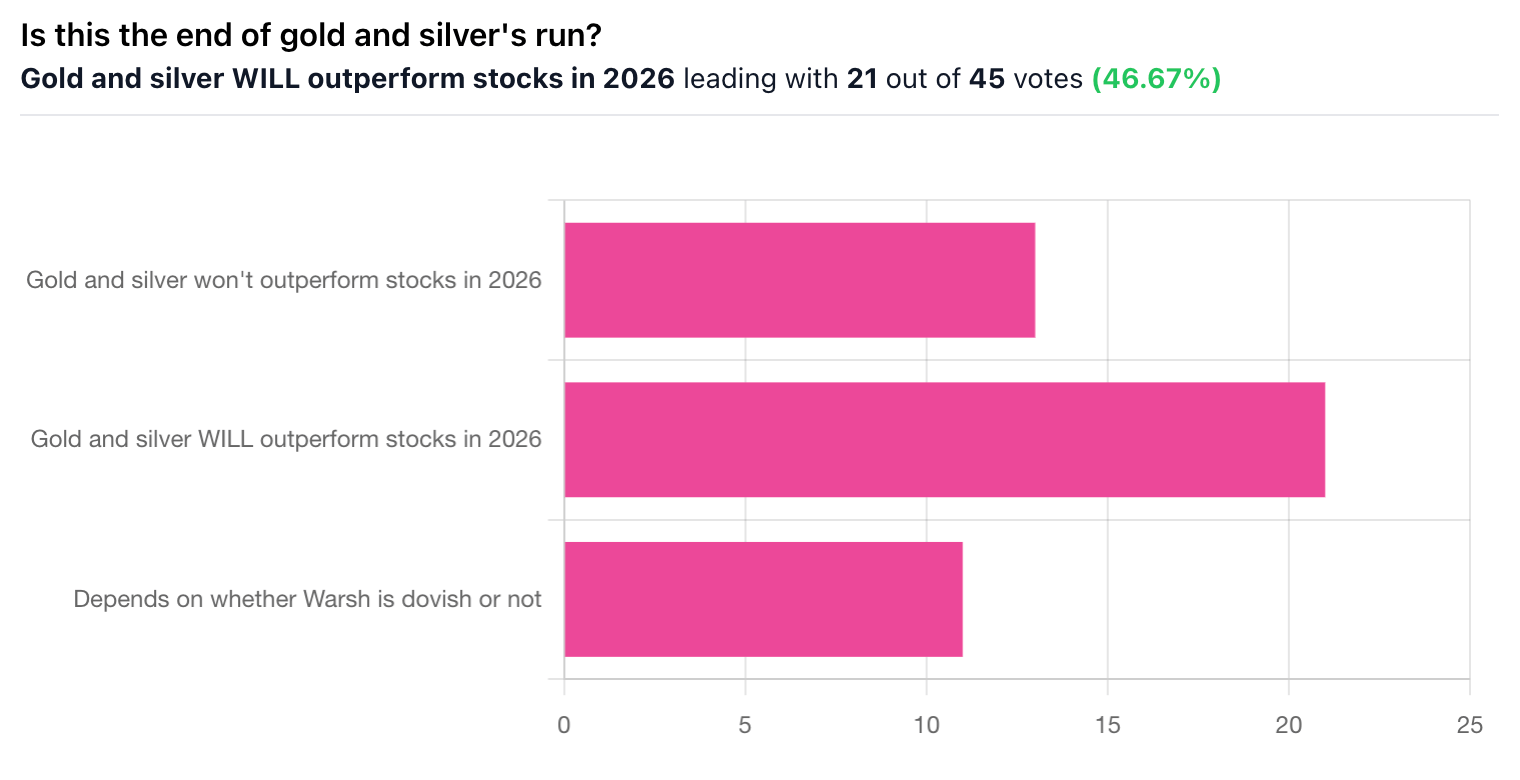

Precious metals stabilized slightly after last week's bloodbath. Gold hovers near $4,900 after tanking 9% Friday, while silver crashed 25%, its biggest single-day drop on record. JPMorgan still sees gold hitting $6,300 by year-end, but one analyst called the swings "disturbing."

Bitcoin slipped below $80,000 over the weekend for the first time since April, extending a volatile stretch that saw the cryptocurrency shed thousands in value. It's now trading around $78,000.

Disney tumbled 7% despite beating on revenue and adjusted EPS. Profits fell from a year ago on higher costs across the business, even as the parks segment continued to shine. Zootopia 2 and Avatar: Fire and Ash both crossed $1 billion at the global box office.

🤖 AI/Future/Tech News

OpenAI dropped a new macOS app for Codex with parallel agent workflows to compete with Claude Code, though benchmarks show rivals closing the gap.

Waymo raised $16 billion at a $126 billion valuation to expand to 20+ cities in 2026, including New York, London, and Tokyo.

Adobe is killing Adobe Animate on March 1st, ending the 30-year-old app and potentially rendering past work "lost media."

🪙 Crypto

Crypto markets got clobbered over the weekend, triggering $2.5 billion in Bitcoin liquidations.

Binance will convert its $1 billion SAFU fund from stablecoins to Bitcoin within 30 days, pledging to top it up if prices push it below $800 million.

South Korea deployed AI-powered surveillance to catch market manipulators down to the second.

🤫 Insider Trading

🚚 Market Movers

Amazon slashed 2,198 corporate jobs in Washington state, over half in software and engineering. That's 4,500+ workers cut in the state in under a year.

Disney's theme parks hit $10 billion in quarterly revenue for the first time, but shares fell 7.4% after a YouTube TV blackout cost $110 million.

Google Cloud and Liberty Global struck a five-year AI partnership to deploy Gemini across 80 million European connections.

T-Mobile cut nearly 400 workers while Expedia and Meta fired hundreds. Seattle lost 12,900 jobs last year—the first annual decline since 2009.

🎤 What do you think?

Are you more interested in a possible SpaceX IPO now that it holds xAI?

🎤️ What you said last time

🧠 The Missing (Market) Links

US manufacturing expanded for the first time in 12 months in January, with the ISM index hitting 52.6 on new orders and pre-tariff stockpiling.

Electricity rates largely tracked inflation over five years, with 34 states seeing below-average increases (data centers aren't driving your bill up yet).

Brazil's soy harvest is projected to hit a record 177 million metric tons this year, even as 15% rates and low prices squeeze smaller farms.

The US pork industry just entered its best economic environment in years, though Brazil still holds a $30-per-pig advantage on disease control and labor costs.

Secondary aluminum import prices dropped 3.9% to $2,772/ton in 2024, while exports fell 16.7%, with Canada, UAE, and Bahrain supplying 74% of US imports.

EU farm investments worth €158 billion in animal agriculture risk becoming stranded assets as meat consumption declines faster than expected.

📜 Quote of the Day

📢 We want to hear from you.

Your feedback matters to us! Let us know what you liked or didn’t like about today’s edition.

⭐️ What did you think of today's edition?

That’s all for today. Did we miss anything? Smash the reply button to let me know.

Cheers,

Brandon & Blake of Invested Inc

The information provided in Stocks & Income is for informational and educational purposes only and should not be construed as financial advice, investment advice, or a recommendation to buy or sell any securities. Stocks & Income is not a registered investment advisor, broker-dealer, or licensed financial planner. Always do your own research and consult with a licensed financial advisor before making any investment decisions. We may hold positions in or receive compensation from the companies or products mentioned. Disclosures will be made where applicable. Past performance doesn’t guarantee future results.

Stocks & Income, AltIndex by Invested Inc. (AltIndex LLC), Finance Wrapped, The Chain, Future Funders, and Dinner Table Discussions are all owned by Invested Inc.